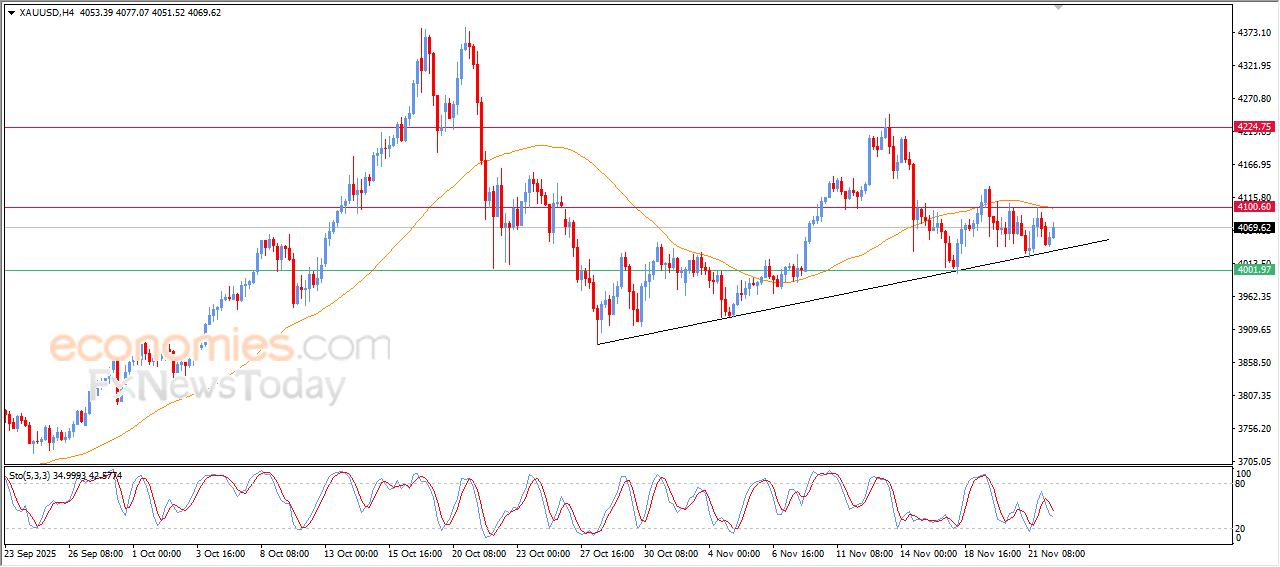

Forecast update for Gold -24-11-2025.

The price of (Gold) rose in its last intraday trading, taking advantage of the dynamic support that is represented by its trading alongside minor bullish trend line on the short-term basis, despite this rise, the price remains under negative pressure due to its trading below EMA50, accompanied by the emergence of the negative signals on the relative strength indicators.

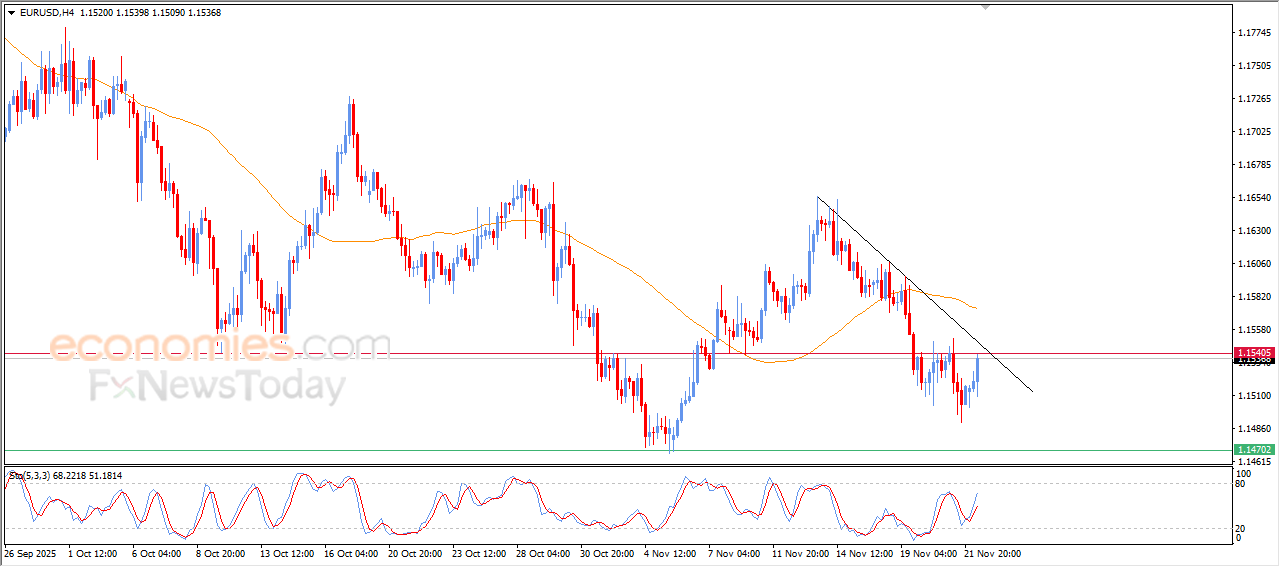

Forecast update for EURUSD -24-11-2025.

