After achieving a stunning legal victory, will Ripple trade above the $1 USD barrier again?

Technical Analysis of Ripple Price (XRPUSD)

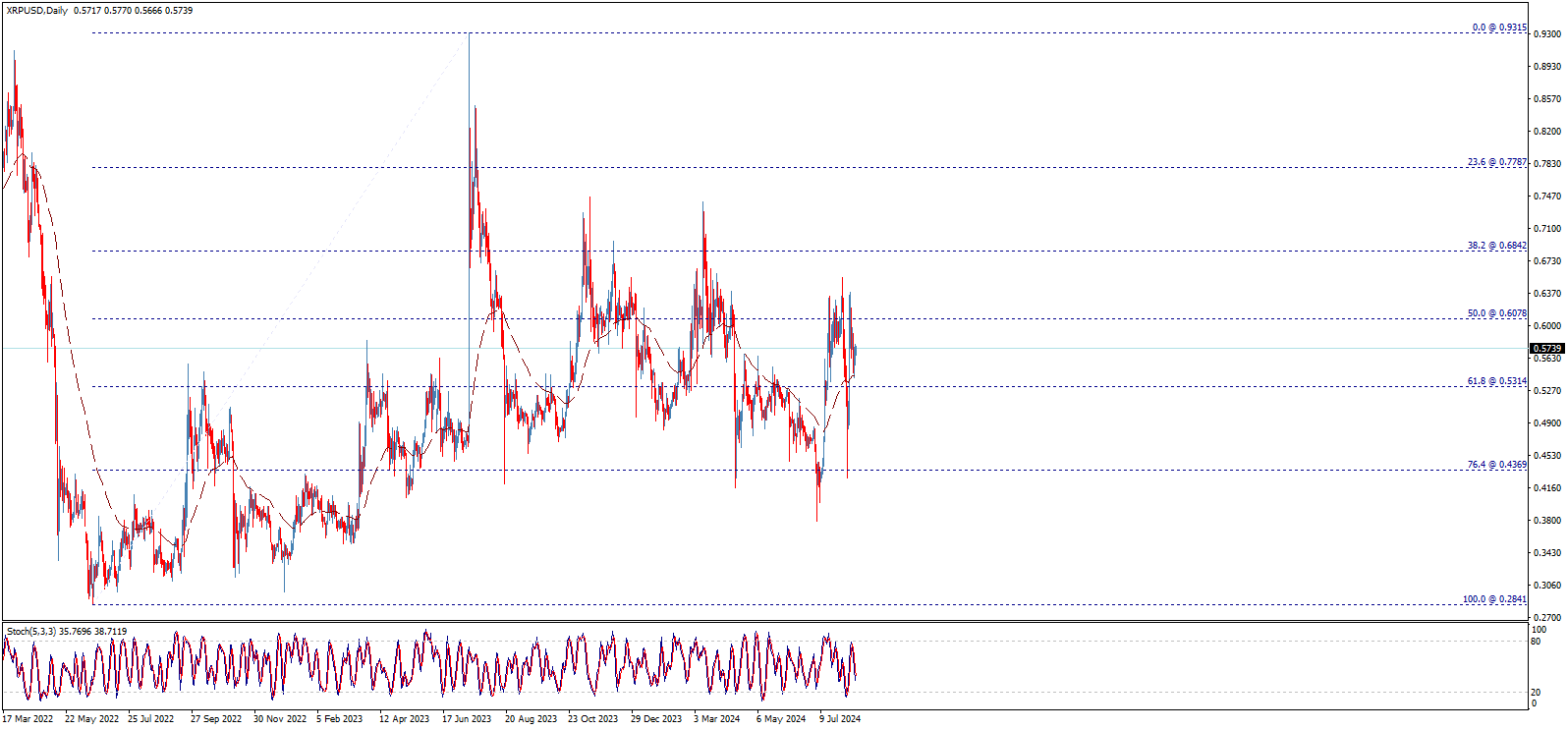

The daily chart shows how Ripple's price is moving in a sideways path after the upward surge that occurred in mid-last year. After reaching the peak level at $0.9315, the price declined to start a downward correction that reached the 76.4% Fibonacci retracement level of the rise that started from $0.2841, stabilizing on a strong support floor at $0.4369, with sideways trades confined between this support and the resistance at $0.6842.

There is a preference for recovery and potential gains in the coming period, as technical indicators provide positive signals that could help the price surpass the aforementioned resistance and move towards the $0.7787 and then $0.9315 levels as main positive targets. The Stochastic indicator is gaining positive momentum noticeably, while the 50-day moving average provides positive support to the price. These factors are expected to form a positive catalyst leading the price to recover and attempt to exit the sideways path that has been dominating the price since last year.

Positive Setup on the Intraday

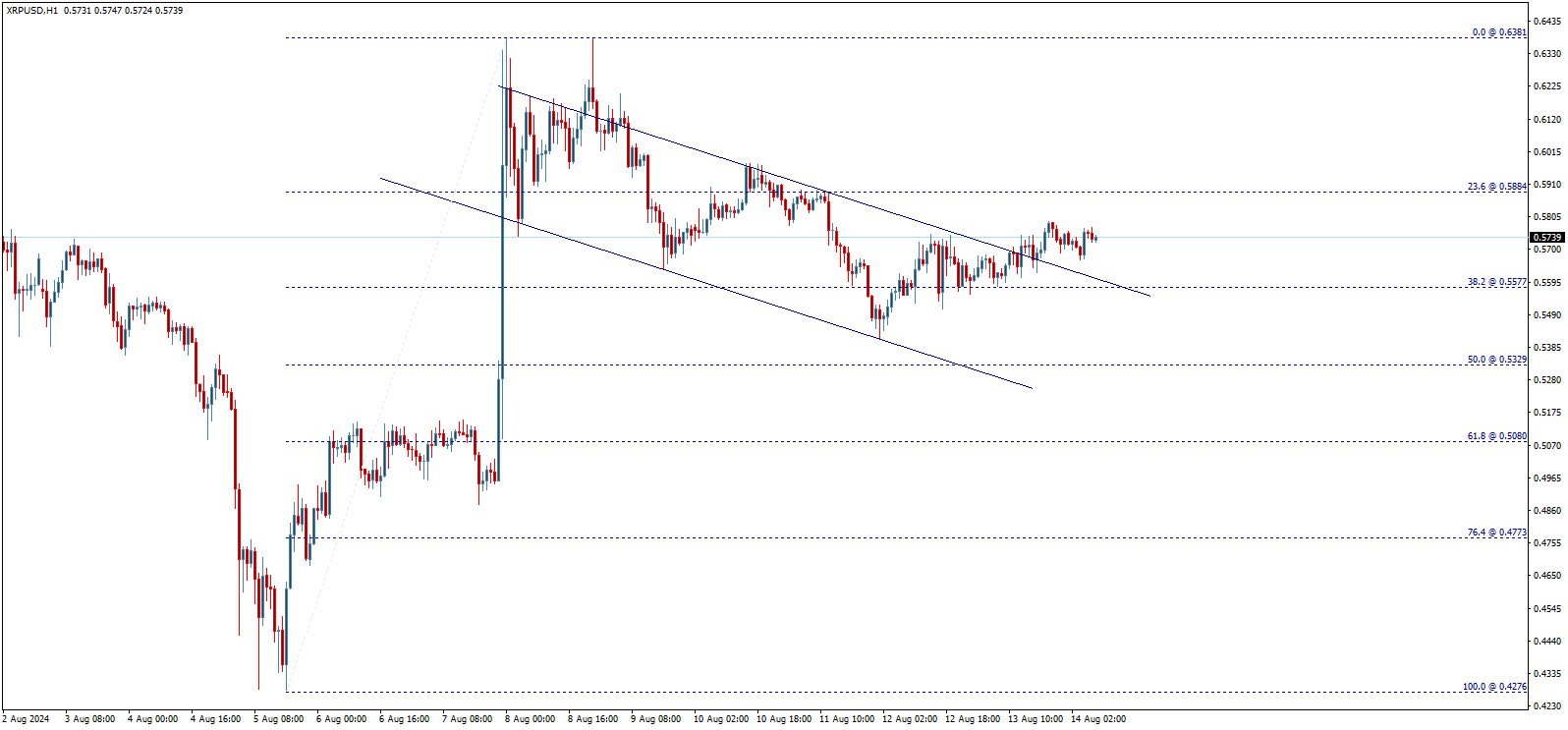

On the intraday timeframes, the price underwent a temporary downward correction of the sub-uptrend wave that stopped upon touching the $0.6381 area. Upon closer inspection of the chart, we find that the price exiting the downward correction path after breaking the descending sub-channel completes the formation of a bullish continuation flag pattern, which is expected to act as a positive catalyst pushing the price to break the resistance mentioned at the beginning of the report and then resume the main upward trend, heading towards achieving the suggested positive targets.

