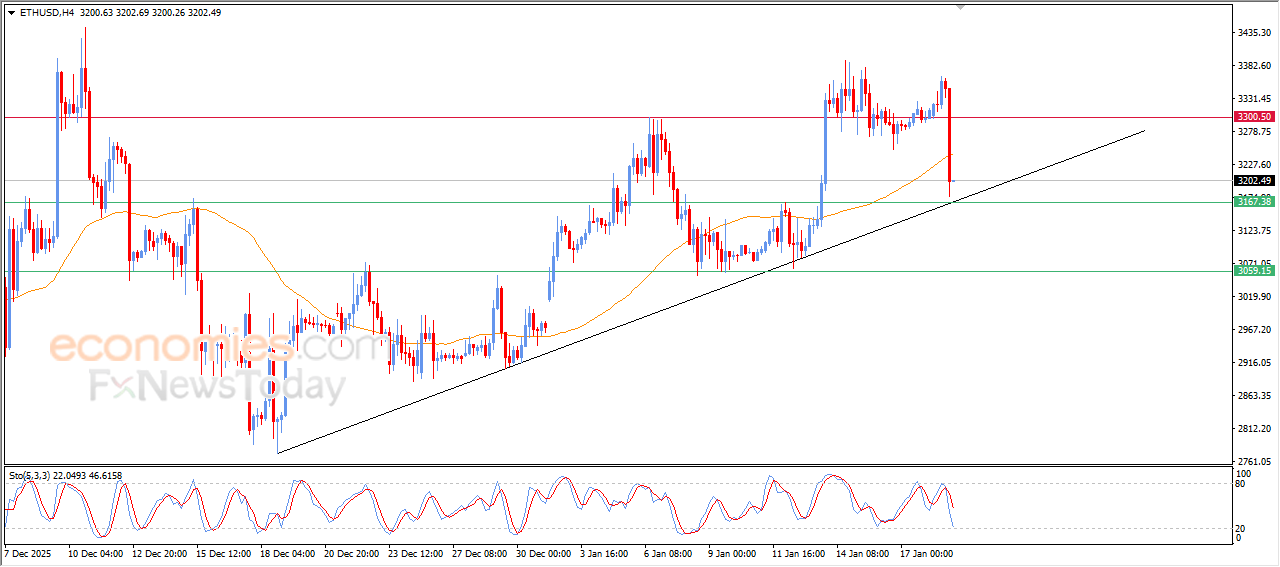

(ETHUSD) is under negative pressure- Analysis- 19-01-2026

The (ETHUSD) price declined sharply in its last intraday trading, amid the emergence of negative signals from relative strength indicators, after reaching overbought levels, surpassing EMA50’s support, which put it under negative pressure and increases the likelihoods of breaking bullish trend line, which represents the last support levels that might help the price to settle against this severe decline.

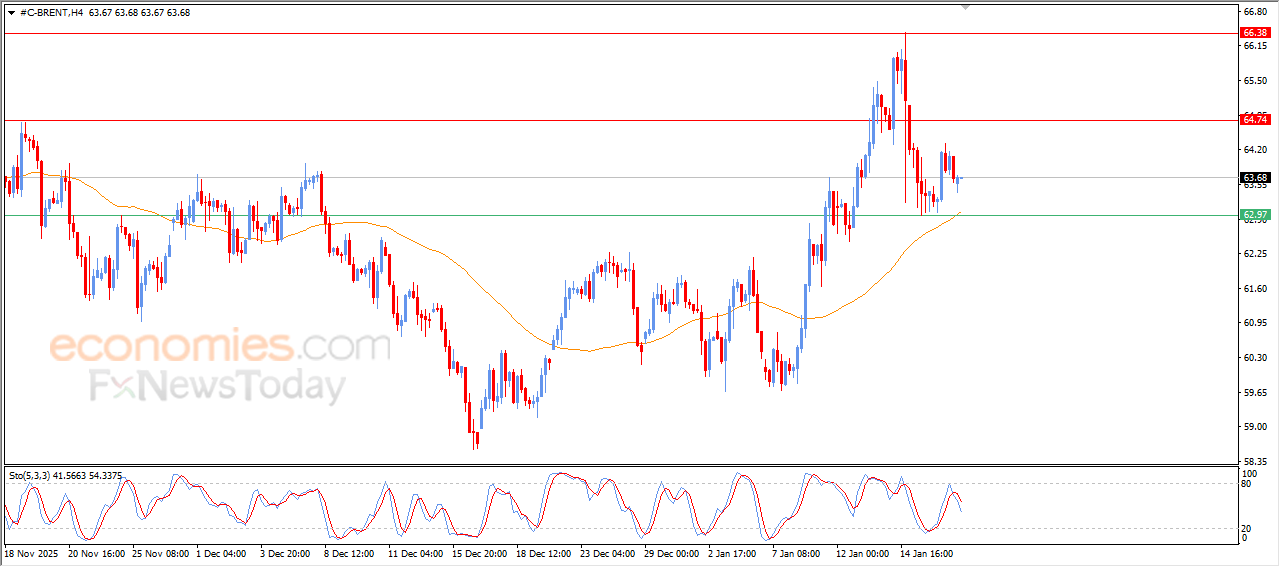

Brent crude oil is attempting to gain bullish momentum- Analysis- 19-01-2026

The (Brent) price settles on losses in its last intraday trading, with the emergence of negative signals from relative strength indicators, after reaching overbought levels, attempting to gain bullish momentum that might help it to recover and rise again, amid the dominance of the main bullish trend on short-term basis, with the continuation of the positive support that comes from its trading above EMA50, intensifying the recovery chances on near-term basis.

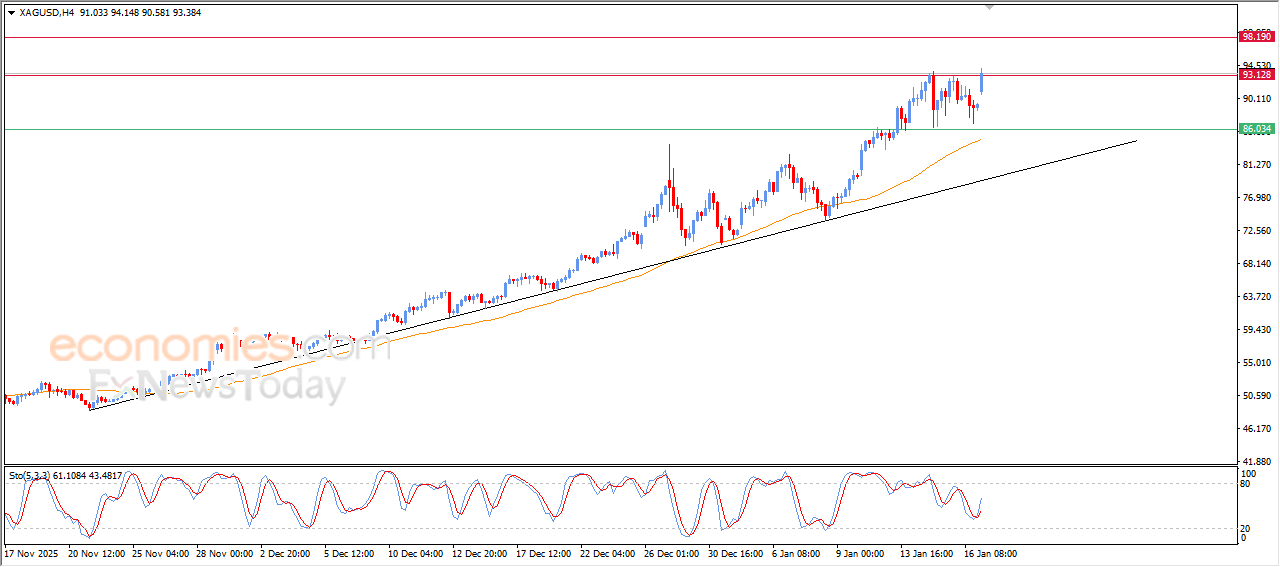

Silver price reaches key resistance- Analysis-19-01-2026

Silver price surged higher in its last intraday trading, attacking the key resistance at $93.00, preparing to record new all-time highs, benefiting from positive signals from relative strength indicators, after reaching exaggerated oversold levels compared to the price move, amid the dominance of the main bullish trend on short-term basis, with the continuation of dynamic support that is represented by its trading above EMA50, reinforcing the chances of extending the gains in the upcoming period.

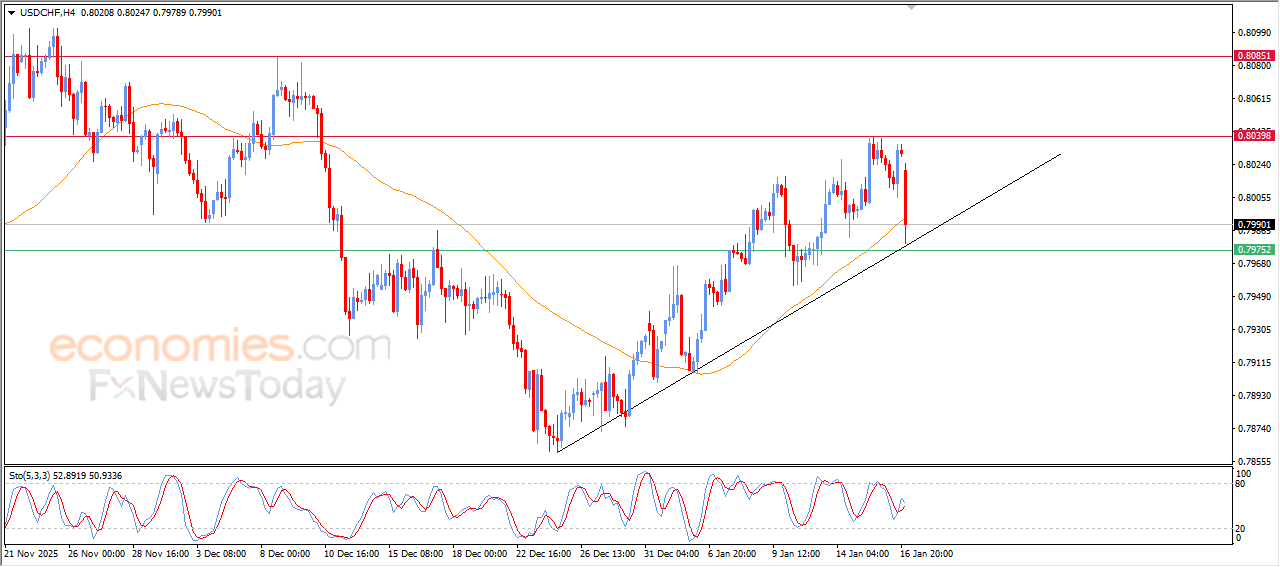

The USDCHF Price wears red- Analysis-19-01-2026

The (USDCHF) price slipped lower in its last intraday trading, due to the stability of 0.8040 resistance, attempting to look for a higher low to use it as a base to help it gain the required bullish momentum for its recovery, to lean on EMA50’s support, accompanied by testing bullish corrective trend line on short-term basis, intensifying the strength of this area as a key support that will effect the upcoming track, with the emergence of positive signals from relative strength indicators, after reaching oversold levels.