The price of (EURUSD) rose in its last intraday trading, supported by the positive signals on the relative strength indicators, to retest the key resistance at 1.1540, amid the continuation of the negative pressure that comes from its trading below EMA50, which reduces the chances of its sustainable recovery on the near-term basis, especially with its trading alongside minor bearish trend line on the short-term basis.

The EURNZD remains bullish – Forecast today – 24-11-2025

The EURNZD price is forced to form mixed trading, despite its stability within the bullish channel’s levels, affected by the strength of the barrier of 2.0635, fluctuating near 2.0550 level, taking advantage of the continuation of the support stability at 2.0410, increasing the chances of gathering the required bullish momentum of resuming the bullish attack.

Stochastic fluctuation below 80 level confirms the effect of the temporary sideways bias dominance, to keep waiting for gathering bullish momentum to ease the mission of surpassing the barrier at 2.0635, to begin targeting the extra stations near 2.0700 and 2.0760.

The expected trading range for today is between 2.0475 and 2.0635

Trend forecast: Bullish

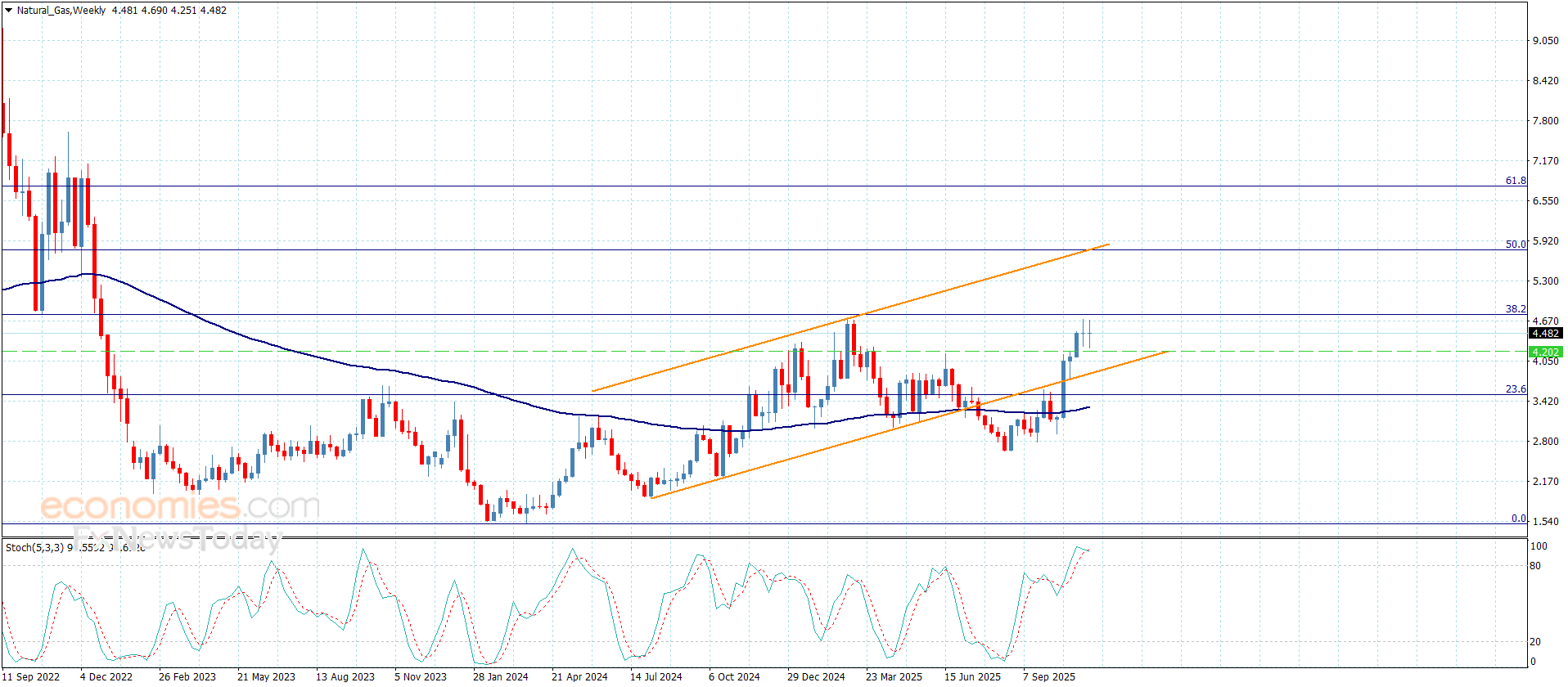

Natural gas price is without any new– Forecast today – 24-11-2025

No news for natural gas prices, due to their neediness to the bullish momentum, to fluctuate again between the support level at $4.200, while $4.750 level continues forming a strong barrier against the last bullish attempts.

Stochastic attempt to exit the oversold level confirms the price surrender to the sideways scenario, to keep waiting to breach the previously mentioned barrier, reinforcing the chances of recording new gains that might begin at $4.910 and $5.180.

The expected trading range for today is between $4.250 and $4.750

Trend forecast: fluctuating within the bullish track