Gold price attempts to recover some of its losses - Analysis-03-02-2026

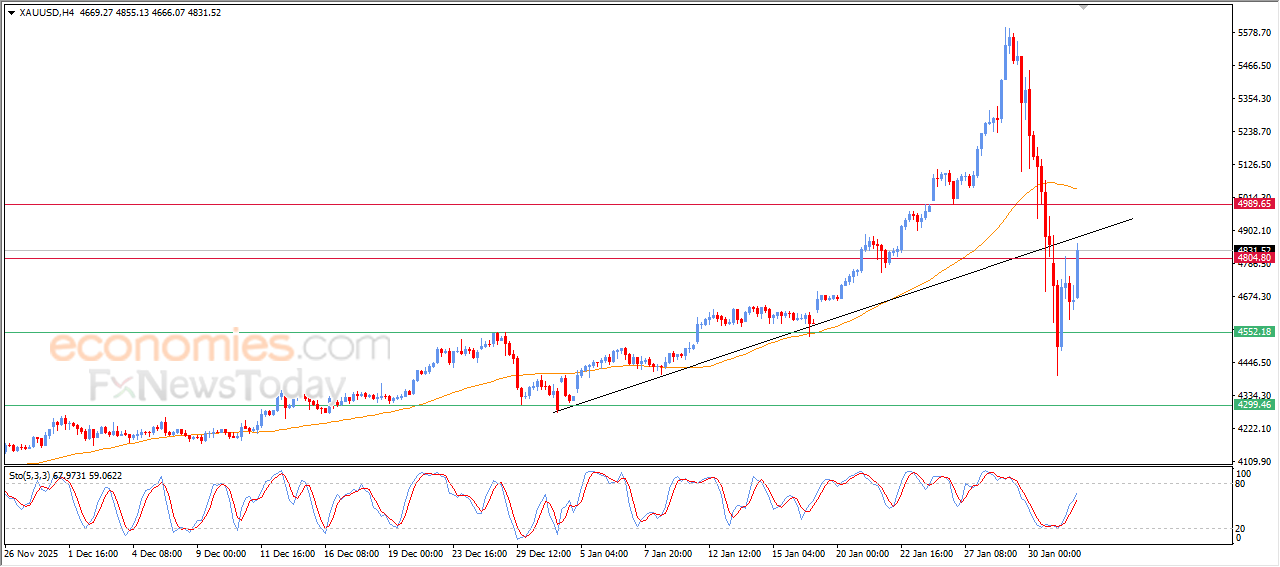

Gold prices (GOLD) rose during recent intraday trading after reaching our expected target at $4,550 support, which provided solid support base that helped it to gain bullish momentum. This rebound was supported by the positive signals from relative strength indicators, after reaching oversold levels, opening the way for recovering some of its previous losses.

This comes amid the continuation of its trading below EMA50, which represents a dynamic resistance that limits the strength of the current recovery, besides the effect of breaking minor bullish trend line on short-term basis, which keeps the scenario of the current rebound within a temporary corrective framework.

EURUSD price is rising after reaching our expected target- Analysis-03-02-2026

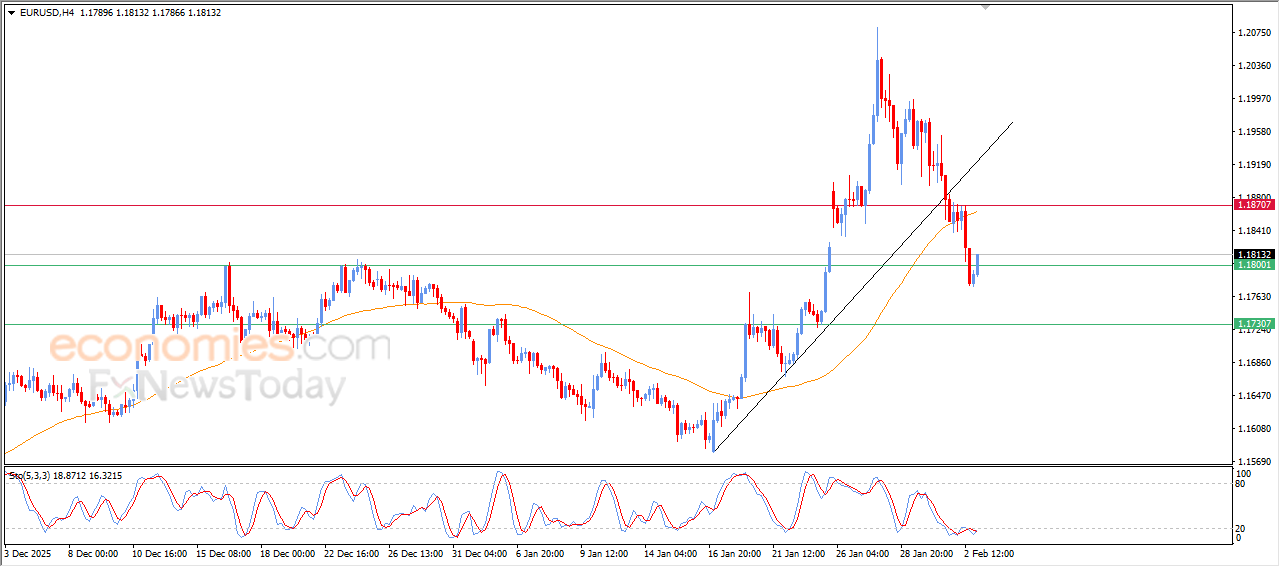

The (EURUSD) price rose in its last intraday trading after the stability of 1.1800 support, which represented a target in our previous analysis, gaining bullish momentum to recover some of its last losses, this rebound comes amid the attempts to offload its clear oversold conditions on relative strength indicators, especially with the emergence of positive overlapping signals.

This comes amid the dominance of steep bearish corrective wave on short-term basis, besides the continuation of its trading below EMA50, which shrinks the chances of achieving sustainable recovery in near period and makes any rise considered as temporary corrective rebound.

Ripple price tries to recoup some losses - Analysis - 02-02-2026

XRPUSD price recorded gains in its latest intraday trading, supported by incoming positive signals from the RSI, as the price attempts to recover part of its previous losses. However, negative pressure remains in place due to trading below its SMA50, which reinforces the stability and dominance of the main short-term downtrend, especially with price action moving along a trend line supporting this bearish path.

Therefore we expect the cryptocurrency price to decline in upcoming intraday trading, as long as it remains below the $1.6775 resistance level, to target the $1.430 support level.

Expected trading trend: Bearish

Marvell Technology price readies to pierce important support - Forecast today - 02-02-2026

Marvell Technology, Inc. (MRVL) stock price recorded a decline in its latest intraday trading, with price action moving along a short-term minor downward trend line. This comes amid continued negative pressure from trading below its SMA50, which limits the chances of a full recovery in the near term, especially with incoming negative signals from the RSI after it reached extremely overbought levels in an exaggerated manner compared to price action, indicating a negative divergence.

Therefore we expect the stock price to decline in upcoming trading, especially if it breaks below the important $79.00 support level, to target the next support at $68.55.

Today’s price forecast: Bearish