Crude oil prices test critical resistance- Analysis-10-09-2025

AI Summary

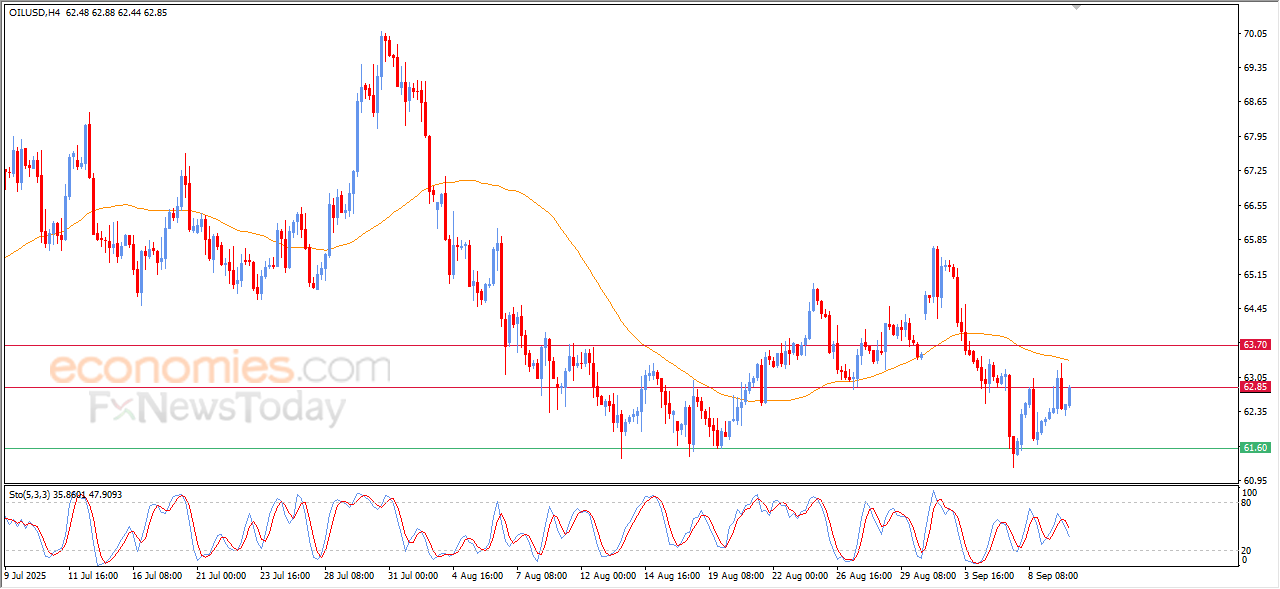

- Crude oil prices rose to retest critical resistance at $62.85 in last intraday trading

- Short-term trend remains under negative pressure with trading below EMA50

- Indicators show signs of buying exhaustion, potential return of selling pressure unless resistance is breached and held

The (crude oil) price rose in the last intraday trading, retesting the critical resistance at $62.85, in attempt to test its strength after wave of mixed trading, despite this rise the main trend on the short-term basis remains under clear negative pressure, especially with the trading below EMA50.

The main indicators reinforce this negative scene, where the (RSI) showed Signs of buying exhaustion after reaching overbought levels, leaving the gate open for a potential return for the selling pressure again, unless the price manages to breach the mentioned resistance and holds above it.