Activation Areas for the Upward Wave

The resistance barriers that the price needs to surpass to confirm the continuation of the rise are represented by the $0.5884 and then $0.6842 levels. Breaking them will push the price to achieve positive targets starting at $0.7787 and extending to the recorded peak at $0.9315, with the note that breaking the latter level will lead the price to surge towards the psychological barrier of $1.0000 and then extend the gains to reach the $1.3371 area.

Summary of the Above

The price movement within the current sideways path will remain in effect until it successfully surpasses the $0.5884 and then $0.6842 levels, heading towards achieving the positive targets mentioned in the previous paragraph. However, it is important to note that breaking $0.4369 will halt the positive outlook and pressure the price to incur new losses, with the main next target reaching the low recorded at $0.2841.

Best Ripple XRP Trading Platforms and Brokers this month

- Pepperstone - Best overall Ripple trading broker for beginners. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in crypto XRP. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top XRP trading platform for educational materials and copy trading. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.

Ripple Analysis and Price Predictions for 2024 and 2025

Ripple, the company behind the digital currency "XRP," achieved a significant legal victory against the U.S. Securities and Exchange Commission (SEC) in early August.

In a case that drew wide attention in financial and digital circles, the SEC filed a lawsuit against Ripple in December 2020, accusing the company of selling XRP as an unregistered security, which Ripple vehemently denied.

In mid-July 2023, the U.S. court ruled that XRP is not considered a security in certain transactions, especially when traded on exchanges.

This ruling was a major win for Ripple and the digital currency industry as a whole, as it removes some regulatory uncertainties surrounding the use and trading of digital currencies.

Continuing the case, on Wednesday, August 7th, a federal court in the United States ordered Ripple to pay a civil penalty of $125 million, which is much lower than the nearly $2 billion fines the SEC had imposed on the company.

The ruling has significant implications for the digital assets market and the crypto industry. After the announcement, the price of XRP surged by over 20%, reflecting growing confidence in the digital currency's future and Ripple as an entity.

It is also expected that this ruling will have a positive impact on the digital currency industry in general, opening the door for more innovation and investment in this field.

The positive impact of this legal victory, along with the continued flow of institutional investment into the crypto industry and the acceleration of the global monetary easing cycle, indicates that Ripple's price could surpass the $1.00 barrier later this year.

Brief Analyses and Predictions for Ripple Prices

- Ripple price predictions this week: Ripple prices may succeed in surpassing the key resistance at $0.65, then targeting the next resistance at $0.75.

- Ripple price predictions in August: Ripple prices are likely to achieve monthly gains in August, thanks to the positive sentiment dominating the digital asset market.

- Ripple price predictions in 2024: Ripple prices are expected to rise to their highest levels this year, with a strong possibility of surpassing the $1.00 barrier.

- Ripple price predictions in 2025: If it strongly surpasses the $1.00 barrier, the next targets for the cryptocurrency may be $1.50 and then $2.00.

About Ripple

Ripple (XRP) is one of the most well-known and widely used digital currencies in the cryptocurrency market. The currency was launched in 2012 by Ripple with the aim of providing faster and more efficient payment solutions for banks and financial institutions.

Unlike other digital currencies like Bitcoin, Ripple is not just a digital currency but a money transfer network designed to facilitate cross-border financial transactions.

Ripple Technology

Ripple relies on blockchain technology but differs from most digital currencies in some aspects. For example, the Ripple system does not rely on traditional mining like Bitcoin and Ethereum. Instead, Ripple uses a proprietary consensus protocol known as the Ripple Consensus Protocol Algorithm (RCPA), which allows transactions to be processed very quickly and at minimal cost.

How Does Ripple Work?

- Consensus Protocol: Ripple uses a proprietary consensus protocol known as the Ripple Consensus Protocol Algorithm (RCPA). This protocol differs from the Proof of Work mechanism used by Bitcoin, Ethereum, and other digital currencies. This protocol allows participants in the network to quickly verify transactions without the need for mining. Transactions are verified by a group of trusted nodes, known as "Unique Nodes".

- Cross-Border Money Transfers: Ripple is designed to enable fast cross-border money transfers between banks. Banks and financial institutions can use the Ripple network to transfer funds in seconds, instead of waiting days as with traditional systems like SWIFT. Funds are transferred between parties using XRP as a bridge currency, enabling highly efficient transfers between different currencies.

- Distributed Ledger: Ripple uses a distributed ledger (XRP Ledger) to record all transactions made on the network. This ledger updates every few seconds and is maintained by distributed nodes worldwide, ensuring transparency and security in recording transactions.

- Using XRP as a Financial Bridge: XRP, the digital currency associated with Ripple, is used as a financial bridge between different currencies. If a bank wants to transfer money from USD to EUR, it can buy XRP with USD, transfer it to another bank, which then converts it into EUR. This reduces transfer costs and speeds up the process.

Ripple's Future

After Ripple achieved a significant legal victory against the U.S. Securities and Exchange Commission (SEC), its future looks brighter in the digital currency world. This victory came after a long legal battle where the SEC accused Ripple of selling XRP as unregistered securities. However, the recent ruling in the case was in favor of Ripple, marking a milestone for the digital currency industry as a whole.

- The Impact of the Legal Victory on Ripple: The legal victory that Ripple achieved provides a significant opportunity for the company to expand its activities and increase the adoption of its financial network. This outcome has lifted a significant burden from the company, allowing it to continue developing its technologies and partnering with more financial institutions. This victory is likely to reduce regulatory concerns surrounding Ripple, thereby enhancing confidence in XRP.

- Institutional Partnerships and Growth: With the removal of major legal obstacles, Ripple can now focus on building new partnerships with major banks and financial institutions. These partnerships will help strengthen the use of the Ripple network as an alternative to traditional cross-border payment systems. Increased institutional adoption will enhance the value of XRP and its competitiveness in the global market.

- Impact on XRP Price: With the removal of legal uncertainties, the price of XRP could see a significant recovery. Analysts predict that XRP could see an increase in value as demand from financial institutions and individual investors, who view the currency as a safe investment opportunity following the court ruling, grows.

- Ripple's Future in Emerging Markets: Thanks to the legal victory, Ripple could expand its activities in emerging markets, where countries are seeking innovative and fast financial solutions. As digital currencies become more widely adopted in these markets, Ripple could play an important role in providing money transfer solutions and improving financial inclusion.

Ripple's Importance

Ripple (XRP) holds significant importance in the digital currency world, offering a unique solution for cross-border financial transactions. The Ripple network relies on blockchain technology to speed up and simplify money transfers between banks and financial institutions around the world.

Unlike many other digital currencies, Ripple does not aim to replace the traditional financial system but seeks to improve it by providing instant liquidity and reducing transfer costs.

Additionally, Ripple enables financial institutions to execute transactions much faster and cheaper than traditional methods like the SWIFT system. This allows companies and banks to achieve significant gains in efficiency and speed, enhancing Ripple's role as a reliable and powerful solution in the digital finance industry.

Finally, the use of XRP as a tool to facilitate these transactions increases Ripple's importance in the global financial system and enhances the adoption of financial technology in general.

Massive Regulatory Approvals Supporting the Crypto Industry

Following the approval of the launch of "Bitcoin" ETFs in the United States, regulatory approvals for financial assets linked to cryptocurrencies are continuing worldwide.

In the United Kingdom, the London Stock Exchange said it would accept the issuance of bonds backed by Bitcoin and Ethereum, and the Securities and Exchange Commission in Thailand indicated it would open foreign exchange-traded funds for cryptocurrencies to individual buyers.

With the approval of the Securities and Exchange Commission in Hong Kong, on Tuesday, April 30, 2024, six Bitcoin spot ETFs began trading on the exchange.

Global Monetary Easing Cycle

- Last March, the global monetary easing cycle began, with the Swiss National Bank (SNB) unexpectedly cutting its benchmark interest rate.

- This was followed by interest rate cuts in Mexico, Canada, Europe, and the United Kingdom, with the Federal Reserve strongly opening the door to cutting U.S. interest rates next September.

- Market experts said: In the medium term, there seems to be clear optimism for stocks, residential real estate, gold, and cryptocurrencies, thanks to the global monetary easing cycle that will result in new liquidity being pumped into the markets.

Major Price Points for Ripple Cryptocurrency

- March 2020: Ripple's price recorded an all-time low of $0.1165 per crypto unit.

- January 2018: Ripple's price recorded an all-time high of $3.3499 per crypto unit.

- July 2017: Ripple's price recorded an all-time low closing at $0.1651 per crypto unit.

- December 2017: Ripple's price recorded an all-time high closing at $1.9900 per crypto unit.

Best Performance for Ripple Price in History

- 2017: Best annual performance for Ripple's price, with a 457% increase.

- Q4 2017: Best quarterly performance for Ripple's price, with a 900% increase.

- December 2017: Best monthly performance for Ripple's price, with a 729% increase.

Worst Performance for Ripple Price in History

- 2018: Worst annual performance for Ripple's price, with an 82.5% decrease.

- Q1 2018: Worst quarterly performance for Ripple's price, with a 75% decrease.

- December 2020: Worst monthly performance for Ripple's price, with a 67% decrease.

Major Events in Ripple History

- May 2017: The digital currency Ripple began trading at a price of $0.3570.

- December 2017: Ripple traded above $0.5000 for the first time ever.

- December 2017: Ripple's price surpassed the $1.0000 barrier for the first time in history.

- December 2017: Ripple traded above $2.0000 for the first time ever.

- January 2018: Ripple's price surpassed the $3.0000 barrier for the first time in history.

Key Ripple Price Predictions for 2024

- Grayscale, the largest investor in traded cryptocurrency funds, expects Ripple's price to reach $1.5 per crypto unit by the end of 2024.

- Binance, the world's largest digital platform, expects Ripple's prices to reach $1.25 by the end of 2024.

- Long Forecast analysts expect Ripple to continue rising in 2024, reaching $1.75 by the end of the year.

- ETC Group expects Ripple to slightly exceed the $1 level in 2024, due to increases in long-term investments.

- Bank of America expects Ripple could reach a price range between $2.5 and $3.0 by the end of 2024, if Ripple continues to expand its use in international transfers after its legal victory.

Factors Affecting Ripple Price Predictions

- Legal and regulatory factors play a significant role, especially after Ripple's recent victory against the U.S. Securities and Exchange Commission (SEC), which gave a positive boost to the currency.

- Adoption by financial institutions of Ripple technology in international transactions could enhance its value.

- Global economic developments, such as central bank decisions on interest rates and monetary policies, affect investors' appetite for digital currencies in general, including Ripple.

- Technical factors such as updates and innovations in the Ripple protocol could improve network performance, influencing market confidence and price.

Frequently Asked Questions About Ripple

Is Ripple Price Suitable for Investment?

Ripple is currently trading around $0.60000 per crypto unit. In light of most predictions pointing to a possible entry into a bullish crypto market in 2024, we believe that levels between $0.5500 and $0.5000 are suitable for investment, with a target above $1.0000.

How to Invest in Ripple?

- Spot Ripple Purchase: You can buy spot Ripple cryptocurrency from reputable digital currency trading platforms, using global currencies such as the US dollar and Euro to purchase Ripple.

- Long-Term Investment: You can hold onto Ripple for a long period and expect its price to rise over time, leading to significant returns. This requires a good risk assessment and the ability to withstand high price volatility.

- Global Stocks: By buying shares of companies involved in providing digital services and blockchain technology, especially those traded on the US markets in Wall Street.

Will Ripple Prices Reach $1?

In light of recent developments in the digital asset market and other global markets, it is not entirely unlikely that Ripple prices will rise to $1 in 2024, with a strong surpassing of this level in the following years.

Is Ripple Price Expected to Rise in 2024?

Yes, Ripple prices are expected to continue rising this year, as most forecasts from major institutions, banks, and experts are stable around Ripple entering a bullish market.

Brent oil price forecast update 14-08-2024

Brent oil price shows calm bullish bias to approach 82.15$ level, waiting to breach this level to open the way to head towards our next target at 83.66$, to continue suggesting the bullish trend for today, motivated by the positive overlapping signal that appears on stochastic, reminding you that it is important to hold above 80.65$ to continue the expected rise.

The expected trading range for today is between 80.10$ support and 83.10$ resistance.

Trend forecast: Bullish

Crude oil price forecast update 14-08-2024

Crude oil price settles around 79.00$ barrier, waiting to get positive motive that assist to push the price to resume the expected bullish wave for today, which its targets begin at 79.84$ and extend to 80.70$ after breaching the previous level.

Therefore, we will continue to suggest the bullish trend for today unless breaking 78.35$ and holding below it.

The expected trading range for today is between 77.50$ support and 80.50$ resistance

Trend forecast: Bullish

Silver price forecast update 14-08-2024

Silver price is testing the bearish channel’s resistance line again, noticing that stochastic loses the positive momentum again, waiting to motivate the price to resume the negative trades to break 27.62$ and open the way to head towards 27.00$ as a next negative station, to keep the bearish trend scenario active, reminding you that breaching 27.85$ will stop the expected decline and push the price to turn to rise.

The expected trading range for today is between 27.15$ support and 27.95$ resistance.

Trend forecast: Bearish