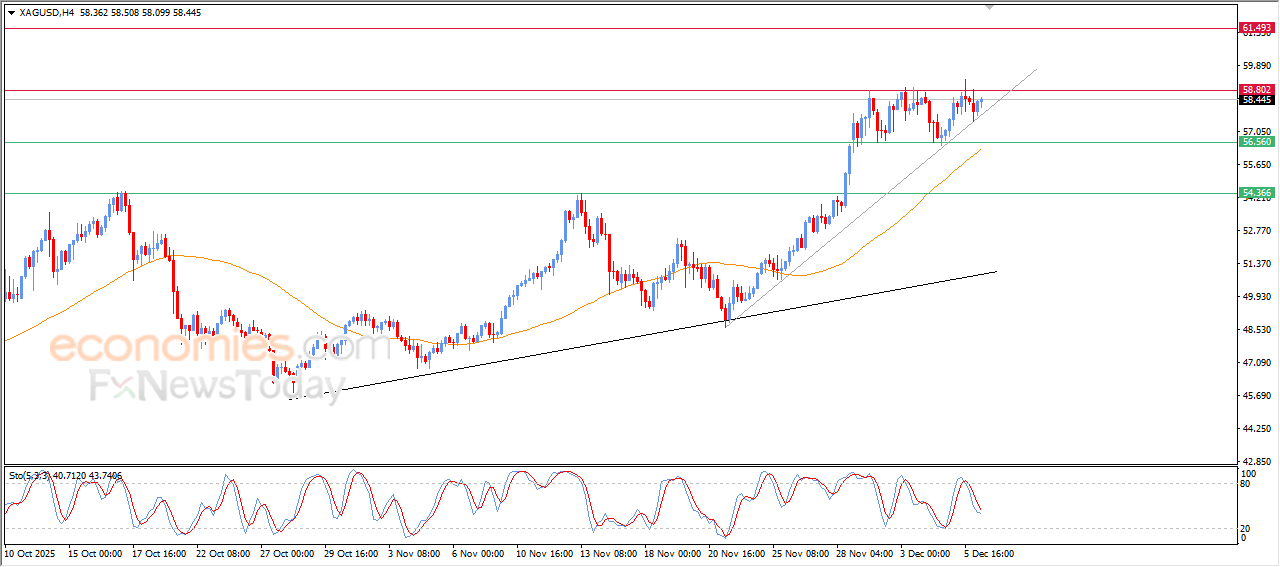

Forecast update for silver -08-12-2025

The price of (silver) rose in its last intraday trading, preparing to reach the key resistance at $58.80, supported by its trading above EMA50, and under the dominance of the main bullish trend on the short-term basis and its trading alongside main and minor supportive trend line for this trend, after offloading the overbought conditions on the relative strength indicators, opening the way for achieving more gains.

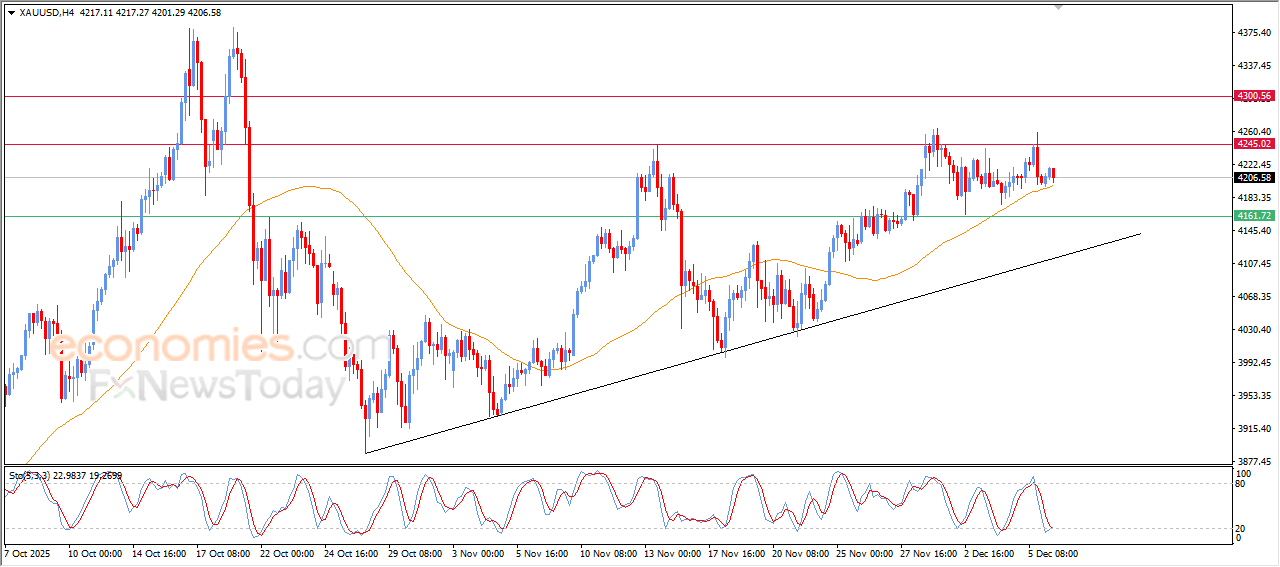

Forecast update for Gold -08-12-2025.

The price of (Gold) declined in its last intraday trading, leaning on the support if its EMA50, amid its attempts to gain bullish momentum that may help it to attack the sold key resistance at $4,245, amid the dominance of the bullish trend on the short-term basis and its trading alongside trend line, besides the emergence of positive overlapping signals on the relative strength indicators after reaching oversold levels, reinforcing the chances of the price’s recovery in the upcoming period.

Forecast update for EURUSD -08-12-2025.

The price of (EURUSD) declined to reduce its early gains for today, to gain bullish momentum that might help it to recover and reinforce these gains, amid the dominance of minor bullish wave on the short-term basis, and its trading alongside trend line, with the continuation of the dynamic pressure that is represented by its trading above EMA50, besides the emergence of the positive signals on the relative strength indicators, after reaching oversold levels.

6,490 Pips with 95% Accuracy from November 24 to December 5, 2025 – BestTradingSignal Weekly Results

The global financial markets have continued to deliver significant volatility over the last two weeks, presenting an environment where disciplined traders with access to structured signals were able to extract measurable opportunities. BestTradingSignal, a leading provider of real-time market signals, has once again demonstrated consistent performance across major asset classes including Gold (XAUUSD), Bitcoin (BTCUSD), NASDAQ, DAX, USDJPY, Silver, USOIL, and GBPUSD.

This report outlines the total number of pips captured, accuracy levels, and the instruments that contributed to the results for the weeks ending November 28, and December 5, 2025.

Performance Summary

Week 1: November 24–28, 2025

BestTradingSignal recorded:

-

+3,325 pips

-

95% accuracy

The majority of opportunities were captured in Gold, Bitcoin, and global indices, benefiting from accelerated price swings driven by liquidity shifts, macroeconomic releases, and momentum-based inflows into commodities and digital assets.

Week 2: December 1–5, 2025

The following week delivered:

-

+3,165 pips

-

96% accuracy

This performance was driven largely by DAX, USDJPY, Silver, NASDAQ, and USOIL, supported by directional momentum and well-defined technical continuation patterns.

What Enabled These Results

BestTradingSignal’s methodology is based on:

1. Structured Entry and Exit Signals

Each opportunity included predefined entry zones, stop-loss levels, and target objectives, enabling traders to react before price movement occurred rather than after trends were established.

2. Market Coverage Across Multiple Asset Classes

Rather than focusing on a single asset, the service diversified across:

-

Precious metals (Gold, Silver)

-

Energy commodities (USOIL)

-

Indices (DAX, NASDAQ, Dow Jones)

-

Currencies (GBPUSD, USDJPY)

-

Crypto (Bitcoin)

This diversification allowed traders to capitalize on volatility regardless of market direction.

3. Real-Time Execution via Telegram

Signals were delivered instantly through Telegram, eliminating delays and guesswork.

Why Structured Signals Matter

Thousands of independent traders enter markets with fragmented strategies, emotional bias, or lagging information. BestTradingSignal’s structured approach provides:

-

Objective trade parameters

-

Clear risk management

-

A repeatable process not dependent on personal bias

-

High probability trade setups aligned with institutional momentum

In a high-volatility environment, this approach can mean the difference between consistent gains and unpredictable outcomes.

Final Verdict

Across two weeks, BestTradingSignal achieved:

-

6,490 pips combined

-

Average accuracy above 95%

-

Profitable results on every major instrument traded

For traders aiming to eliminate uncertainty, adopt a plan, and enter markets with confidence, the service provides a competitive advantage in timing, execution, and market awareness.

Those seeking access to the next cycle of signals can join directly via Telegram: