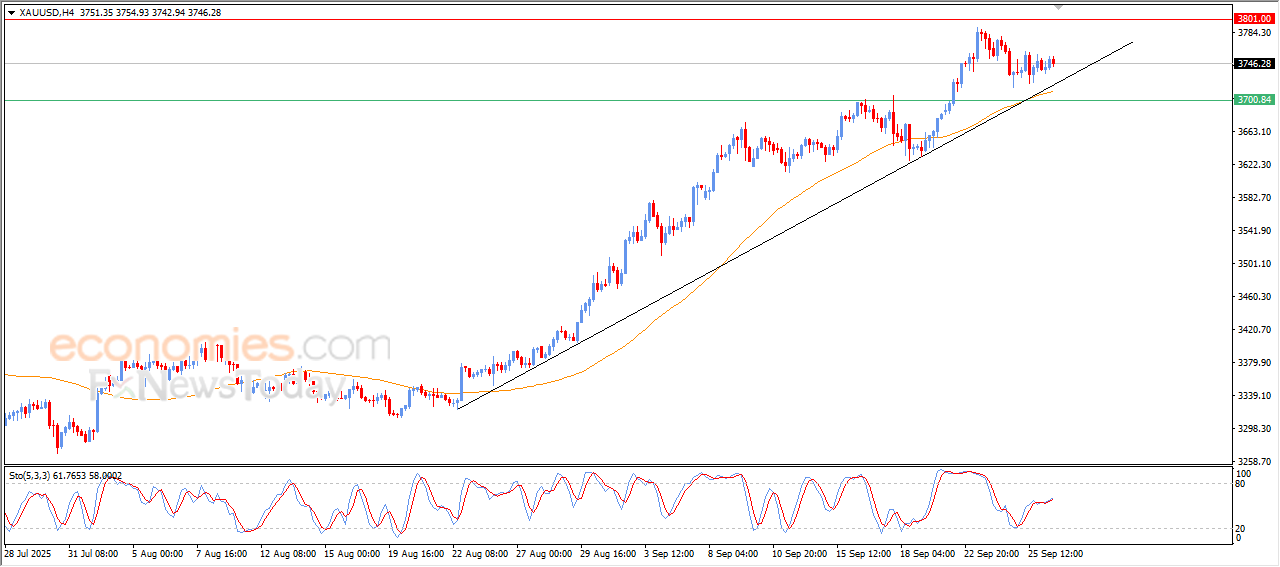

Forecast update for gold -26-09-2025.

AI Summary

- Gold price showing bullish momentum with support from EMA50 and positive signals on relative strength indicators

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for gold, oil, forex, bitcoin, ethereum, and indices

- Subscription packages available starting from €44/month delivered directly to Telegram for top market signals

The price of (gold) continues its attempts to gain bullish momentum in its last intraday trading, taking advantage of the dynamic support that is represented by its trading above EMA50, reinforcing the dominance of the main bullish trend on the short-term basis, amid its trading alongside trend line, besides the emergence of the positive signals on the relative strength indicators.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

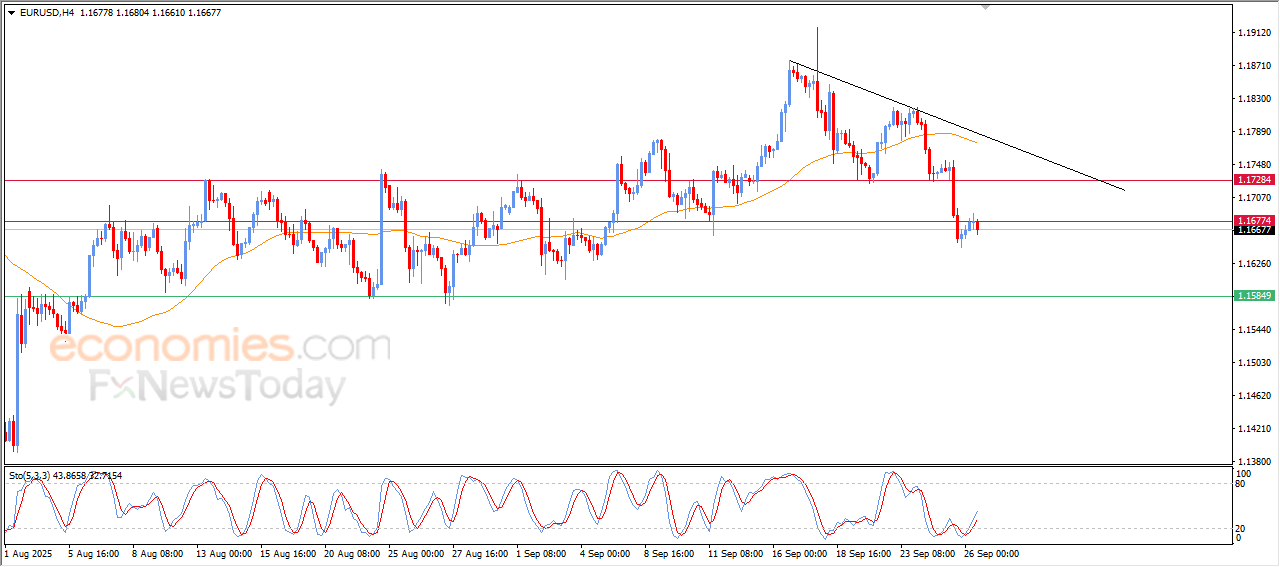

Forecast update for EURUSD -26-09-2025.

The price of (EURUSD) declined in its last intraday trading, due to the stability of the resistance at 1.1680, surrendering to the negative pressure, after the price success in offloading its oversold conditions on the relative strength indicators, opening the way for recording new losses, amid the dominance of the bearish correction trend on the short-term basis, and its trading alongside supportive trendline for this track.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

The NZDCAD moves to a new negative track– Forecast today – 26-9-2025

The NZDCAD achieved a clear break to 0.8080 support in yesterday’s trading, forming strong bearish decline by targeting 0.8015 level, to confirm its move to a new negative station.

Stochastic stability within the oversold level to settle negatively, providing extra negative momentum to resume the bearish attempts, to expect reaching 0.7980 followed by the next support near 0.7930.

The expected trading range for today is between 0.7980 and 0.8070

Trend forecast: Bearish

Natural gas price press on the resistance– Forecast today – 26-9-2025

Natural gas prices rallied to the resistance at $3.260 in its last trading, affected by stochastic reach to the overbought level, threatening the dominance of the suggested negative bearish track.

We recommend the trading for today and waiting for the next close, to confirm the expected trend in the upcoming trading, the price success in breaching the resistance and holding above it will turn the bullish track, to begin recording several gains that might begin at $3.480, while confirming the bearish scenario requires the decline below $3.050 and providing new negative close to confirm its readiness to target several negative levels that begin at $2.820.

The expected trading range for today is between $3.050 and $3.260

Trend forecast: Neutral