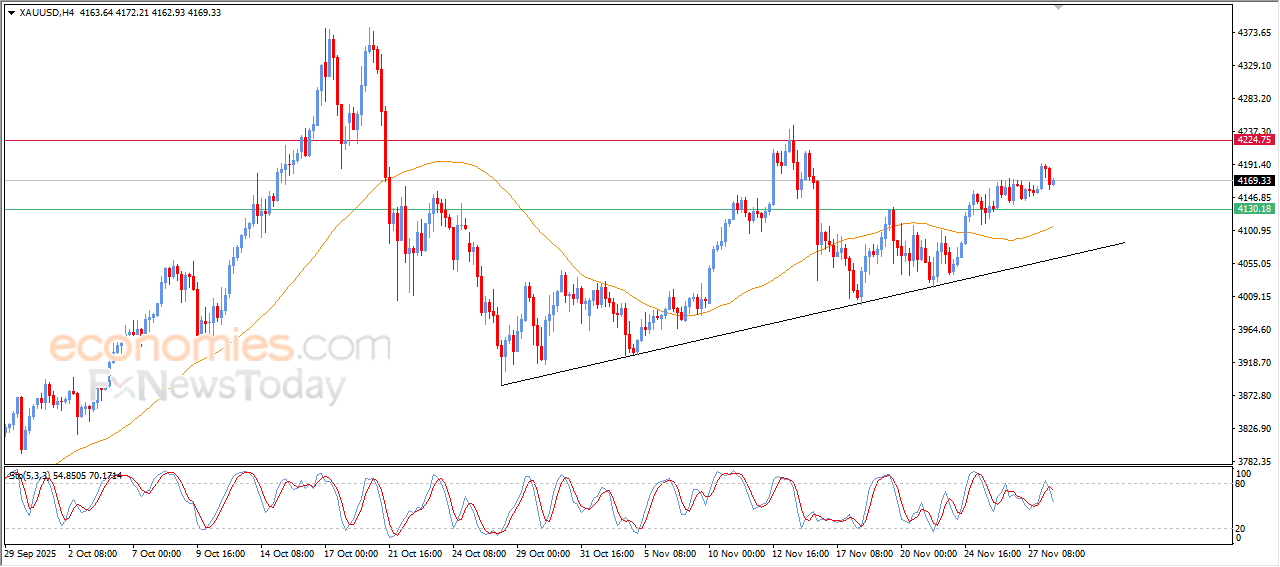

Forecast update for Gold -28-11-2025.

The price of (Gold) settles lower in its last intraday trading, after losing its early gains for today, to complete its intraday fluctuations, amid the emergence of the negative signals on the relative strength indicators, after reaching overbought levels, to continue its attempt to gain bullish momentum that may help it to recover and rise again, amid the continuation of the dynamic pressure that is represented by its trading above EMA50, reinforcing the stability and dominance of the bullish trend on the short-term basis.

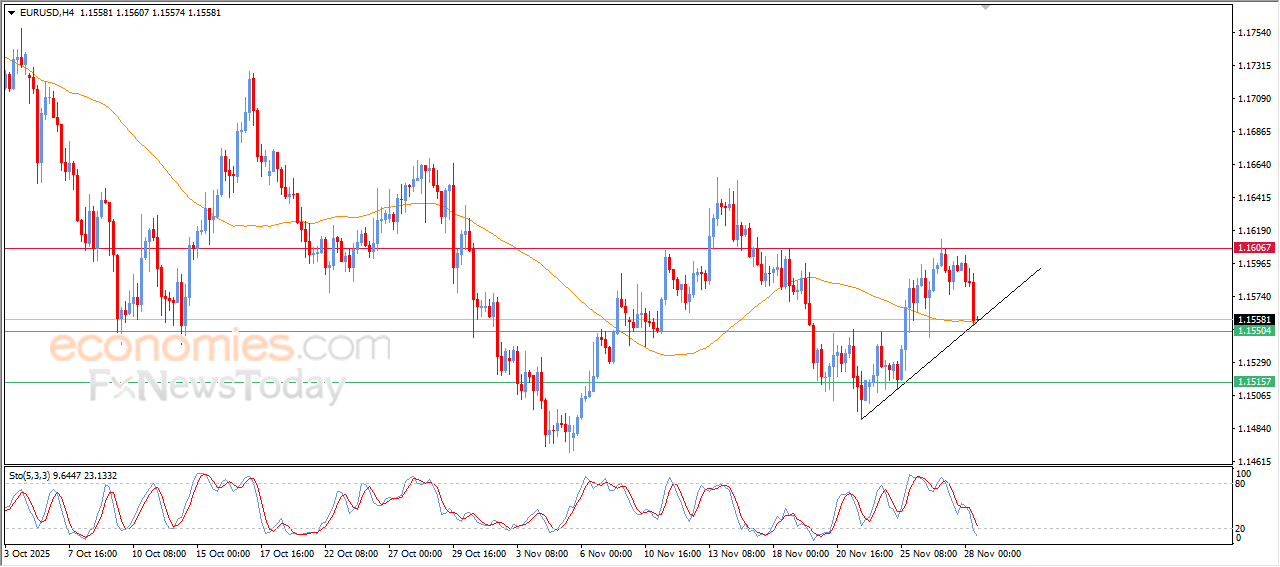

Forecast update for EURUSD -28-11-2025.

