Evening update for crude oil -01-09-2025

AI Summary

- Crude oil settled with strong gains, preparing to reach critical resistance at $65.00, supported by trading above EMA50 and bullish correctional wave on short-term basis

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for gold, oil, forex, bitcoin, ethereum, and indices

- VIP signals performance report for August 25-29, 2025 available for viewing on the website

The (crude oil) settled with strong gains in its last intraday trading, getting ready to attack the critical resistance at $65.00, supported by its continuous trading above EMA50, and under the dominance of bullish correctional wave on the short-term basis, besides the emergence of the positive signals on the (RSI), despite reaching overbought levels.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

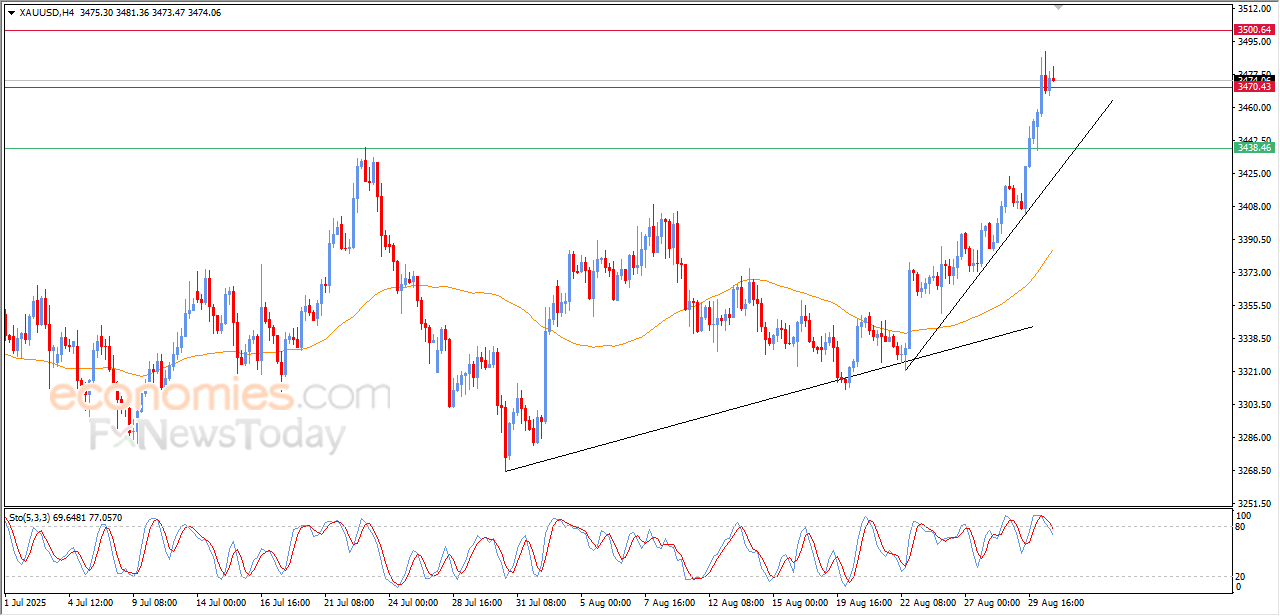

Evening update for Gold -01-09-2025

The (Gold) price witnessed fluctuated trading in its last intraday levels, amid the dominance of the main bullish trend on the short-term basis and its trading alongside the negative signals on the (RSI), on the other hand, we notice the emergence of the negative signals on the (RSI), after reaching overbought levels, which caused the fluctuation on the intraday basis, to attempt to gain bullish momentum that supports the stability of the dominant positive station on the price.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

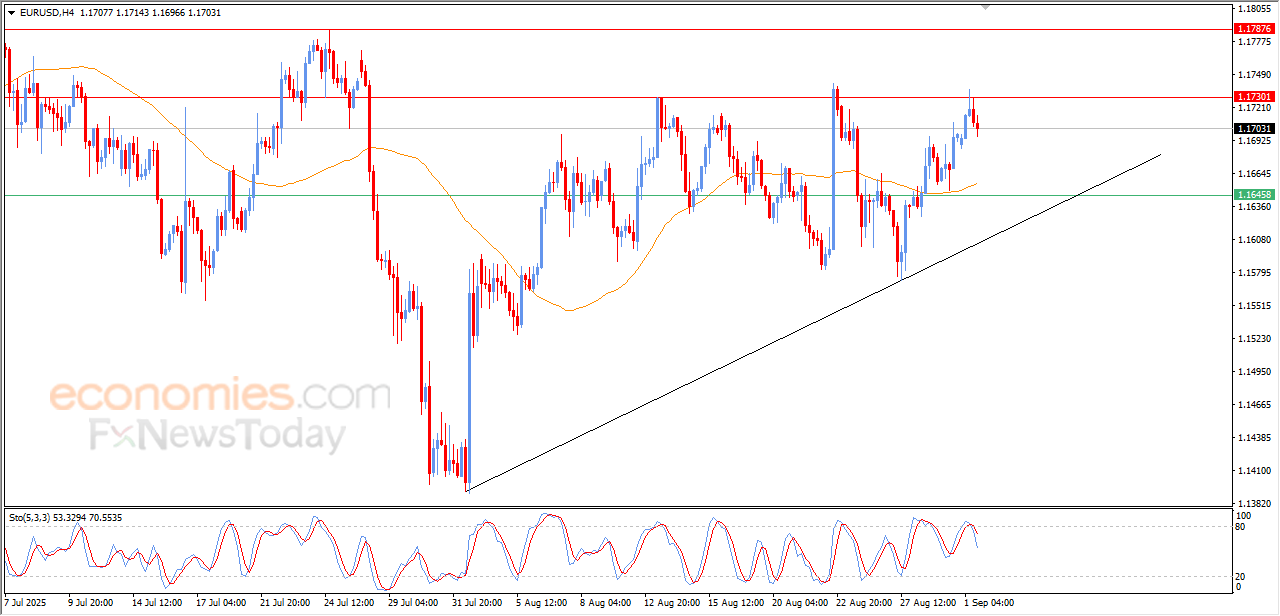

Evening update for EURUSD -01-09-2025

The (EURUSD) declined in its last intraday trading, due to the stability of the key resistance level at 1.1730, to attempt to gain positive momentum that might help to breach this resistance and offload some of its clear overbought conditions on the (RSI), especially with the emergence of the negative signals, amid the dominance of the main bullish trend.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

Algorand price suffers from negative pressures - Analysis - 01-09-2025

Algorand (ALGOUSD) price declined slightly in its latest intraday trading, under continued negative pressure from trading below its 50-day SMA. The main bearish trend also remains in control, with trading moving along a minor downward slope line that supports this path. Meanwhile, the Stochastic indicators have reached exaggerated overbought levels relative to the price movement, signaling the fading of the positive momentum that had helped the price hold up in recent sessions.

Therefore, we expect the currency to decline in its upcoming intraday trading, as long as the resistance level of 0.2457 holds, to then target the key support level of 0.2232.

Today’s price forecast: Bearish.