Gold turns its early losses into gains- Analysis-18-08-2025

AI Summary

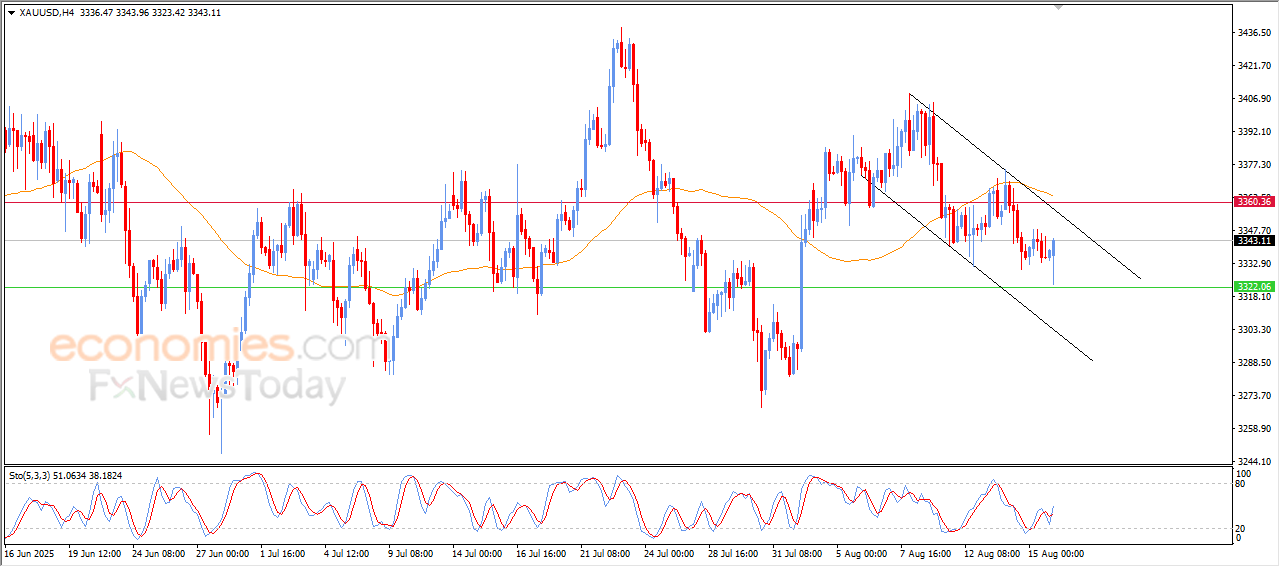

- Gold rose in intraday trading after holding above key support at $3,225, turning early losses into gains

- Despite rebound, gold remains in bearish correctional channel with negative pressure below EMA50

- Forecast for gold is bearish with expected trading range between $3,300 support and $3,360 resistance

The (Gold) rose in its last intraday trading, after holding above the key support at $3,225, that we mentioned in our previous reports, providing clear positive momentum that helped it to bounce higher and turn its early losses into intraday gains, supported by the emergence of positive signals on the (RSI) after reaching oversold levels.

Despite this intraday rebound, the precious metal remains moving within bearish correctional channel on the short-term basis, with the continuation of the negative pressure that comes from its stability below EMA50, which makes any potential rise face this technical obstacle.

Therefore, we suggest a decline in (Gold) price in its upcoming intraday trading, if it settles below $3,360, to target $3,225 level, and there are chances for the intraday bullish rebound, and it might retest the mentioned resistance.

The expected trading range is between $3,300 support and $3,360 resistance.

Today's forecast: Bearish

VIP Trading Signals Performance by BestTradingSignal.com (August 11–15, 2025)

BestTradingSignal.com – Professional Trading Signals with high accuracy. Subscribe now to tailored packages for the world’s leading markets and receive signals instantly via Telegram from an expert team:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramCheck full VIP signals performance report for the week of August 11–15, 2025: Full Report

EURUSD declines temporarily within bullish track-Analysis-18-08-2025

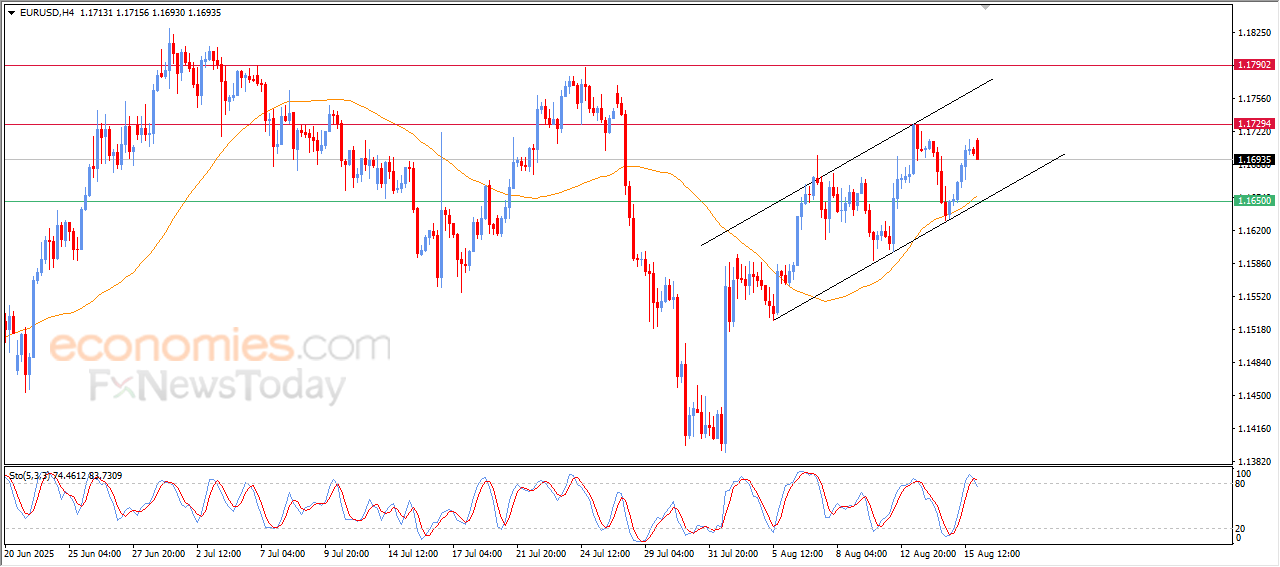

The (EURUSD) declined in its last trading on its intraday levels, to gather gains after the previous bullish wave, accompanied by the attempts to offload the clear overbought conditions on the (RSI), especially with the emergence of negative signals from there.

Despite this intraday decline, the pair remains supported by its trading above EMA50, and its move within the minor bullish channel’s range, reinforcing the chances for gathering positive powers and resuming the rise again on the near-term basis.

Therefore, our expectations suggest a rise in (EURUSD) price in the upcoming intraday trading, if the support level settles at 1.1650, targeting the key resistance at 1.1730, if the pair manages to breach this resistance, its next target will be at the key resistance at 1.1790.

The expected trading range is between 1.1650 support and 1.1790 resistance.

Today’s forecast: Bullish

VIP Trading Signals Performance by BestTradingSignal.com (August 11–15, 2025)

BestTradingSignal.com – Professional Trading Signals with high accuracy. Subscribe now to tailored packages for the world’s leading markets and receive signals instantly via Telegram from an expert team:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramCheck full VIP signals performance report for the week of August 11–15, 2025: Full Report

VIP Trading Signals Performance by BestTradingSignal.com (August 11 – 15, 2025

According to BestTradingSignal.com, here is the official performance summary of VIP signals during the week of August 11 – 15, 2025. The trading signals covered gold, oil, forex pairs, indices, and cryptocurrencies, generating strong results in just one week. For more trusted signal providers, you can also check the Trading Signals section on Economies.com.

- EURUSD: +10 / +60 / +110

- GOLD: +70 / +40 / +160 / +170 / +40 / +150

- NASDAQ: -60

- USOIL: +30 / +200

- GBPUSD: -90

- USDCHF: +70

- SILVER: +120

- USDJPY: +150

- ETHEREUM: +300

Total Profit: +1570 pips

Winning trades: 16

Losing trades: 2

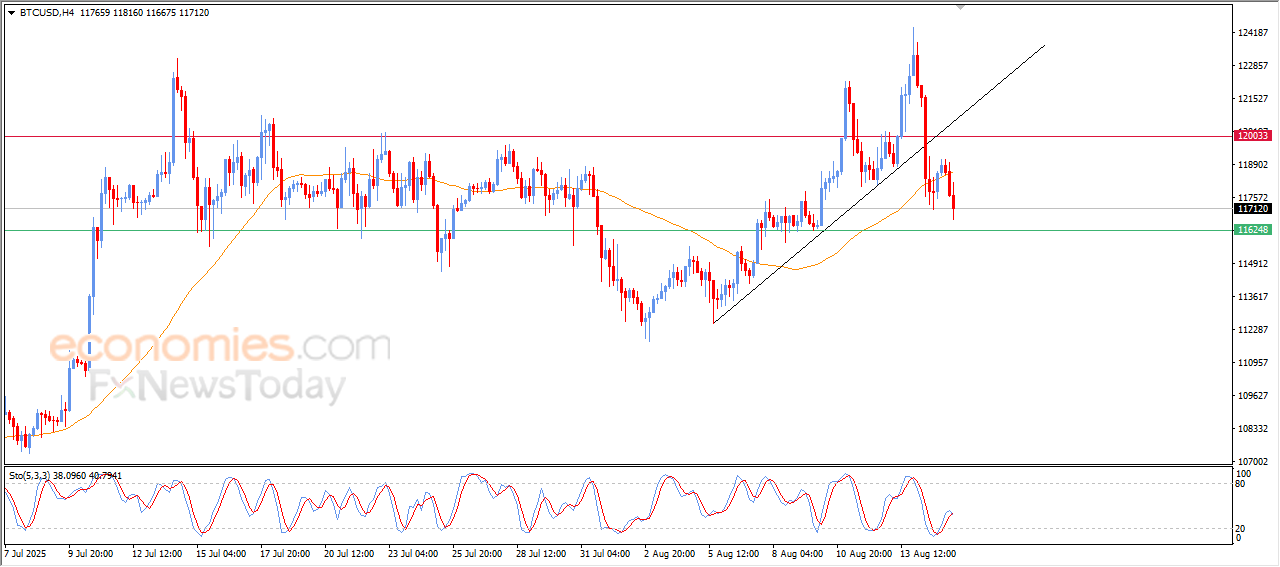

Evening update for Bitcoin (BTCUSD) -15-08-2025

The (BTCUSD) deepened their losses on the last intraday trading, affected by the negative pressure due to its trading below EMA50, affected by breaking a minor bullish bias line on the short-term basis, after offloading the clear oversold conditions on the (RSI), opening the way for recording more of the losses.

BestTradingSignal.com – Professional Trading Signals

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull performance report available here: