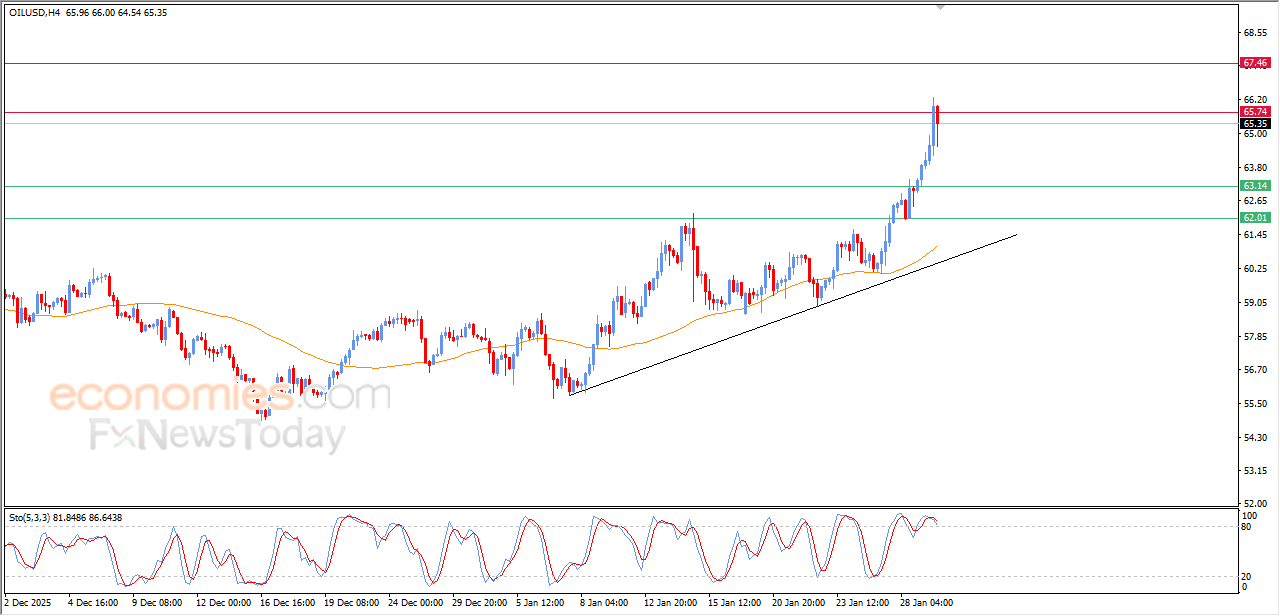

Evening update for crude oil -29-01-2026

The (crude oil) price declined in its last intraday trading, after reaching our morning expected target at $63.00 resistance, attempting to gain bullish momentum that might help it to breach this resistance, attempting to offload some of its clear overbought conditions on relative strength indicators, especially with the emergence of negative signals from there, amid the dominance of the main bullish trend on short-term basis, with its trading alongside supportive trend line for this track.

