Forecast update for silver -08-01-2026

The price of (silver) deepened its losses in its last intraday trading, due to its attempts to look for rising low to use it as a base to gain the required bullish momentum for its recovery, to lean on EMA50’s support, amid the dominance of the main bullish trend on the short-term basis, with its trading alongside supportive trend line for this bullish track, reinforcing the recovery chances and the upside track return.

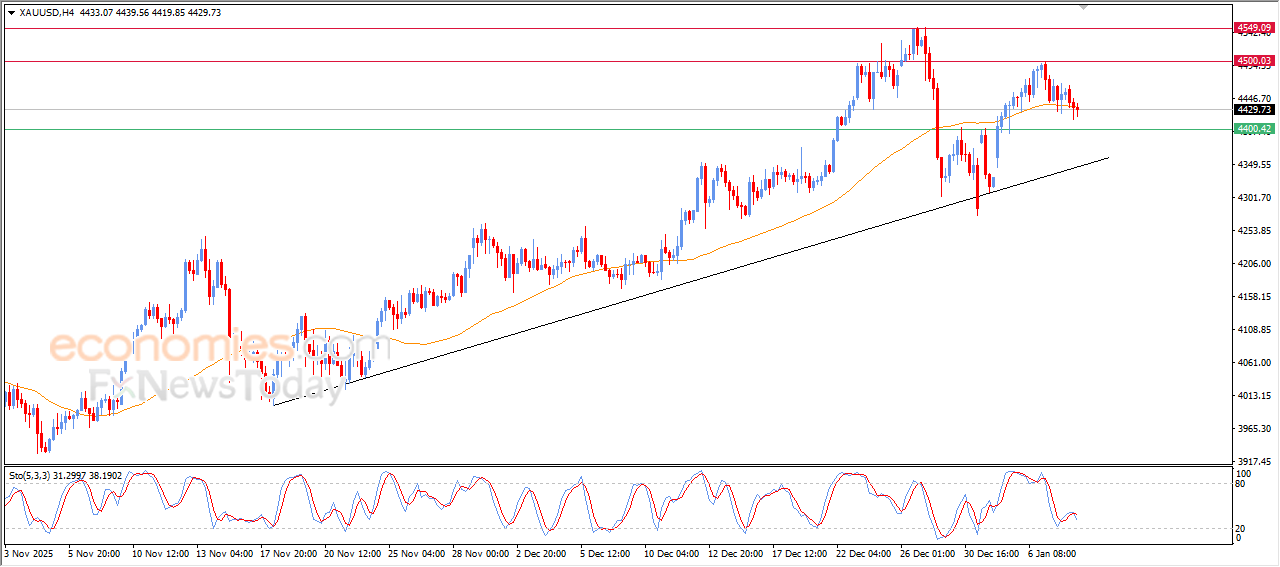

Forecast update for Gold -08-01-2026.

The price of (Gold) kept declining on its recent intraday levels, to surpass the support of EMA50, with the emergence of negative overlapping signals from the relative strength indicators, after offloading its oversold conditions, putting it under negative pressure in the upcoming intraday sessions, but the bullish trend remains the dominant on the short-term basis with its trading alongside trend line, keeping the recovery chances valid.

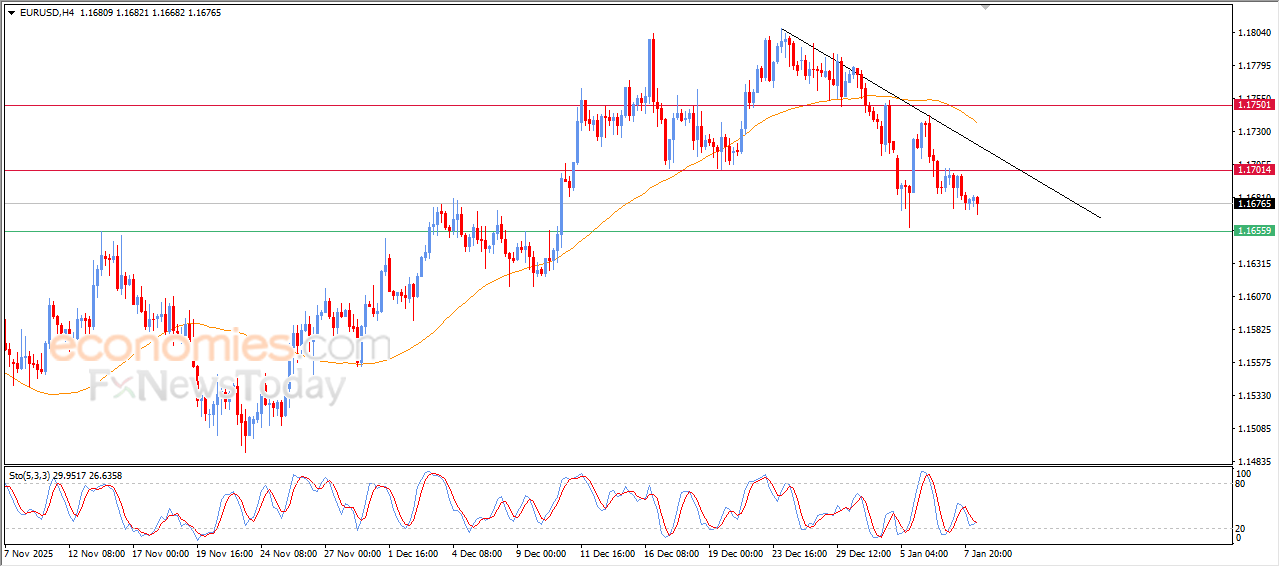

Forecast update for EURUSD -08-01-2026.

The price of (EURUSD) declined in its last intraday trading, amid the continuation of the negative pressure due to its trading below EMA50, reinforcing the strength of the bearish corrective track on the short-term basis, especially with its trading alongside trend line, on the other hand, we notice the emergence of positive overlapping signals from the relative strength indicators, which are stable at the oversold levels, and that might limit the decline temporarily.

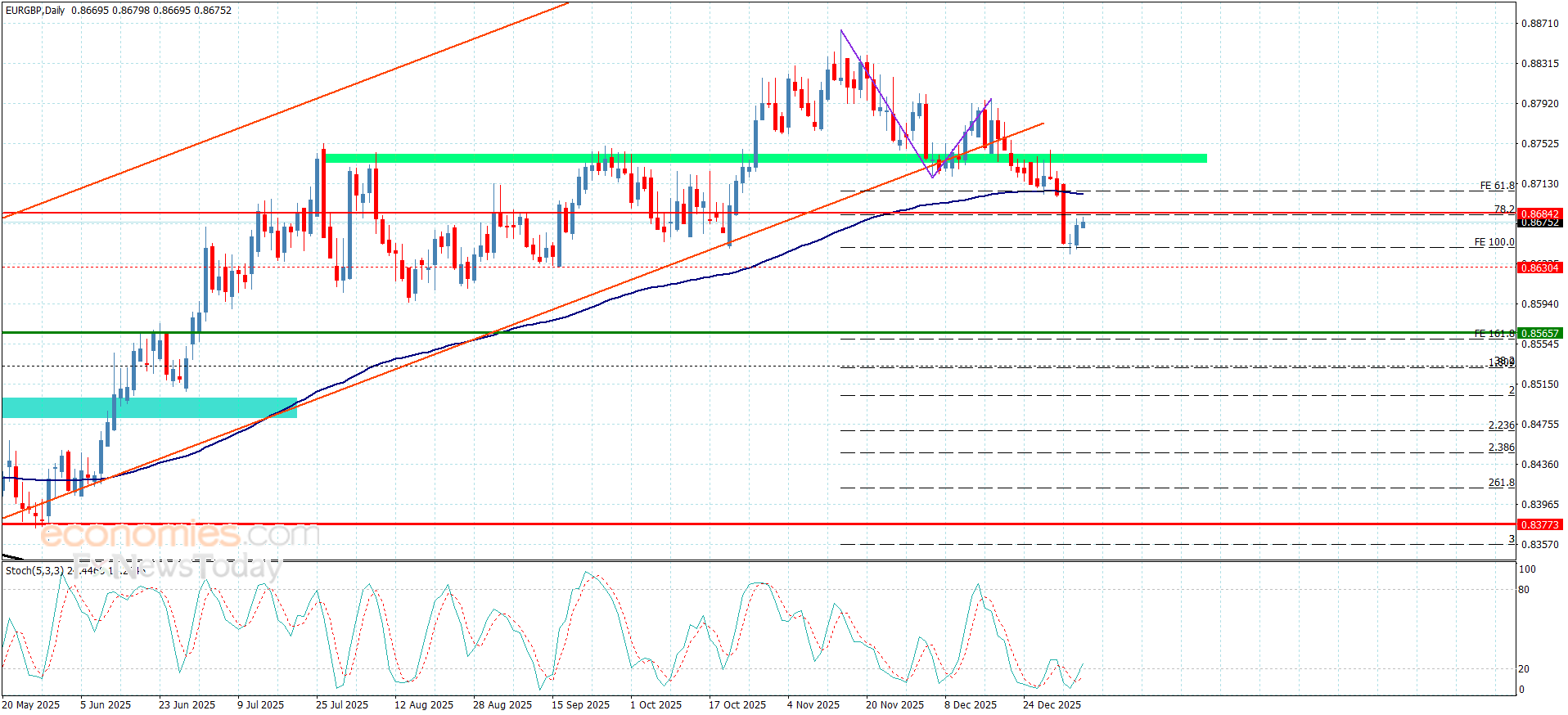

The EURGBP begins bearish moves– Forecast today – 8-1-2026

The EURGBP surrendered to strong negative pressures, which forces it to break the decline below 0.8735 level, activating the negative track by its targeting 0.8645 level, which forms 100.00 Fibonacci extension level that appears in the above image.

The contradiction between the main indicators that might force the price to provide mixed trading until gathering the required extra negative momentum to resume the negative attack, to expect reaching 0.8625 reaching the next main target near 0.8570.

The expected trading range for today is between 0.8625 and 0.8710

Trend forecast: Bearish