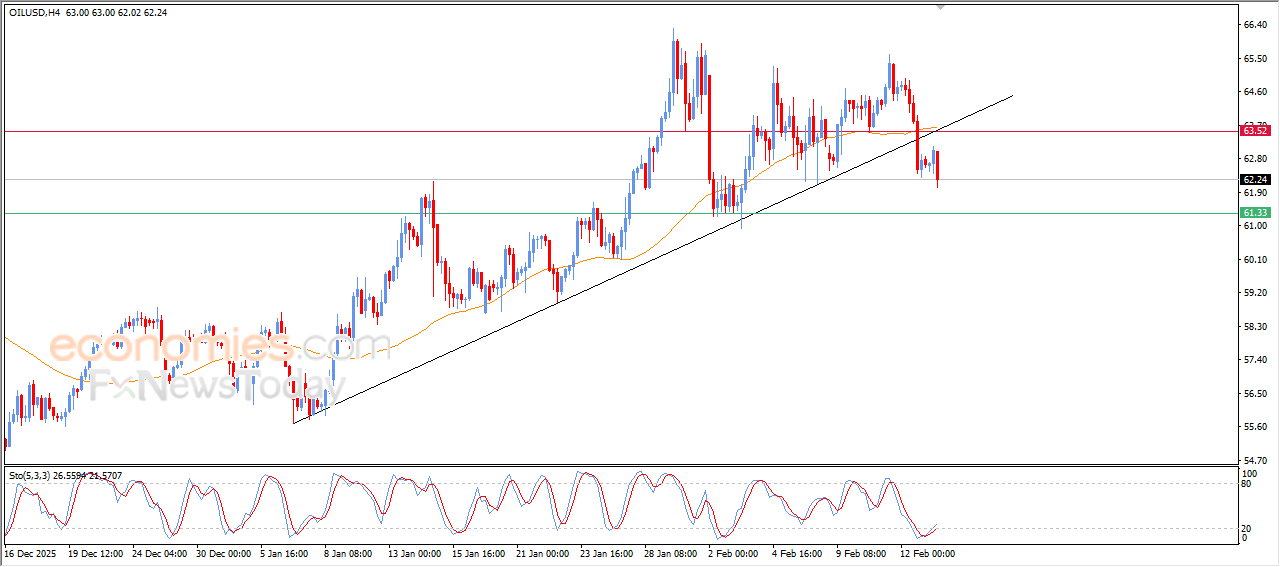

Forecast update for crude oil -13-02-2026

The price of (crude oil) slipped lower in its last intraday trading, affected by breaking main bullish trend on short-term basis, and there is negative and dynamic pressure that is represented by its trading below EMA50, surrendering to these negative pressure, after offloading some of its oversold conditions on relative strength indicators, opening the way for recording these intraday losses.

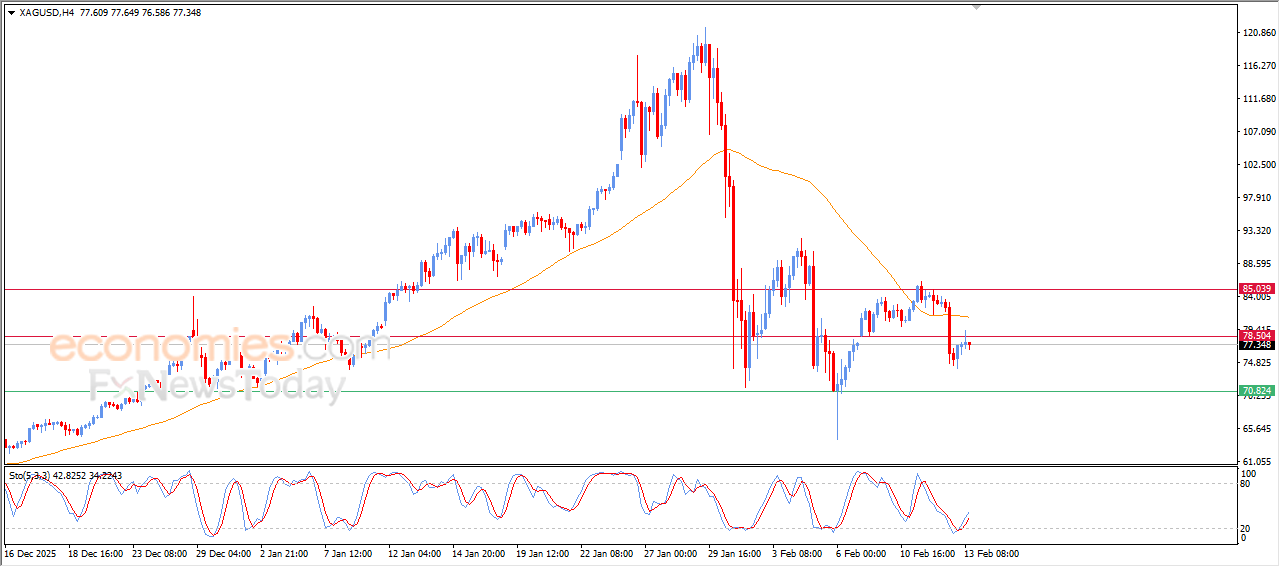

Forecast update for silver -13-02-2026

The price of (silver) settles on cautious gains in its last intraday trading, offloading its clear oversold conditions on relative strength indicators, in a clear signal for quick decline in the bullish momentum, especially with the continuation of the negative and dynamic pressure that is represented by its trading below EMA50, reducing the chances of extending these intraday gains, amid the dominance of the bearish trend scenario on short-term basis.