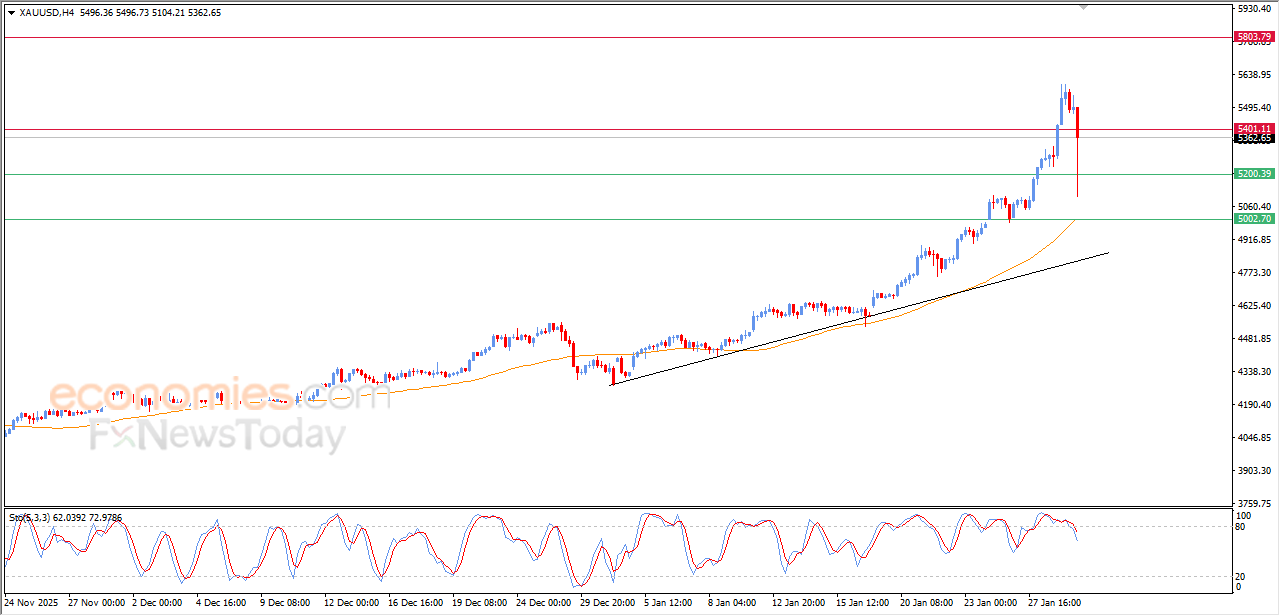

Evening update for gold -29-01-2026

(Gold) fluctuated strongly on its last intraday levels, amid the emergence of negative signals from the relative strength indicators after reaching overbought levels, attempting to offload this overbought conditions and looking for higher low to use it as a base that might help it to gain the required bullish momentum for its recovery, amid the main bullish trend on short-term basis, with its trading alongside supportive minor trend line for this trend.

