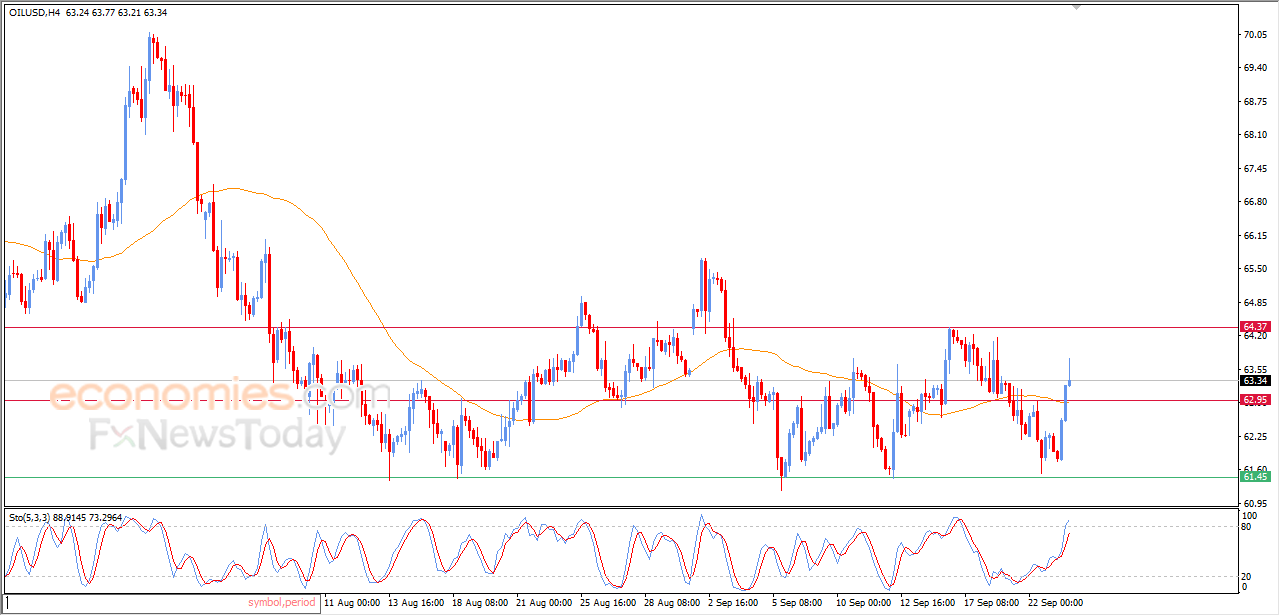

Evening update for crude oil -23-09-2025

AI Summary

- Crude oil saw gains in its last intraday trading session, supported by positive signals on relative strength indicators and surpassing negative pressure on EMA50.

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for various markets.

- VIP signals performance report for September 15-19, 2025 is available for viewing.

The (crude oil) expanded its gains in its last intraday trading, supported by the emergence of the positive signals on the relative strength indicators, surpassing the negative pressure of the EMA50, which pushed it to achieve more of the gains that increase the chances for building new bullish wave on an intraday basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

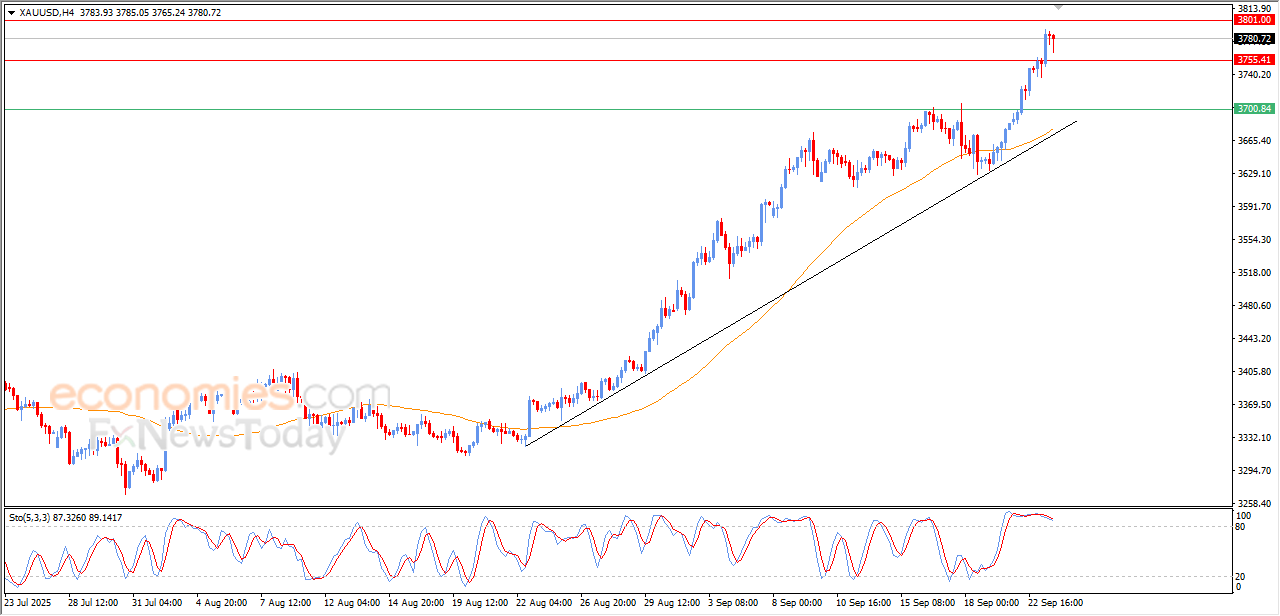

Evening update for Gold -23-09-2025

The (Gold) price declined from its all-time high in its last intraday trading, to gather the gains of its previous rises, attempting to offload some of its clear overbought conditions on the relative strength indicators, especially with the emergence of the negative signals from there, to gather its positive strength that help it to keep the main bullish stability on the short-term basis amid its trading alongside supportive bias line for this track.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

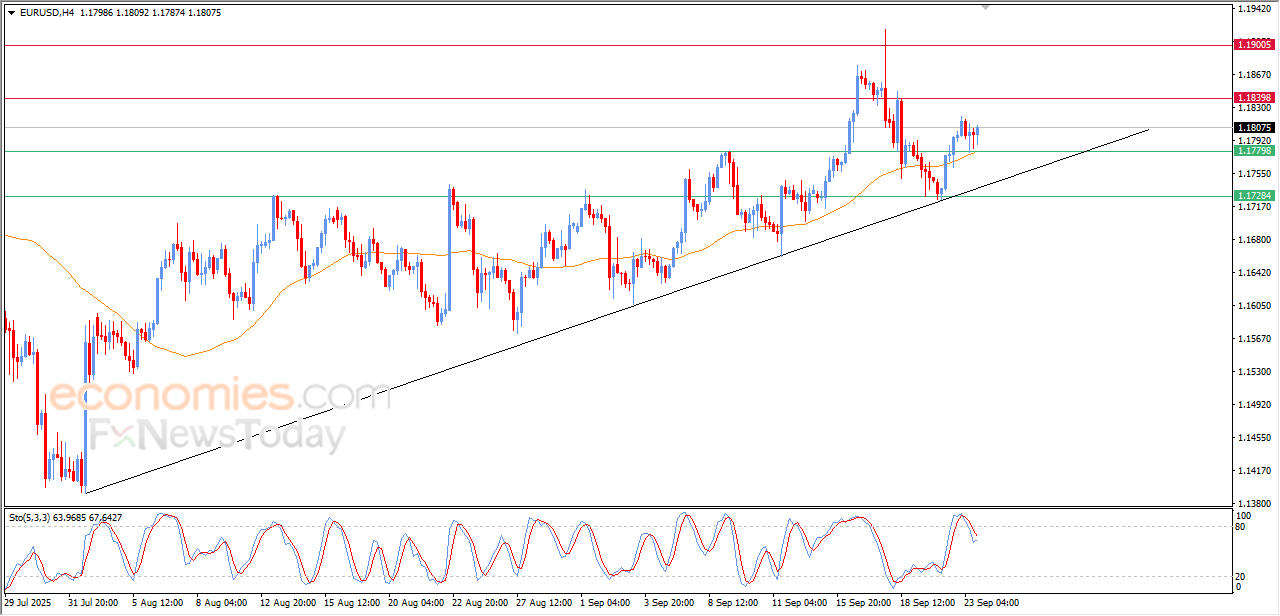

Evening update for EURUSD -23-09-2025

The (EURUSD) rose in its last intraday trading, after its success in offloading its overbought conditions on the relative strength indicators, which removed the negative pressure and opens the way for achieving more of the gains, especially with the continuation of the positive pressure that comes from its trading above EMA50, and under the dominance of the main bullish trend on the short-term basis and its trading alongside bias line.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

WLD price suffers from negative pressures - Analysis - 23-09-2025

Worldcoin (WLDUSD) declined in its latest intraday trading, with the short-term corrective downtrend still dominant as price moves along a descending slope. Ongoing pressure from trading below the 50-day SMA reinforces the bearish bias, while the RSI has reached strongly overbought levels relative to price action, signaling a negative divergence that adds to the surrounding downside risks.

Therefore, we expect the price to fall in upcoming intraday trading, as long as resistance at 1.46686285 holds, targeting the first support level at 1.20695252.

Today’s price forecast: Bearish.