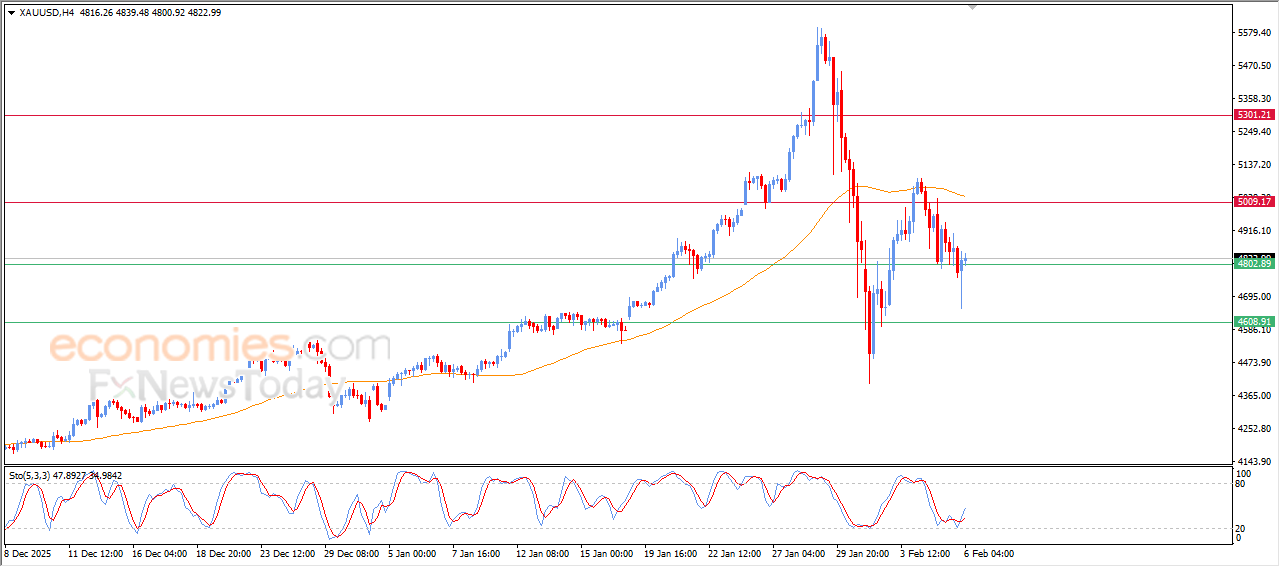

Gold price attempts to offload its oversold conditions - Analysis-06-02-2026

Gold prices rebounded higher in recent intraday trading, holding above $4,800 support, to recover its previous losses and to absorb the dominant selling pressure. This rebound is supported by the relative strength indicators attempting to offload their oversold conditions, with the emergence of positive signals, which helped the price to settle temporarily above this key support.

Despite this intraday improvement, the overall image remains negative on short-term basis, amid the bearish corrective trend dominance, and the continuation of trading below EMA50, which represents a dynamic resistance that limits any potential recovery, and reduces the chances of regaining the upside track.

Therefore, we suggest a decline in gold prices' upcoming intraday trading, when breaking $4,800 support, to target its next support at $4,600.

The expected trading range is between $4,600 support and $5,000 resistance.

Today’s forecast: Bearish

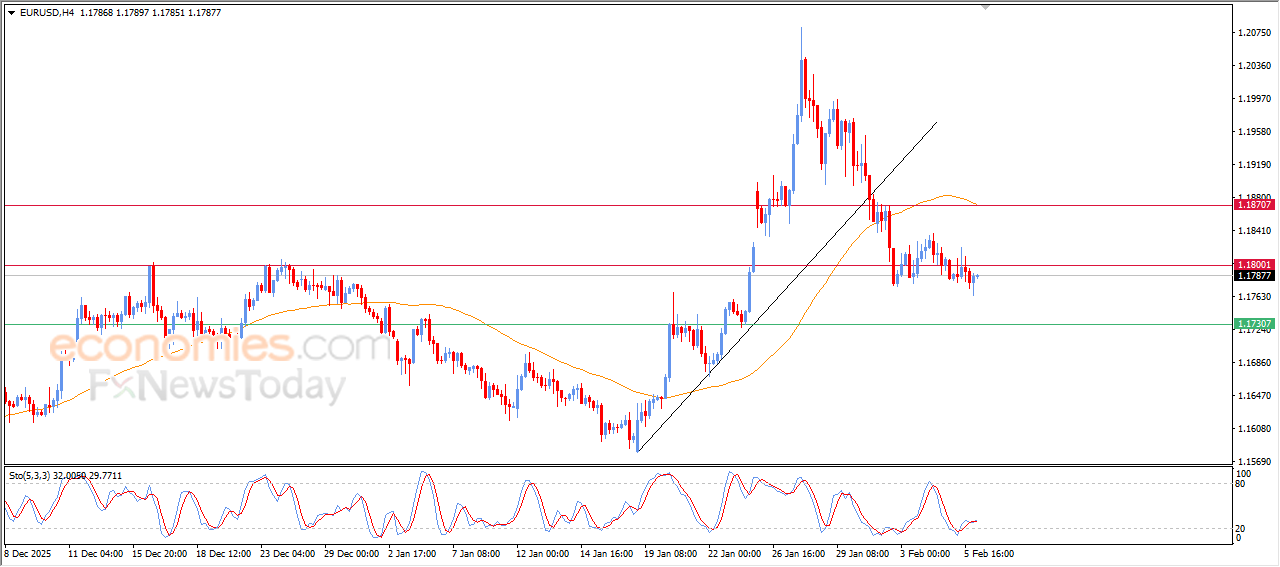

EURUSD price is showing modest positive signals that are limiting its decline- Analysis-06-02-2026

The (EURUSD) price is experiencing fluctuating trading in its last intraday trading, amid its stability below 1.1800 resistance, indicating the continuation of the selling pressures on the price, this weak performance with the trading below EMA50, which represents a dynamic resistance that limits any strong rebound, accompanied by the dominance of bearish corrective wave on short-term basis.

Accompanied by the emergence of positive signals from the relative strength indicators after reaching oversold levels, in attempt to offload these oversold conditions, which might limit the downside moves and support sideways range trading of limited rebound in near period.

Therefore, we suggest a decline in (EURUSD)price’s upcoming intraday trading, if it settles below 1.1800 resistance to target the next support at 1.1730.

The expected trading range is between 1.1730 support and 1.1850 resistance.

Today's forecast: Bearish

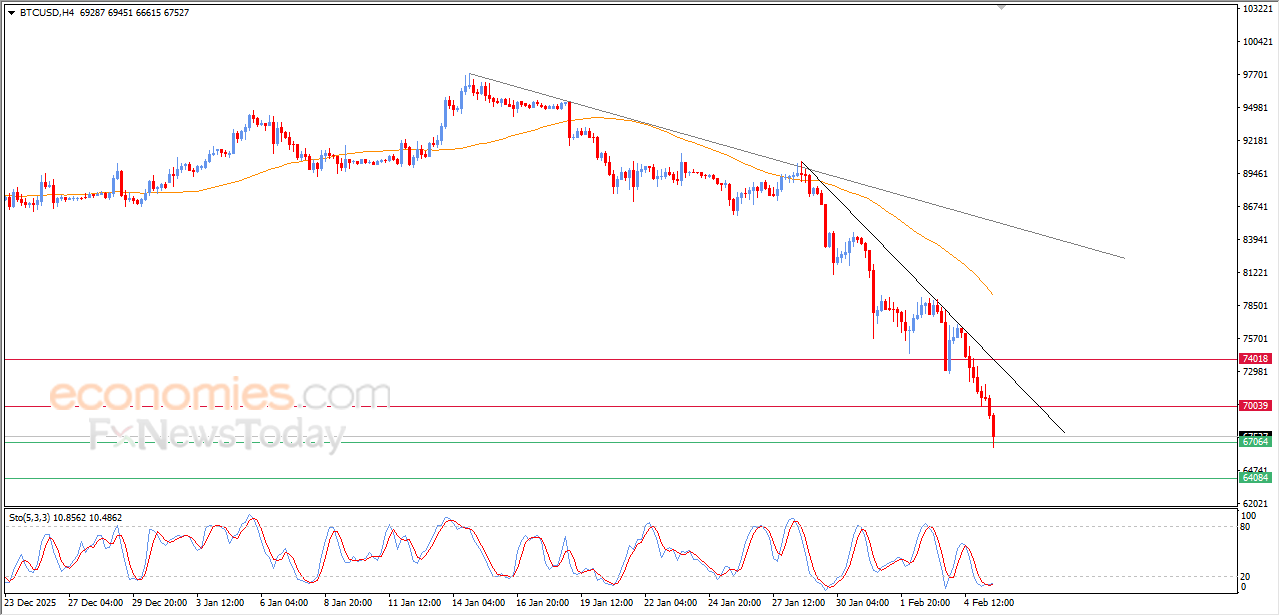

Evening update for Bitcoin -05-02-2026

The (BTCUSD) price kept deepening its losses on its last intraday levels, reaching our expected target in our previous analysis at $67,000 support, amid the dominance of the main bearish trend on short-term basis, with its trading alongside supportive main and minor trend line for this path, besides the continuation of the negative pressure due to its trading below EMA50, intensifying the negative pressure on the price.

Evening update for crude oil -05-02-2026

The (crude oil) price slipped lower in its last intraday trading, amid the emergence of negative signals from relative strength indicators, attempting to look for higher low to take it as a base that might help it to gain the required bullish momentum for its recovery and rise again, leaning on EMA50’s support, amid the dominance of the bullish trend on short-term basis.