Forecast update for Gold -26-08-2025

AI Summary

- Gold price declined due to resistance at $3,375 and negative signals on RSI

- BestTradingSignal.com offers professional trading signals for US stocks, crypto, forex, and more

- VIP signals package includes Gold, Oil, Forex, Bitcoin, Ethereum, and Indices for €179/month

The price of (Gold) declined in its last intraday trading, due to the stability of the stubborn resistance level at$3,375, which prevented the price recovery previously, especially with the emergence of the of the negative signals on the (RSI), after reaching overbought levels, in attempt o offload this condition, amid the continuation of the positive pressure that comes from its trading above EMA50, which represents a dynamic support that assist the stability of the bullish trend.

VIP Trading Signals Performance by BestTradingSignal.com (August 18–22, 2025)

BestTradingSignal.com – Professional Trading Signals with high accuracy. Subscribe now to tailored packages for the world’s leading markets and receive signals instantly via Telegram from an expert team:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramCheck full VIP signals performance report for the week of August 18–22, 2025: Full Report

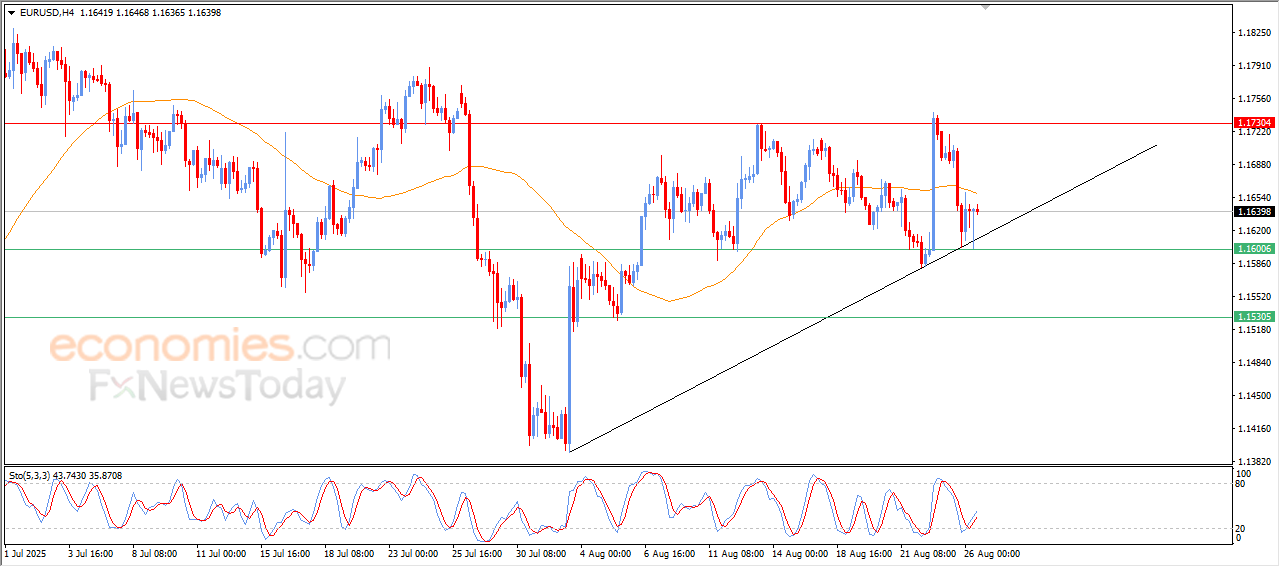

Forecast update for EURUSD -26-08-2025

The price of (EURUSD) settled high in its last intraday trading, duet o the stability of the critical support at 1.1600, gaining some bullish momentum that helped it to recover some of yesterday’s losses, besides the emergence of the positive signals on the (RSI), after reaching oversold levels, amid the dominance of the bullish correctional trend on the short-term basis and its trading alongside a supportive bias for this trend until now, on the other hand, the negative pressure that comes from its trading below EMA50 remains valid, which stopped the pair’s last gains.

VIP Trading Signals Performance by BestTradingSignal.com (August 18–22, 2025)

BestTradingSignal.com – Professional Trading Signals with high accuracy. Subscribe now to tailored packages for the world’s leading markets and receive signals instantly via Telegram from an expert team:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramCheck full VIP signals performance report for the week of August 18–22, 2025: Full Report

The GBPCHF attempts to settle above the support– Forecast today – 26-8-2025

The GBPCHF is under strong negative pressures, forcing it to form weak sideways trading by its fluctuation near 1.0840, affected by the negativity of the moving average 55, but its stability above the extra support at 1.08050 helps to confirm the continuation of the positivity, to expect gathering the positive momentum towards 1.0875, and surpassing this barrier will extend the trading towards the main targets at 1.0905 and 1.0945.

The expected trading range for today is between 1.0815 and 1.0905

Trend forecast: Bullish

Natural gas price looks for extra momentum– Forecast today – 26-8-2025

Natural gas price lost its negative momentum by stochastic exit from the oversold level, to notice the attempt to recover some losses by its rally from $2.645 level and its stability near $2.820.

The current positive rebound will not affect the main bearish track due to the negative stability below the resistance of $3.140, therefore, we will keep waiting for gathering the negative momentum to renew the pressure on the obstacle of $2.640, surpassing it will make the price reach the next main target at $2.390.

The expected trading range for today is between $2.620 and $2.900

Trend forecast: Bearish