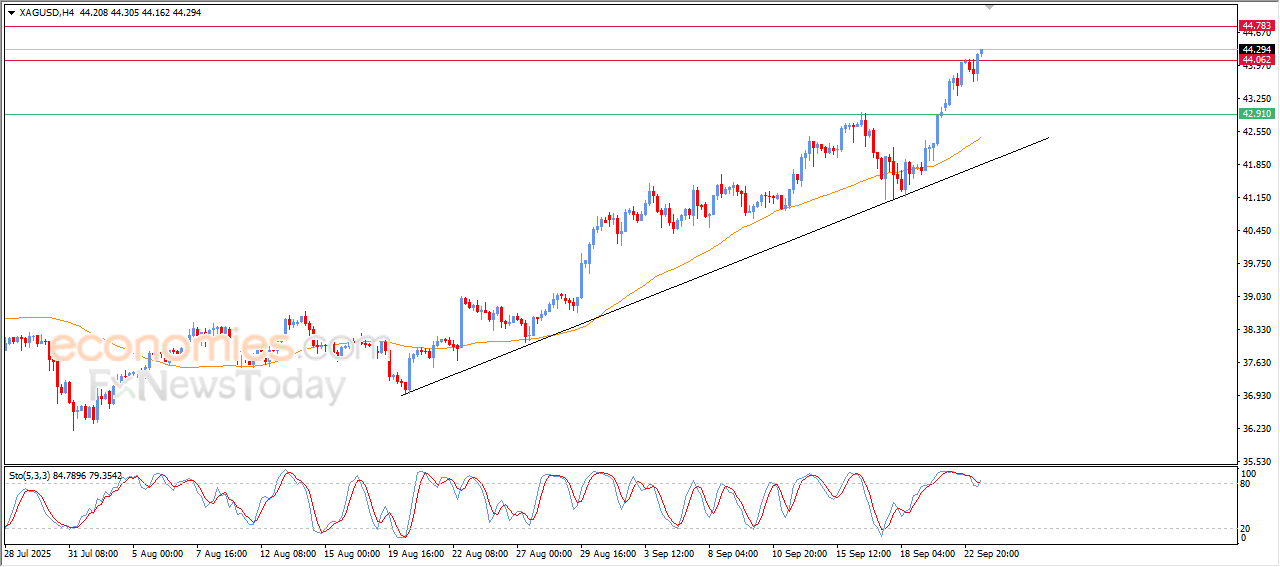

Forecast update for Silver -23-09-2025

AI Summary

- Silver price rose to breach resistance of $44.05, supported by bullish trend and positive signals on relative strength indicators

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for gold, oil, forex, bitcoin, ethereum, and indices

- Subscription packages range from €44/month for US stock signals to €179/month for VIP signals, with performance reports available for September 15-19, 2025.

The price of (Silver) rose in its last intraday trading, to breach the resistance of $44.05, which represents the expected target in our previous analysis, supported by its continued trading above EMA50, and under the dominance of the main bullish trend on the short-term basis and its trading alongside trendline, besides the emergence of positive overlapping signals on the relative strength indicators, after offloading some of its overbought conditions, opening the way for achieving more of the gains on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

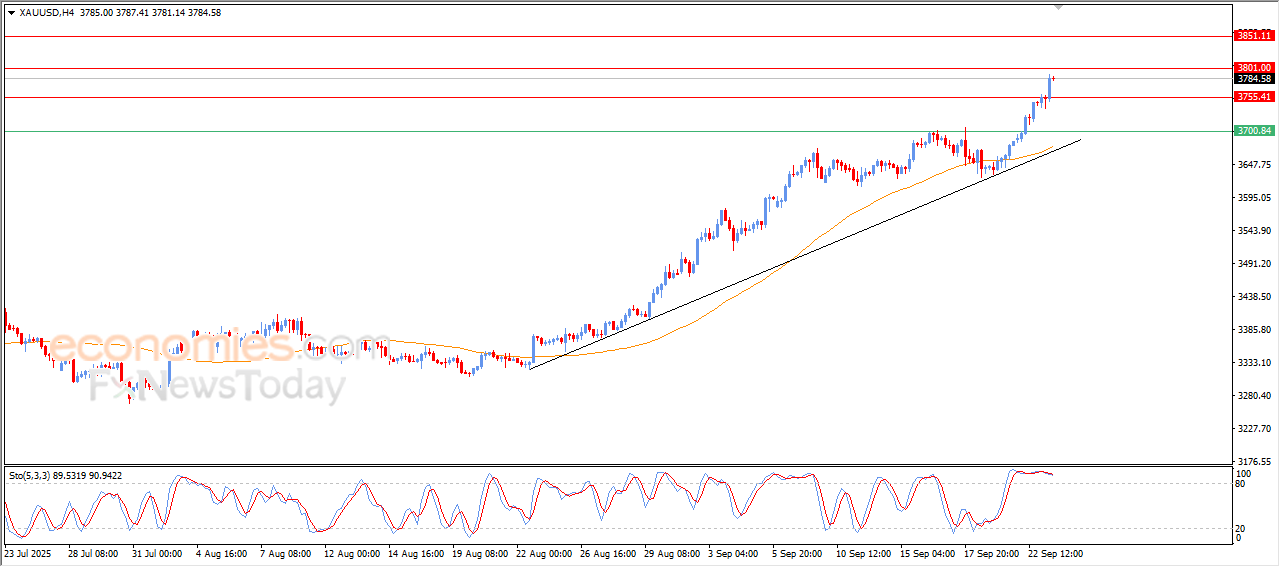

Forecast update for Gold -23-09-2025

The price of (Gold) continues its rise in its last intraday trading, continuing to post new record highs, breaching the resistance of $3,755, this resistance was our expected target previously, supported by its continued trading above EMA50, and under the full dominance of the main bullish trend and its trading alongside supportive trend line, on the other hand, we notice the emergence of the negative signals on the relative strength indicators, after reaching overbought levels, which might reduce the upcoming gains of the price.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

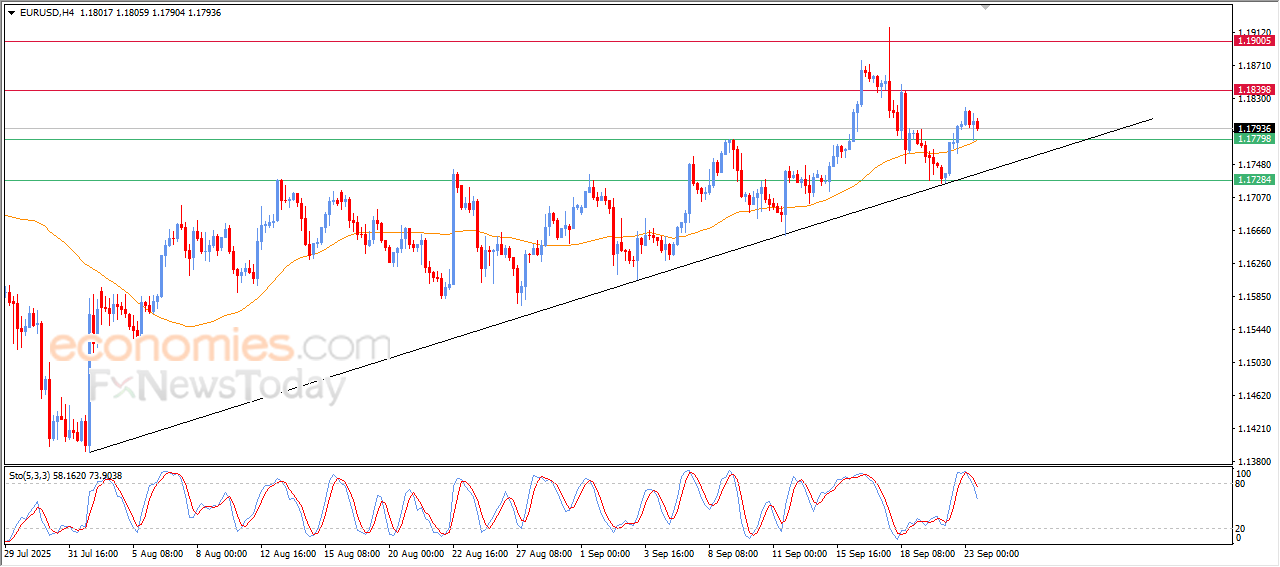

Forecast update for EURUSD -23-09-2025.

The price of (EURUSD) declined in its last intraday trading, to gather the gains of its previous rises, attempting to gain bullish momentum that might help it to recover and rise again, besides the attempts of the pair to offload some of its clear overbought conditions on the relative strength indicators, especially with the emergence of the negative signals from there, amid its trading above EMA50, reinforcing the stability of the main bullish trend on the short-term basis, with its move alongside trend line.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

The GBPCHF confirms the negativity – Forecast today – 23-9-2025

The GBPCHF provided several negative trading, affected by its stability below the main bearish channel’s resistance at 1.0748, suffering some losses by hitting 1.0670 level, then forming correctional trading by its stability near 1.0705.

Note that the continuation of providing positive momentum by the main indicators will increase the chances of forming new bearish waves, attempting to press on the barrier at 1.0660, and breaking it will extend the losses towards 1.0630, to face the support of bearish channel that appears in the above image.

The expected trading range for today is between 1.0720 and 1.0660

Trend forecast: Bearish