Gold prices attempt to recover - Analysis-10-09-2025

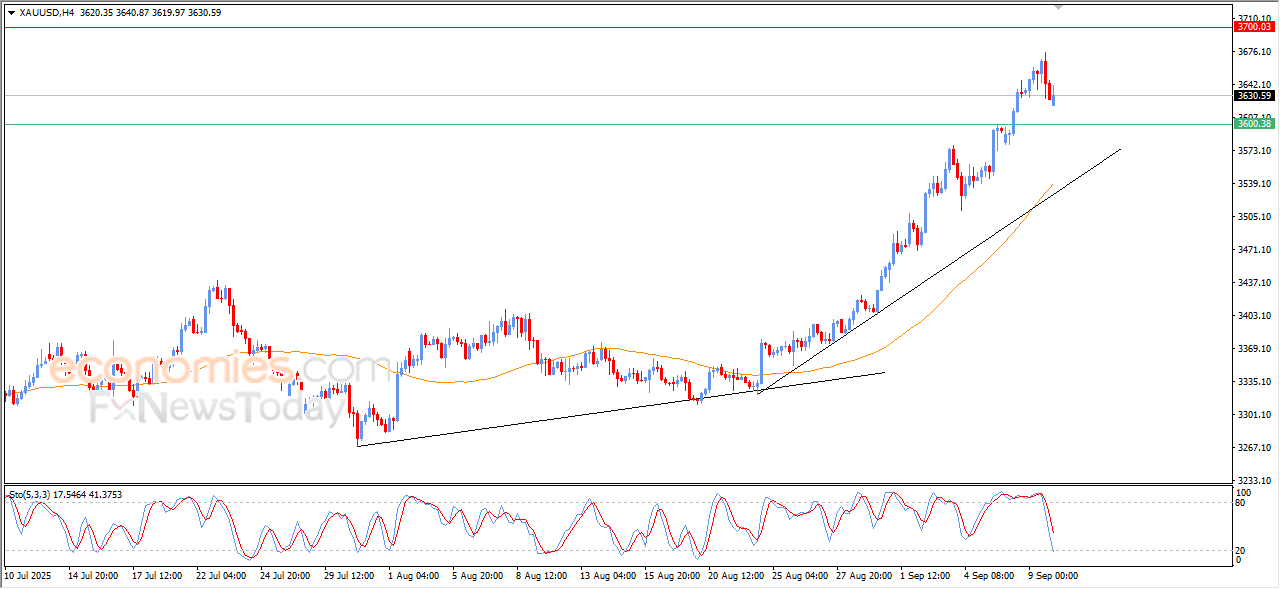

The (Gold) price rose in its last intraday trading, after gathering the gains of its previous rises and offloading the clear overbought conditions on the (RSI), noticing that the (RSI) reached oversold levels, compared with the price movement, opening the way for regaining positive momentum.

At the same time, the yellow metal benefited from its positive support by its trading above EMA50, and the bullish trend remains dominant on the short-term basis, supported by the trading alongside minor bias line that reinforces the positive overview for the main trend.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025:

EURUSD is looking for a rising low -Analysis-10-09-2025

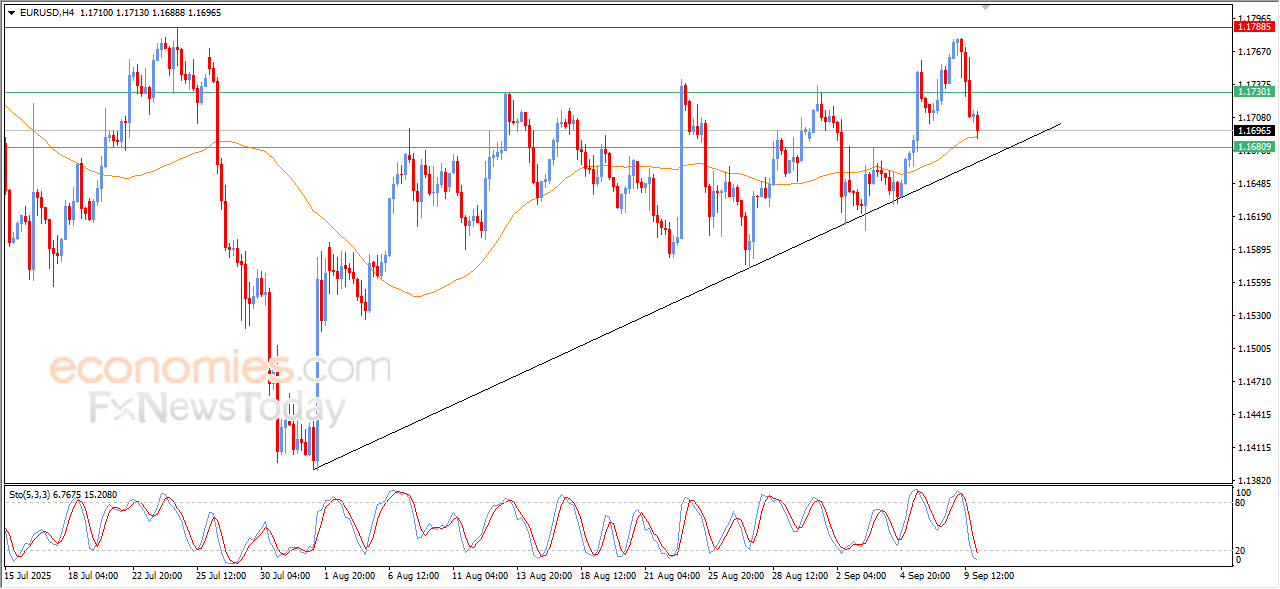

The (EURUSD) declined in its last intraday trading, amid its attempts to form a rising low to regain its bullish momentum and recover again, reaching the support of the EMA50, and the price remains moving alongside a bullish trend line on the short-term basis, reinforcing the positive overview of the main track.

On the other hand, the (RSI) indicators have reached sever oversold levels compared to the price movement, to indicate forming positive divergence that might pave the way for a bullish rebound soon, these technical data reinforce turning the current decline into a break within the bullish track.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025:

Evening update for Bitcoin (BTCUSD) -09-09-2025

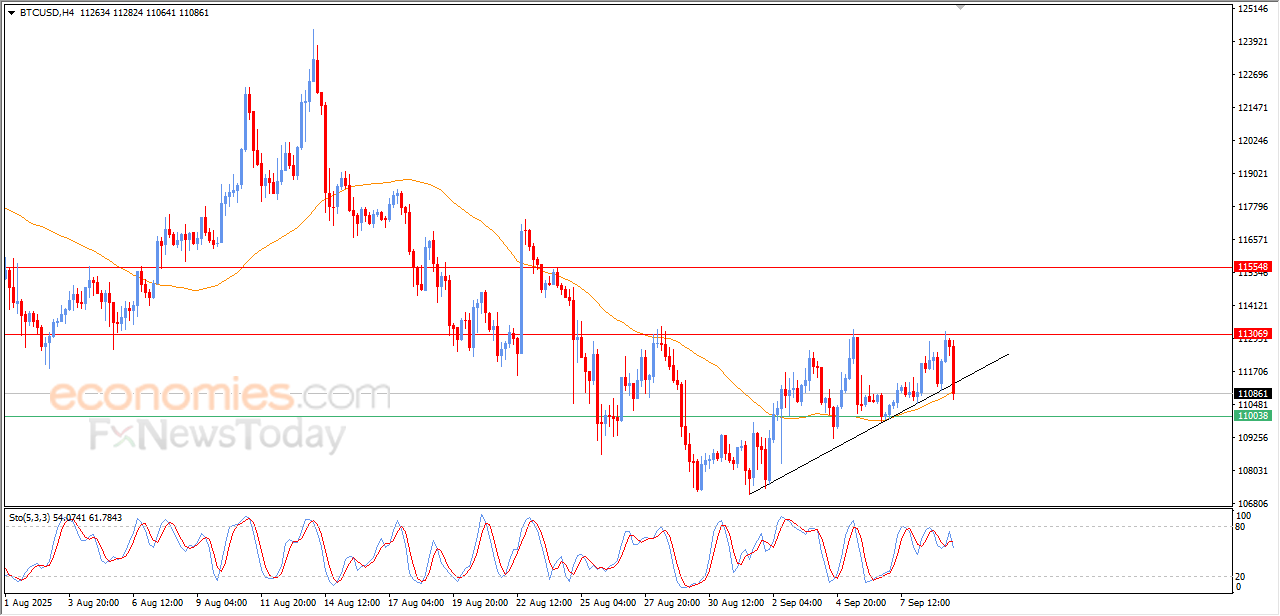

The (BTCUSD) declined in its last intraday trading, due to the stability of the stubborn and critical resistance level at $113,000. With the emergence of the negative signals on the (RSI), to lean on the support of EMA50, accompanied by its lean on bullish correctional trend on the short-term basis, in a last attempt to gain positive momentum that might help it to rise again.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025: