End of day crude oil price forecast update - 07-08-2024

Crude oil price rallied upwards strongly to start attacking 75.50$ level, and we need to monitor the price at this level, as breaching this level will push the price to achieve more gains and open the way to head towards 77.24$ as a next positive station, while consolidating against the bullish rally will push the price to rebound bearishly, to target 72.64$ on the near term basis.

The rise of the Japanese yen confuses global financial markets: Reasons and forecasts

Technical Forecast for USD/JPY

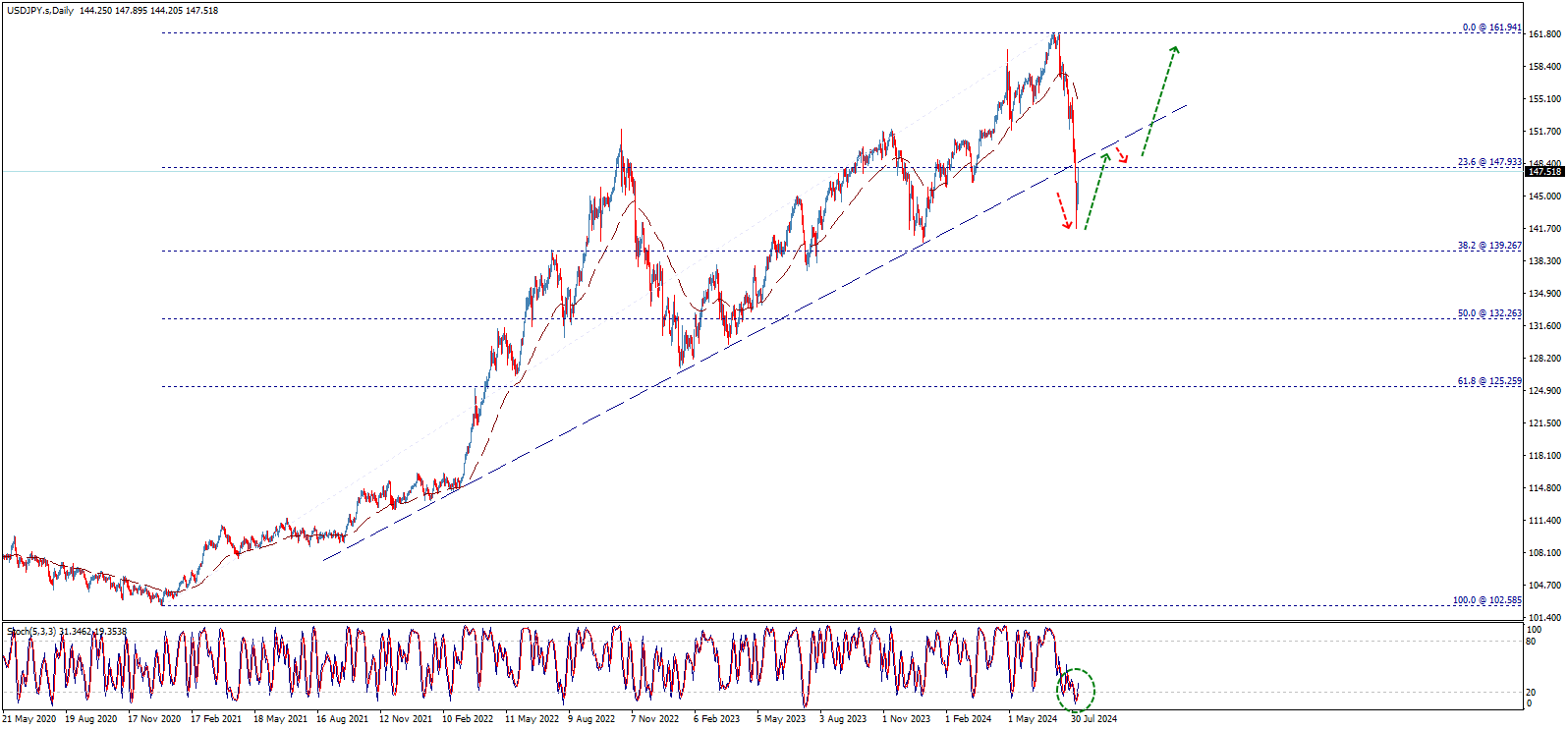

The USD/JPY pair started a long-term upward trend journey since the beginning of the last quarter of 2011, starting from the 75.57 areas. Since the beginning of 2021, the pair began a series of surges and upward waves that led it to record new historical levels, reaching the 161.94 areas at the end of June last year. From this peak, the pair fell sharply to undergo a downward correction for the entire mentioned rise, and the following chart illustrates the indicated movements:

We notice that the sharp decline stopped at the 23.6% Fibonacci retracement level for the entire mentioned rise, to rebound upward and resume the main upward trend within the long-term ascending channel, which we expect to carry the price to achieve new positive record levels, supported by oversold signals appearing through the Stochastic indicator on the weekly time frame.

Obstacles to Overcome

The new upward journey may face strong resistance barriers that the price needs to overcome to confirm the continuation of the upward trend and achieve long-term gains. On the weekly time frame, there is an important resistance level at 150.80, breaking this level will lead the price to surge towards the 156.15 and then 161.94 areas as main positive stations. But before that, there is a nearby resistance level located at 148.50, represented by the short-term ascending trend line that was broken during the last downward correction journey, and this level can be identified through the following daily chart:

The positive opening of the pair along with the positive signals appearing through the Stochastic indicator on different time frames enhance the chances of continued rise in the upcoming period. Let’s wait for positive trading and an upward wave targeting the mentioned resistance levels and then moving to achieve long-term positive targets.

Instant Technical Composition

An additional positive factor supporting the chances of overcoming resistance barriers that may hinder the price's task of rising is the double bottom pattern that was completed with today's trading opening, and it is shown through the following chart, which is considered a key for the surge to achieve the required breakouts and then officially return the price to the main upward trend again.

Summary of the Above

We expect the USD/JPY price to build an upward wave in the short and medium term, and breaking the 148.50 then 150.80 levels is required to confirm the surge towards our positive targets extending to the 156.15 then 161.94 areas, supported by the mentioned technical factors. However, it is necessary to note that failing to break the first resistance barrier at 148.50 and rebounding downward to attack the 141.55 level will stop the expected positive scenario and press the price to make additional downward corrections in the medium term, which may target the 129.00 areas before any new attempt to return to the main upward trend again.

Best Trading Brokers for USD/JPY this month

- Pepperstone, the best company for trading USD/JPY. Reliable for beginners. Dubai license. Minimum deposit: $0. 20% discount on trading.

- XM, the best platform for trading USD/JPY. Offers educational materials and trade copying. Dubai license. Minimum deposit: $5. Regular financial contests and prizes.

- Plus500, the best licensed brokerage for trading USD/JPY. Dubai license. Minimum deposit: $100.

USD/JPY Pair Analysis

USD/JPY Pair Forecast for 2024 and 2025

The Japanese yen is experiencing strong and unprecedented movements during the current period, achieving massive gains against a basket of global currencies. These gains started since the intervention of the Bank of Japan in the foreign exchange market on July 11th last year.

This sudden rise in the yen's value came amid amazing economic shifts in Japan and the United States, leading to a state of confusion in global financial markets.

These economic shifts pushed the Bank of Japan last week to raise Japanese interest rates for the second time this year, along with the announcement of an aggressive quantitative tightening program.

These shifts also resulted in a significant rise in the chances of the Federal Reserve lowering US interest rates by about 50 basis points next September.

The continued raising of Japanese interest rates in contrast to significant cuts in US interest rates will undoubtedly reduce the current interest rate gap between Japan and the United States, which is currently leading to an acceleration in the unwinding of carry trades.

The acceleration in the unwinding of carry trades is considered one of the main reasons behind the recent surge and sudden movements in the Japanese currency price. This has resulted in investors rushing out of high-risk and high-yield assets, causing significant confusion in global financial markets.

In this report, we will review in detail the reasons that led to this sudden rise in the Japanese yen, and discuss the main future forecasts.

Brief Analyses and Forecasts for USD/JPY

- USD/JPY Forecast for This Week: The yen is expected to continue its rise against the dollar, attempting to trade above the 140 yen barrier for the first time this year.

- USD/JPY Forecast for August: The yen is expected to continue its monthly gains in August against the US dollar if the Bank of Japan reveals more evidence about raising Japanese interest rates for the third time this year.

- USD/JPY Forecast for 2024: Some analysts expect the USD/JPY pair to be traded in the 140-130 yen range.

- USD/JPY Forecast for 2025: According to some banks and based on interest rate probabilities, the USD/JPY rate should be traded below the 120 yen level in the coming years.

What is Carry Trade?

Carry trade is one of the best and most important strategies relied upon by many experts and traders in the trading world. It is a way to build long-term trading positions to benefit from the interest rate differentials between currencies in the forex market.

Carry trades in the forex market are executed by selling a low-yielding currency and buying a high-yielding currency with the trading position financed daily, weekly, or for any period chosen by the trader, allowing them to benefit from the interest rate differential.

The low-interest-rate currency is called the "funding currency" and the high-interest-rate currency is called the "carry currency". In the USD/JPY pair, the carry currency is the US dollar and the funding currency is the Japanese yen.

The trader borrows the Japanese yen "low-yield" through forward points daily, weekly, or for any period chosen by the trader, and then lends the US dollar "high-yield" through forward points.

If we assume that the yields of the low-yield currency will continue to decline or that the yields of the high-yield currency will continue to rise, financing this trade daily is an easy way to make profits.

Unwinding Carry Trade Positions

The unwinding of long-term carry trade positions on the Japanese currency has accelerated due to strong speculations about the future directions of the Bank of Japan and the full probabilities of US interest rate cuts.

Speculations focused on the likelihood that the Bank of Japan will discuss raising interest rates and unveiling a plan to halve bond purchases in the coming years, indicating its intention to gradually withdraw from its massive monetary stimulus.

A series of weak economic data in the United States raised the chances of the Federal Reserve cutting US interest rates by about 25 basis points in September and November to full pricing at 100%.

Thus, the Bank of Japan is about to take new steps towards normalizing monetary policy for the world's third-largest economy, while the Federal Reserve is getting closer to easing monetary policy and starting a cycle of US interest rate cuts.

Amazing Economic Shifts

Some amazing economic shifts have occurred in Japan recently, especially the upside risks facing price levels, and personal consumption, which remains strong despite the clear impacts of inflation currently.

This is in addition to rising wages and income levels providing additional support for personal consumption, alongside the widespread momentum of wage growth, whether in small or medium-sized companies, and import prices are once again witnessing an increase.

Bank of Japan

Highest Japanese Interest Rate Since 2008

At the end of the July 30-31 meeting, the Bank of Japan raised the benchmark interest rate by about 15 basis points to a range of 0.25%, the highest level since 2008 during the global financial crisis, contrary to market expectations to keep Japanese interest rates unchanged at a range of 0.10%.

The new increase in Japanese interest rates is the second this year, after the Bank of Japan decided at its March meeting to exit the negative interest rate policy, raising the short-term interest rate by about 20 basis points to a range of 0.10%, the first increase in Japanese interest rates since 2007.

The Bank of Japan said it will continue to raise the benchmark interest rate and adjust the degree of monetary easing, assuming its economic forecasts are achieved.

Quantitative Tightening Plan

The Bank of Japan also announced a two-year quantitative tightening plan, with a reduction in government bond purchases by about 400 billion yen per quarter, leading to the purchase of about 3 trillion yen monthly in the first quarter of 2026. The bank currently executes government bond purchases of about 6 trillion yen monthly.

This plan will lead to a reduction in the total holdings of Japanese government bonds by about 7% to 8% by the fiscal year 2026. The Bank of Japan's holdings of Japanese government bonds currently stand at 579 trillion yen as of July 19, 2024.

(The Japanese fiscal year starts from April 1st and ends on March 31st, meaning the fiscal year 2024 will end in March 2025)

However, the Bank of Japan confirmed it will be flexible in this plan and conduct a temporary assessment of the quantitative tightening plan at the June 2025 meeting.

The bank indicated it is ready to adjust this plan at monetary policy meetings if necessary, making quick responses to weak economic activities and slow prices by increasing the volume of Japanese government bond purchases.

