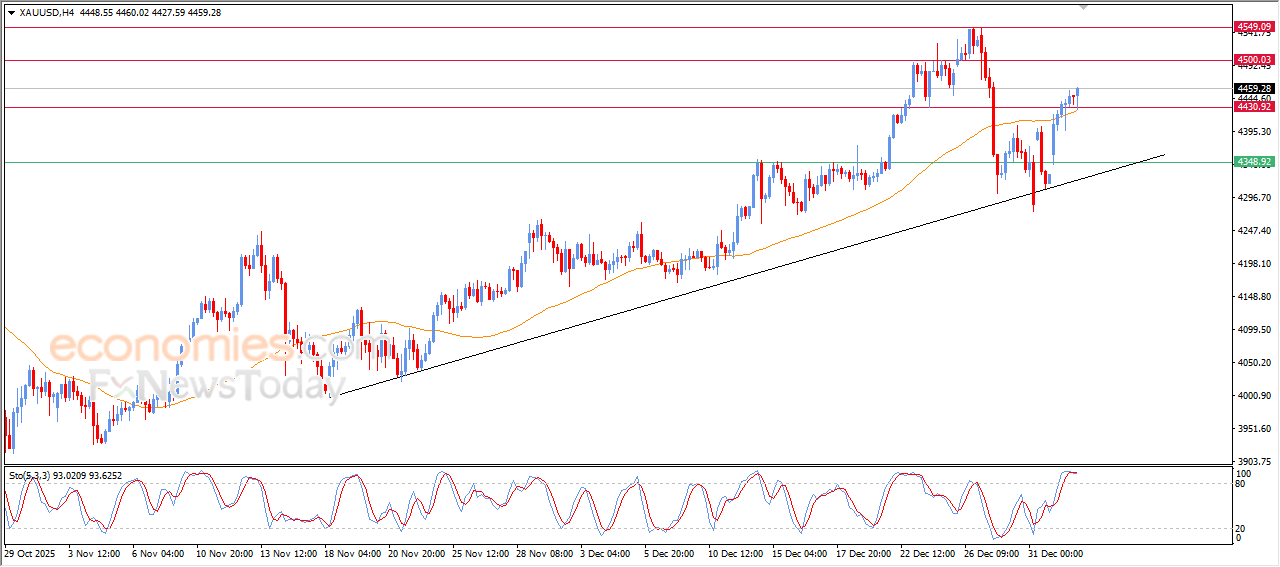

Gold price is facing a potential consolidation after strong bullish wave- Analysis-06-01-2026

Gold rose in its recent intraday trading, taking advantage of its stability above $4,400, besides the continuation of the dynamic support due to its trading above EMA50, amid the dominance of the main bullish trend on the short-term basis and the trading alongside supportive trend line for this trend.

On the other hand, the relative strength indicators began sending negative signals with the emergence of negative overlapping signals after reaching overbought levels, which might limit the ability of resuming the rise in the upcoming period, making its recent gains vulnerable to consolidation or limited correction.

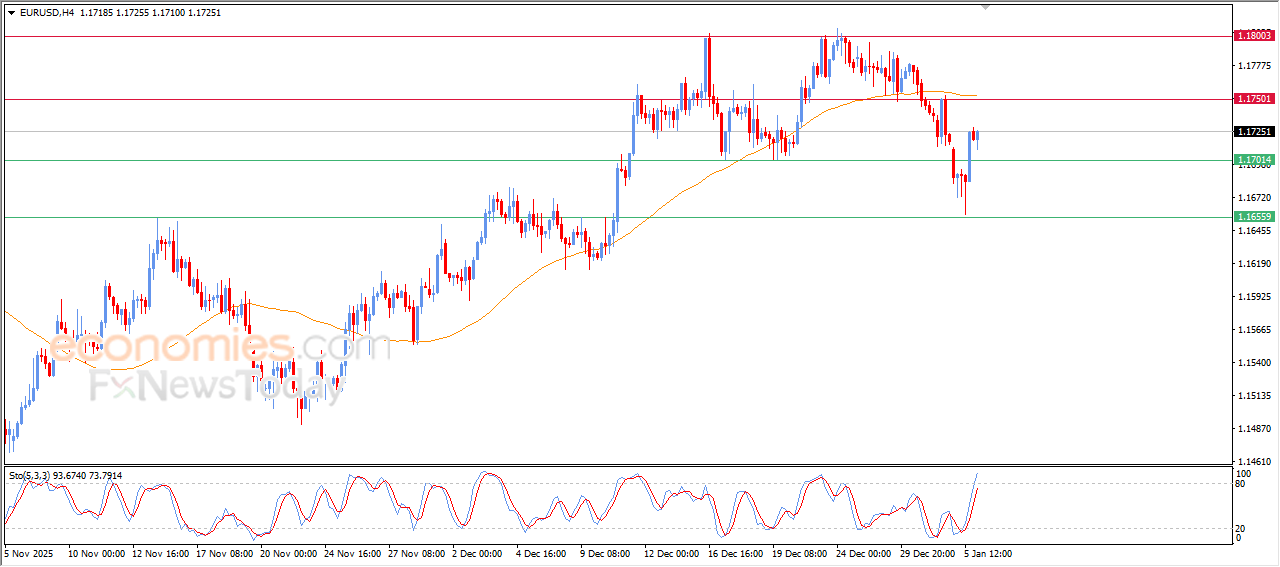

EURUSD price is bouncing strongly from our expected target- Analysis-06-01-2026

The (EURUSD) price is experiencing a sharp rise in its last intraday trading, after leaning on the key support at 1.1655, which represents an expected target in our previous analysis, to recover big part of its previous losses in a clear correction.

This rise comes amid the continuation of the dominant bearish corrective wave on the short-term basis, besides the continuation of the negative pressure due to the trading below EMA50, with the relative strength indicators reaching overbought levels, suggesting a quick decline in the momentum.

Evening update for Bitcoin (BTCUSD) -05-01-2026

The (BTCUSD) price kept rising in its last intraday trading, preparing to attack the key resistance at $94,000, this resistance represents an expected target in our previous analysis, amid the dominance of strong minor bullish wave on the short-term basis, despite reaching overbought levels.

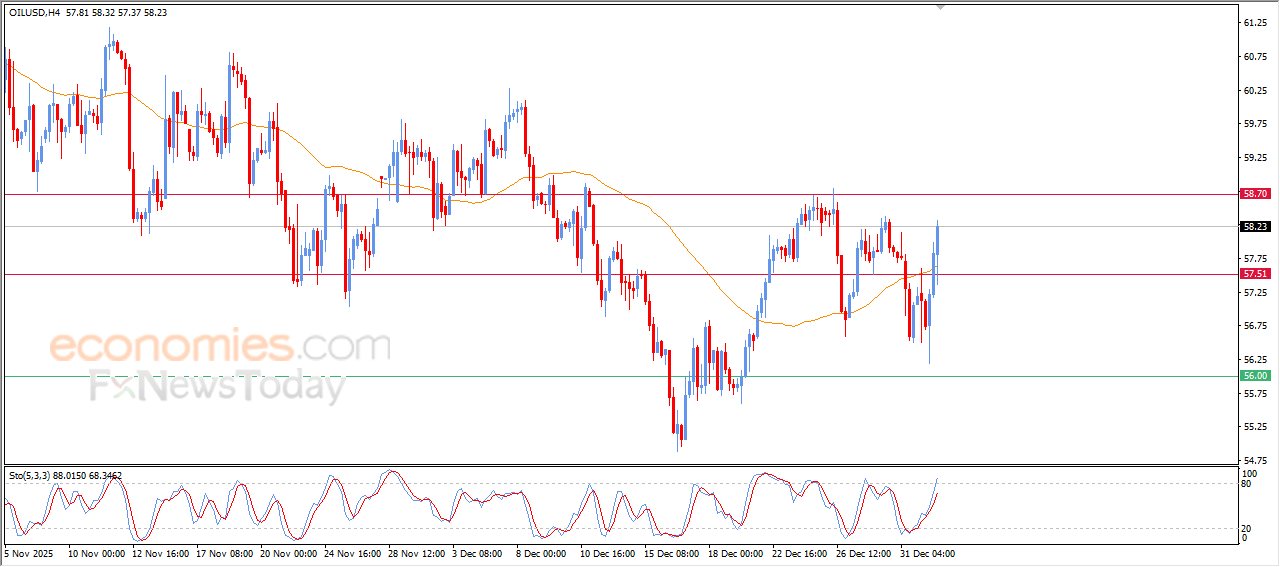

Evening update for crude oil -05-01-2026

The (crude oil) price extended its gains in its last intraday trading, taking advantage of the positive signals from the relative strength indicators, to surpass the negative pressure of the EMA50, announcing its recovery on an intraday basis, confirming the dominance of the bullish corrective on a short-term basis.