Gold is expected to reach $3,000 by end of 2024: Here are the best 3 platforms and brokers for trading it

Gold Price Technical Analysis and Forecasts for 2024 and 2025

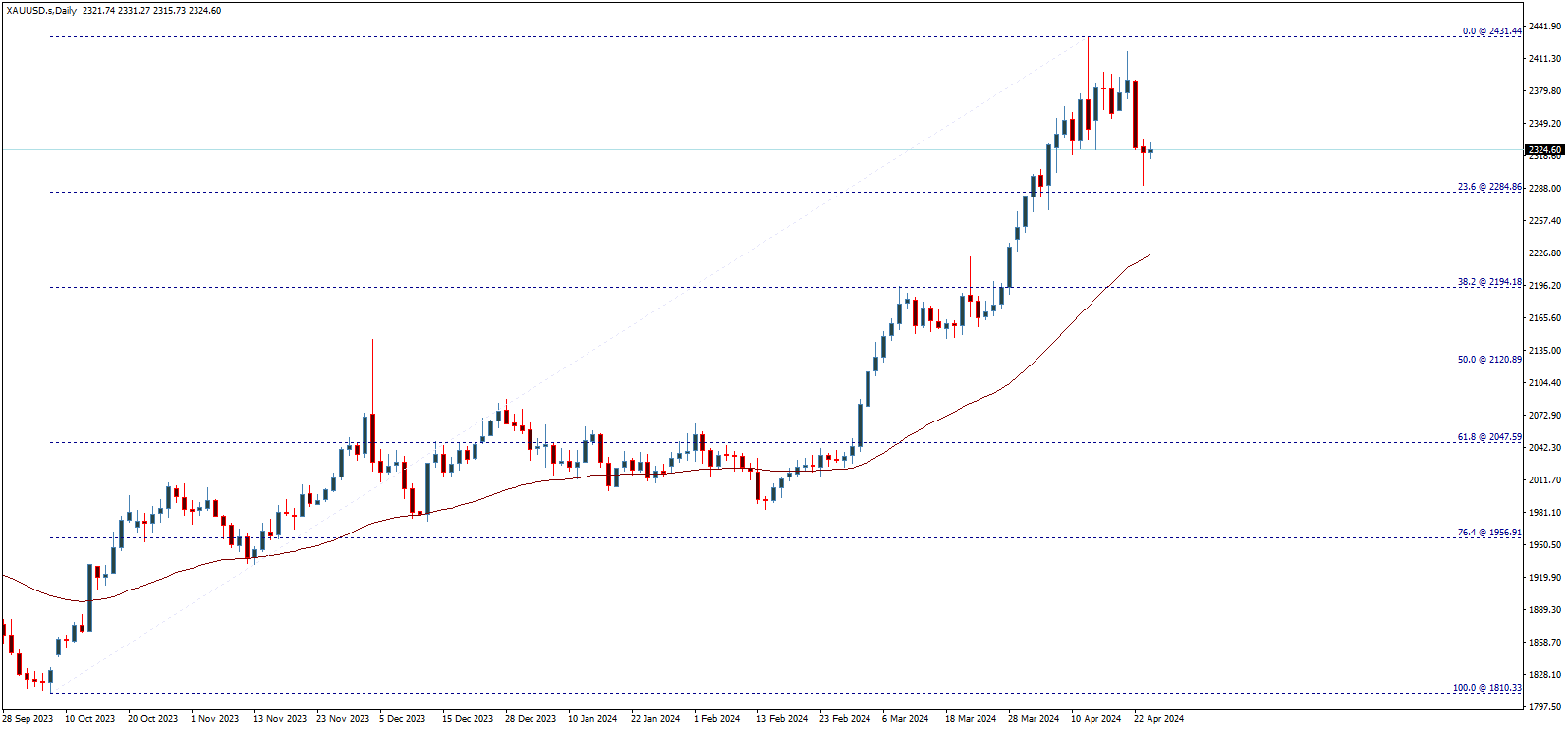

Gold price has resumed its long-term upward trend since the beginning of 2016, with real signs of the upward wave starting in the last quarter of 2018, propelling the price into an upward path and achieving new historical levels, surpassing the two thousand dollar mark for the first time after mid-2020. Following temporary downward corrections, the price surged again reaching current areas and recording new historical peak levels at $2430.00 per ounce.