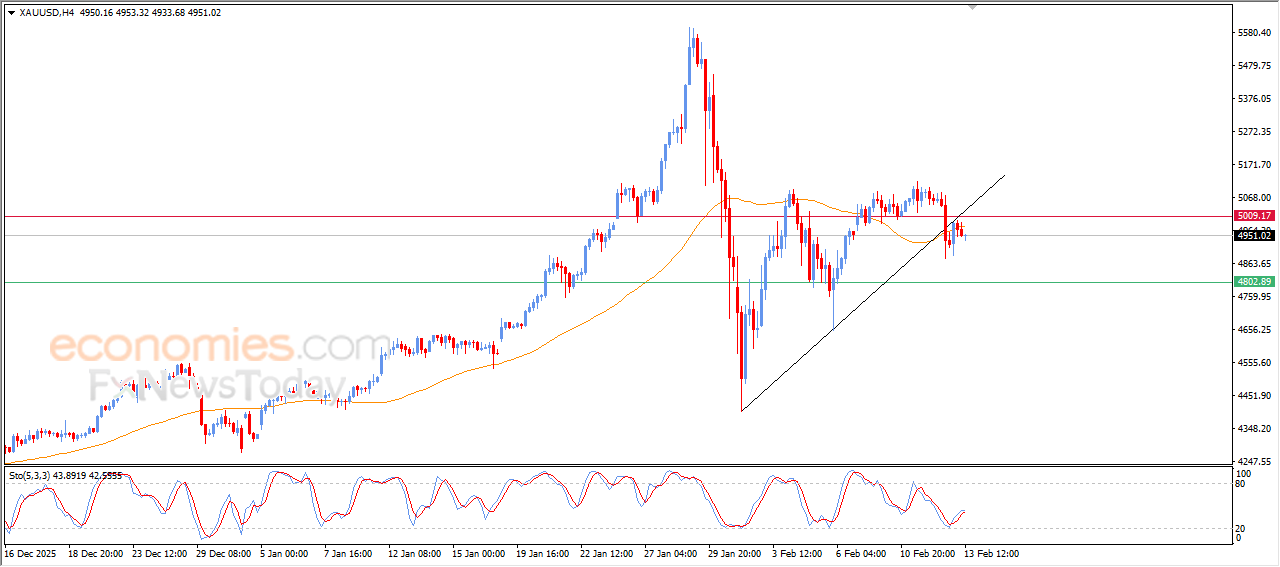

Forecast update for gold -13-02-2026.

The price of gold declined in its last intraday trading, as we expected in our morning analysis, due to its trading below $5,000 psychological resistance, and there are negative pressure due to its trading below EMA50, affected by breaking minor bullish trend line on short-term basis, intensifying the negative pressures, noticing that the price managed to offload its oversold conditions on relative strength indicators, opening the way for recording more losses on near-term basis.

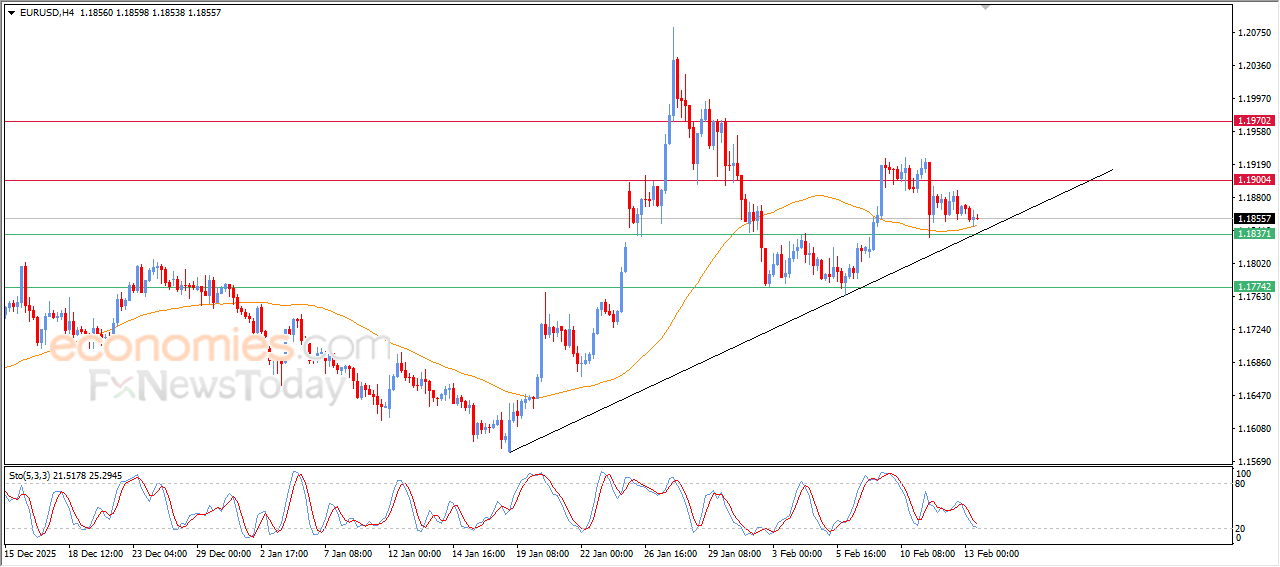

Forecast update for EURUSD -13-02-2026.

The price of EURUSD settles on a decline in its last intraday trading, leaning on EMA50 in attempt to gain bullish momentum that might help it to recover and rise again, amid its trading alongside main bullish trend line on short-term basis, reinforcing the bullish scenarios, especially with the relative strength indicators reaching oversold levels, exaggeratedly compared to the price, indicating the beginning of forming positive divergence.