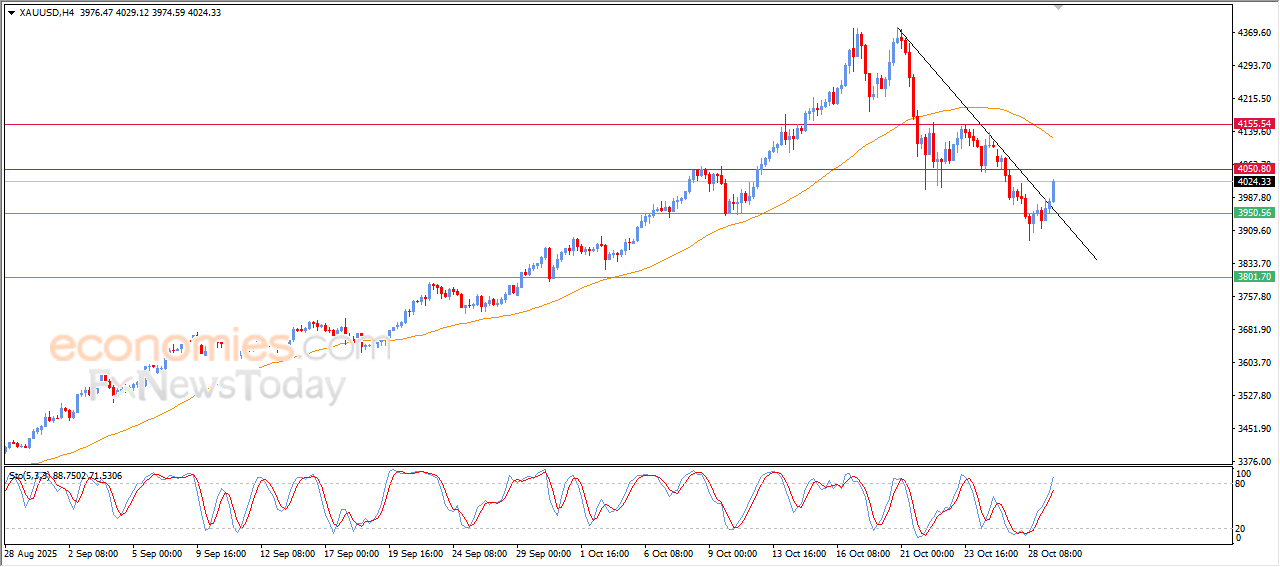

Forecast update for gold -29-10-2025.

he price of (gold) surged high in its last intraday trading, supported by the emergence if the positive signals on the relative strength indicators, to corrective bearish trend line on the short-term basis, preparing to attack the key resistance level at $4,050, on the other hand, the negative pressure that comes from its trading below EMA50 continues, reducing the chances of the price sustainable recovery on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (13-17 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 13-17, October 2025:

View Full Performance Report Telegram (https://t.me/besttradingsignalstocksbot?start=p88d632b0-66dd-11f0-a948-13815052d5ae)

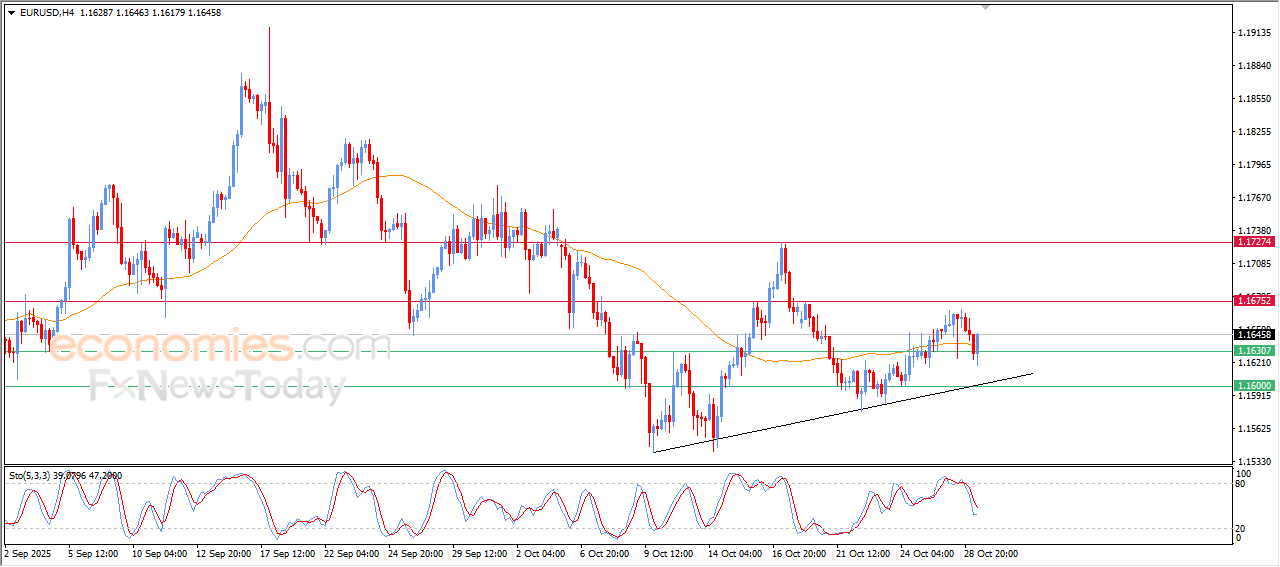

Forecast update for EURUSD -29-10-2025.

The price of (EURUSD) rose in its last intraday trading, due to the stability of the current support at 1.1630, gaining bullish momentum that helped it tp achieve these gains, especially with its lean on the support of its EMA50, this decline came after the price success in offloading its overbought conditions on the relative strength indicators, with the emergence of positive crossover, reinforcing the chances for the price recovery on the near-term basis, amid the dominance of the bullish corrective trend on the short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (13-17 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 13-17, October 2025:

View Full Performance Report Telegram (https://t.me/besttradingsignalstocksbot?start=p88d632b0-66dd-11f0-a948-13815052d5ae)

The GBPCHF resumes the decline– Forecast today – 29-10-2025

GBPCHF confirmed its surrender to the suggested bearish bias by forming strong negative attack, taking advantage of forming an extra solid barrier at 1.0605 level, to notice its decline below the support of the minor bearish channel’s support at 1.0535.

Stochastic attempts to reach the oversold level, which will increase the negative pressure on today’s trading, to keep preferring the negative attempts that target 1.0495 level reaching 161.8%Fibonacci extension level near 1.0460 level.

The expected trading range for today is between 1.0495 and 1.0565

Trend forecast: Bearish

Natural gas price tests the extra support– Forecast today – 29-10-2025

Natural gas prices faced extra negative pressure in yesterday’s trading by stochastic reach to 20 level, which forces it to form new bearish correction, to test $3.830 support and to settle above it.

The stability of today’s trading above the current support is important to reinforce the chances of gathering the positive momentum, then attempts to target some bullish stations by its rally towards $4.050 reaching the next target near $4.210, while breaking the current support and holding below it will force the price to suffer extra losses by reaching $3.690 and $3.550 before any new attempt to activate the bullish track again.

The expected trading range for today is between $3.800 and $4.050

Trend forecast: Bullish