Platinum price provides sideways trading– Forecast today – 2-10-2025

AI Summary

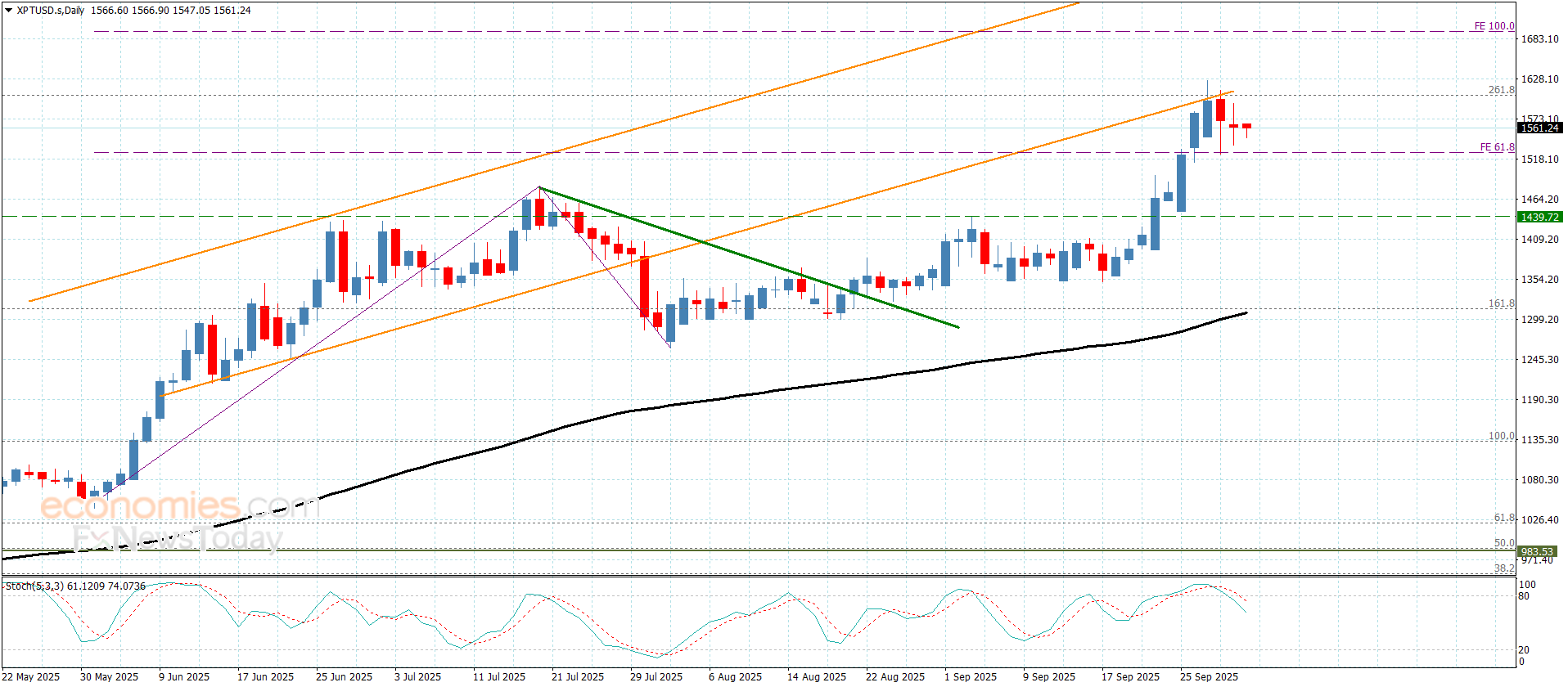

- Platinum price has been trading sideways near $1560.00, with support at $1525.00 and resistance at $1610.00

- Main indicators suggest a continuation of the sideways trend, with potential gains up to $1642.00 and $1690.00

- The expected trading range for today is between $1525.00 and $1605.00, with a sideways trend forecasted.

No news for Platinum price, providing mixed sideways trading since morning by its stability near $1560.00, confined between the extra support at $1525.00, while $1610.00 level forms a strong barrier against the attempts of resuming the bullish attack.

The contradiction between the main indicators supports the dominance of the sideways trend in the current trading, to keep waiting to surpass the current barrier, which allows it to achieve new gains that might extend towards $1642.00 reaching the next main target at $1690.00.

The expected trading range for today is between $1525.00 and $1605.00

Trend forecast: Sideways

Copper price repeats the positive closes– Forecast today – 2-10-2025

Copper price succeeded to settle above $4.7500 level, confirming its readiness to resume the bullish attack, activating with the positivity of the main indicators, to reach the initial target at $4.9500, surpassing it will extend the trading towards the next station near $5.3200.

Note that the price attempt to decline below the breached barrier might force it to provide intraday sideways trading, but it didn’t affect the main bullish trend due to its stability within the bullish channel’s levels, and forming new support by the moving average 55 at $4.3700.

