Natural gas price press on the resistance– Forecast today – 26-9-2025

AI Summary

- Natural gas prices rallied to resistance at $3.260, affected by stochastic reaching overbought level

- Trading recommendation for today includes waiting for next close to confirm trend, breach of resistance could lead to gains starting at $3.480

- Expected trading range for today is between $3.050 and $3.260, with a neutral trend forecast

Natural gas prices rallied to the resistance at $3.260 in its last trading, affected by stochastic reach to the overbought level, threatening the dominance of the suggested negative bearish track.

We recommend the trading for today and waiting for the next close, to confirm the expected trend in the upcoming trading, the price success in breaching the resistance and holding above it will turn the bullish track, to begin recording several gains that might begin at $3.480, while confirming the bearish scenario requires the decline below $3.050 and providing new negative close to confirm its readiness to target several negative levels that begin at $2.820.

The expected trading range for today is between $3.050 and $3.260

Trend forecast: Neutral

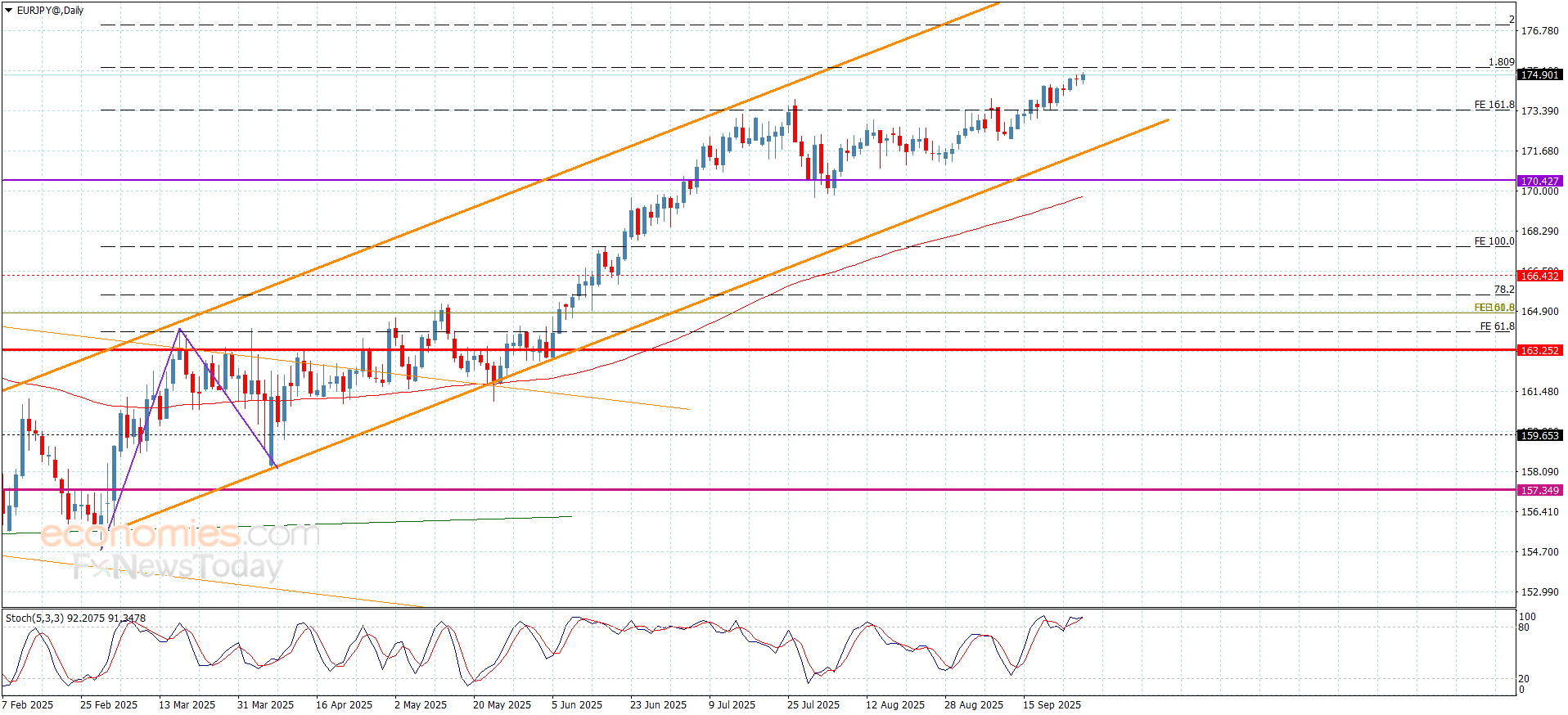

The EURJPY is waiting for breaching the barrier– Forecast today – 26-9-2025

The EURJPY pair failed to resume the bullish attack, due to its stability below %1.809 Fibonacci extension level, forming an extra barrier at 175.20, providing sideways trading since yesterday by its stability near 174.85.

Reminding you that the bullish scenario will remain valid, due to the stability within the bullish channel’s levels besides the continuation of forming an initial support at 173.40 level, which makes us wait for breaching the current barrier to ease the mission of recording extra gains that might begin at 176.00 and 176.95.

The expected trading range for today is between 174.20 and 175.20

Trend forecast: Sideways until achieving the breach

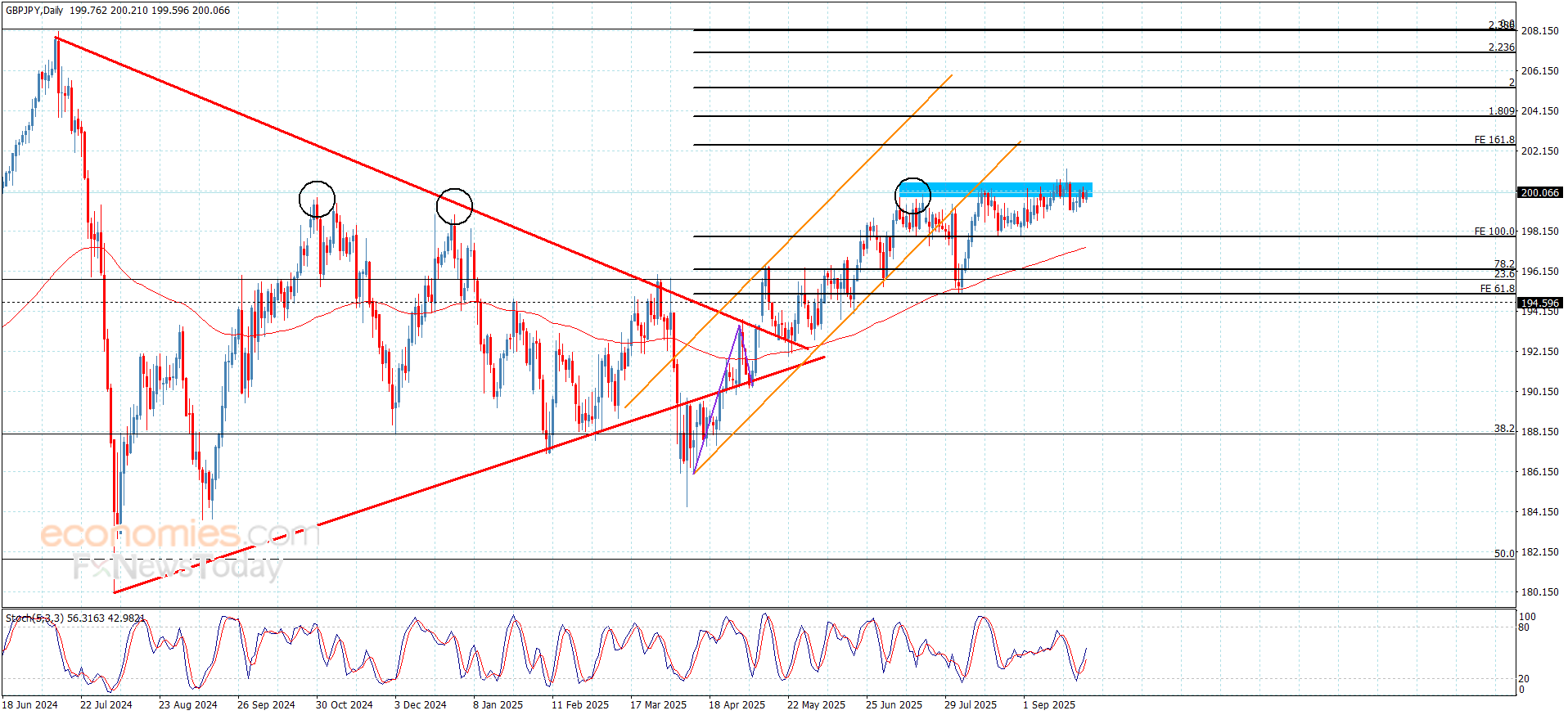

The GBPJPY repeats the sideways flcuatution– Forecast today – 26-9-2025

No news for the GBPJPY pair, to keep providing weak sideways trading by its stability near200.10, reminding you that the continuation of providing support by the main indicators that might help it to breach the barrier at 200.45, to open the way for achieving several gains that might begin at 200.95 and 201.55.

While the risk of activating the bearish correction track again is represented by the trading reach below 198.60, and holding below it will increase the efficiency of the bearish correction, to expect targeting the support initial at 197.80.

The expected trading range for today is between 199.20 and 201.55

Trend forecast: Bullish

Platinum price hits the extra targets– Forecast today – 26-9-2025

Platinum price continued its bullish attempts yesterday, taking advantage of providing positive momentum by the main indicators, achieving the extra targets by its rally to $1550.00, to face %2.236 Fibonacci extension level, which forms an intraday obstacle against the bullish scenario.

Stochastic attempt to exit the overbought level might force the price to provide sideways trading, but the stability above $1475.00 supports the continuation of the positivity, which might target $1583.00 resistance in the near period trading.

The expected trading range for today is between $1515.00 and $1560.00

Trend forecast: Bullish