Key Factors Investors Should Watch Ahead of the OPEC+ Meeting to Forecast Oil Prices

The decline in global demand for crude oil has led to a significant drop in prices from their peak in May 2022, which reached around $120 per barrel. By mid-November 2024, West Texas Intermediate (WTI) crude oil futures on the Chicago Mercantile Exchange were trading at about $71 per barrel, approximately 10% lower than their levels at the beginning of the 2024 summer season.

As we approach the end of this year, crude oil prices continue to attract significant attention. A combination of production restrictions, geopolitical challenges, and changing global demand trends play crucial roles in shaping the future of the market.

Factors Influencing Oil Prices

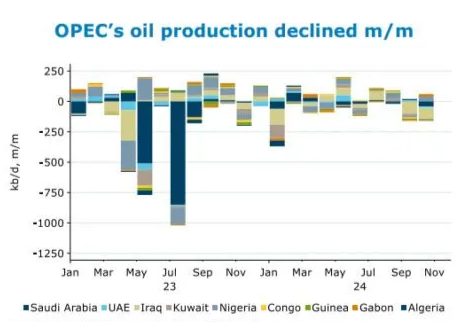

OPEC+ Production

One of the main drivers of oil prices this year has been the production cuts implemented by OPEC+. This coalition, led by Saudi Arabia and Russia, has strategically reduced production to counter global market volatility. Saudi Arabia has extended production cuts to support prices and stabilize the market.

Historically, OPEC’s cuts have led to sharp price increases. However, in recent years, their impact has been less pronounced, raising concerns about the potential economic effects on some OPEC nations. Analysts will closely monitor any additional announcements regarding production changes.

At the same time, U.S. crude oil exports have gained significance. This has led more market participants to rely on WTI-linked futures contracts to hedge against price volatility risks.

Geopolitical Risks and Supply Disruptions

Geopolitical tensions have always been a critical factor in shaping oil markets. In 2025, rising instability in key regions poses a threat to supplies.

- Tensions in the Middle East: Diplomatic or military conflicts could heighten volatility. Iran remains a key player under investor scrutiny.

- Russia-Ukraine Conflict: The ongoing war continues to affect global powers. Sanctions on Russia are redirecting its exports to countries like China and India.

- Instability in Africa and South America: Political unrest in Libya, Venezuela, and Nigeria adds another layer of uncertainty.

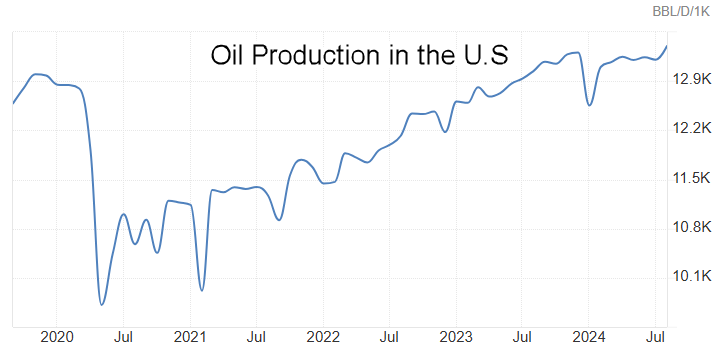

U.S. Shale Oil Production

The U.S. currently stands as the largest crude oil producer thanks to hydraulic fracturing technology. However, fracking companies have adopted a more cautious approach to production expansion. Stricter environmental regulations have slowed growth in this sector.

As prices recover, U.S. producers may face increased pressure to ramp up production, particularly if inflationary pressures reemerge.

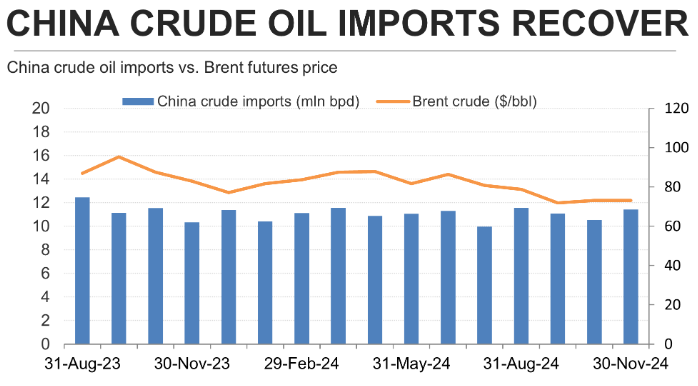

Chinese Oil Demand

China's demand for fossil fuels has been declining due to challenging economic conditions. However, the People's Bank of China has introduced stimulus measures that could boost oil demand.

The U.S. Economy

The U.S. Federal Reserve cut interest rates by 50 basis points in September. If the anticipated recession materializes, demand for U.S. crude oil could decline.

Global Energy Transition

The shift to renewable energy continues to pose a challenge to oil markets. However, the transition to cleaner energy will take considerable time. Oil remains a key component of energy consumption for many industries.

Energy organizations predict that the decline in oil demand could peak earlier than expected. Nonetheless, the current reliance on oil remains substantial, making markets prone to short-term volatility.

3 Best Stocks That Could See a Santa Claus Rally This Year

What is the Santa Claus Rally?

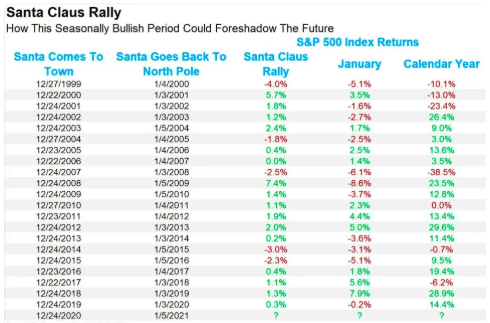

The Santa Claus Rally is a term used in financial markets to describe the positive trend typically seen in stock prices during the final days of December and the first few days of January. Most analysts estimate that these gains occur in the week leading up to Christmas, while others see movements starting on Christmas Day and lasting until January 2nd.

Some theories have been proposed to explain this phenomenon, such as the general sense of optimism and seasonal cheer on Wall Street. Additionally, institutional investors often settle their accounts and take holidays during this time, leaving the market to individual investors who tend to be more optimistic about the market. Some also attribute this trend to increased holiday shopping or end-of-year tax settlements.

Market Performance and Historical Context:

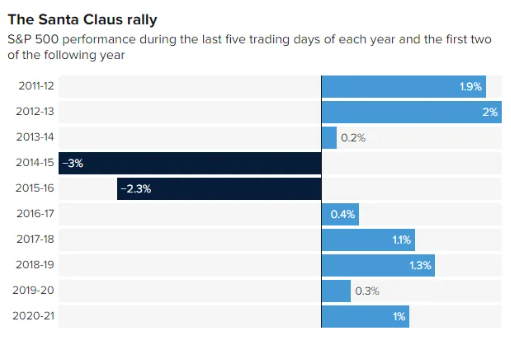

The term was coined by Yale Hirsch, the founder of Hirsch Organization and creator of the Stock Trader’s Almanac, in 1972. He identified the final five trading days of the year and the first two trading days of the next year as the timeframe for the rally.

Historically, these seven days have shown stock price increases 79.2% of the time, as reflected in the S&P 500 Index. Data from the Stock Trader’s Almanac, covering 73 years from 1950 to 2022, reveals that the Santa Claus Rally occurred 58 times (roughly 80% of the time), with the S&P 500 Index gaining an average of 1.4%.

In recent years, this trend has persisted with only a few exceptions. For example, in 2021, the S&P 500 not only followed the rally but also reached new record highs, affirming the market’s tendency to rise during this period. However, 2022 was different due to recession fears and banking collapses.

Importance and Impact of the Phenomenon:

The impact of the Santa Claus Rally is not merely theoretical; it is often seen as a precursor to market performance in the new year. Yale Hirsch’s famous saying goes, "If Santa Claus should fail to call, bears may come to Broad and Wall." This implies that if the rally does not occur, it could signal a negative outlook for the following year. Thus, the Santa Claus Rally is considered a significant indicator, with past performance often hinting at future outcomes.

This article aims to answer the key question currently on everyone’s mind: Will there be a Santa Claus Rally in the U.S. markets this year?

Will We See a Santa Claus Rally This Year?

So far this year, Wall Street has enjoyed one of its best presidential election years on record, with the S&P 500 gaining over 26% in 2024.

However, the euphoria following the election has started to give way to more realistic expectations about anticipated changes in Washington. But since Inauguration Day is still far off, there is little cause for concern at present. For now, nothing significant seems to be on the horizon that could halt the usual end-of-year market rally known as the Santa Claus Rally.

This is particularly true following a larger-than-expected drop in initial unemployment claims last week, reaching a seven-month low. Meanwhile, the Federal Reserve’s preferred inflation gauge for core personal consumption expenditures aligned with expectations. Additionally, the Bureau of Economic Analysis’s second-quarter forecast for real GDP growth in the third quarter at 2.8% matched projections.

The third-quarter earnings season was also strong for major tech companies, leading analysts to raise their earnings estimates for both Q4 and 2025.

How to Trade During the Santa Claus Rally

Traders often focus on cyclical or seasonal trends, finding various ways to capitalize on historical patterns. However, not all trends last forever; some become more random over time. The Santa Claus Rally is no exception.

Investors should manage trading risks by determining position sizes and setting stop-loss orders in case trades move against them. Having a clear plan for unprofitable trades is essential, especially considering the holidays accompanying Christmas.

For long-term investors, the Santa Claus Rally has little impact on their portfolios. It remains a headline event with marginal significance and should not be a reason for excessive optimism or caution during the rally or the January Effect.

Top Stocks to Watch During This Time of Year

We have identified three stocks that are garnering significant buying interest this month:

Alphabet (NASDAQ: GOOGL)

Known as the parent company of Google, Alphabet also boasts strong segments under its umbrella. The company is deeply involved in the AI arms race through its Gemini model, which has emerged as a leading framework in the field. A significant part of this strength comes from Google Cloud, which has been thriving recently, with revenues rising by 35% in the last quarter.

Meta Platforms (NASDAQ: META)

Like Alphabet, Meta is also a parent company but dominates social media instead of search engines. Meta has ambitious AI aspirations through its Llama model, a top choice for developing AI-driven solutions. With revenues up 19% year-over-year and diluted EPS increasing by 37%, Meta demonstrates exceptional strength for its size.

Meta stock trades at 24.5 times forward earnings, aligning with the S&P 500’s valuation. However, given Meta’s rapid earnings and revenue growth, the stock appears relatively undervalued.

ASML Holding (NASDAQ: ASML)

ASML is vastly different from the previous companies and needs no introduction. It is the world’s sole manufacturer of extreme ultraviolet (EUV) lithography machines, essential for producing advanced semiconductor chips. Semiconductor companies rely on these machines to imprint microscopic circuits on chips. Without ASML's technology, current computational capabilities, including AI advancements, would be unattainable.

ASML’s machines are heavily regulated, with increasing restrictions on sales to China and its allies. This poses challenges, as China accounted for nearly 50% of its Q3 sales. The company expects China’s revenue share to drop to about 20% by 2025. Consequently, ASML revised its 2025 revenue forecast from €30-40 billion to €30-35 billion.

Investors reacted negatively to this news, leading to a stock price drop. However, management has reiterated the long-term growth outlook remains strong. At 33 times forward earnings, the stock may seem expensive relative to the other two, but it is the cheapest ASML valuation in years. Given its unique position with no competition, ASML stock offers a compelling long-term investment opportunity before 2025.

Ethereum price (ETHUSD) forecast update - 02-12-2024

Ethereum price (ETHUSD) trades with clear negativity to break 3660.00$ level and head towards achieving negative targets that start by testing 3545.00$ and might extend to 3475.00$, to make the bearish bias suggested now, noting that it is important to monitor the price at the last level due to its importance to detect the next trend, as consolidating above it will lead the price to resume the main bullish trend within the bullish channel that appears on the chart, while breaking it will put the price under more negative pressure to start bearish correction on the intraday and short-term basis.

The expected trading range for today is between 3500.00$ support and 3750.00$ resistance.

Trend forecast: Bearish

Bitcoin price (BTCUSD) forecast update - 02-12-2024

Bitcoin price (BTCUSD) trades with clear negativity to attack the bullish channel’s support line and attempts to hold below it, to hint turning to decline for the rest of the day, paving the way to head towards 94655.00$ followed by 91852.35$ levels as main negative stations.

Therefore, the bearish bias will be suggested for the upcoming sessions unless the price managed to breach 96325.00$ and hold above it again.

The expected trading range for today is between 93500.00$ support and 97000.00$ resistance.

Trend forecast: Bearish for the rest of the day