4 Reasons Why Bitcoin is Set to Skyrocket in 2025

The year 2024 will be remembered as a turbulent year for cryptocurrencies, with several significant developments that ultimately helped "clean up" the space, making it more attractive to mainstream investors.

As of October 20th, Bitcoin recorded a price of $68,393, 7.20% off its all-time high in March of this year, but it has risen 11.60% last month and by 3.90% so far this month.

After the Federal Reserve cut interest rates, Bitcoin's value reached $64,000. The Fed lowered rates by 50 basis points, while the Bank of Japan kept rates unchanged. However, this did little to push Bitcoin higher, as its value only rose by about 3% one day after the announcements from both central banks. On September 26, 2024, the Swiss National Bank lowered rates by 25 basis points to 1.0%, pushing Bitcoin to $65,000, an increase of 2.41% the next day.

While the recent sentiment surrounding Bitcoin may have turned positive, there are several compelling reasons to remain optimistic as we head toward the end of the year. In fact, four key factors could push Bitcoin to new heights by 2025.

1. The Impact of Bitcoin Spot ETFs

One of the most significant developments in the cryptocurrency space this year was the introduction of Bitcoin Spot ETFs by the U.S. Securities and Exchange Commission (SEC). ETFs already exist for everything from oil to the FTSE 100 index and even for regions and countries. They track underlying assets, creating an easy way for people to invest without directly buying the assets. They provide institutional investors with a regulated and easy way to gain exposure to Bitcoin, and as more institutions adopt this asset class, the potential for price increases grows.

In the first quarter of 2024, these 11 new funds played a pivotal role in pushing Bitcoin’s price up by around 60% at its peak. These funds were collectively buying more than 10 times the daily production rate of Bitcoin, driving up demand and thus prices.

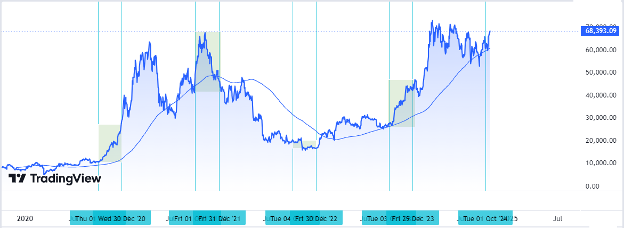

Bitcoin’s rise from the start of 2024

Moreover, regulators in Hong Kong announced they are open to Bitcoin Spot ETF applications and have issued guidelines that allow for several types of funds, including the standard model seen in the U.S., where investors buy Bitcoin ETFs with dollars. Hong Kong is also open to a second type known as "in-kind."

This would make it possible to convert shares in a Bitcoin ETF into Bitcoin and vice versa, allowing for more flexibility and attracting more institutional investors into the space.

2. Interest Rates

The second reason for optimism about Bitcoin is the expected shift in Federal Reserve policy. After more than two years of aggressive rate hikes, Federal Reserve Chair Jerome Powell hinted that rates might have peaked, and the Fed is likely to cut them in 2025. Similarly, in the UK, the leading mortgage lender Halifax lowered its lending rate in anticipation of a Bank of England rate cut.

If rates are lowered or even stabilized in 2025, this could make Bitcoin (and other digital assets) more attractive to investors, as its limited supply makes it a hedge against traditional currencies that lose value over time.

Bitcoin is often viewed as a "risky" asset, meaning it performs well when investors are willing to take more risks in search of higher returns in a low-interest-rate environment.

Furthermore, lower interest rates generally lead to a weaker dollar. Bitcoin's unique monetary policy with its limited supply and decentralized nature provides a hedge against inflationary pressures that can erode the value of fiat currencies.

3. Halving

The Bitcoin “halving” is a major event where Bitcoin’s blockchain rewards miners with half of the Bitcoin they previously received for solving complex mathematical puzzles. This event occurs every 210,000 blocks (approximately every four years).

The reward started at 50 BTC in 2009 and was reduced from 6.25 BTC to 3.125 BTC in mid-April 2024. This reduction decreases the number of Bitcoin sold on the market, as it squeezes out less efficient miners, reducing the overall supply of the currency. Previous halvings have driven dramatic increases in Bitcoin’s price, and we’re still awaiting the market's response to the most recent halving that took place in April this year.

The impact of the 2020 and 2024 halvings

Historically, halving events are seen as excellent indicators of future upward momentum for Bitcoin's price. While the halving that occurred on April 20, 2024, did not immediately cause the value to spike as experts predicted, it appears that the trend has reversed, and Bitcoin’s price is set to rise once again to create a new peak.

4. Historical Patterns Indicate a Strong Q4

The fourth reason for optimism is rooted in Bitcoin’s historical performance. Over its fifteen-year history, Bitcoin has shown a clear pattern of quiet summer months followed by a strong fourth quarter, and this year appears to be following the same trajectory.

The impact of Q4 on price

On average, Bitcoin has returned -4% in September, 26% in October, 36% in November, and 11% in December. If these historical averages hold, Bitcoin could see a significant surge in the coming months, potentially pushing its price beyond six figures to around $107,000. While past performance is not a guarantee of future results, the consistency of this pattern over the years suggests that Bitcoin may be set for another impressive year-end rally.

While Bitcoin’s future appears optimistic, individual investors should exercise caution with each move Bitcoin makes, as it has experienced violent disruptions before due to several other factors. Therefore, it’s crucial to remember that investing in Bitcoin should be approached with a long-term perspective.

Best Bitcoin Trading Platforms 2025

- Pepperstone - Best overall Bitcoin BTC trading broker for beginners. Founded 2010. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in Bitcoin BTC (CFDs). Founded 2008. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top Bitcoin BTC CFDs trading platform for educational materials and copy trading. Founded 2009. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.

Ethereum price (ETHUSD) hits the target – Forecast today - 21-10-2024

Ethereum price (ETHUSD) rallied upwards strongly in the previous sessions to succeed achieving our waited target at 2720.00$, noticing that the price breaches this level by today’s open to head towards achieving more gains on the intraday and short-term basis, noting that the next target reaches 2905.30$.

Therefore, the bullish trend will remain valid and active for the upcoming period, supported by the EMA50, noting that it is important to hold above 2623.77$ to continue the expected bullish wave.

The expected trading range for today is between 2630.00$ support and 2870.00$ resistance.

Trend forecast: Bullish

Bitcoin price (BTCUSD) keeps rising – Forecast today - 21-10-2024

Bitcoin price (BTCUSD) shows more bullish bias to approach our new waited target at 70000.00$, organized inside the bullish channel that appears on the chart, which supports the chances of achieving more gains that we expect to reach 70850.00$.

The EMA50 keeps supporting the suggested bullish wave, noting that breaking 68000.00$ barrier might push the price to achieve some bearish correction and test 65480.00$ areas before any new attempt to rise.

The expected trading range for today is between 67700.00$ support and 71000.00$ resistance.

Trend forecast: Bullish

Wheat price under the negative pressure – Forecast today - 21-10-2024

Wheat price couldn’t manage to hold for long time above 599.00$, to rebound downwards strongly and settle below it again, which puts the price under expected negative pressure in the upcoming sessions, targeting 568.50$ areas mainly.

Therefore, we expect to witness more decline on the intraday basis unless breaching 599.00$ and holding with a daily close above it.

The expected trading range for today is between 570.00$ support and 595.00$ resistance.

Trend forecast: Bearish