Gold price is getting ready to attack stubborn and critical resistance -Analysis-21-07-2025

AI Summary

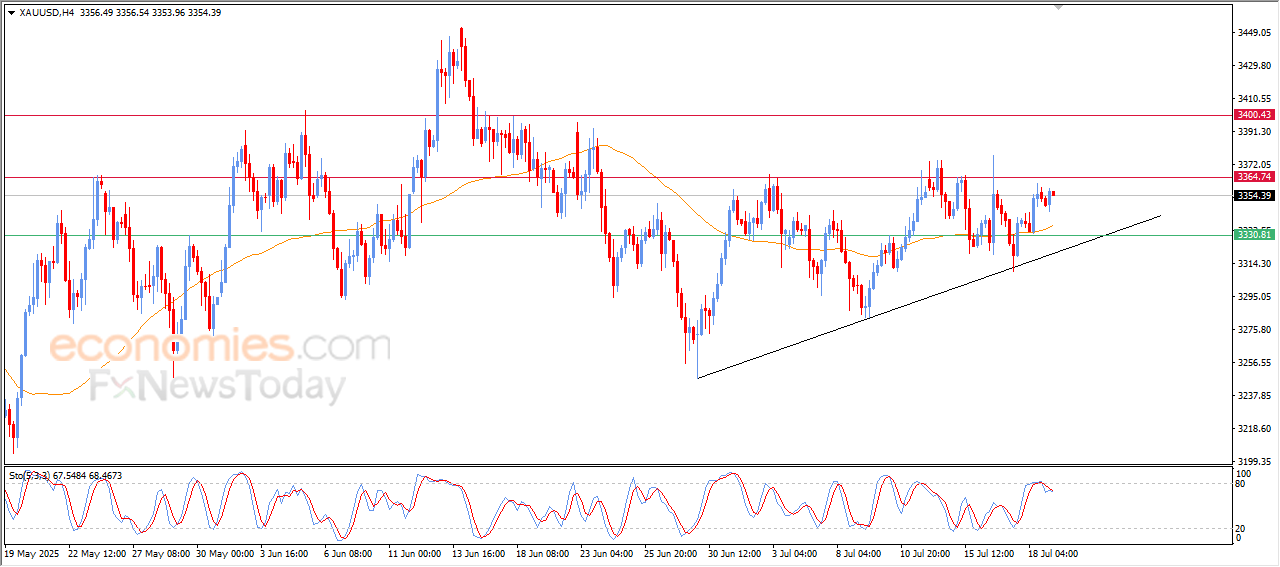

- Gold price settled with gains in last intraday trading, trading above EMA50

- Price preparing to attack stubborn key resistance at $3,365

- Rise came after offloading overbought conditions on RSI, providing momentum for further gains

The (Gold) price settled with gains in its last intraday trading, taking advantage of the continuation of the trading above EMA50, which provides dynamic support that reinforces the positive track, and the dominance of the bullish trend on the short-term basis remains valid, with the price move alongside a minor bullish bias.

This last rise came after offloading some of the clear overbought conditions on the (RSI), providing extra momentum for the continuation of the rise, preparing to attack the stubborn key resistance at $3,365, which represents a significant technical obstacle against the continuation of the gain.

EURUSD is under negative pressure -Analysis-21-07-2025

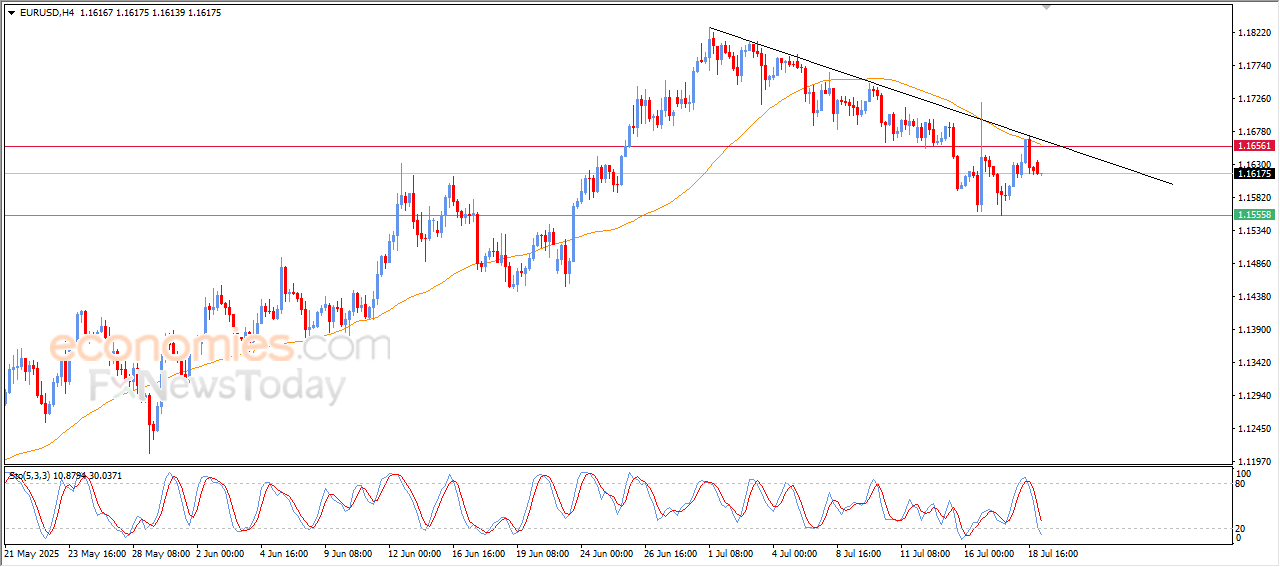

The (EURUSD) declined in its last intraday trading, to keep moving within a bearish correctional trend that dominates the short-term basis, amid its trading alongside a bearish bias line that indicates the continuation of the negative technical pressures on the pair.

This pressure is reinforced by the continuation of the trading below EMA50, indicating the weakness of the bullish momentum currently, besides the emergence of the negative signals on the (RSI), which confirm the possibility for the continuation of the decline in the upcoming trading, unless the buyers show a strong support near significant technical support levels.

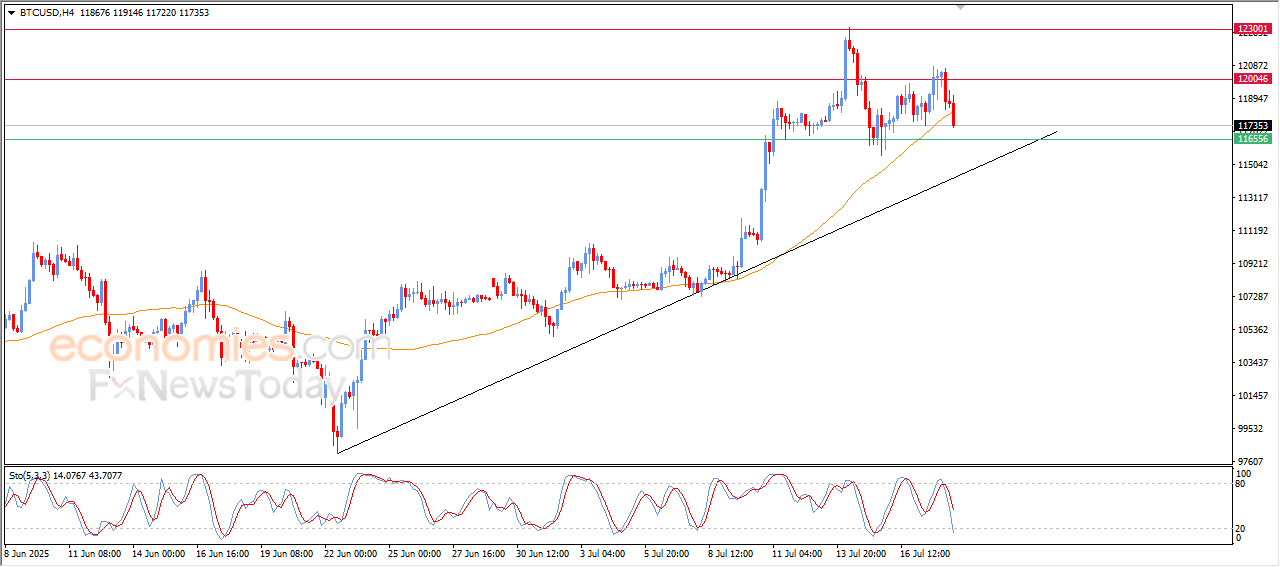

Evening update for Bitcoin (BTCUSD) -18-07-2025

The (BTCUSD) declined in its last intraday trading, amid the emergence of the negative signals on the (RSI), after reaching overbought levels, attempting to gain a positive momentum that might assist it to recover and rise again, amid the dominance of the main bullish trend on the short-term basis and its trading alongside a bias line, to notice surpassing the support of its EMA50, which puts it under the negative pressure and that might decelerate the price recovery on the near-term basis.

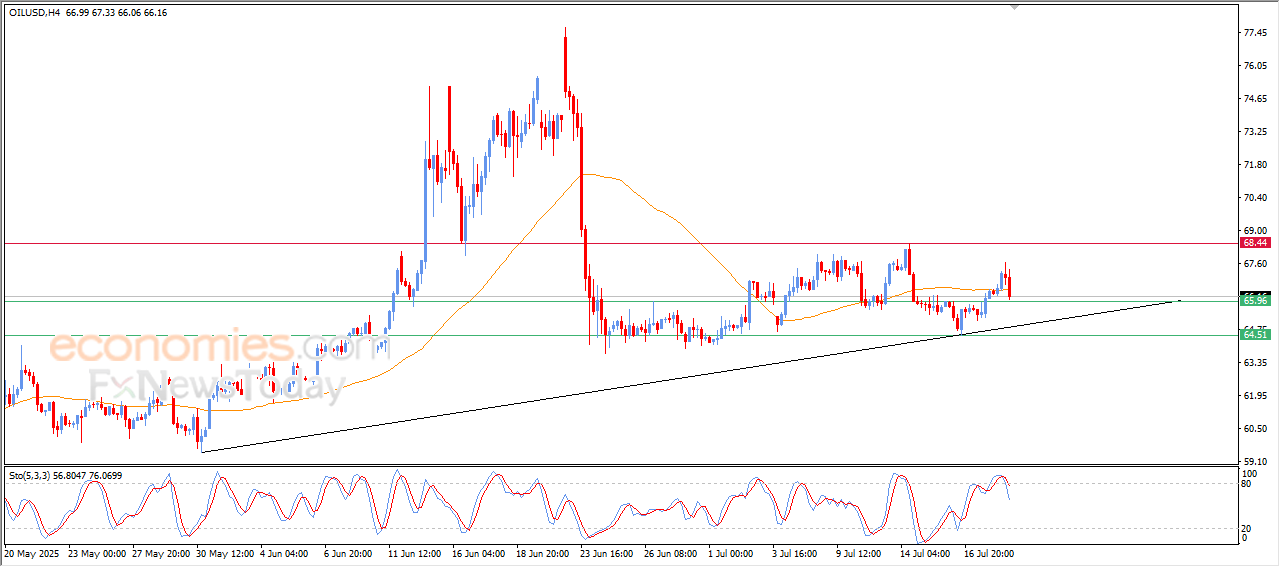

Evening update for crude oil -18-07-2025

The (crude oil) declined in its last intraday trading, to begin offloading its clear overbought conditions on the (RSI), especially with the beginning of the negative signals appearance, to lean on the support of its EMA50, amid the dominance of the bullish trend on the short-term basis and its trading alongside a bias line.