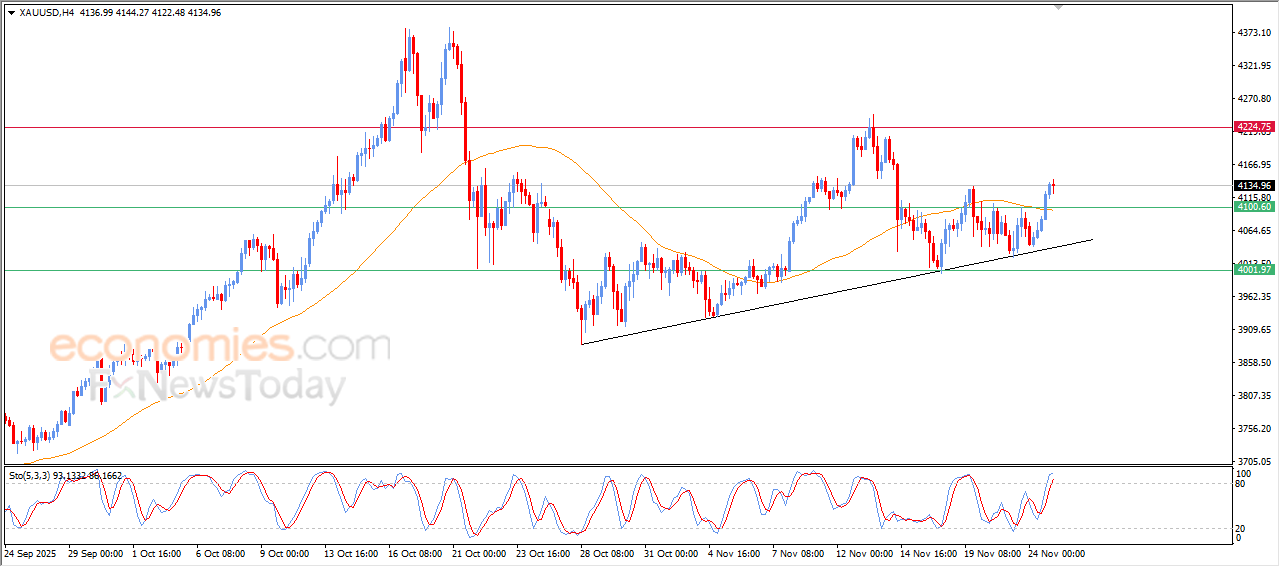

Gold prices get rid of its bearish pressure- Analysis-25-11-2025

Gold posted strong gains in its last intraday trading after breaching the key resistance at $4,100, supported by surpassing the EMA50, completing its recovery from the recent weakness. This advance enhances stability within a clear bullish path, especially as trading continues along the supportive minor trend line of the main short-term uptrend.

Positive signals appear on relative strength indicators despite reaching strong overbought levels, which may slow intraday upside without negating the overall bullish momentum. Maintaining this breach remains essential to support extending the bullish wave in the near term.

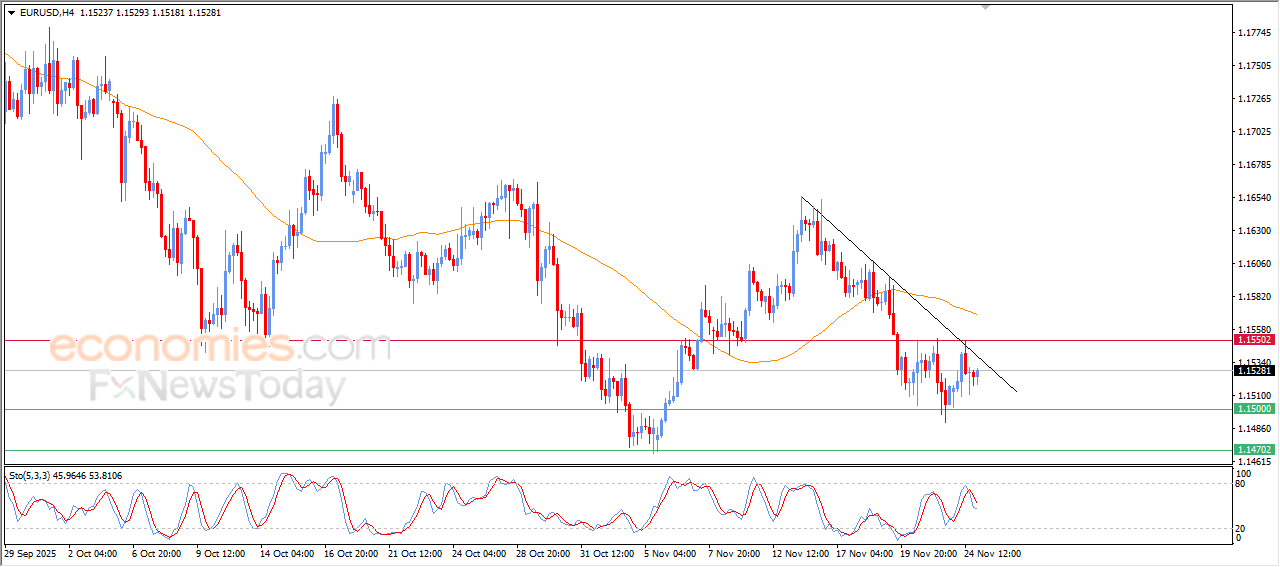

EURUSD price is experiencing fluctuating trading-Analysis-25-11-2025

The (EURUSD) price rose slightly in its last intraday fluctuating trading, but this rise remains limited amid the negative pressure on the pair, that is represented by its stability below EMA50, and trading within main bearish trend range on a short-term basis, with its trading alongside minor trend line that reinforces this bearish trend.

And the relative strength indicators show negative signals after reaching overbought levels, reducing the chance of the intraday rising continuation, this signs suggest a potential return to the selling pressure unless the price breaches key resistance levels to turn the bullish momentum.

Evening update for Bitcoin (BTCUSD) -24-11-2025

The (BTCUSD) price rose in its recent intraday trading, with the emergence of positive overlapping signals on the relative strength indicators, if it manages to offload its overbought conditions, attacking minor bearish trend line on a short-term basis, amid the continuation of the negative pressure due to its trading below EMA50, reducing the possibilities of the price recovery on a near-term basis.

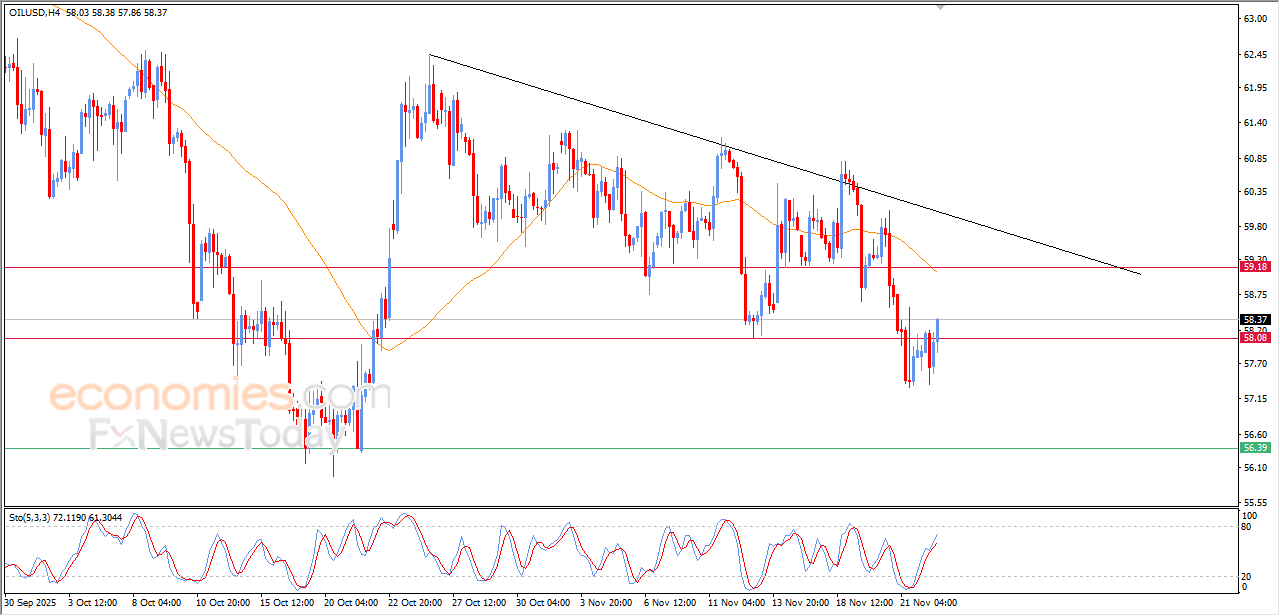

Evening update for crude oil -24-11-2025

The (crude oil) witnessed strong gains in its last intraday trading, breaching the key resistance at $58.00, taking advantage of the emergence of the positive signals on the relative strength indicators, reaching overbought levels, indicating a quick decline for the bullish momentum, amid the continuation of the negative pressure that comes from its trading below EMA50, which reduce the chances of the price recovery on the near-term basis.