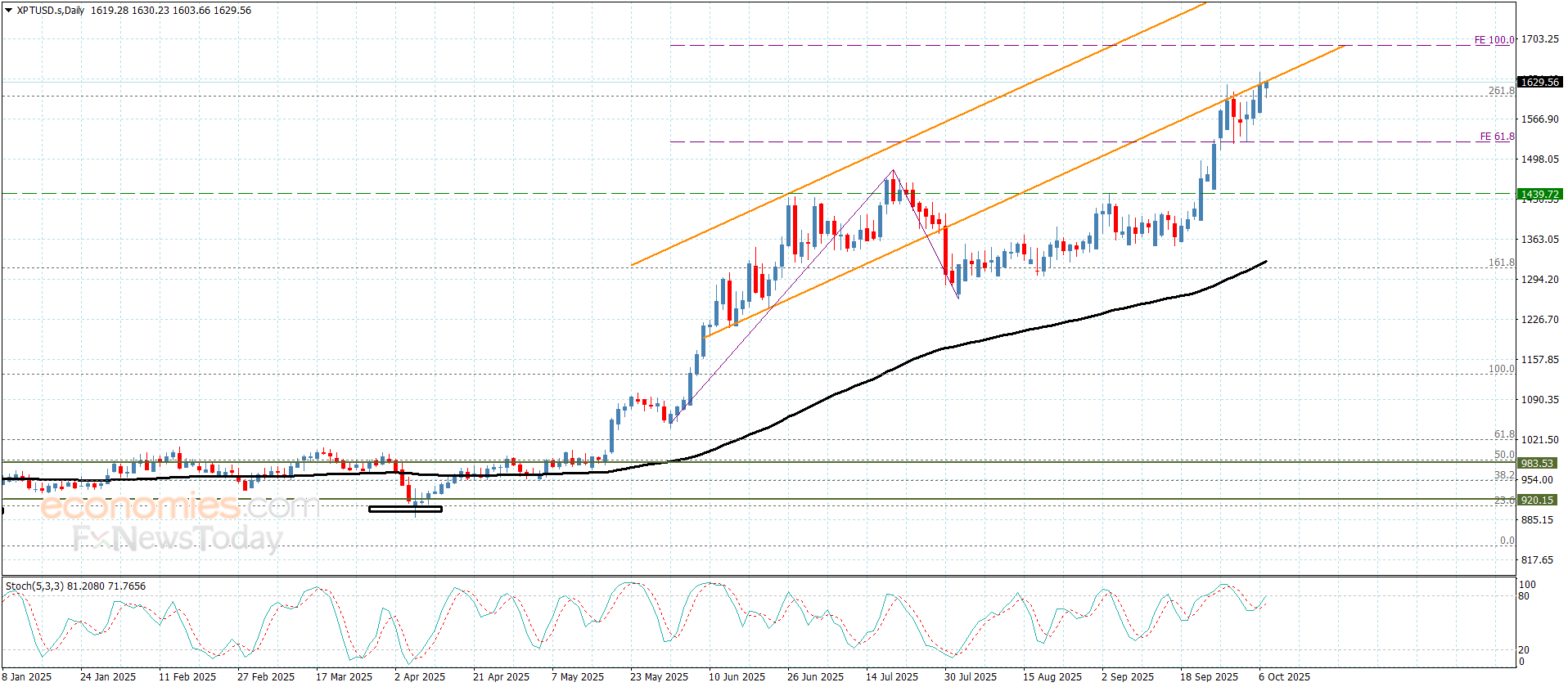

Platinum price repeats the bullish attempts– Forecast today – 7-10-2025

Platinum price took advantage of the positive momentum that comes from the unionism of the main indicators, keeping the chances of resuming the bullish trend by reaching $1630.00 resistance, to find an exit to achieve new gains that might extend to $1660.00 and $1690.00.

Reminding you that the stability of the support at $1525.00 forms a main factor to confirm the bullish scenario in the near and medium period trading, while breaking this support will force the price to activate the bearish corrective track, which forces it to suffer some losses by reaching $1480.00 and $1440.00 before any new attempt to resume the bullish trend.

The expected trading range for today is between $1575.00 and $1660.00

Trend forecast: Bullish

Copper price keeps the bullish track– Forecast today – 7-10-2025

Despite the fluctuation of copper price since yesterday below $5.0600 level, the main stability remains within the bullish channel levels, if the main indicators kept providing positive momentum, then our previously suggested bullish scenario remains valid.

The stability of the extra support near $4.7500 confirms the confinement of the trading within the bullish track, to keep waiting for breaching the current barrier, then begin recording new gains towards $5.2000 and $5.3200.

The expected trading range for today is between $4.9100 and $5.2000

Trend forecast: Bullish

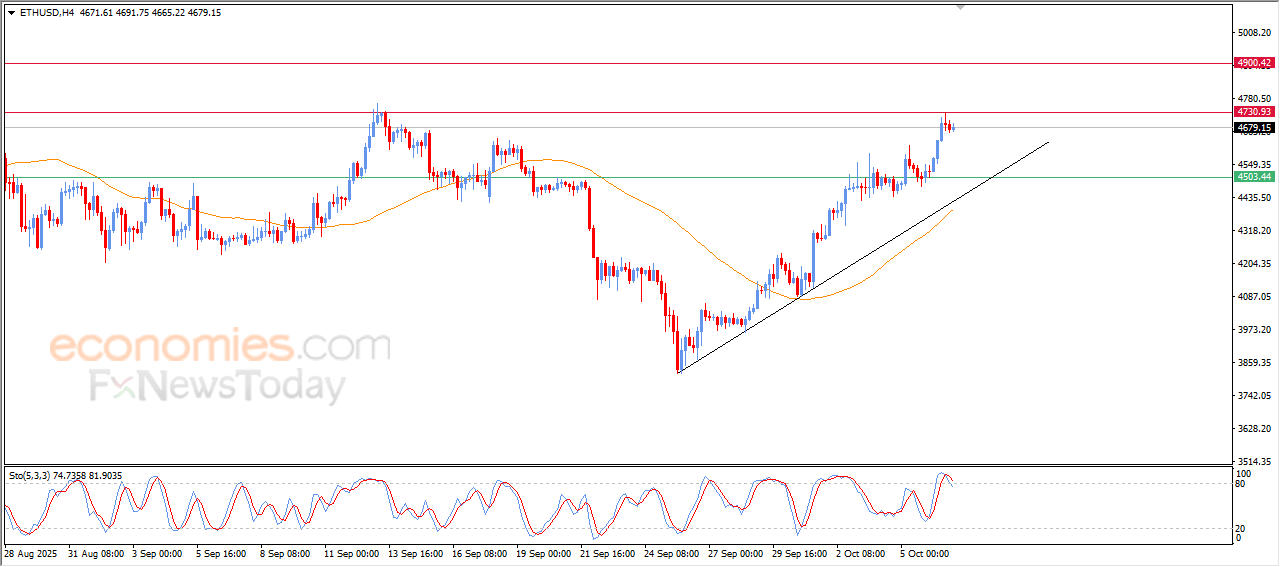

The (ETHUSD) price is reaching our suggested target- Analysis- 07-10-2025

The (ETHUSD) price settled high in its last intraday trading, after reaching our last suggested target at $4,730 resistance, to take a breather to catch its breath and book profits from its previous rally, attempting to offload some of its clear overbought conditions on the relative strength indicators, gathering its positive strength that might help it to breach this resistance, amid the dominance of the main bullish trend and its trading alongside minor trend line on the short-term basis that supports this track.

VIP Trading Signals Performance by BestTradingSignal.com (Sept 29 – Oct 3, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for Sept 29 – Oct 3, 2025:

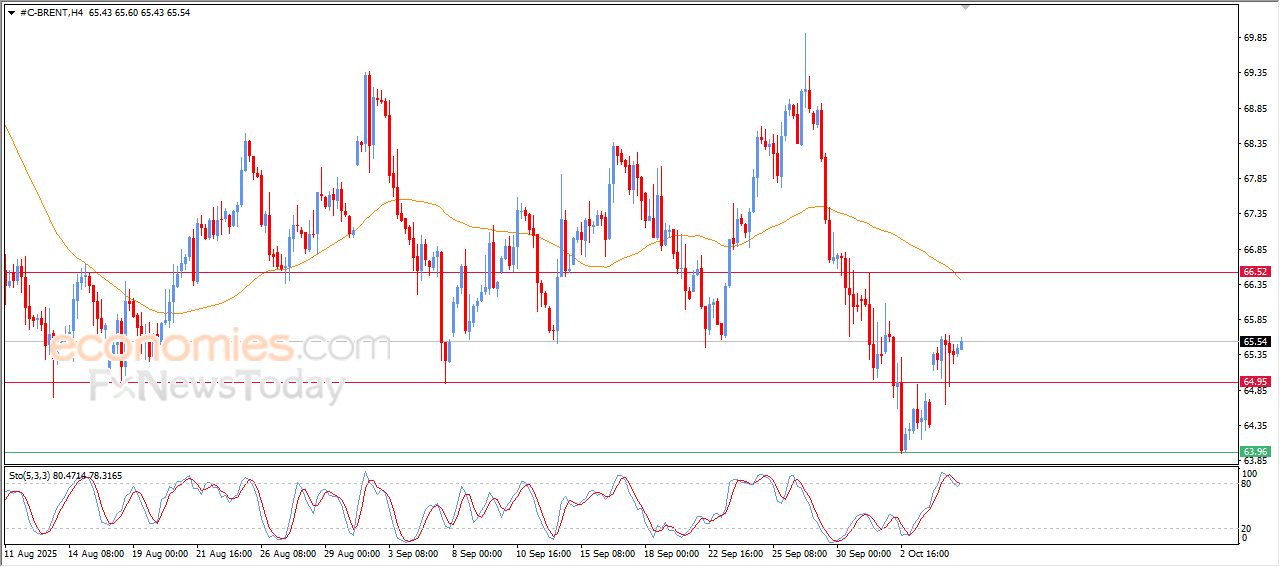

Brent crude oil is rising carefully- Analysis-07-10-2025

The (Brent) price rose in its last trading on the intraday basis, amid the stability of its trading above the critical support of $64.95, attempting to correct the main bearish trend on the short-term basis, amid the continuation of the negative pressure due to its trading below EMA50, reducing the chances for a sustainable recovery in the upcoming period, especially with the beginning of the negative signs appearance on the relative strength indicators, after reaching overbought levels, exaggeratedly compared to the price movement, forming negative divergence that intensifies the negative pressure around the price.

VIP Trading Signals Performance by BestTradingSignal.com (Sept 29 – Oct 3, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for Sept 29 – Oct 3, 2025: