Crude oil prices attempt to offload its overbought conditions-Analysis-25-08-2025

AI Summary

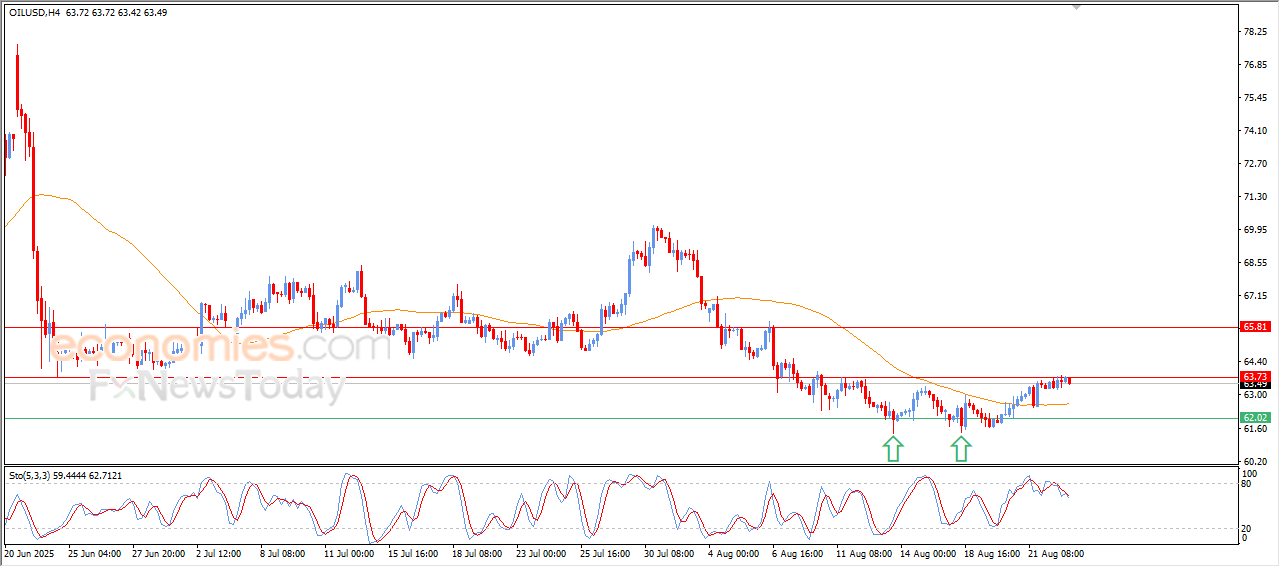

- Crude oil prices are slightly declining after facing resistance at $63.75, attempting to offload overbought conditions on the RSI

- Positive pressure remains dominant, with the possibility of a bullish momentum return and breaching $63.75 in the future

- BestTradingSignal.com offers professional trading signals for US stocks, crypto, forex, and VIP signals for various markets starting at €44/month

The (crude oil) price declines slightly in the last intraday trading, after facing strong resistance at the critical resistance at $63.75, this decline represents a natural move to gather gains, while the price attempts to offload its clear overbought conditions on the (RSI), especially with the emergence of the negative signals that might obstacle its recovery on an intraday basis.

Technically, the positive pressure remains the dominant, supported by its stability above the EMA50, affected by positive technical formation on the short-term basis that is represented by the double bottom pattern, reinforcing the possibilities for the bullish momentum return and breaching $63.75 in the upcoming period, unless it kept the current support levels.

VIP Trading Signals Performance by BestTradingSignal.com (August 18–22, 2025)

BestTradingSignal.com – Professional Trading Signals with high accuracy. Subscribe now to tailored packages for the world’s leading markets and receive signals instantly via Telegram from an expert team:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramCheck full VIP signals performance report for the week of August 18–22, 2025: Full Report

Gold declines temporarily near its current resistance - Analysis-25-08-2025

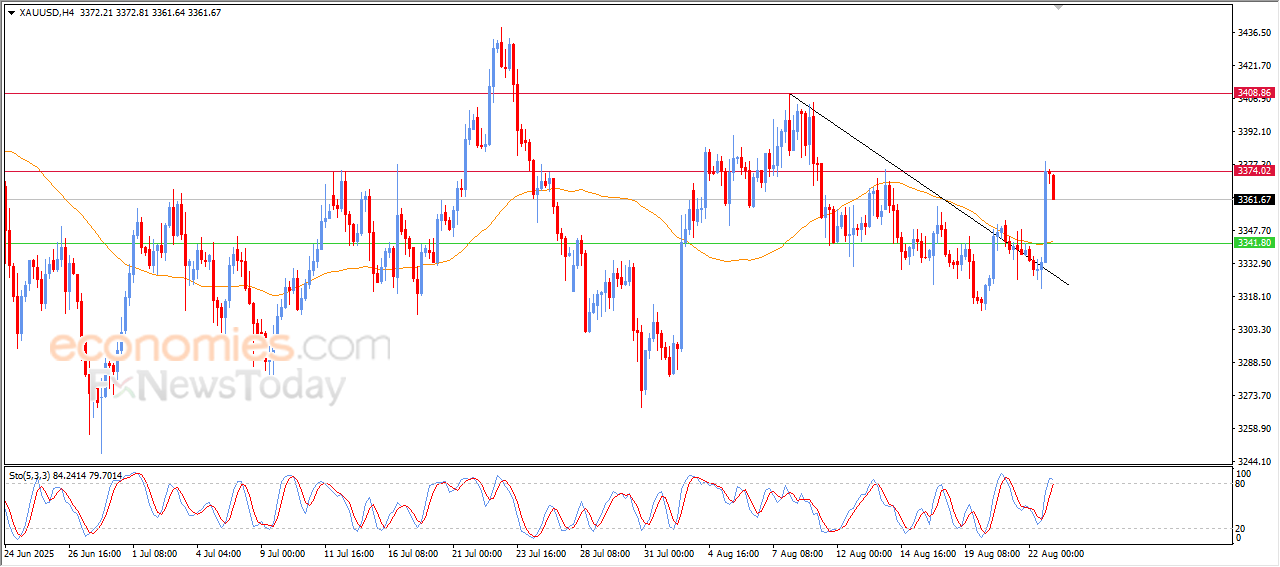

The (Gold) price declined in its last intraday trading, after reaching the current resistance at $3,375, to begin a natural move to gather the gains after its previous rises, despite this decline, the precious metal attempts to gain positive momentum that might assist it to retest this critical resistance on the near-term basis.

Technically, the main bullish trend remains the dominant of the trading, after breaching a bearish correctional bias on the short-term basis previously, the price keeps its dynamic support by its stability above EMA50, accompanied by the continuation of the positive signals on the (RSI), despite entering the overbought levels.

VIP Trading Signals Performance by BestTradingSignal.com (August 18–22, 2025)

BestTradingSignal.com – Professional Trading Signals with high accuracy. Subscribe now to tailored packages for the world’s leading markets and receive signals instantly via Telegram from an expert team:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramCheck full VIP signals performance report for the week of August 18–22, 2025: Full Report

EURUSD gathers its gains-Analysis-25-08-2025

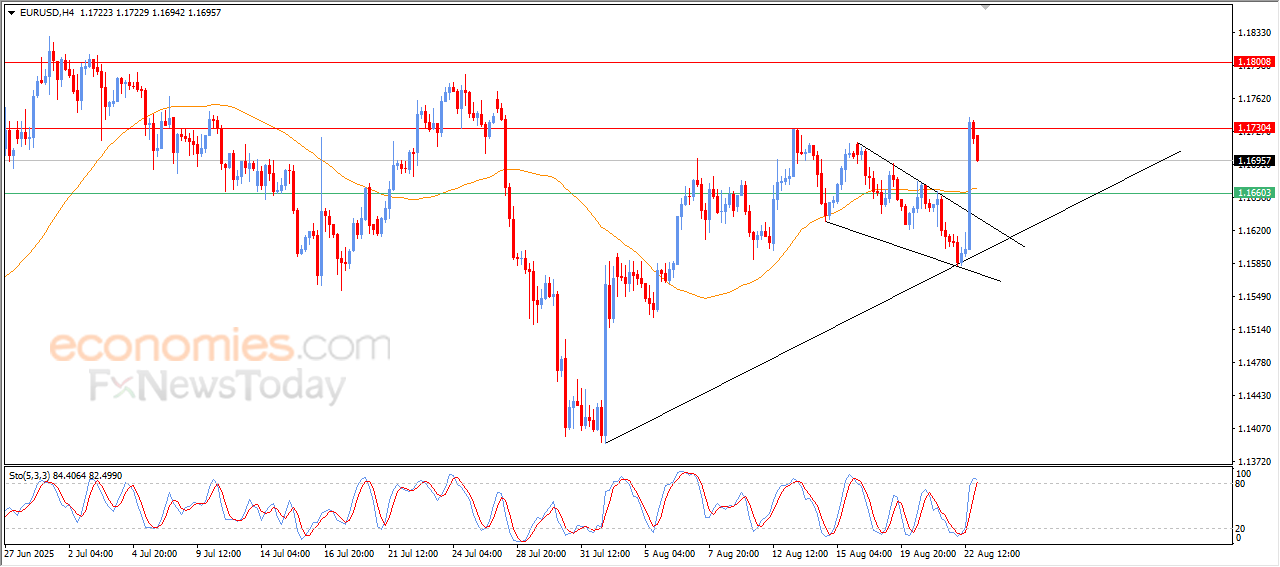

The (EURUSD) declined in its last trading on the intraday levels, after the stability of the critical resistance at 1.1730, gathering the gains of its previous rises, and it is attempting to offload the clear overbought conditions on the (RSI), especially with the emergence of negative overlapping signal that might reinforce the possibilities for the temporary decline on the near-term basis.

The bullish correctional trend remains the dominant on the pair’s moves, supported by its trading alongside a bullish bias line and its stability above EMA5. The price is affected by supported technical formation on a short-term basis, represented by falling wedge’s pattern, which provides new chance for breaching 1.1730 resistance, unless it gathers its positive momentum again.

VIP Trading Signals Performance by BestTradingSignal.com (August 18–22, 2025)

BestTradingSignal.com – Professional Trading Signals with high accuracy. Subscribe now to tailored packages for the world’s leading markets and receive signals instantly via Telegram from an expert team:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramCheck full VIP signals performance report for the week of August 18–22, 2025: Full Report

Weekly Forex & Gold Signals Performance: +2580 Pips (Aug 18–22, 2025)

Weekly Forex & Gold Signals Performance: +2580 Pips (Aug 18–22, 2025)

According to BestTradingSignal.com, here is the weekly performance summary of VIP signals for the period August 18 – 22, 2025. The signals covered gold, oil, major forex pairs, global indices such as Dow Jones and Nasdaq, as well as digital assets like Bitcoin and Ethereum. These results highlight the consistency of VIP trading packages in generating strong returns within a single trading week. For more trusted providers, you can also visit the Trading Signals page on Economies.com.

- AUDUSD: +80

- NZDUSD: +40 / +100

- USDJPY: +75 / +75

- Dow Jones: +190 / +300

- Bitcoin (BTC): +600

- Gold: +150 / +45 / -100 / +120 / +30 / +50

- US Oil: +200 / +150 / +100

- Silver: +90

- Nasdaq: +100

- GBP/USD: +75 / +50

- EUR/USD: +35

- USD/CHF: +25

Total Profit: +2580 pips

Winning trades: 22

Losing trades: 1 only

Get the best trading signals today and start trading with confidence.