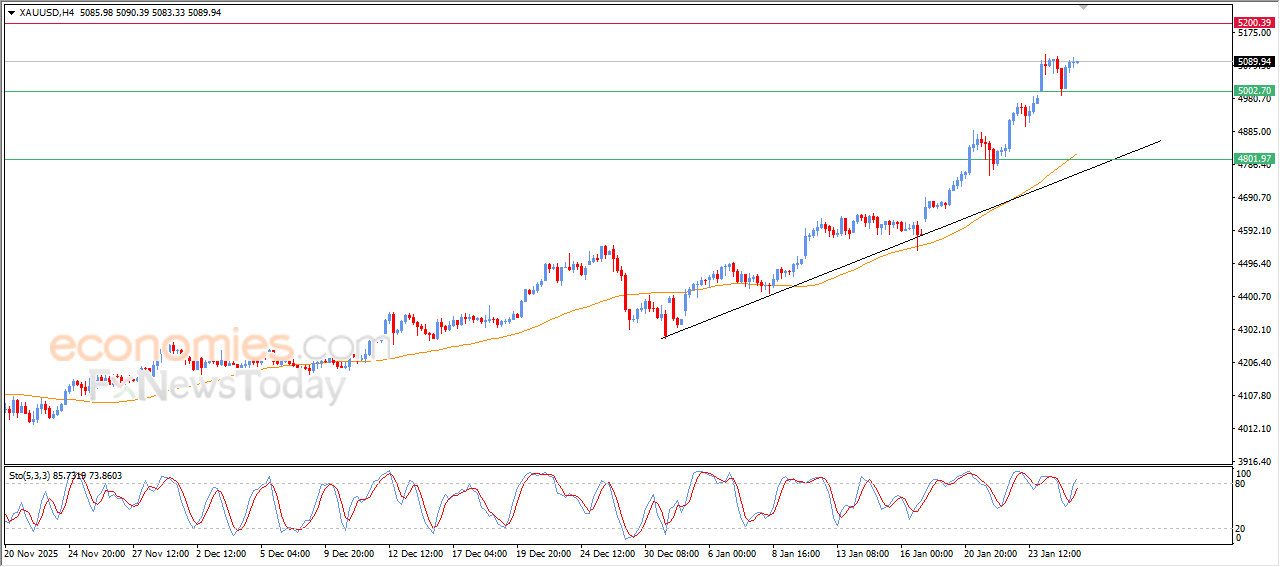

Forecast update for gold -27-01-2026.

The price of gold kept its early gains in its last intraday trading, amid the positive signals from relative strength indicators, after offloading its overbought conditions, supported by its continuous trading above EMA50, reinforcing the stability and dominance of the main bullish trend on short-term basis, with its trading alongside supported minor trend line for this bullish track, recording new record highs.

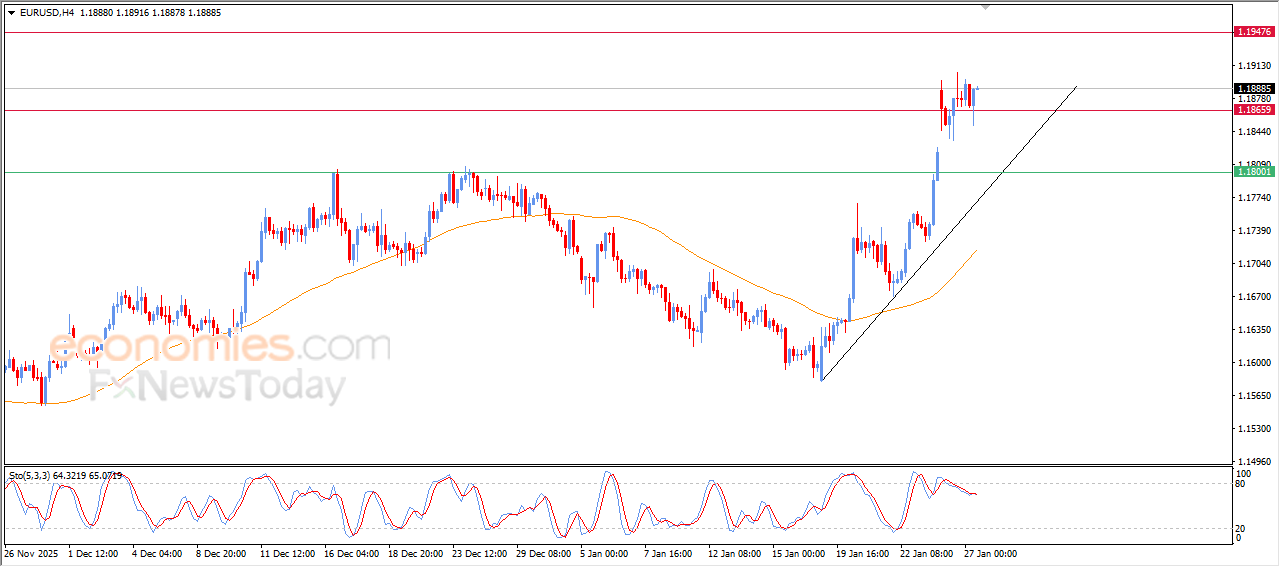

Forecast update for EURUSD -27-01-2026.

The price of EURUSD rose in its last intraday trading, to settle above 1.1865 resistance, taking advantage of the positive support due to its trading above EMA50, under the dominance of the main bullish trend on short-term basis, with its trading alongside minor trendline, after offloading its overbought conditions on relative strength indicators, especially with the emergence of positive overlapping signals from there.

The GBPCAD renews the bullish action– Forecast today – 27-1-2026

The GBPCAD succeeded in renewing the bullish rally by surpassing 1.8680 barrier, to settle above it, forming several bullish waves and recording clear gains by reaching 1.8790.

Depending on forming a new support level by the previously breached barrier against the bullish trading, besides providing bullish momentum by the main indicators, which will increase the chances of resuming the bullish trend, to expect reaching 1.8835 following the next main target at 1.8885.

The expected trading range for today is between 1.8730 and 1.8835

Trend forecast: Bullish

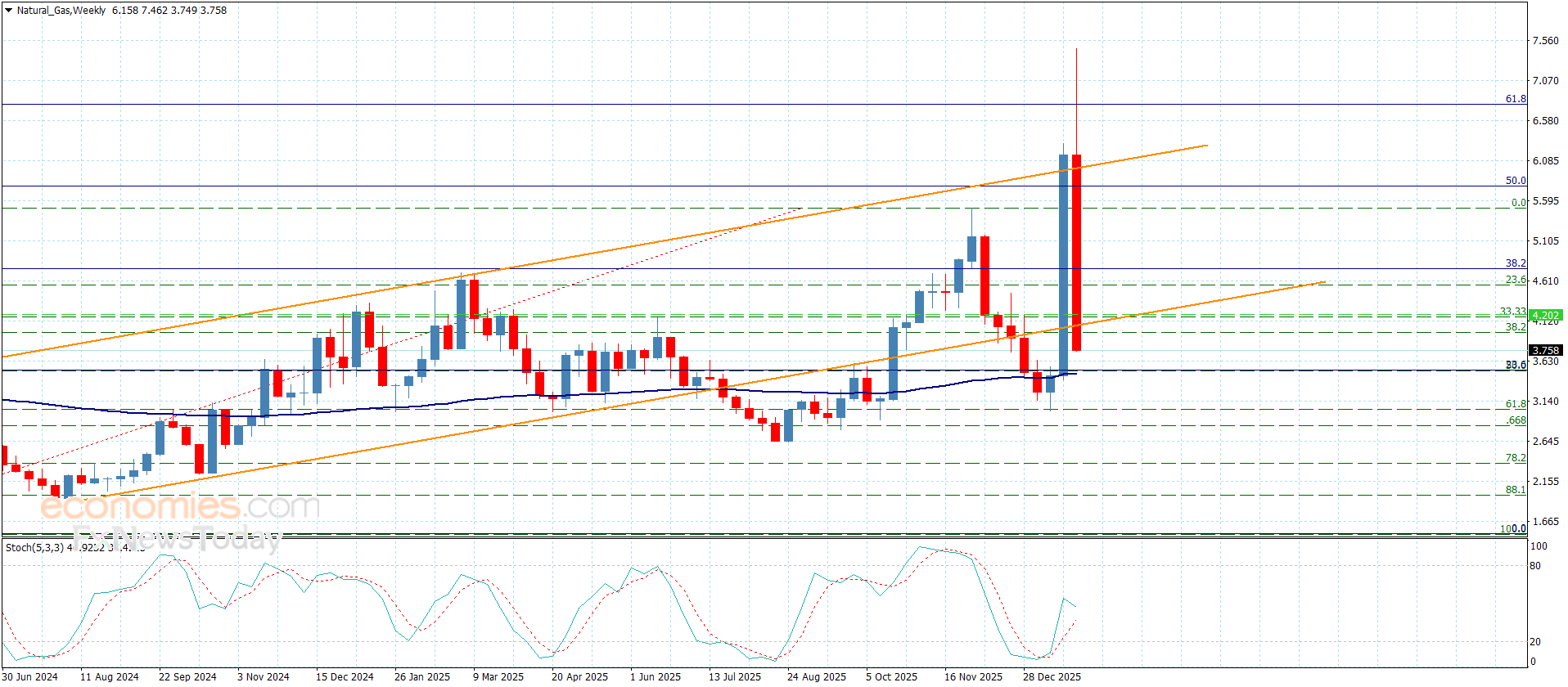

Natural gas price loses its gains– Forecast today – 27-1-2026

Natural gas price reached $6.150 level yesterday, facing strong negative pressures, which forces it to lose its gains by surpassing the bullish channel’s levels and its stability below $4.100 support.

All that confirms that the price enters a state of instability, to suggest the neutrality until confirm the main trend in the upcoming trading, note that the price attempt to decline below $3.450 level might force it to suffer new losses by targeting 61.8%Fibonacci corrective level at $3.030, while regaining the bullish bias requires providing a new daily close above $4.220 level.

The expected trading range for today is between $3.450 and $4.250

Trend forecast: Neutral