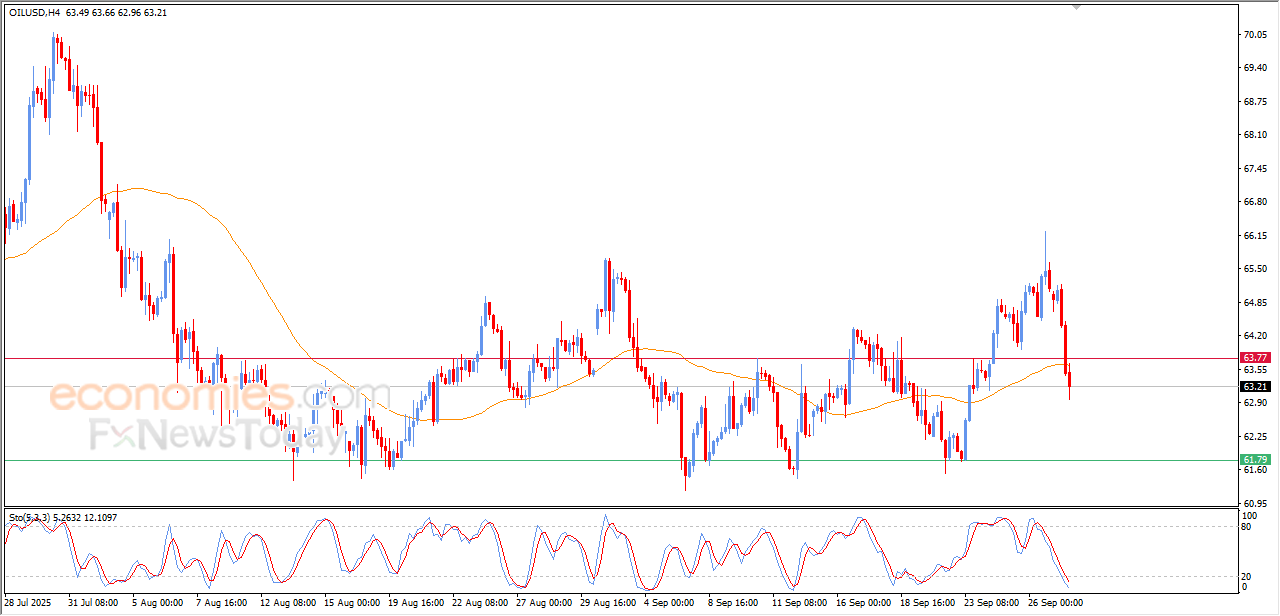

Evening update for crude oil -29-09-2025

AI Summary

- Crude oil experienced a decline in its last intraday trading, with negative signals on relative strength indicators indicating potential downside moves in the near-term.

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, cryptocurrencies, forex, and VIP signals for various markets.

- Subscription packages are available for specialized trading signals delivered directly to Telegram, with prices ranging from €44/month to €179/month.

The (crude oil) continued the decline in its last intraday trading, ending hopes of its recovery on a short-term basis, where it surpassed the support of its EMA50, besides the emergence of the negative signals on the relative strength indicators, despite reaching oversold levels, which might limit the losses temporarily, and more potential downside moves on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

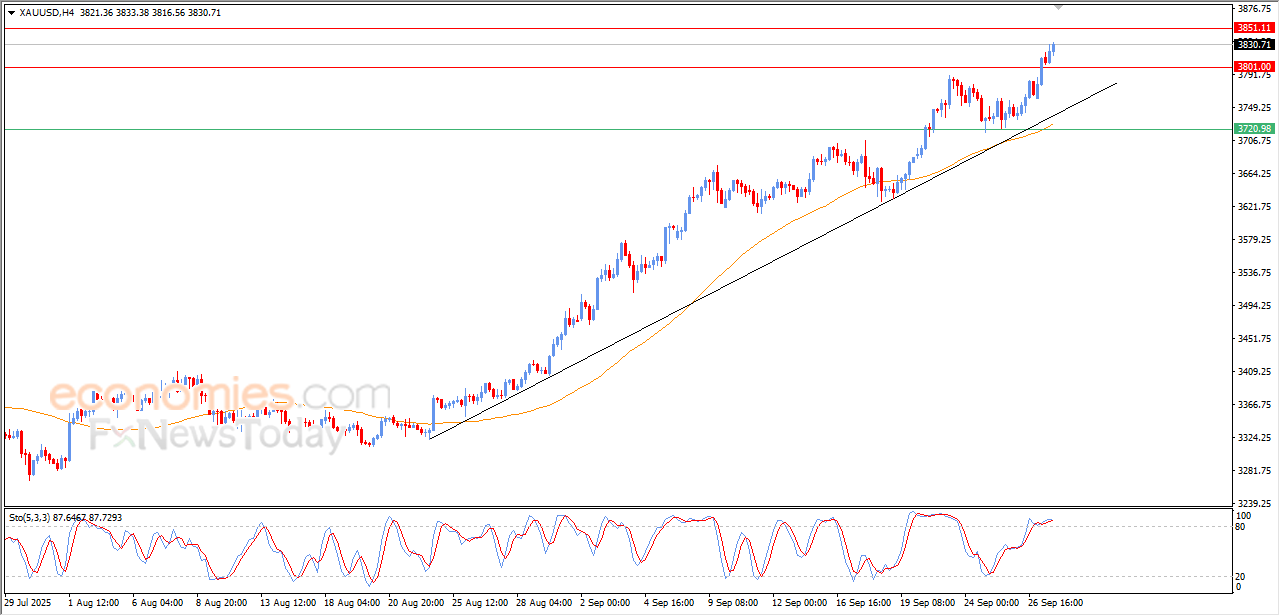

Evening update for Gold -29-09-2025

The (Gold) price extended its gains in its last intraday trading, to continue recording new all-time highs in every step to the upside, settled above $3,800 support, supported by its continued trading above its EMA50, and under the dominance of the main bullish trend line on the short-term basis and its trading alongside supportive trend line for this track.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

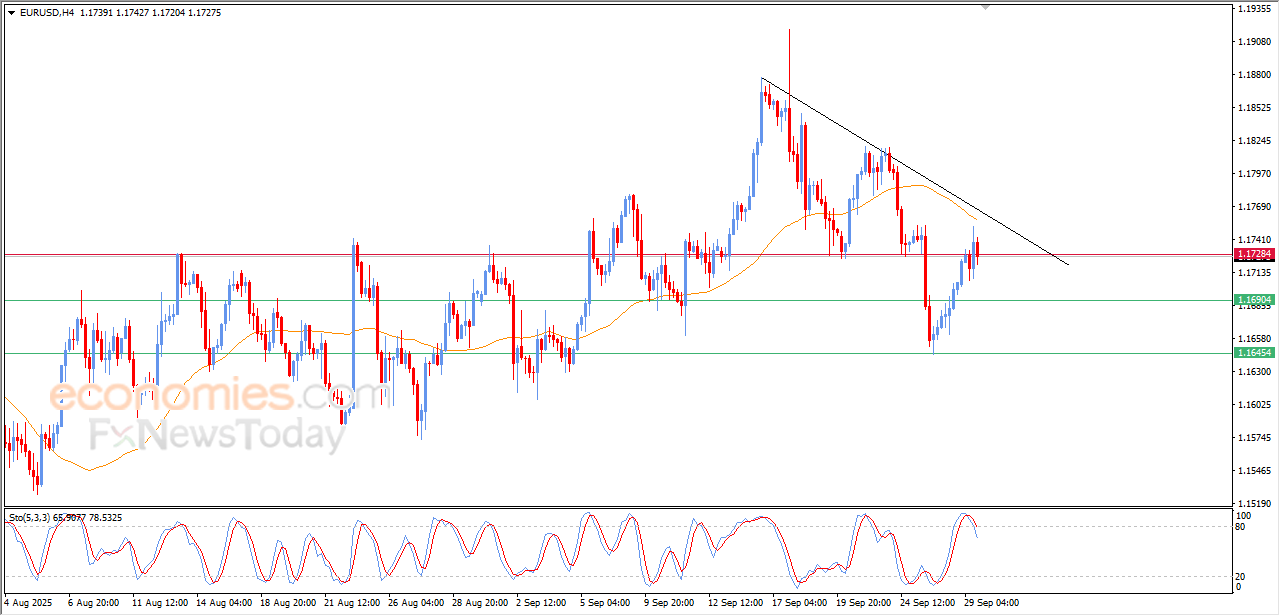

Evening update for EURUSD -29-09-2025

The (EURUSD) witnessed fluctuated trading in its last intraday levels, after its rise to hit the resistance of its EMA50, which forced it to bounce lower, amid the dominance of bearish correction wave on the short-term basis, and the stability of the critical resistance level at 1.1730, besides forming a negative divergence on the relative strength indicators, after reaching overbought levels, exaggeratedly compared by the price movement, with the emergence of the negative signals.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

Coinbase price tries to recoup some losses - Forecast today - 29-09-2025

Coinbase Global (COIN) rose in its latest intraday trading, attempting to recover part of its previous losses. However, the short-term corrective downtrend remains intact after breaking a minor ascending trendline, with ongoing negative pressure from trading below the 50-day SMA. Additional downside risks are reinforced by bearish signals from the RSI after previously reaching extreme overbought levels.

Therefore, we expect the stock to decline in upcoming trading, as long as resistance at 337.60 holds, targeting the key support level at 293.30.

Today’s price forecast: Bearish.