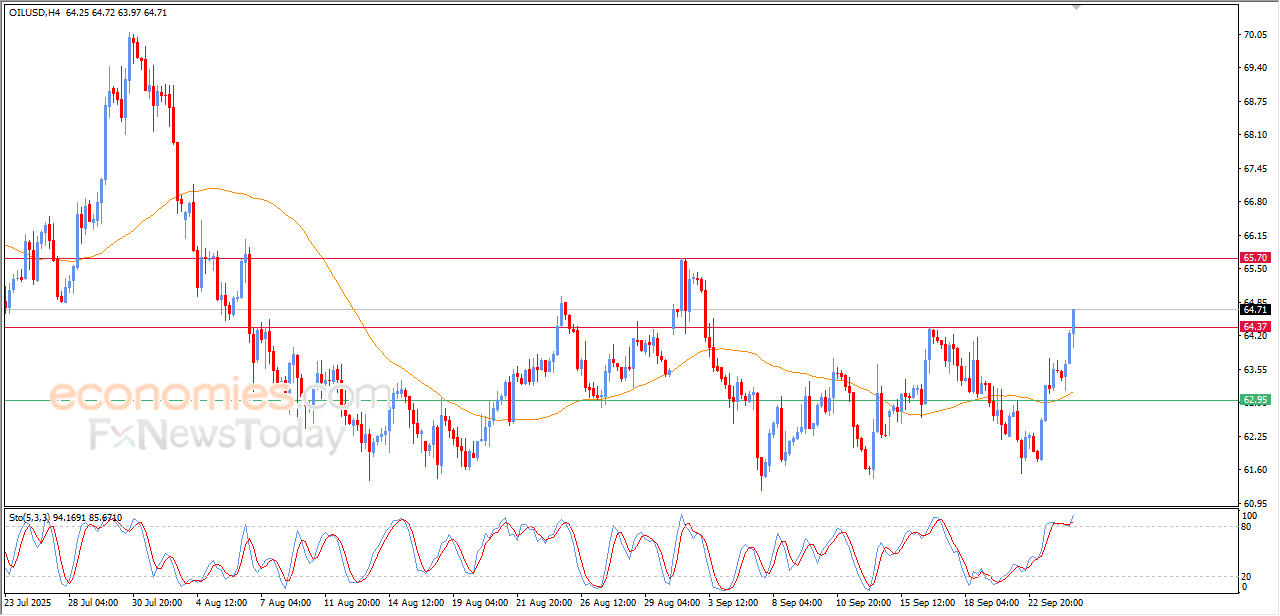

Evening update for crude oil -24-09-2025

AI Summary

- Crude oil soared high in last intraday trading, breaching the suggested target at $64.35 resistance

- Positive signals on relative strength indicators indicate dominance of bullish correctional wave trend

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for gold, oil, forex, bitcoin, ethereum, and indices, with subscription packages starting from €44/month

The (crude oil) soared high in its last intraday trading, to breach our suggested target at $64.35 resistance, taking advantage of the dynamic support that is represented by its trading above EMA50, and under the dominance of bullish correctional wave, indicating the dominance of this trend, especially with the emergence of the positive signals on the relative strength indicators, despite its stability in overbought levels.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

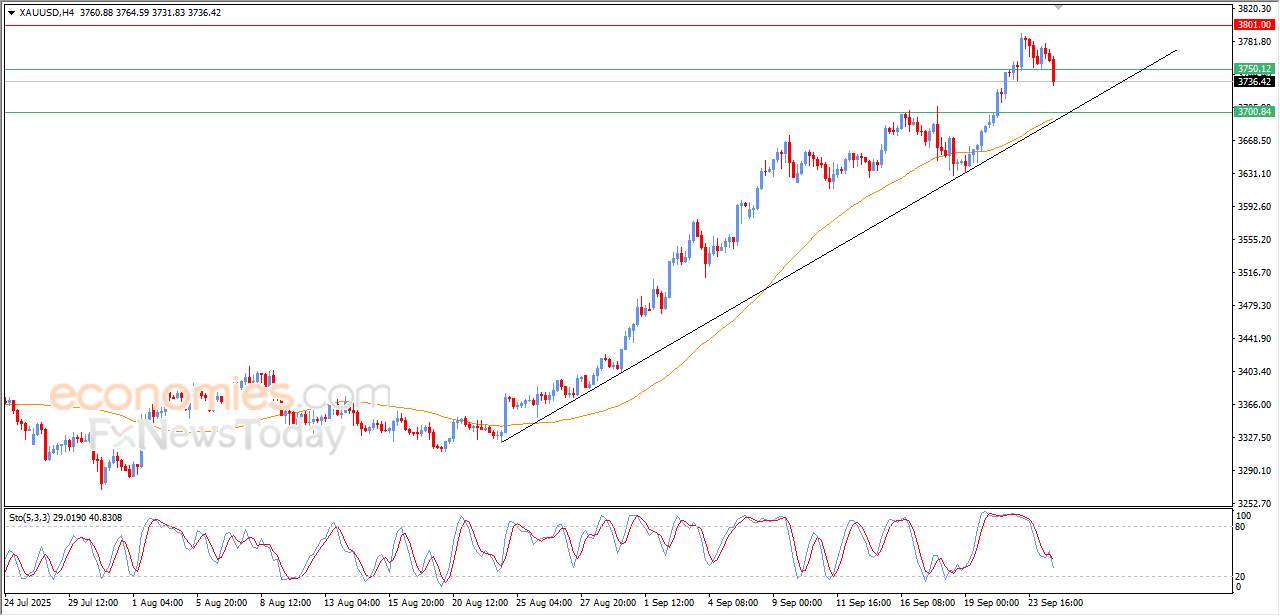

Evening update for Gold -24-09-2025

The (Gold) price declined in its last intraday trading, with the emergence of the negative signals on the relative strength indicators, after reaching overbought levels, looking for a higher low to take it as a base for gaining the required positive momentum to recover, amid the continuation of the dynamic support that is represented by its trading above EMA50, reinforcing the chances for the price recovery, amid the dominance of the main bullish trend on the short-term basis and its trading alongside supportive bias line.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

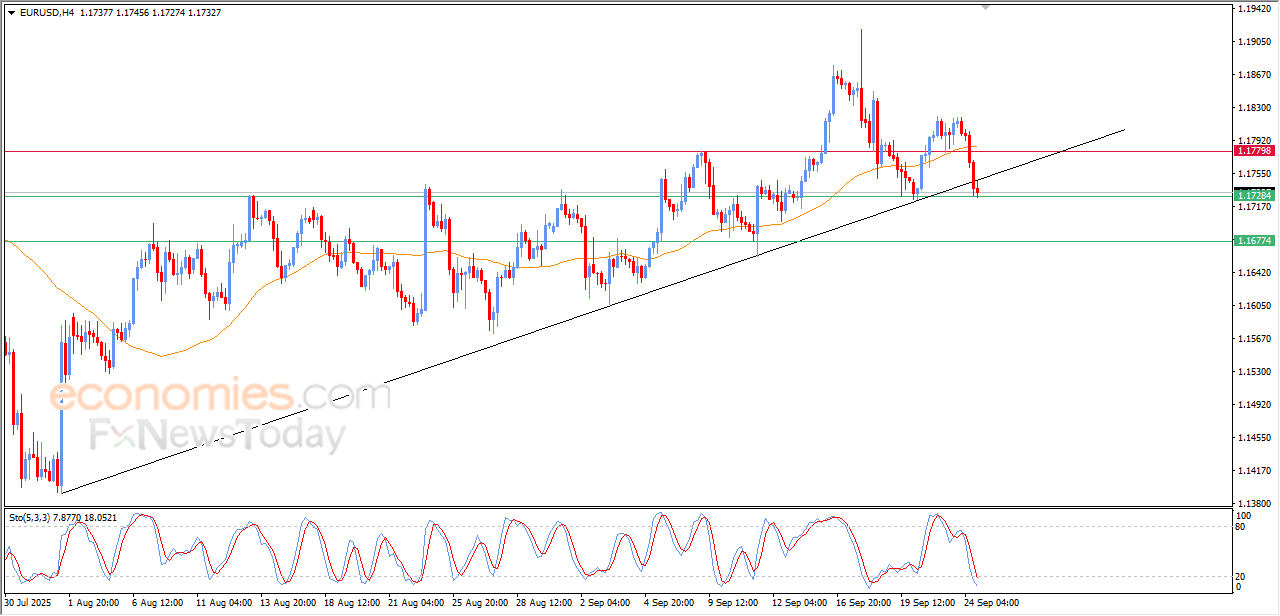

Evening update for EURUSD -24-09-2025

The (EURUSD) deepened its losses in its last intraday trading, with negative pressure due to its trading below EMA50, with the emergence of the negative signals on the relative strength indicators, despite reaching oversold levels, breaking main bullish trend line on the short-term basis, reducing the chances of its recovery in the upcoming period.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

dogwifhat price tries to recoup some losses - Analysis - 24-09-2025

Dogwifhat (WIFUSD) rose slightly in its latest intraday trading, supported by positive RSI signals as the token attempted to recover part of earlier losses. However, the broader short-term trend remains bearish, with price action moving along a descending slope and staying below the 50-period SMA, which maintains negative pressure. Meanwhile, RSI has reached overbought levels relative to price movement, signaling weakening bullish momentum.

Therefore, we expect the price to decline in upcoming intraday sessions, as long as resistance holds at 0.8560, with the next key support at 0.73063.

Today’s price forecast: Bearish.