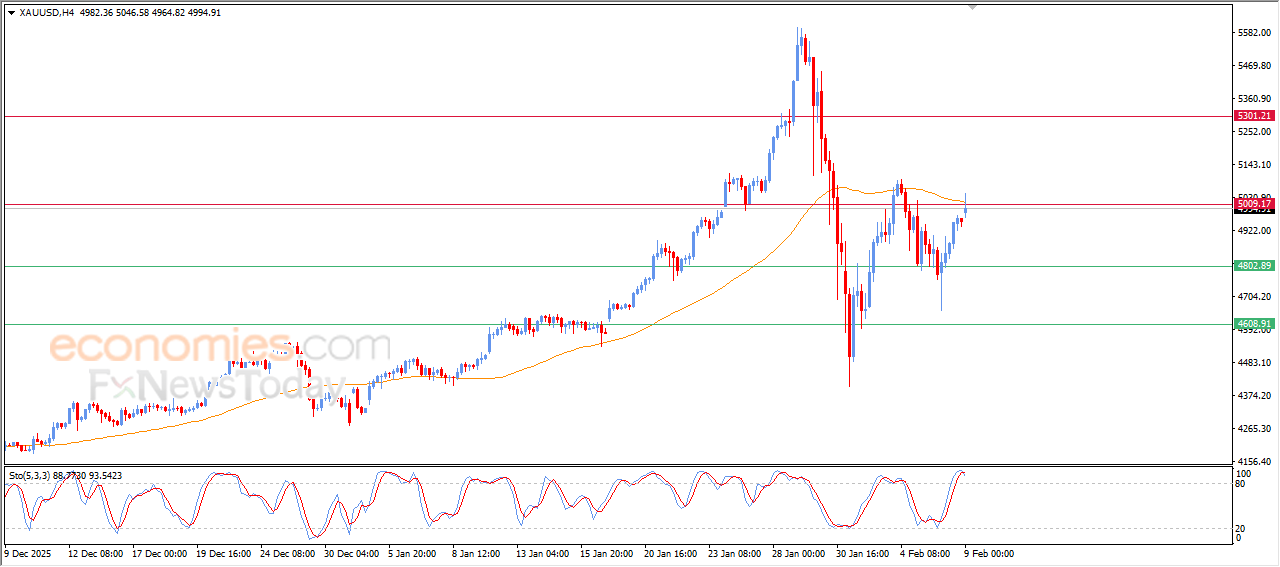

Gold price is facing a double resistance that may hinder its gains- Analysis-09-02-2026

Gold prices rose in recent intraday trading, retesting the key psychological resistance at $5,000, accompanied by reaching EMA50’s resistance, which reinforces the strength of this area and gives it significant technical weight to determine the next trend.

Noticing negative overlapping signals on relative strength indicators after reaching exaggerated overbought levels compared to the price move, opening the way for forming negative divergence that might increase the negative pressures in the upcoming period.

Therefore, we suggest a decline in gold prices' upcoming intraday trading, if $5,000 resistance settles to target $4,800 support.

The expected trading range is between $4,800 support and $5,100 resistance.

Today’s forecast: Bearish

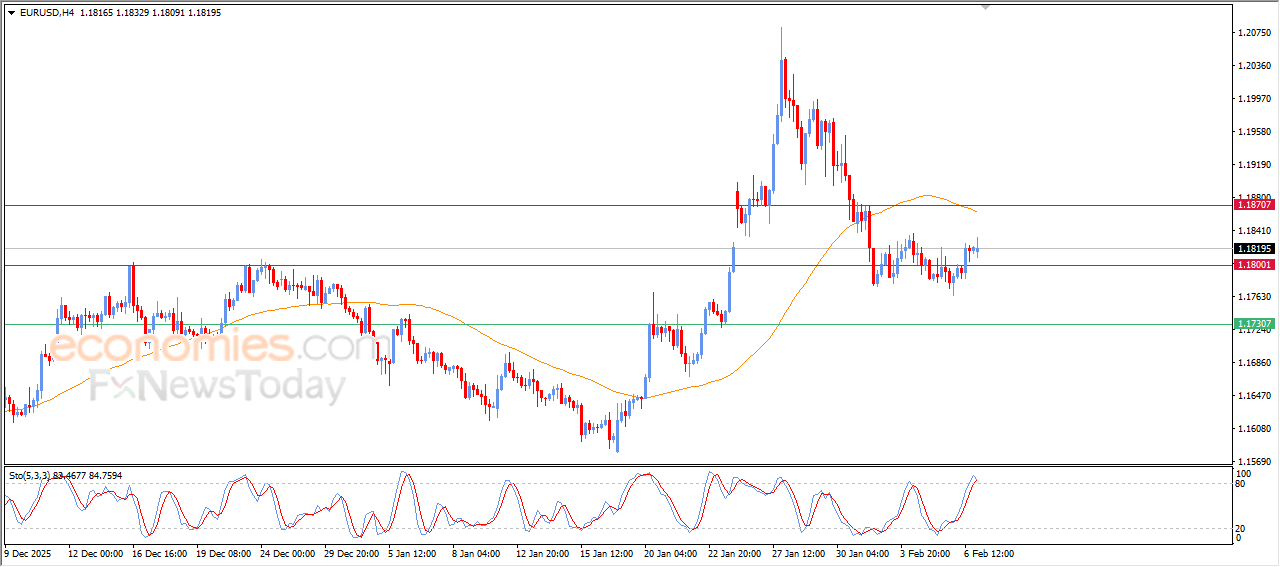

EURUSD price is showing new negative signals- Analysis-09-02-2026

The (EURUSD) price continues its sideways trading in its last intraday trading, amid the dominance of bearish corrective wave on short-term basis, accompanied by the continuation of the negative pressure due to the continuation of the trading below EMA50, which forms an obstacle against any attempt to rise.

Notice the beginning of negative overlapping signals emergence on relative strength indicators after reaching overbought levels, exaggeratedly compared to the price move, to indicate forming negative divergence that might increase the strength of the pressure in the upcoming period.

Therefore, we suggest a decline in (EURUSD)price’s upcoming intraday trading, if it settles below 1.1800 resistance to target the next support at 1.1730.

The expected trading range is between 1.1730 support and 1.1870 resistance.

Today's forecast: Bearish

Evening update for Bitcoin -06-02-2026

The (BTCUSD) price extended its gains in its last intraday trading, benefiting from the emergence of the positive signals from relative strength indicators, amid attempts to recover some of its previous losses, amid the continuation of the negative pressure due to its trading below EMA50, under the dominance of the main bearish trend on short-term basis, with its trading alongside main and minor trend line that supports this path.

Evening update for crude oil -06-02-2026

The (crude oil) price rebound higher in its last intraday trading, as it gained bullish momentum due to its leaning on EMA50’s support, especially with the emergence of the positive signals from relative strength indicators, under the dominance of the main bullish trend on short-term basis, with its trading alongside supportive trendline for this path.