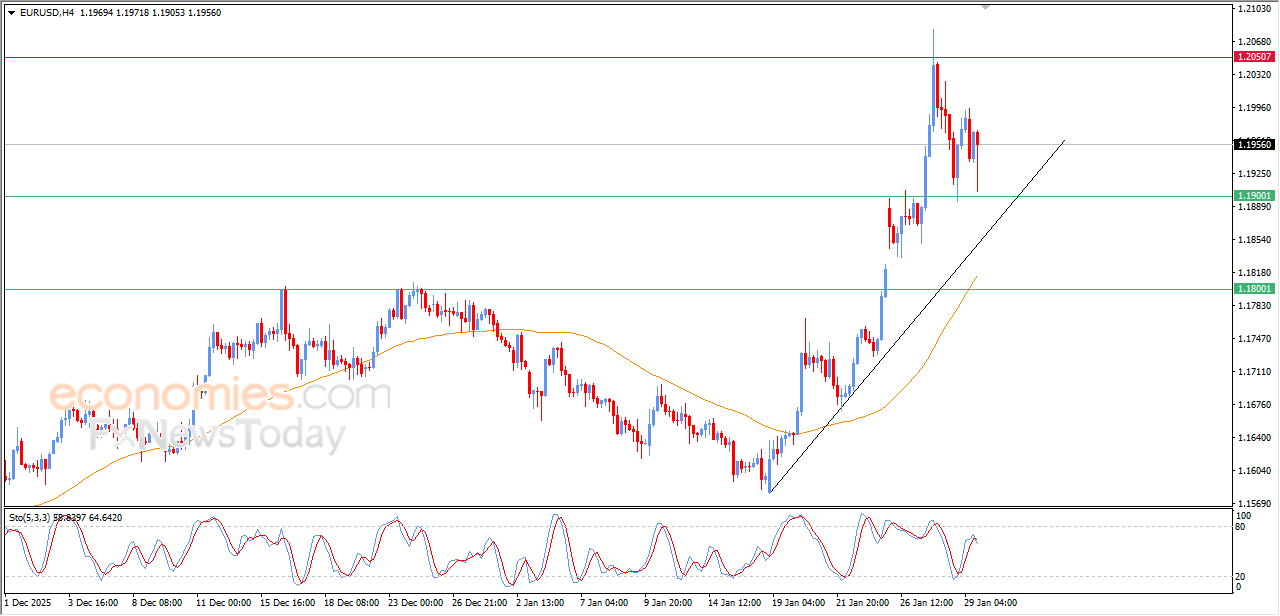

Evening update for EURUSD -29-01-2026

(EURUSD) price witnessed sharp fluctuations on its last intraday level, attempting to gain bullish momentum that might help it to recover and rise again, amid the continuation of the dynamic support that is represented by its trading above EMA50, reinforcing the stability and dominance of the main bullish trend on short-term basis.

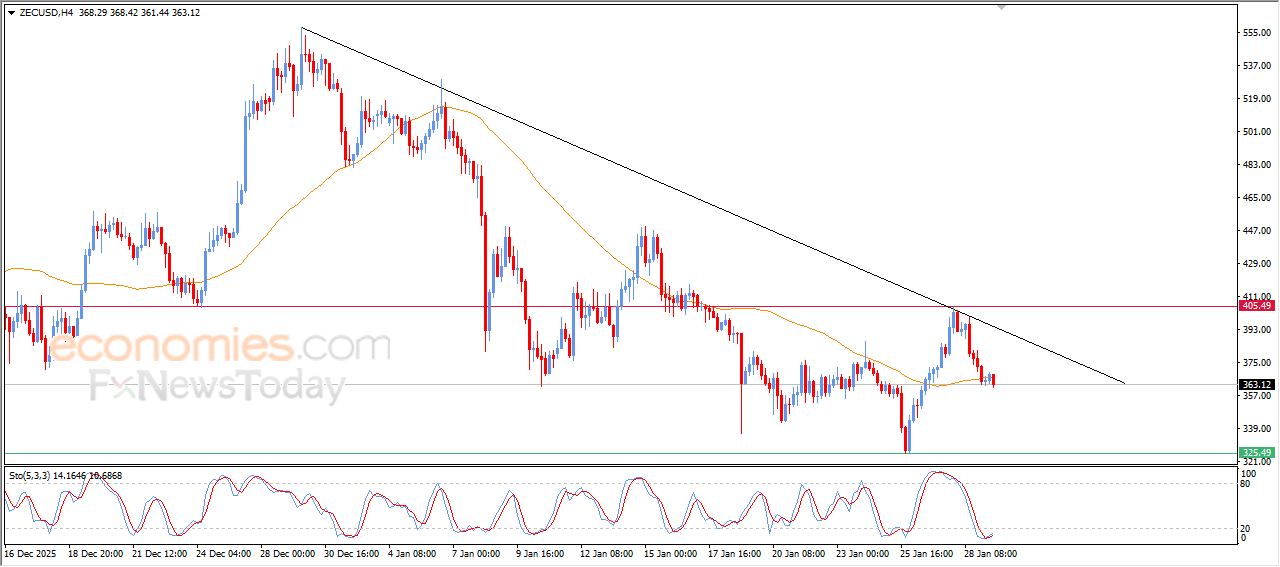

Zcash price declines alongside main downward line - Analysis - 29-01-2026

Zcash (ZECUSD) price recorded a decline in its latest intraday trading, amid the dominance of the main short-term downtrend, with price action moving along a trend line supporting this bearish path. The recent decline brought the price to lean on support from its SMA50, while positive signals have begun to emerge from the RSI after it reached extremely oversold levels in an exaggerated manner compared to price action, suggesting the early formation of a positive divergence that could drive limited upside rebounds in the near term.

Therefore, as long as the cryptocurrency price remains below the key resistance at 405.50, our expectations lean toward downside movement in upcoming intraday trading, targeting the 325.50 support level.

Expected trading trend: Neutral