The price of (EURUSD) slipped lower in its last intraday trading, amid the emergence of the negative signals on the relative strength indicators, reaching oversold levels, exaggeratedly compared to the price move, indicating a quick decline for the bearish momentum, to lean on the support of EMA50, accompanied by its leaning in minor bullish corrective trend line on the short-term basis.

The EURNZD attempts to exit the bullish track– Forecast today – 28-11-2025

The EURNZD is under strong negative pressures in the last sessions, affected by reaching below the extra support at 2.0400, activating with stochastic negativity by attacking the support of the bullish channel at 2.0245.

The continuation of facing negative pressure will force it to break the support of the bullish channel, forcing it to suffer extra losses by reaching 2.0175 then attempts to press on %261.8 Fibonacci extension level at 2.0060.

The expected trading range for today is between 2.0320 and 2.0175

Trend forecast: Bearish

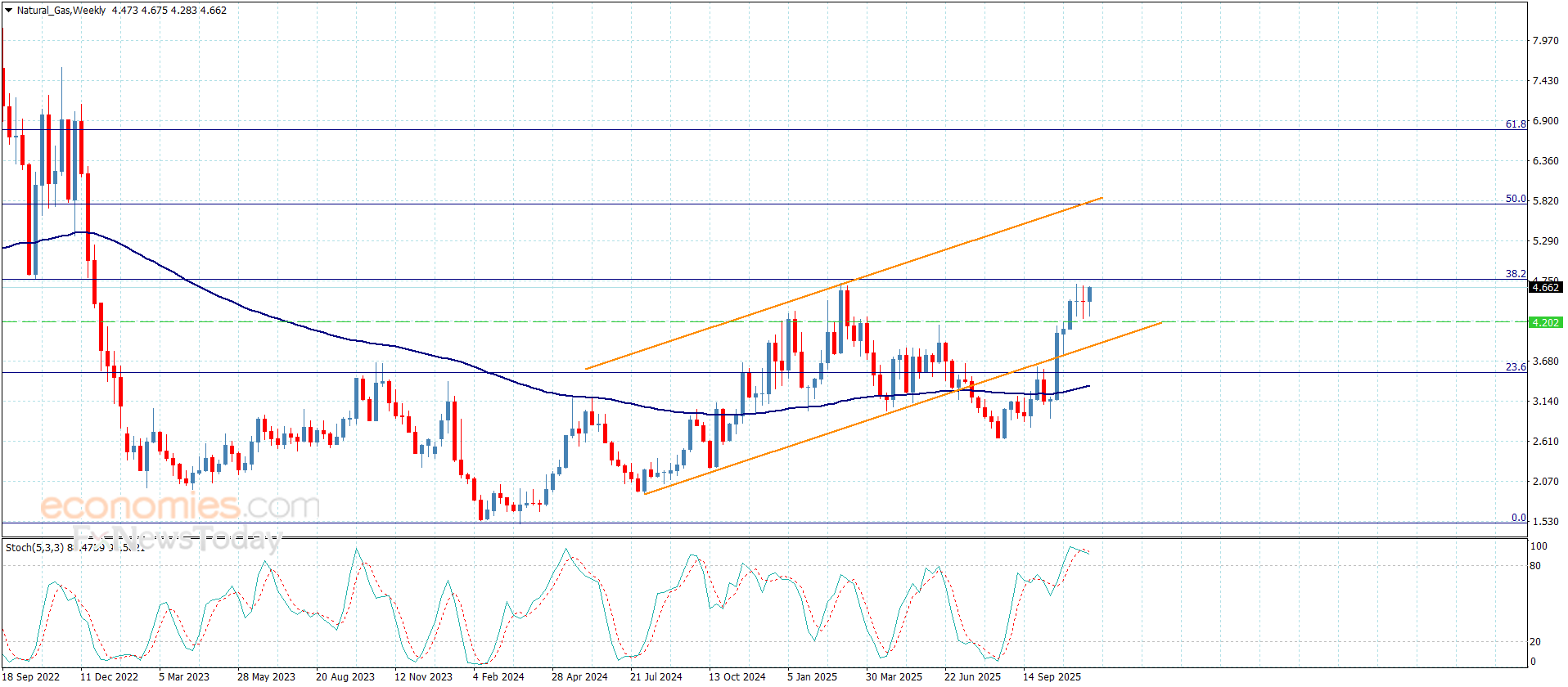

Natural gas price renews the positive action– Forecast today – 28-11-2025

Natural gas price renewed its positive action, taking advantage of its stability above the support at $4.200 level, activating with the main indicators and its stability near $4.660.

Breaching the barrier at $4.750 is important to open the way towards recording new gains by its rally towards $4.910 reaching $5.180, forming a new obstacle against the bullish attempts.

The expected trading range for today is between $4.450 and $4.910

Trend forecast: Bullish