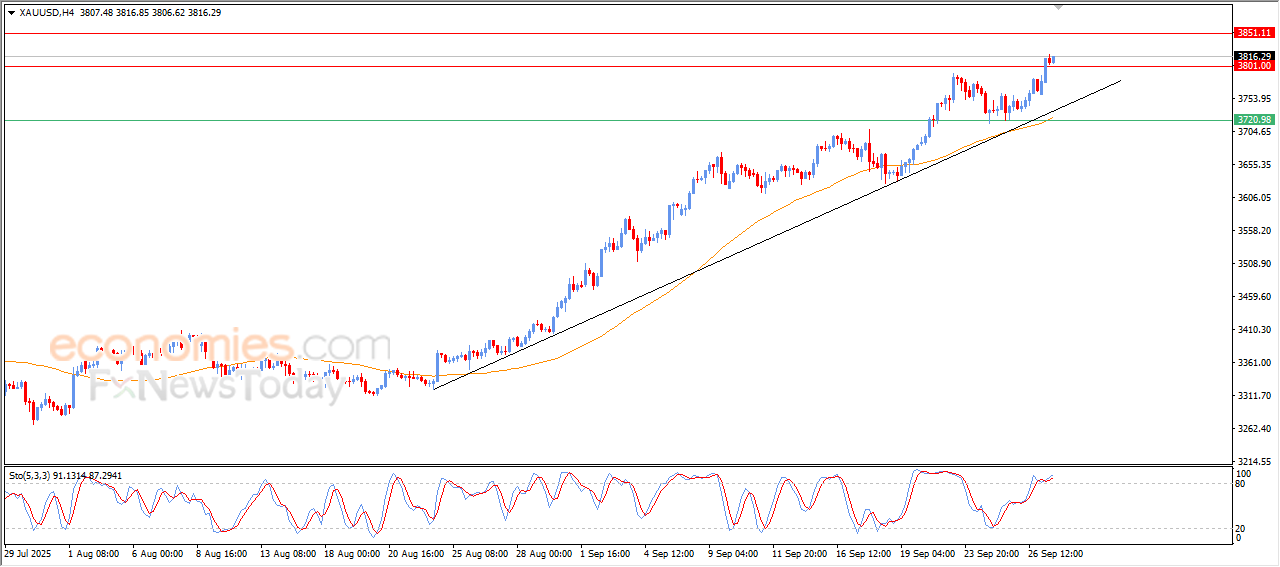

Forecast update for gold -29-09-2025.

AI Summary

- Gold price reached a historic high above $3,800, supported by trading trends and positive signals on relative strength indicators

- BestTradingSignal.com offers specialized trading signal packages for US stocks, cryptocurrencies, forex, and VIP signals for gold, oil, forex, bitcoin, ethereum, and indices

- Subscriptions for trading signals range from €44/month for US Stock Signals to €179/month for VIP Signals, with high-accuracy signals delivered directly to Telegram

The price of (gold) rose in its last intraday trading, to settle for the first time in history above $3,800, supported by its continuous trading above EMA50, and under the dominance of the main bullish trend on the short-term basis, and its trading alongside supportive trend line, besides the emerging of the positive signals on the relative strength indicators, despite reaching overbought levels.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

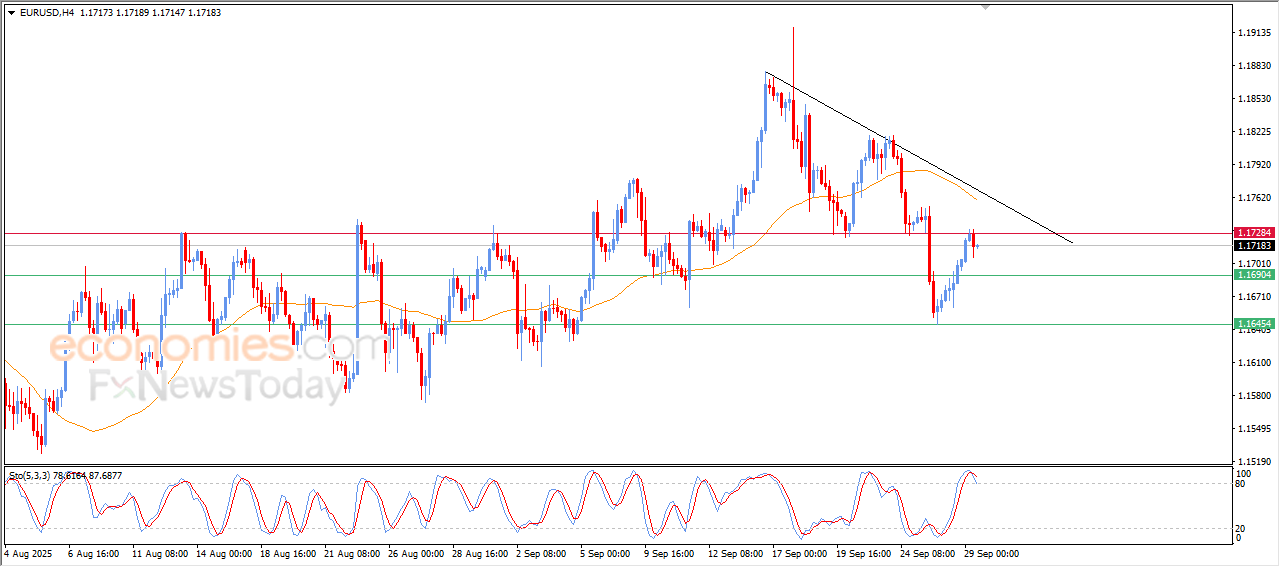

Forecast update for EURUSD -29-09-2025.

The price of (EURUSD) declined in its last intraday trading as we expected in our morning report with the beginning of forming negative divergence on the relative strength indicators, and the emergence of the negative signals, pushing negatively on the price with the stability of the key resistance at 1.1730, with the continuation of its move below its EMA50, and under the dominance of bearish correctional wave on the short-term basis, and the chances for the price recovery remain valid on the near-term basis if it breaches the current resistance.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

The CADCHF declines slowly– Forecast today – 29-9-2025

The CADCH suffered new bearish pressure, forcing it to break 100% Fibonacci extension level at 0.5780, crawling negatively to settle near 0.5715.

The negative factors that are represented by the main stability within the bearish channel’s levels that appear in the above image, and the continuation of providing negative momentum by the main indicators will increase the chances for suffering extra losses that might begin at 0.5655, while the price success by surpassing 0.5780 level will allow it to form bullish correction wave, to begin recovering some losses by targeting 0.5835 and 0.5910 level.

The expected trading range for today is between 0.5750 and 0.5655

Trend forecast: Bearish

Natural gas price settles below the resistance– Forecast today – 29-9-2025

Natural gas price kept its negative stability below the critical resistance at $3.275, fluctuating below the moving average 55, to increase the chances of gathering the extra negative momentum.

Stochastic exit from the overbought level will increase the negative pressures, providing chance for attacking $3.060 level and breaking it will confirm regaining the bearish bias, opening the way for targeting several negative stations by reaching $2.820.

The expected trading range for today is between $3.050 and $3.220

Trend forecast: Bearish