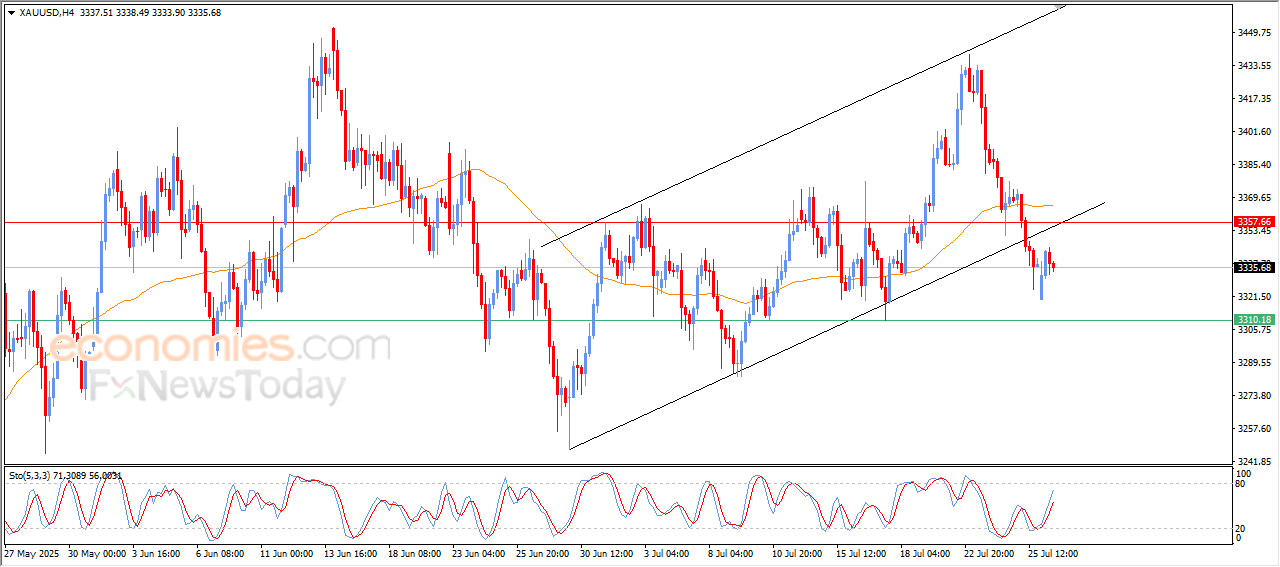

Forecast update for Gold -28-07-2025

AI Summary

- Gold price declined on last intraday trading, erasing early gains supported by positive signals on RSI

- Negative pressure from trading below EMA50 and surpassing bullish channel suggests end to positive momentum

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals with subscription options starting at €44/month

The price of (Gold) declined on its last intraday trading, to erase its early gains that have been achieved by the support of the positive signals on the (RSI), to offload the oversold conditions and reach exaggerated overbought levels, which suggest ending the positive momentum on the intraday basis, especially with the continuation of the negative pressure that comes from its trading below EMA50, affected by surpassing the bullish channel’s range that limited the previous trading on the short-term basis.

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Signals Performance – Week of July 21–25, 2025

Forecast update for EURUSD -28-07-2025

The price of (EURUSD) declined in its recent intraday levels, to break minor bullish trend line on a short-term basis, which puts the price under strong negative pressure that pushed it to surpass the support of its EMA50.

This break reinforces the chances for the continuation of the bearish move in its upcoming move, especially with the emergence of the negative signals on the (RSI) that confirms the weakness of the positive momentum.

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Signals Performance – Week of July 21–25, 2025

The GBPCAD leans above the moving average 55– Forecast today – 28-7-2025

The GBPCAD ended the last bearish correctional by its stability near 1.8390, facing the moving average 55, reinforcing the stability of the extra support near 1.8355, increasing the chances for renewing the positive action in the near and medium period trading.

Therefore, we will begin by preferring the bullish trading that might target 1.8470 level, reaching the next target at 1.8580, while the price declined below the support mentioned and holding below it, will confirm its surrender to the bearish correctional scenario, which forces it to suffer more of the losses by reaching 1.8310 and 1.8270.

The expected trading range for today is between 1.8360 and 1.8470

Trend forecast: Bullish

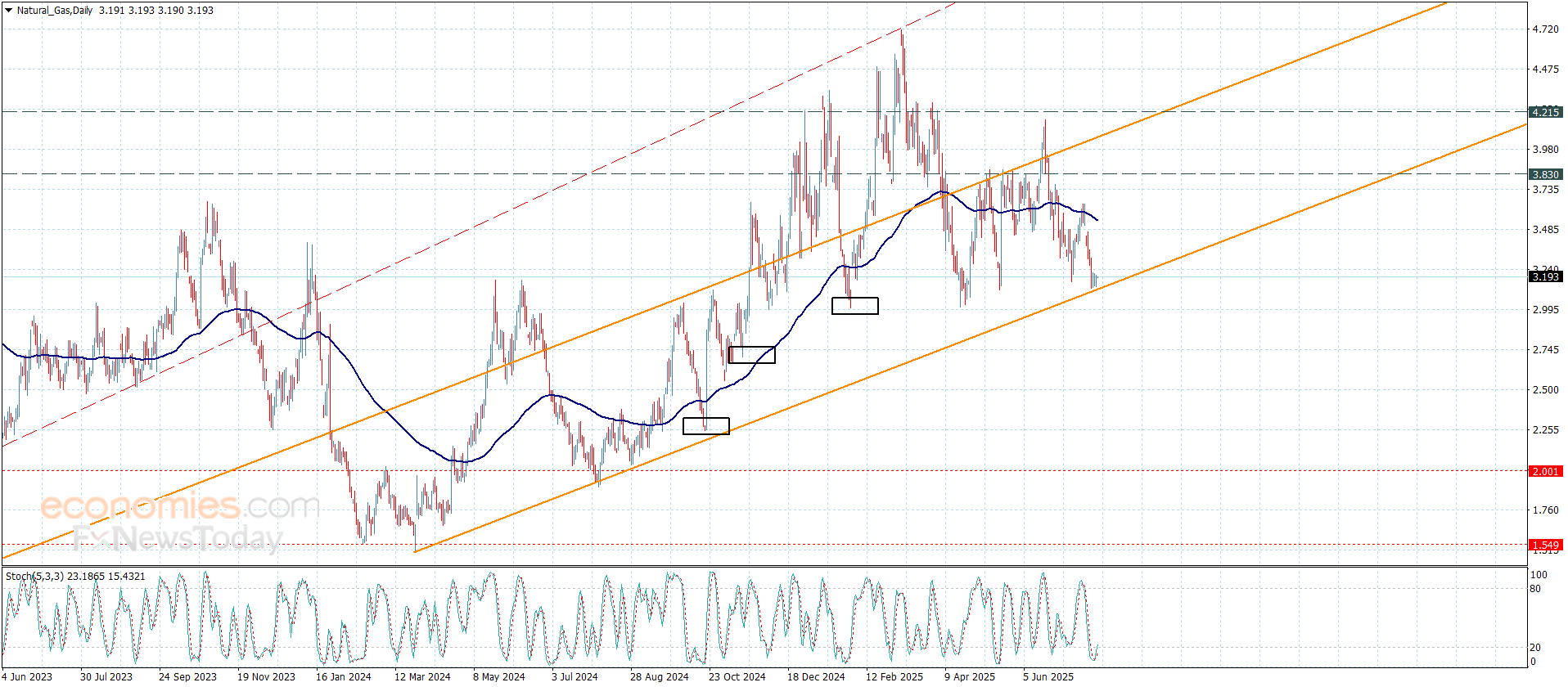

Natural gas price reaches the support of the bullish channel’s support– Forecast today – 28-7-2025

Natural gas price continued forming bearish correctional trading in the last trading, approaching from the support of the bullish channel’s support at $3.110, forming a key for detecting the main trend in the upcoming trading.

The price success to settle above the current support will provide a chance for begin forming strong bullish trading, to target $3.350 level reaching the moving average 55 near $3.560, while facing new bearish pressures and reaching below the current support will confirm its move to a new bearish station, which forces it to suffer several losses by reaching $2.860 and $2.730.

The expected trading range for today is between $3.110 and $3.350

Trend forecast: Bullish