The expected trading range for today is between $4.7000 and $4.9500

Trend forecast: Bullish

The (ETHUSD) price witness strong gains- Analysis- 02-10-2025

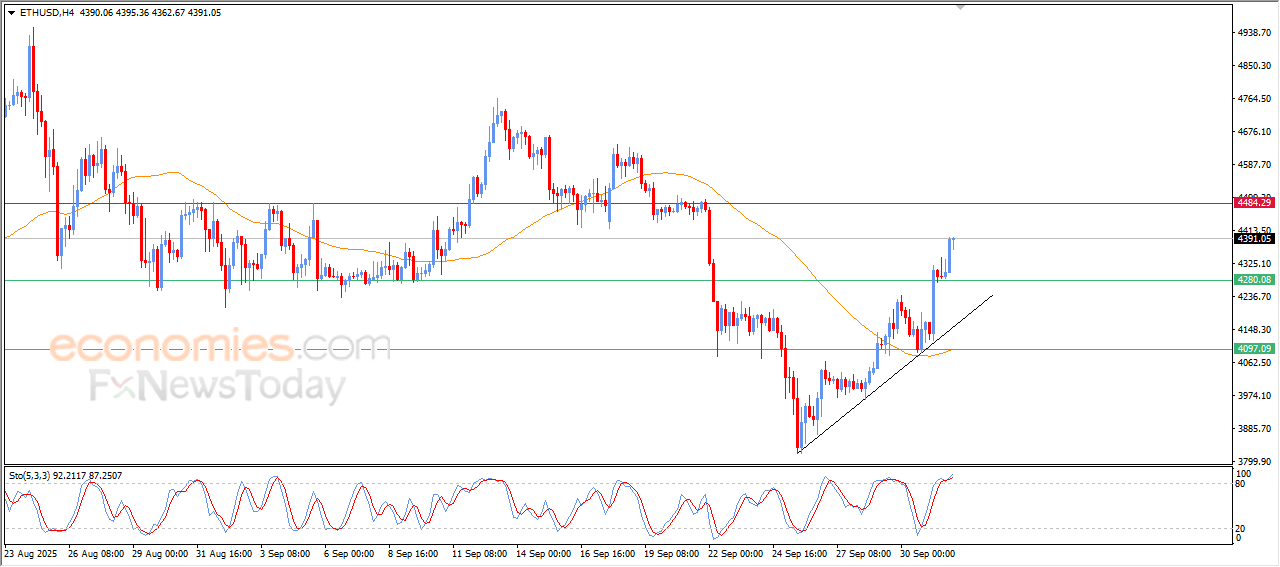

The (ETHUSD) price soared high in its last intraday trading, resuming its strong gains amid the dominance of the bullish corrective trend on the short-term basis and its trading alongside supportive trendline for this track, with the continuation of the positive pressure due to its trading above EMA50, with the emergence of the positive signals on the relative strength indicators, despite reaching overbought levels, indicating the strength of the positive momentum.

Therefore, our expectations suggest a rise in the (ETHUSD) price in its upcoming intraday trading, conditioned by its stability above $4,280, to target the initial resistance level at $4,500.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

Brent crude oil attempts to recover some of its losses- Analysis-02-10-2025

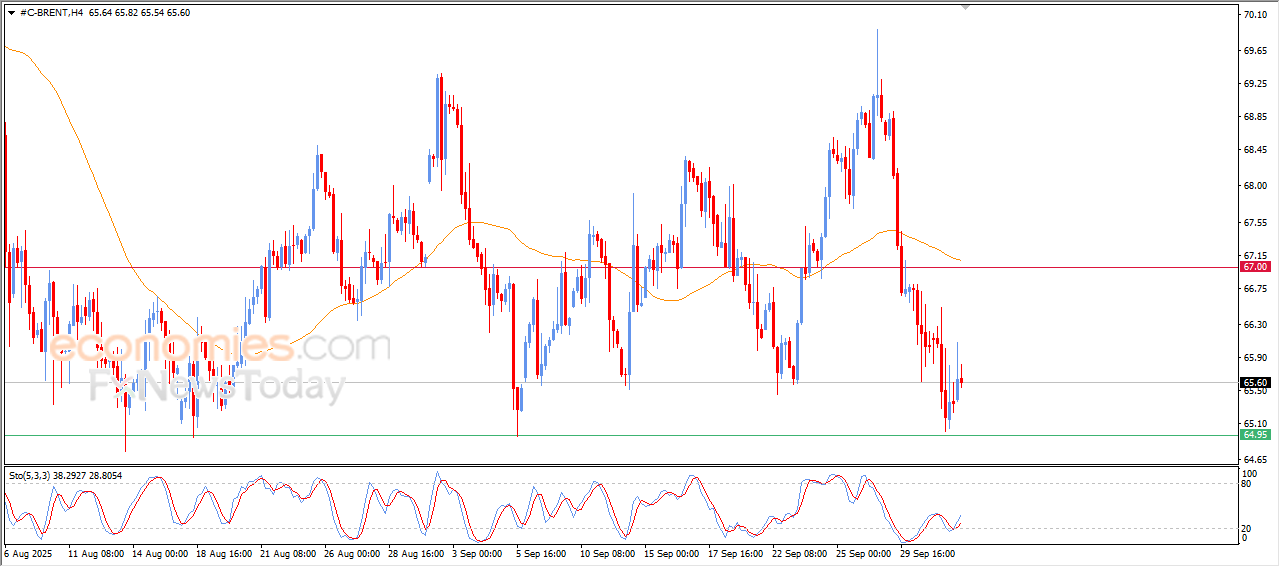

The (Brent) price settled with cautious gains in its last intraday trading, supported by the emergence of the positive signals on the relative strength indicators, attempting to offload some of its oversold conditions to recover its previous losses, amid the dominance of steep bearish sub-wave on the short-term basis, with the continuation of the negative pressure due to its trading below EMA50, intensifying the negative pressure.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025: