Will the price of Natural Gas double before the end of the year? This is why it's likely to happen

Amidst the rapidly changing dynamics of global energy markets, natural gas stands out as one of the key factors influencing the global economic landscape.

As the end of 2024 approaches, forecasts indicate the potential for natural gas prices to double, raising questions about the investment opportunities that may arise from this possible surge.

The factors driving this potential rise are numerous and complex, ranging from increasing global demand, especially in emerging markets like China and India, to global geopolitical tensions casting a shadow over gas-producing countries such as Russia and Iran.

On the other hand, environmental considerations play a crucial role in the global shift towards natural gas, which strengthens the prospects of price doubling in both the near and distant future.

As governments and companies increasingly aim to reduce carbon emissions, natural gas is seen as the ideal transitional fuel, providing a balance between the need for clean energy and the continuity of meeting growing energy demand.

This shift is driving many countries and investors to increase their investments in the natural gas sector, further enhancing expectations of rising prices.

Moreover, delays in major liquefied natural gas (LNG) projects and production constraints in certain regions suggest that global gas supplies are struggling to keep pace with rising demand.

In addition, geopolitical complexities in the Middle East and Eastern Europe contribute to growing concerns about supply stability, driving prices upwards.

In this context, a key question arises: Does the rise in natural gas prices present a real investment opportunity? This report explores the economic and geopolitical factors supporting this potential upward trend.

It also examines the investment opportunities that may arise from this reality, whether in exploration and production, LNG infrastructure, or even in green technology associated with reducing carbon emissions.

Overview of Natural Gas Prices

• Natural gas is trading near the $3 per million BTU mark, the highest level in the past four months.

• Natural gas has risen by more than 12% during the third quarter of this year, marking the second consecutive quarterly gain after achieving a 48% increase in the second quarter.

• This translates into a 60% rise in natural gas prices from early April to the end of September, amid a noticeable improvement in global demand levels.

• The natural gas price is targeting trade above the key technical resistance at $3.5, with the next target being $6 before the end of the year or in the first quarter of next year, signaling a potential 100% surge from current levels.

Bullish Factors for Natural Gas Prices

Several intertwined and interacting economic and geopolitical factors drive natural gas prices higher. Below are the main ones:

- Increased global demand for natural gas: Industrial growth and urban expansion in emerging markets, like China and India, significantly drive up demand for natural gas.

- Production declines and supply constraints: Despite rising global demand, many natural gas-producing countries face challenges related to declining production or delays in major infrastructure development projects.

- Geopolitical tensions: Geopolitical tensions play a crucial role in pushing natural gas prices higher.

- Global environmental policies: With increasing international pressure to meet climate goals and reduce carbon emissions, there is a growing shift towards natural gas as a transitional fuel.

- Fluctuations in other energy markets: Price fluctuations in oil and coal directly impact natural gas prices.

- Delays in LNG infrastructure projects: The delay in implementing LNG projects has reduced the available supply in global markets.

- Increased demand for LNG: As demand for LNG grows, global natural gas prices rise.

- Economic crises in some exporting countries: Some natural gas-exporting countries face economic crises that affect their production and ability to meet export commitments.

Natural Gas Reserves

By the end of June, the natural gas reserves stored in the United States were 19% higher than the five-year average (2019-2023).

The U.S. Energy Information Administration expects the pace of gas injections into storage to fall below this average during the current injection season due to relatively stable production in the second half of 2024 and increased summer demand from the electric power sector.

Global Demand Growth Forecast

Forecasts indicate that global demand for natural gas will grow at a faster pace in 2024, led by Asia, which remains the main driver of this growth, along with contributions from the Middle East.

A research report stated that global gas demand is expected to rise by more than 2%, equivalent to 78 billion cubic meters, bringing the total to 4.138 trillion cubic meters.

Key Predictions for Natural Gas Prices in 2024

- Fitch Ratings: Predicts that U.S. natural gas prices will remain low in the long term, around $2.75 per million BTU.

- World Bank: Projects that U.S. natural gas prices will average $6 in 2024.

- Welt Investors: Expects natural gas prices to reach around $3.5 by the end of 2024.

- U.S. Energy Information Administration: Forecasts that U.S. natural gas prices will be around $4.25 by the end of 2024.

- ANZ Bank: Predicts that U.S. natural gas prices will reach around $3.75 by the end of 2024.

How to Invest in Natural Gas

Investing in natural gas can be rewarding, especially in light of volatile global energy prices.

Buying Natural Gas Futures Contracts

Futures contracts are a popular way to speculate on natural gas prices, traded in markets such as the New York or Chicago exchanges.

Investing in Exchange-Traded Funds (ETFs)

ETFs offer the opportunity to invest in natural gas without the need to buy or trade futures contracts.

Investing in Natural Gas Companies

Buying shares in natural gas companies like ExxonMobil, Chevron, or Chesapeake Energy offers a way to invest in the sector.

Hedge Funds and Direct Investment

Some hedge funds invest directly in natural gas assets, either through purchasing gas fields or making complex investments.

Investing in Natural Gas Technology

Technology and infrastructure related to natural gas production and distribution, such as pipelines or drilling platforms, offer an indirect way to invest in the sector.

Best Natural Gas Trading Brokers October 2024

- Pepperstone - Best overall natural gas trading broker for beginners. Founded 2010. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in natural gas. Founded 2008. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top natural gas trading platform for educational materials and copy trading. Founded 2009. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.

Compare Best Natural Gas Trading Platforms 2024

| # | Broker | Trade | Analyst Forecast for Natural Gas Prices 2025 | Special Features | Regulation | Account Types | Leverage for Natural Gas | Spread for Natural Gas | Minimum Deposit | Trust Score |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Pepperstone | Trade | $5 | Fast execution, tight spreads on natural gas | ASIC, FCA, DFSA, SCB | Standard, Razor | Up to 1:500 | From $0.03 | $0 | 9.5/10 |

| 2 | XM | Trade | $5 | Loyalty program, negative balance protection | IFSC, CySEC, ASIC | Micro, Standard, Zero, Ultra | Up to 1:888 | From $0.04 | $5 | 9/10 |

| 3 | Plus500 | Trade | $5 | Commission-free trading, easy-to-use platform | FCA, CySEC, ASIC, FMA | Retail, Professional | Up to 1:30 | From $0.05 | $100 | 9/10 |

Technical Analysis of Natural Gas Price (Natural Gas)

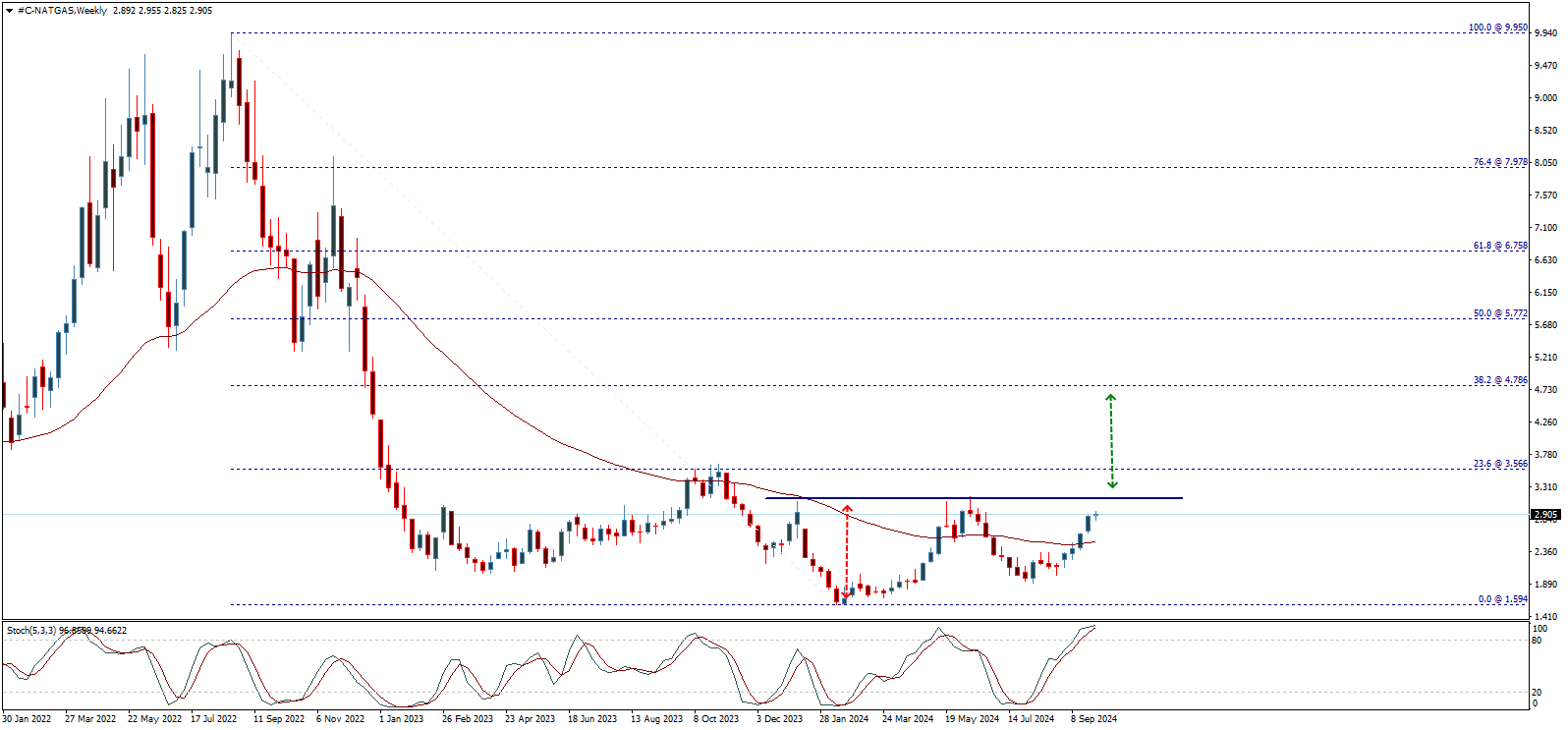

By examining the weekly chart of natural gas prices, we find that the decline that began in August 2022 from the $9.950 level stopped at the low of $1.594 recorded at the beginning of this year, starting a corrective upward wave facing some challenges during the rise, aiming to test the Fibonacci 23.6% retracement level at $3.566.

By looking closely at the chart, we find that the price is forming a medium-term double bottom pattern, with the neckline of this pattern located at $3.172, meaning that breaking above this level will lead to further upward corrections, extending gains to reach the $4.300 and $4.786 areas as the next positive targets.

One obstacle that appears in the way of the upward correction lies now at $2.930, representing a resistance level shown on the daily chart below. The price needs to overcome this barrier to facilitate the continuation of the rise and the completion of the positive pattern mentioned above, thus achieving the awaited gains.

On shorter time frames, the price is moving within an ascending channel that has been carrying the price from around $2.000, this channel reinforces the chances of continuing the upward trend to break the aforementioned barrier at $2.930 and supports the expected upward wave, but the price may need a temporary decline and rely on the channel support around $2.725 before resuming the upward trend.

In conclusion, we believe that there is room for continued rise in the short and medium term, supported by positive factors that strengthen the chances of further upward corrections in the coming period. The main targets start at $3.566 and extend to $4.300 and $4.786. However, it is important to consider that breaking the $2.725 - $2.655 levels will halt the upward trend and force the price to turn downward, weakening the chances of continuing the expected upward trend.

The AUDCAD approaches the additional support – Forecast today – 3-10-2024

The CADCHF price formed correctional bearish rebound recently after touching 0.9375 level, to notice crawling towards the additional support at 0.9255 that forms 38.2% Fibonacci correction level as appears on the chart.

We expect to form some sideways fluctuation followed by starting to activate the bullish track due to stochastic attempt to crawl towards the oversold areas, to ease the mission of targeting the positive stations at 0.9335 followed by reaching 0.9410 on the medium-term period.

The expected trading range for today is between 0.9260 and 0.9335

Trend forecast: Bullish

Natural gas price fluctuates below the barrier – Forecast today – 3-10-2024

Natural gas price attempted to surpass the barrier yesterday by targeting 3.010$ level, to end that by providing new negative close below 2.970$ barrier and confirm its continuous affection by the previously suggested correctional bearish track.

We assure the importance of gathering the negative momentum to ease the mission of targeting the negative stations near 2.780$ followed by reaching the additional support at 2.610$, while succeeding to confirm breaching the barrier and closing positively above it will cancel the negative overview and target new positive stations that start at 3.070$ and 3.170$.

The expected trading range for today is between 2.780$ and 2.990$

Trend forecast: Bearish

The EURJPY jumps above the barrier – Forecast today – 3-10-2024

The EURJPY pair took advantage of the positive pressures caused by stochastic approach to 50 level to form strong bullish rally and settled above 161.60 barrier, recording some additional gains by touching 162.45.

Confirming regaining the bullish bias requires the stability above 161.60 level, to reinforce the chances of targeting new positive stations by rallying towards 162.80 level first followed by attempting to surpass the MA55 near 163.25 in order to find a way to record additional gains in the upcoming period.

The expected trading range for today is between 161.60 and 162.80

Trend forecast: Bullish