Best Gold Trading Brokers for 2024 and 2025

- 999.9% Pure Gold

- Secure Vaulting

- Unlimited Monthly Rewards

- LBMA Approved Gold Provider

- Register - Create an account and get verified for free.

- Deposit - Fund your account in multiple currencies.

- Buy - Purchase real or tokenized gold.

The chart shows the price movement within an ascending channel carrying the mentioned upward wave, receiving good support from the exponential moving average 50. This channel has an additional positive target reaching $2485.00 before the possibility of a new downward correction. Let's wait for more expected rise during the upcoming period.

The decline witnessed by the price since yesterday is considered a temporary downward correction to the recent rise that started from the 1810.00$ areas, and the price is testing an important support level at 2285.00$. It is likely that the price will resume its positive trades again, towards the mentioned target above.

The following chart shows us the impact of negative models that may force the price to undergo further downward correction, where the price completed an ascending wedge model in addition to a double top that may pressure the price to break the 2285.00$ level and head to test the 2194.20$ level as the next negative station, before resuming the rise again, paying attention to the fact that breaking this level will extend the downward correction to reach 2120.90$ and may extend to 2050.00$ in the short term.

The technical indicators on the momentary time frames support the chances of further downward correction, let's watch the upcoming movement carefully especially regarding the support 2285.00$ and the resistance 2390.00$, as overcoming one of them represents a key to determining the next direction on the momentary term.

Overall, the general upward path is still ongoing in the long term, but we take into account the possibility of extending the downward correction especially if the price continues to decline and breaks 2050.00$, which will pressure the price to incur additional losses reaching the support of the main ascending channel around the 1800.00$ barrier before resuming the upward path again, noting that basing the price on this barrier and starting a new upward wave will push the price to achieve new gains and new historical levels surpassing the 2600.00$ barrier to mainly reach 2800.00$.

On the other hand, it should be noted that breaking the 1800.00$ level could cause a significant shift in direction and pressure the price to stop the long-term upward wave.

Best 3 Gold Trading Platforms for 2024 and 2025

- Bullionz, a premier gold trading platform, reliable and recognized for its purity standards.

Bullionz offers a dynamic platform for buying and selling 999.9% pure gold. It provides secure vaulting and unlimited monthly rewards, making it a top choice for investors seeking stability and consistent benefits. As an LBMA approved gold provider, Bullionz ensures high-security standards and flexibility in trading both real and tokenized gold.

- Plus500, the best global trading company, reliable and licensed in gold trading.

Plus500 offers an advanced trading environment for gold trading, making it a preferred choice for traders looking for diversity in trading products and high security. It provides access to gold trading via contracts for difference, allowing traders to benefit from gold price movements up and down without the need to own the actual metal.

- XM, the best trading platform, reliable and suitable for beginners in gold trading.

XM stands out in the field of gold trading thanks to its provision of comprehensive educational materials and webinars focused on gold trading strategies. XM offers diverse gold trading opportunities through contracts for difference, enabling traders to efficiently exploit opportunities in the gold market. With strong technical support and easy-to-use trading platforms, XM is a great choice for anyone looking to enter the world of gold trading.

Gold Price Fundamental Analysis and Forecasts for 2024 and 2025

- Most global institutions expect the gold market to continue rising

- Significant increase in investment demand for gold metal in 2024

- The actual demand in China and India has contributed significantly to the rise in gold bullion prices

Brief Analyses and Forecasts of Gold Prices

- Gold Price Forecasts This week: Gold prices entered a cycle of downward correction in the short and momentary term with the target of testing the $2,300 per ounce barrier.

- Gold Price Forecasts in April: It is likely that the volatility of gold prices will continue during the remaining transactions of April between the pressure of correction operations with the slowdown in safe-haven demand against the continued activity of investment buying operations.

- Gold Price Forecasts for 2024: As it approaches surpassing $2,500 per ounce, the next target for the precious metal will become the $3,000 barrier, which it may reach before the end of the year.

- Gold Price Forecasts for 2025: Next year 2025 may actually witness the gold bullion trading above $3,000 per ounce, especially if the global central banks implement a violent cycle of monetary easing.

$3,000 per Ounce

Citibank group said: We expect the gold price to reach $3,000 per ounce over the next six to eighteen months.

Gold, which retains its value as a hedge against inflation, tends to perform well in periods of economic uncertainty when investors move away from riskier assets such as stocks.

Gold bullion prices recorded the highest level ever at $2,431.55 per ounce last Friday, April 12th.

Spot Gold Prices

The stock market has been on a tear since the beginning of the year, rising more than 15% year-to-date amid a range of factors including the generosity of global central banks and geopolitical tensions and expectations for a Federal Reserve interest rate cut.

Gold prices typically have an inverse relationship with interest rates. With lower interest rates, gold becomes more attractive compared to fixed income assets such as bonds, which would yield weaker returns.

U.S. inflation hotter than expected in March led to a pullback in market expectations for a rate cut to September, with expectations now for two rate cuts instead of three.

Nevertheless, analysts remain optimistic about the outlook for the yellow metal, supported by ongoing physical demand in addition to its geopolitical hedge attractiveness.

Citibank analysts led by Akash Doshi, head of commodity research in North America at Citibank: We expect the gold price to reach $3,000 per ounce over the next six to 18 months.

Doshi explained: "The 'floor price' for financial gold also rose from around $1,000 to $2,000 per ounce.

Monetary Easing Cycle

- In March, the Swiss National Bank (SNB) unexpectedly reduced the benchmark interest rate to start a new cycle of monetary easing, and the Mexican central bank cut interest rates, and the Federal Reserve, the European Central Bank, and the Bank of England laid the groundwork for what is called easing of monetary policy in the coming months.

- Market experts said: In the medium term, there is clear optimism for stocks and residential real estate and gold and bitcoin, thanks to the global monetary easing cycle that will result in the injection of new liquidity into the markets.

Chinese Demand for Gold Records Record Levels ..Why?

China relies heavily on the U.S. dollar in its trade with the rest of the world, as it is the main currency in the world, with most commodities priced in dollars, and more than half of global trade conducted using the dollar.

While China's role in challenging the economic dominance of the United States over the past three decades has been successful, it has built up huge foreign currency reserves, most of them in dollars, but Beijing fears becoming overly reliant on the American currency, and is keen to diversify the reserves of the People's Bank of China.

Therefore, the People's Bank of China has increased its gold reserves for the past 16 consecutive months, according to the World Gold Council.

In 2023, the People's Bank of China bought larger amounts of gold than all other central banks.

According to the Chinese industry authority, China's purchases of the precious metal last year amounted to 225 metric tons, nearly a quarter of the 1,037 tons bought by all central banks worldwide.

In January and February 2024, the People's Bank of China increased its gold reserves by 22 tons, according to sources in the World Gold Council, bringing the total held by the central bank to about 2,257 tons of gold.

In addition to the People's Bank of China, Chinese consumers are buying gold coins, bullion, and jewelry, following the depreciation of their real estate investments and the yuan and the stock market in the country due to recent economic problems in the world's second-largest economy.

John Reid, chief market strategist at the World Gold Council, said: "Since the beginning of the year, we have seen massive retail buying in China... record quantities of buying in the local Shanghai Gold Exchange."

Largest Gold Buyer

China and India typically compete for the title of the world's largest buyer. But that changed last year with the inflation of Chinese consumption of jewelry and bullion and coins to record levels. Gold jewelry demand in China increased by 10% while demand in India decreased by 6%. Meanwhile, China's investments in bullion and coins increased by 28%.

Key Forecasts for Gold Prices in 2024

- "Citibank" group expects gold prices to rise up to $3,000 per ounce over the next six to eighteen months.

- "Goldman Sachs" group expects gold prices to rise up to $2,700 per ounce by the end of this year, thanks to the unwavering bull market.

- J.P. Morgan Bank expects the gold price to reach $2,500 per ounce by the end of 2024, saying that the precious metal is its primary choice in commodity markets.

- Morgan Stanley expects the gold price to reach $2,500 per ounce by the end of 2024, while some analysts at the bank see the possibility of reaching $2,700 per ounce in the long term.

Opinions and Analyses

- Capital.com's financial markets analyst "Kyle Rodda" said: Gold is only traded as an alternative to primary yields, and it is in itself an agent for the increasing expectations of interest rate cuts in the United States.

- "Hugo Pascal," a precious commodities trader at M Provd said: As long as gold remains above the $2,000 per ounce level, I remain positive about the metal.

- "Tim Waterer," senior market analyst at KCM Trade said: There is enough instability in the Middle East to keep investors interested in gold as part of the safe-haven demand.

- "Chris Gaffney," head of global markets at Everbank said: The main driver for gold in the short term is interest rate expectations, there is a risk that gold will remain under pressure in the short term until the Federal Reserve actually says it's time to cut interest rates.

- "Yap John Rong," a market analyst at IG said: Given the recent geopolitical developments calling for continued tensions for a longer period, the yellow metal finds some renewed momentum on safe-haven flows.

- "Philip Streible," chief market strategist at Blue Line Futures in Chicago said: The slight rise in inflation data will put pressure on the gold market, but the precious metal is well supported at the $2,000 level through central bank purchases.

- "Bob Haberkorn," senior market strategist at RJO Futures said: The Federal Reserve is in the driver's seat for the gold market, we can see a significant rise in prices when it says something about when it's time to cut interest rates.

- "Matt Simpson," chief analyst at City Index said: Positive flows for exchange-traded funds support gold prices, in addition to the Chinese central bank, which was the second largest buyer of gold reserves in the fourth quarter of last year.

- "Edward Meir," a metals analyst providing research on behalf of Marks said: The main drivers for gold are what will happen on the interest rate front.

- "Jonny Teves," a strategy expert at UBS Bank said: This rise in gold resulted from a decline in real interest rates, in addition to positive investor sentiment towards gold, which has put the market in an upward trend.

- "Jigar Pandit," head of commodities at BNP Paribas said: We expect central bank buying to continue in light of geopolitical uncertainty, alongside the slowdown in China which will keep global growth under pressure. Hence, that uncertain financial environment, gold will remain a safe investment for global central banks.

Types of Demand for Gold

Industrial Demand

- Electronics: Gold is widely used in electronic components such as printed circuits and motherboards in smartphones, computers, and other electronic devices, thanks to its distinctive properties of high efficiency and effectiveness in conducting electricity.

- Renewable Energy: Gold is used in renewable technologies such as solar cells and lithium-ion batteries, which are essential elements in the transition towards cleaner and sustainable energy.

- Vehicles: Gold is used in car engines to improve their performance and efficiency.

- Household Products: Gold is used in household appliances such as refrigerators and air conditioners to improve their functions and efficiency.

Investment Demand

- Jewelry: Gold is one of the precious metals used in the manufacture of jewelry and art pieces for its beauty and distinctive properties.

- Coins: Gold is used in the making of coins for its unique value and relative stability.

- Safe Haven: Gold bullion is a safe haven for investors in times of economic and geopolitical uncertainty for its constant value and ability to retain its value.

- Exchange-Traded Funds (ETFs): Gold is used in exchange-traded funds that allow investors to buy and sell gold without the need to physically own it.

Global Central Banks

- Global central banks hold reserves of gold as part of their foreign exchange reserves to support the value of their currencies and maintain financial stability.

- Gold reserves provide a form of insurance against currency fluctuations and geopolitical risks.

- Central banks can buy or sell gold depending on their monetary objectives and economic conditions.

Key Factors Affecting Gold Demand

- Global Economic Growth: Economic growth leads to increased demand for gold in various industrial and consumer areas.

- Global Interest Rates: Lower interest rates increase the attractiveness of gold as an alternative investment to low-yielding government bonds.

- Economic and Geopolitical Uncertainty: Economic and geopolitical uncertainty increases the demand for gold as a safe haven for investors.

- Technological Developments: Technological developments in fields such as electronics and renewable energy lead to increased demand for gold.

Important Gold Price Milestones

- August 2008: Gold price recorded the lowest level at $251.90 per ounce.

- April 2024: Gold price recorded the highest level ever at $2,431.55 per ounce.

- April 2024: Gold price recorded the highest closing level ever at $2,391.82 per ounce.

Best Gold Price Performance in History

- Year 2007: Best annual performance ever with a rise of nearly 31%.

- First Quarter/2016: Best quarterly performance ever with a rise of more than 16%.

- September/1999: Best monthly performance ever with a rise of nearly 17%.

Common Questions About Gold

How to Invest in Gold?

There are several different ways to invest in gold, firstly through buying actual gold such as coins or bullion. Secondly by investing in gold funds traded on global exchanges (ETFs), especially those traded in Wall Street markets. Thirdly by buying shares of gold mining and minting companies, especially those traded in the U.S. markets on Wall Street. Fourthly by trading gold futures contracts, options contracts, and contract for differences...

Will Gold Prices Reach $3,000 per Ounce?

In light of recent developments in global markets and economic and geopolitical risks, it is not entirely out of the question that gold prices may rise over the coming years to levels of $3,000 per ounce. In order to reach this historical level, we need factors that have a strong impact on industrial and investment demand for gold bullion in the long term.

Is it Expected That Gold Prices Will Rise in 2024?

Yes, it is expected that gold prices will continue to rise this year, as most forecasts from major institutions and banks are stable around entering the metal into a bull market with approaching the barrier of $2,500 per ounce.

Ethereum price (ETHUSD) tests the support base – Forecast today - 25-04-2024

Ethereum (ETHUSD) Price Analysis

- Ethereum price (ETHUSD) faces negative pressure to test the key support 3132.80$ and attempts to break it, to hint potential return to the correctional bearish track, but we notice that the technical indicators attempt to protect the price from suffering more losses, to face contradiction between the technical indicators that makes us prefer to stay aside until the price confirms its situation according to the mentioned level and detect its next destination clearly.

Expected Scenarios

- Note that consolidating above the mentioned support will lead the price to resume the bullish wave that its next target located at 3360.31$, while breaking it will push the price to achieve addition bearish correction that its next target reaches 2905.30$.

Trading Range

- The expected trading range for today is between 3030.00$ support and 3250.00$ resistance.

Trend forecast: Neutral

Bitcoin price (BTCUSD) breaks the support – Forecast today - 25-04-2024

Bitcoin (BTCUSD) Price Analysis

- Bitcoin price (BTCUSD) faced clear negative pressure yesterday to break 65391.74$ level and settle below it, as it was affected by the rising wedge pattern that appears on the chart, to fall under the correctional bearish pressure again, on its way to achieve negative targets that start by visiting 60252.85$ areas.

Expected Scenarios

- The bearish bias will be suggested for today, noting that breaching 65391.75$ will stop the expected negative pressure and push the price to start new recovery attempts.

Trading Range

- The expected trading range for today is between 61500.00$ support and 65600.00$ resistance.

Trend forecast: Bearish

Wheat price achieves more gains – Forecast today - 25-04-2024

Wheat Price Analysis

- Wheat price rallied upwards yesterday to succeed achieving our new waited target at 614.10$, and we suggest breaching this level to achieve more gains in the upcoming period, affected by the previously completed inverted head and shoulders’ pattern, noting that our next target reaches 635.00$.

Expected Scenarios

- Therefore, the bullish trend scenario will remain valid and active on the intraday and short-term basis conditioned by the price stability above 597.10$.

Trading Range

- The expected trading range for today is between 600.00$ support and 620.00$ resistance.

Trend forecast: Bullish