Monetary Policy Directions

The Bank of Japan said it expects real interest rates to remain "significantly negative," adding that "easing financial conditions will continue to strongly support economic activity."

The Bank of Japan said it will continue to raise the political interest rate and adjust the degree of monetary easing, assuming its economic forecasts are achieved.

The Bank of Japan sees that developments in the foreign exchange market are likely to affect prices in the country more than in the past.

Bank of Japan Forecasts

- The Bank of Japan expects the overall consumer price index to reach 2.5% by fiscal year 2024, lower than the April forecast of 2.8%.

- The Bank of Japan expects the core consumer price index to reach 1.9% for fiscal year 2024, unchanged from the previous April forecast.

- The Bank of Japan expects the overall consumer price index to reach 2.1% in fiscal year 2025, up from 1.9% in the April forecast.

- The Bank of Japan expects the core consumer price index to reach 1.9% in fiscal year 2025, unchanged from the previous April forecast.

- The Bank of Japan expects the average real GDP growth forecast for 2024 to drop to 0.6% from 0.8% in April.

- The Bank of Japan maintains the GDP growth forecast for fiscal year 2025 at 1.0%.

Kazuo Ueda Statements

Bank of Japan Governor Kazuo Ueda said: We will continue to raise interest rates in the country while adjusting the pace of monetary easing, if our current economic forecasts for prices are achieved.

Ueda added: There are upside risks facing price levels. Personal consumption remains strong despite the clear impacts of inflation currently. Rising wages and income levels will provide additional support for personal consumption. The momentum of wage growth has become widespread whether in small or medium-sized companies. Import prices are once again witnessing an increase, which requires more attention.

Ueda explained: I do not see that raising interest rates will have clear negative effects on the Japanese economy, and the Bank of Japan does not consider the interest rate cap at 0.5%.

Japanese Interest Rate Probabilities

If inflationary pressures continue to escalate on the Bank of Japan's policymakers, it is not unlikely that the Bank of Japan will raise interest rates for the third time this year at the September 20th meeting.

US Interest Rate Probabilities

After the jobs report issued in Washington on Friday, which included grim data on the state of the US labor market, showing the acceleration of recession in the United States, the chances of the Federal Reserve cutting US interest rates by about 50 basis points in September rose from 10% to 80%.

Interest Rate Gap Between Japan and the US

Investors have been relentlessly selling the yen for several months, given the low-interest rates in Japan compared to anywhere else, especially the United States, leading to a build-up of bearish positions in the Japanese currency that some have been forced to unwind.

The interest rate gap between the US and Japan created a very lucrative trading opportunity, where traders borrow the yen at low rates to invest in dollar-denominated assets for a higher yield, known as "carry trade".

After the Bank of Japan and Federal Reserve decisions last week, the interest rate gap between Japan and the US narrowed to 525 basis points in favor of US interest rates, the lowest gap since July 2023.

In light of the current probabilities, the gap is expected to narrow to 475 basis points in September, with Japanese interest rates remaining unchanged.

New Black Monday

Similar to what happened on "Black Monday" in 1987, and during the global financial crisis in 2008, and the COVID-19 pandemic in 2020, most global markets collapsed on Monday, August 5, 2024, as extreme tension dominated most major financial markets.

Open selling operations were widespread due to the acceleration of unwinding carry trades, and the global rush to get rid of high-risk and high-yield assets.

Most global stock markets entered a state of collapse as investor concerns increased that the United States is heading towards an economic recession faster than expected.

Tense Atmosphere

An extremely tense atmosphere dominated most global markets, with the pace of investors exiting high-risk and high-yield assets accelerating.

Main Reasons Behind This Tension

- First, the acceleration of unwinding carry trades, after the Bank of Japan raised Japanese interest rates last week to the highest levels since 2008.

- Second, the succession of weak economic data in the United States, showing that the world's largest economy is heading towards a recession faster than previously expected, renewing concerns about the likelihood of the Federal Reserve delaying early US interest rate cuts.

Opinions and Analyses

- Managing Partner at Harris Financial Group "Jamie Cox": The sell-offs seen through the wild market swings are sharp and fast, but they are usually short-term.

- Cox added: It is clear that markets are nervous about the divergent paths taken by central banks, leading to a lot of violent swings.

- Investment Strategist at Legal & General Investment Management "Ben Bennett": I was surprised at how aggressive the Bank of Japan's quantitative tightening plan was.

- Bennett added: I thought the recent yen rally had reduced the pressure to raise interest rates. But it seems that the Bank of Japan is keen on raising interest rates and normalizing policy. This might lead to further yen strength, but it could weigh on the Japanese economy and stock market.

- Barclays Bank Analysts said that the Japanese currency was the most bought among major and minor currencies in the foreign exchange market, and thus the cap for further outperformance in the near term seems high.

- Chief Currency Strategist at Mizuho Securities in Tokyo "Masafumi Yamamoto": The market is expecting a 50 basis points rate cut from the Federal Reserve at its September meeting, which I think is overdone.

- Yamamoto added: The US economy shows signs of slowing, but it is not as bad as the market expects. Yamamoto explained: But the near-term momentum could keep the sell-offs going, as technical levels also point to more yen gains.

Major Price Points for USD/JPY

- January 1971: USD/JPY recorded its all-time high at 358.44 yen.

- April 1995: USD/JPY recorded its all-time low at 79.76 yen.

- January 1971: USD/JPY recorded its all-time high closing at 357.72 yen.

- April 1995: USD/JPY recorded its all-time low closing at 84.25 yen.

Best Performance of USD/JPY in History

- Year 1979: Best annual performance of USD/JPY with a rise of 24%.

- Q3 1995: Best quarterly performance of USD/JPY with a rise of 18%.

- November 1978: Best monthly performance of USD/JPY with a rise of 11%.

Worst Performance of USD/JPY in History

- Year 1987: Worst annual performance of USD/JPY with a decline of 23.5%.

- Q4 1987: Worst quarterly performance of USD/JPY with a decline of 17.5%.

- October 1998: Worst monthly performance of USD/JPY with a decline of 15.5%.

Major Events in USD/JPY History

- January 1971: USD/JPY trading started at 357.73 yen.

- June 1972: USD/JPY traded below the 300 yen barrier for the first time in history.

- July 1978: USD/JPY traded below the 200 yen barrier for the first time in history.

- June 1994: USD/JPY traded below the 100 yen barrier for the first time in history.

Major Forecasts for USD/JPY in 2024

- Goldman Sachs Group: The Goldman Sachs Group expects the Japanese yen to continue its strength during 2024, supported by expectations of narrowing the interest rate gap between Japan and the United States. The bank expects USD/JPY to reach 120 yen per dollar by the end of the year.

- Morgan Stanley Bank: Morgan Stanley Bank sees that the continued pressure on the US dollar, due to the expectations of the Federal Reserve lowering interest rates, will contribute to supporting the yen. The bank expects USD/JPY to reach 118 yen per dollar by the end of 2024, with the possibility of the yen rising further if global geopolitical tensions continue to escalate.

- Bank of America: Bank of America expects USD/JPY to witness significant fluctuations during 2024, due to expected changes in the monetary policies of both the Bank of Japan and the Federal Reserve. The bank expects the pair to range between 115 and 125 yen per dollar throughout the year, with the average likely around 120 yen.

- JP Morgan Bank: JP Morgan Bank expects that the recovery of the Japanese economy, alongside the improvement in Japanese exports, will boost the yen's value. The bank expects USD/JPY to drop to 117 yen per dollar by the end of 2024, supported by the improvement in Japan's trade balance.

Factors Affecting USD/JPY Forecasts

USD/JPY forecasts are affected by various economic and political factors that interact to determine price trends. Here are some key factors:

- Monetary policy of central banks: The monetary policies of both the Federal Reserve (Fed) and the Bank of Japan (BoJ) have a significant impact on USD/JPY. If the Fed decides to raise interest rates, it increases the attractiveness of the dollar compared to the yen, leading to a rise in USD/JPY. Conversely, if the BoJ lowers interest rates or maintains its expansionary monetary policy, it could lead to a weaker yen against the dollar.

- Interest rate gap: The interest rate gap between the United States and Japan is a crucial factor. If this gap narrows due to the Fed lowering interest rates, the yen tends to strengthen against the dollar. Conversely, if the gap widens due to the Fed raising interest rates or the BoJ lowering rates, it leads to a weaker yen.

- Economic data: Economic data such as GDP, unemployment and labor market indicators, and inflation play a significant role in determining USD/JPY forecasts. Improvement in the Japanese economy and increased exports can strengthen the yen, while a weak US economy can pressure the dollar.

- Geopolitical events: Global geopolitical tensions often drive investors to seek safe havens like the Japanese yen. In times of global political or economic instability, demand for the yen as a safe haven may rise, leading to a decrease in USD/JPY.

- Financial markets and other markets: Movements in global stock and bond markets also affect USD/JPY. For example, if US financial markets experience significant volatility, it may drive investors to convert their funds to the Japanese yen.

- International trade: Changes in international trade, especially between the United States and Japan, also affect USD/JPY forecasts. Increased Japanese exports or reduced US imports can support the yen and lead to a decrease in the pair.

- Future expectations: Analyst and major financial institution forecasts play a significant role in guiding investors. Reports from institutions like Goldman Sachs and Morgan Stanley on future USD/JPY expectations significantly influence investor behavior.

Frequently Asked Questions About USD/JPY

Is USD/JPY Price Suitable for Investment?

USD/JPY is trading around 145 yen. In light of most forecasts indicating an upward trend in the second half of this year, we believe that levels between 145 and 150 yen are suitable for investment ("selling USD/JPY"), targeting above 130 yen levels.

How to Invest in USD/JPY?

There are several ways to invest in USD/JPY:

- Spot trading of USD/JPY: USD/JPY can be traded immediately on global forex trading platforms.

- Futures trading: Futures contracts obligate the buyer to purchase or sell a specific asset at a predetermined price on a predetermined future date. Futures can be used to speculate on the direction of USD/JPY price movements. Futures require a significant margin, meaning a sum of money must be deposited as collateral for your trade. Futures are high-risk investment tools and can lead to significant losses.

- Options trading: Options contracts give the buyer the right, but not the obligation, to buy or sell a specific asset at a predetermined price on a predetermined future date. Options can be used to speculate on the direction of USD/JPY price movements or hedge against risks. Options require a smaller margin than futures, making them more suitable for investors with limited capital. Options are complex investment tools and can be high-risk.

- Contracts for Difference (CFDs): CFDs allow traders to speculate on the direction of an asset's price movement without owning it. CFDs require a smaller margin than futures and options, making them more suitable for investors with limited capital. CFDs are high-risk investment tools and can lead to significant losses.

- Exchange-Traded Funds (ETFs): ETFs track the performance of an index or a basket of assets. There are many ETFs that include USD/JPY. ETFs are an easy and diversified way to invest in USD/JPY. ETFs are less risky than direct trading in futures, options, or CFDs.

Will USD/JPY Reach the 130 Yen Barrier?

It is not entirely unlikely for USD/JPY to drop in the coming months targeting the important psychological barrier at 130 yen, especially if the Federal Reserve makes a significant cut in US interest rates next September.

Is USD/JPY Expected to Drop in 2024?

Yes, USD/JPY is expected to drop in 2024, as the Bank of Japan is expected to continue raising interest rates, while the Federal Reserve will start a monetary easing cycle next month.

The NZDUSD price forecast update 07-08-2024

The NZDUSD price achieved initial breach to 0.6000$ level and closed the last four hours’ candlestick above it, reinforcing the expectations of continuing the bullish trend for the rest of the day, opening the way to head towards 0.6070$ that represents our next main target, noting that holding above 0.6000$ is important to the continuation of the expected rise.

The expected trading range for today is between 0.5960$ support and 0.6060$ resistance

Trend forecast: Bullish

The AUDUSD price forecast update 07-08-2024

The AUDUSD price shows more bullish bias to touch 0.6570$ level now, waiting to breach this level to confirm extending the bullish wave towards 0.6640$, to continue suggesting the bullish trend for today conditioned by the stability of the minor support base at 0.6540$.

The expected trading range for today is between 0.6510$ support and 0.6620$ resistance

Trend forecast: Bullish