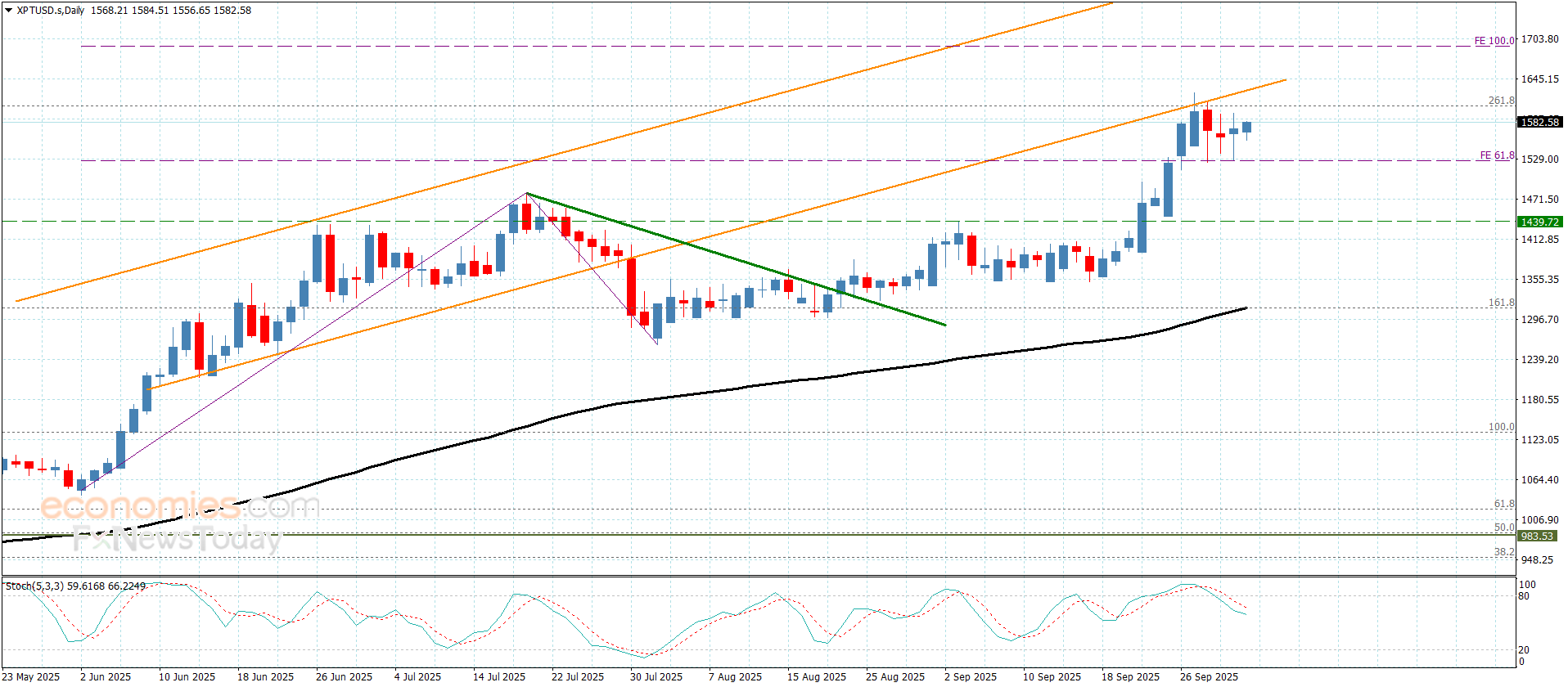

Platinum price remains confined– Forecast today – 3-10-2025

Platinum price is affected by the dominance of the sideways bias, due to the contradiction between stochastic negativity by its stability above the extra support at $1525.00, providing sideways fluctuation by its stability near $1575.00.

Note that breaching the sideways track at $1605.00 is important to ease the mission of activating the bullish trend and begin recording new gains by its rally towards $1642.00 and $1690.00.

The expected trading range for today is between $1535.00 and $ 1605.00

Trend forecast: Sideways

Copper price hits the target– Forecast today – 3-10-2025

Copper price continued to form strong bullish waves, reaching the initial extra target at $4.9500, keeping its positive stability above $4.7400 level, forming new support against the bullish trading.

The continuation of the providing positive momentum by the main indicators makes us expect renewing the bullish attempts, attempting to press on $5.0600 level, and surpassing it will open the way towards the next main target at $5.3200.

The expected trading range for today is between $4.8200 and $5.0600

Trend forecast: Bullish

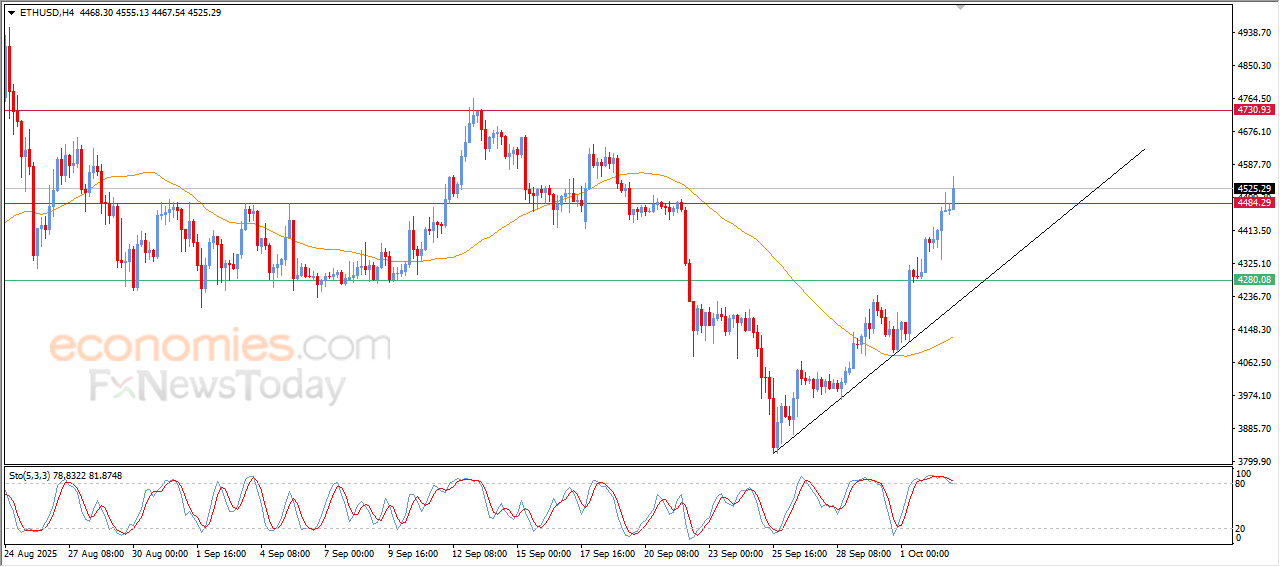

The (ETHUSD) price breaches our expected target- Analysis- 03-10-2025

The (ETHUSD) price extended its strong gains in its last trading on the intraday levels, breaching the resistance of $4,500, this resistance was our expected target in our previous analysis supported by its continuous trading above EMA50, under the dominance of minor bullish trend on the short-term basis and its trading alongside trend line. This rise came despite the emergence of the negative signals on the relative strength indicators after reaching overbought levels, and it didn’t affect the price movement, indicating the strength and volume of the positive momentum.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

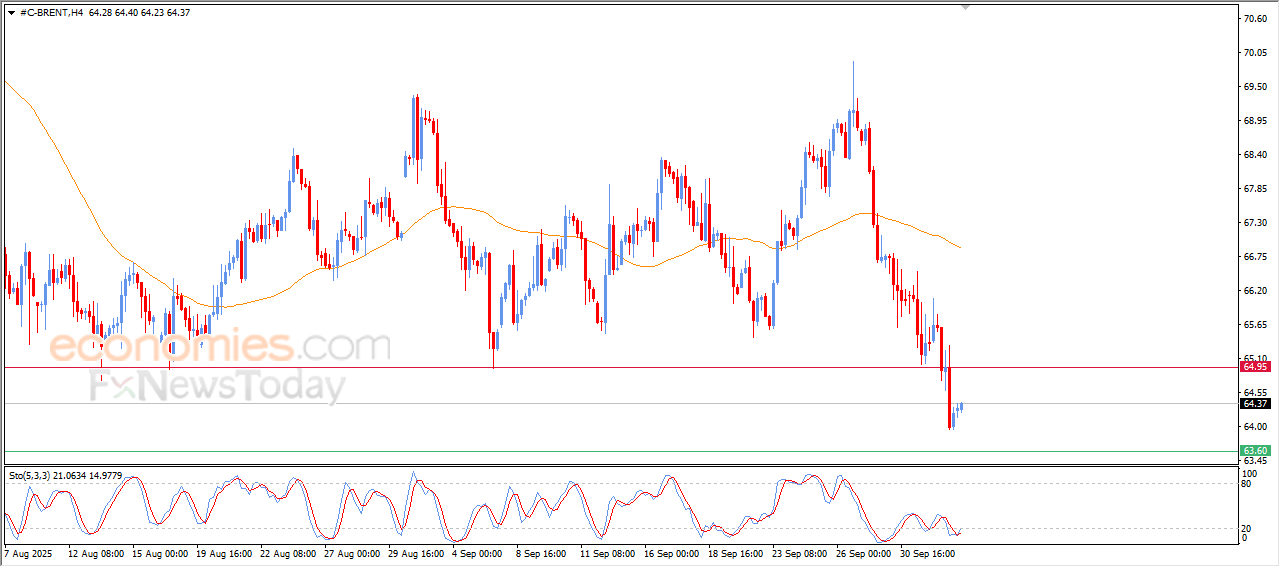

Brent crude oil is witnessing cautious gains- Analysis-03-10-2025

The (Brent) price rose in its last trading on the intraday levels, amid the dominance of main bearish wave on the short-term basis, with the continuation of the negative pressure that comes from its trading below EMA50, intensifying the negative pressure around the price, attempting to recover some of its previous losses, and offloading some of its clear oversold levels on the relative strength indicators, especially with the emergence of the positive signals.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025: