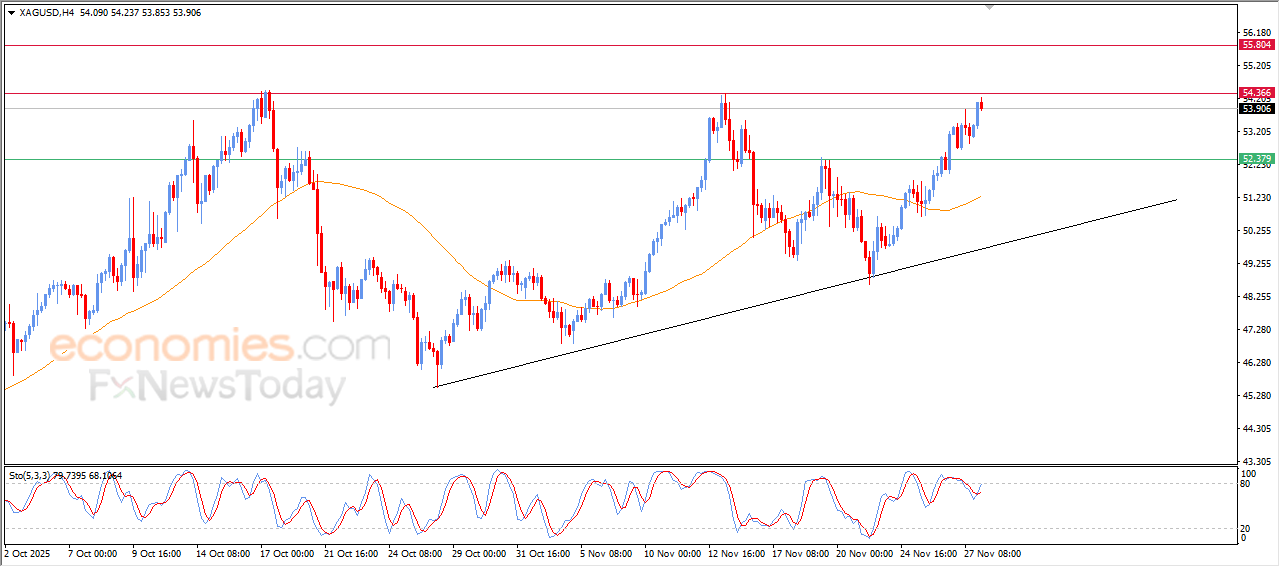

Silver price is getting ready to attack key resistance- Analysis-28-11-2025

Silver price settled higher in its last intraday trading, preparing to attack the key resistance level at $54.35, taking advantage of the dynamic support that is represented by its trading above EMA50, under the dominance of the main bullish trend on the short-term basis and its trading alongside trend line, noticing the emergence of the positive signals on the relative strength indicators, after offloading its overbought conditions, opening the way for achieving more gains on the near-term basis.

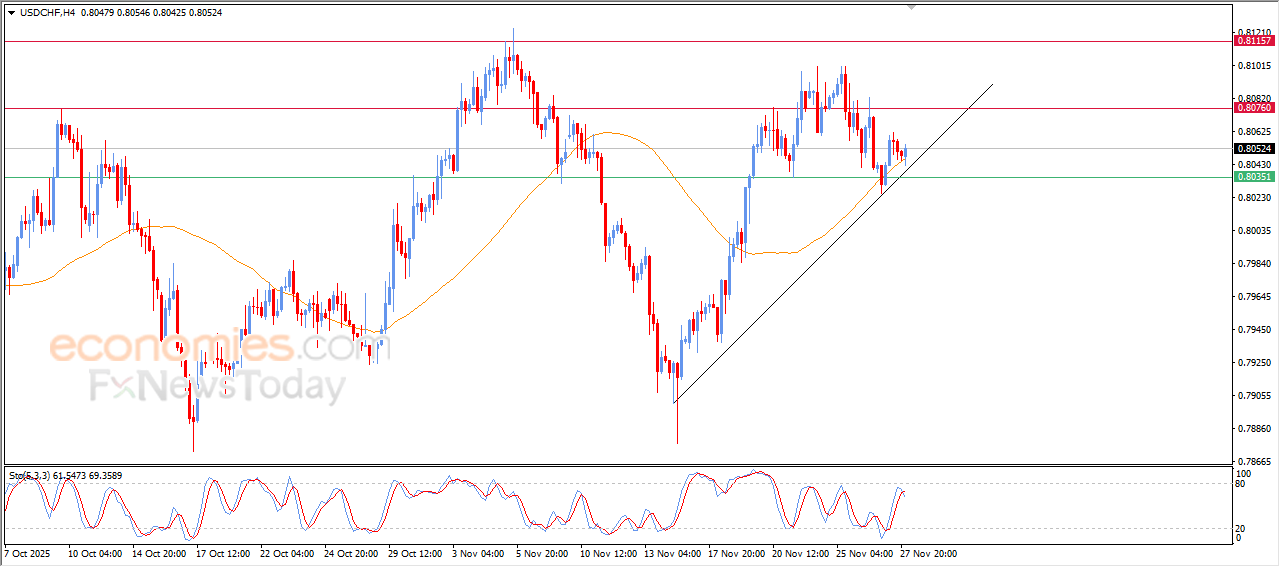

The USDCHF price regains its bullish momentum- Analysis-28-11-2025

The (USDCHF) price rose in its last intraday trading, as it leans on the support of EMA50, which prevented its decline in the previous period, amid the dominance of bullish wave on the short-term basis and its trading alongside steep trend line, on the other hand, we notice the emergence of negative overlapping signals on the relative strength indicators, after reaching overbought levels, which may obstruct the chances of sustainable recovery on the near-term basis.

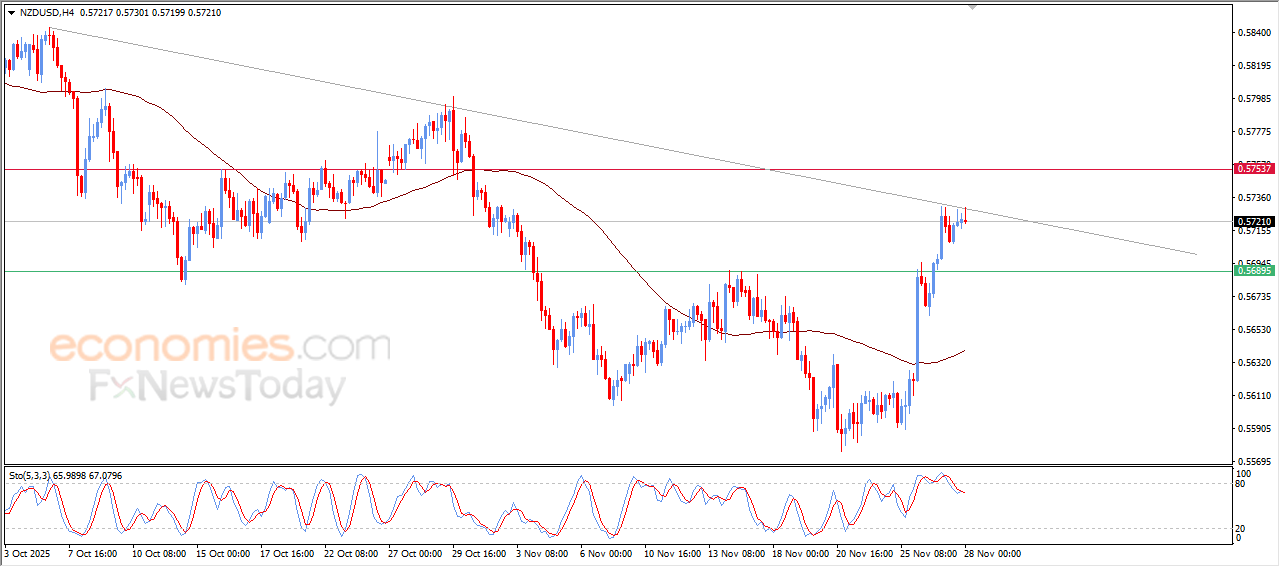

NZDUSD is attempting to resume its gains-Analysis-28-11-2025

The (NZDUSD) price settled higher in its last intraday trading, amid the dominance of strong bullish corrective wave on the short-term basis, with the continuation of the bullish support due to its trading above EMA50, noticing the emergence of positive overlapping signals on the relative strength indicators, after offloading its overbought conditions, opening the way for achieving more gains in the upcoming period.

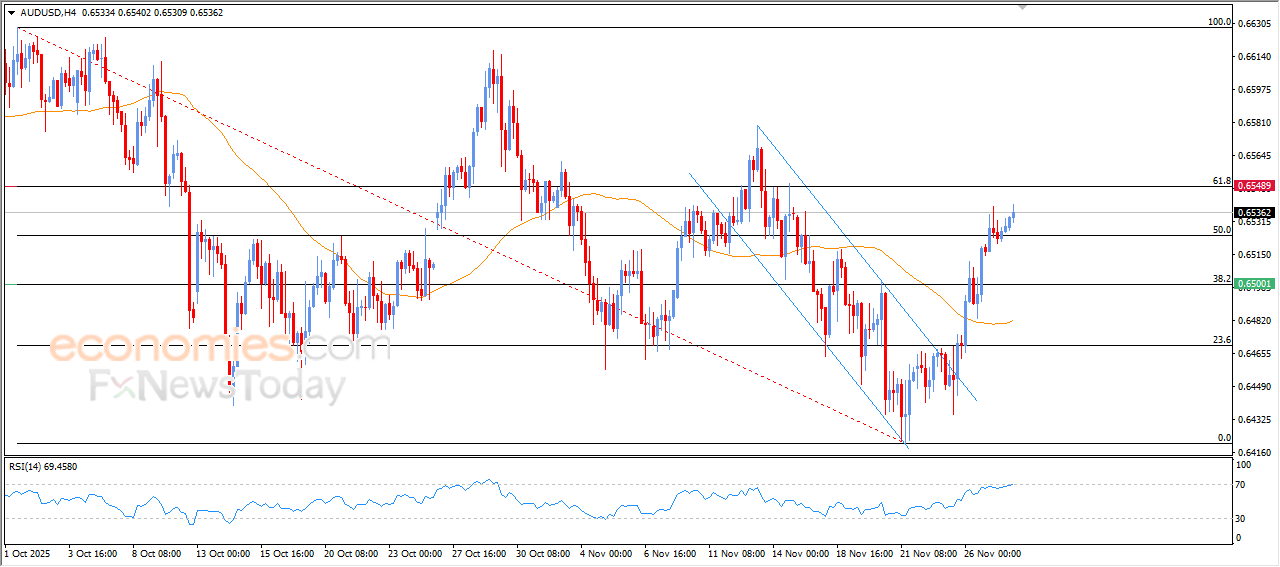

The AUDUSD price extends its gains- Analysis-28-11-2025

The (AUDUSD) price extended its gains in its last intraday trading, taking advantage of its stability above 0.6525, this resistance represents 50%Fibonacci correction level for the last bearish wave on the short-term basis( from 0.6628 to 0.2422), and there is a dynamic support that is represented by its trading above EMA50, besides the emergence of the positive signals on the relative strength indicators.