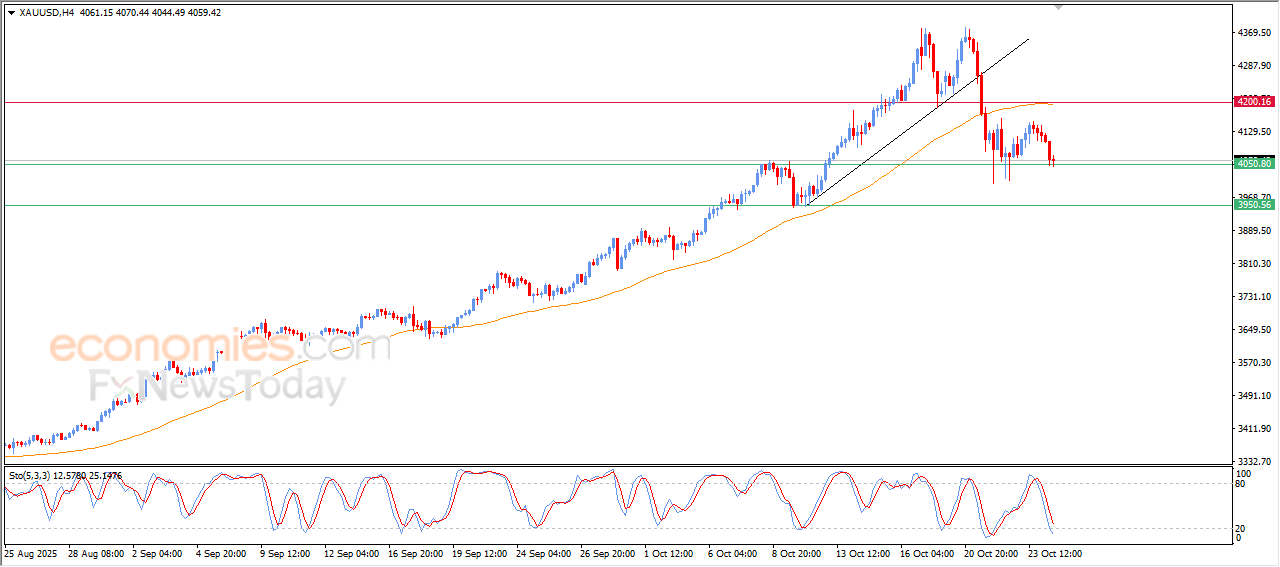

Forecast update for gold -24-10-2025.

The price of (gold) declined in its last intraday trading, amid the emergence of the relative strength indicators, leaning onto the key support level at $4,050, which was our suggested target in our previous analysis, amid the continuation of the negative pressure that comes from its trading below EMA50, and under bearish corrective wave on a short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (13-17 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 13-17, October 2025:

View Full Performance Report Telegram (https://t.me/besttradingsignalstocksbot?start=p88d632b0-66dd-11f0-a948-13815052d5ae)

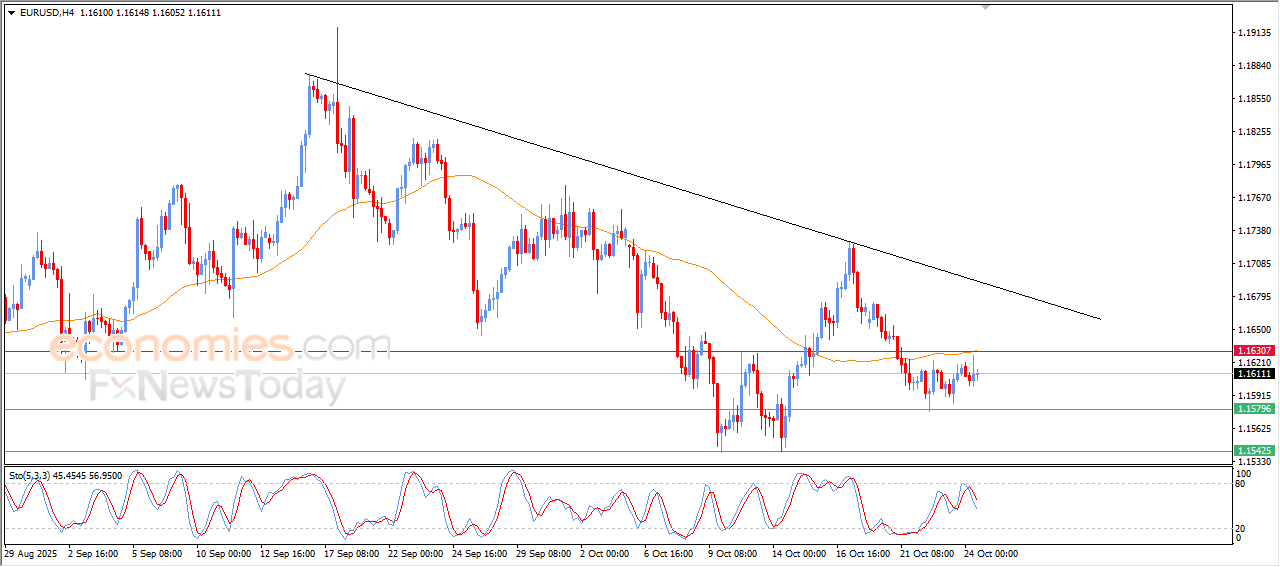

Forecast update for EURUSD -24-10-2025.

The price of (EURUSD) witnessed fluctuated trading on its last intraday levels, amid the continuation of the negative pressure that comes from its trading below EMA50, reinforced by the stability of the main bearish trend on the short-term basis, especially with its trading alongside trendline, besides the emergence of the negative signals on the relative strength indicators, after reaching overbought levels.

VIP Trading Signals Performance by BestTradingSignal.com (13-17 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 13-17, October 2025:

View Full Performance Report Telegram (https://t.me/besttradingsignalstocksbot?start=p88d632b0-66dd-11f0-a948-13815052d5ae)

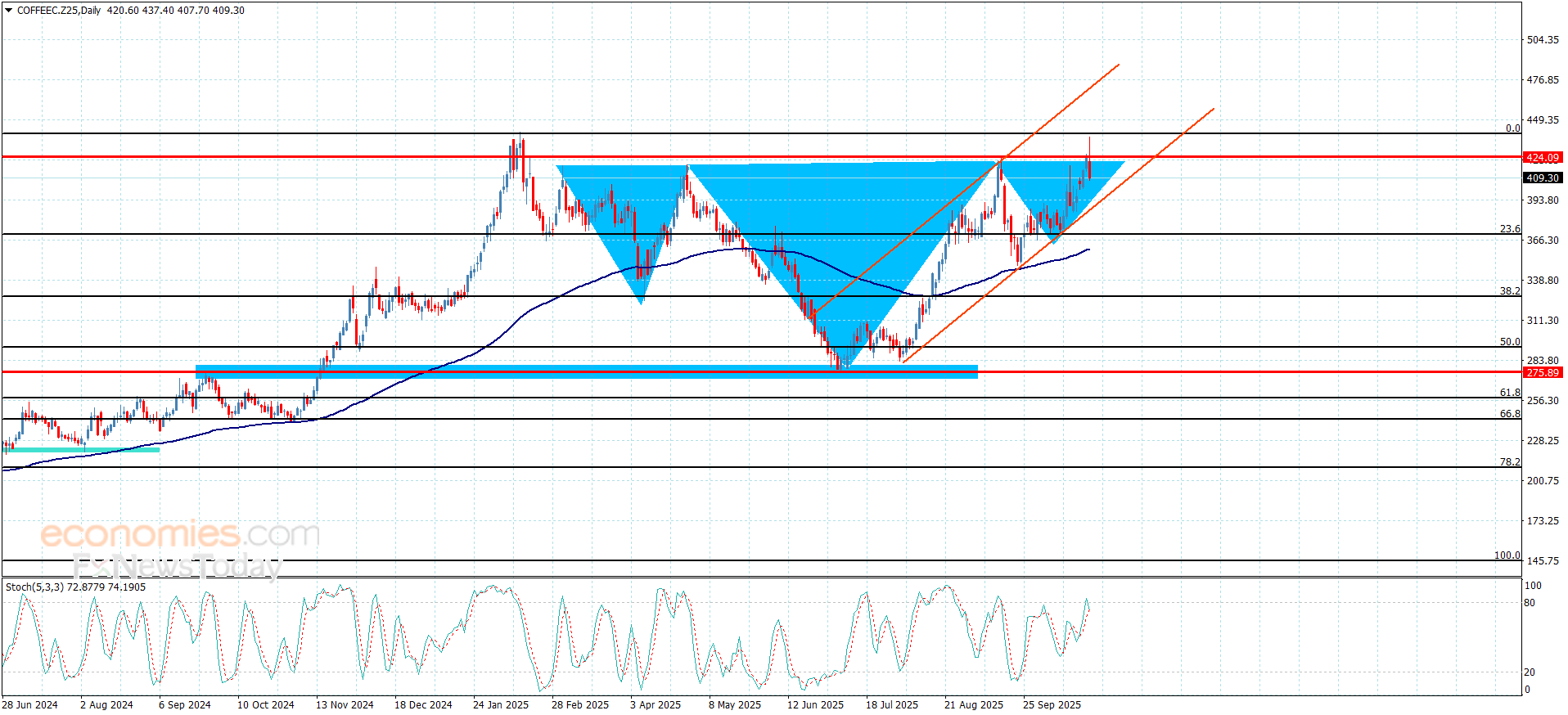

Coffee price attempts to form positive pattern – Forecast today – 24-10-2025

Coffee price formed the inverted head and shoulders pattern in its last trading, and 424.20 level forms the main neckline as appears in the above image, noticing the attempt to surpass the neckline at 437.40 in yesterday trading, to bounce quickly towards 410.00.

The price needs new positive momentum that allows it to settle above extra support towards 393.25, then wait for breaching 424.20 level, to confirm activating the bullish pattern, to target 457.50 and 486.00 level.

The expected trading range for today is between 400.50 and 457.50

Trend forecast: Bullish

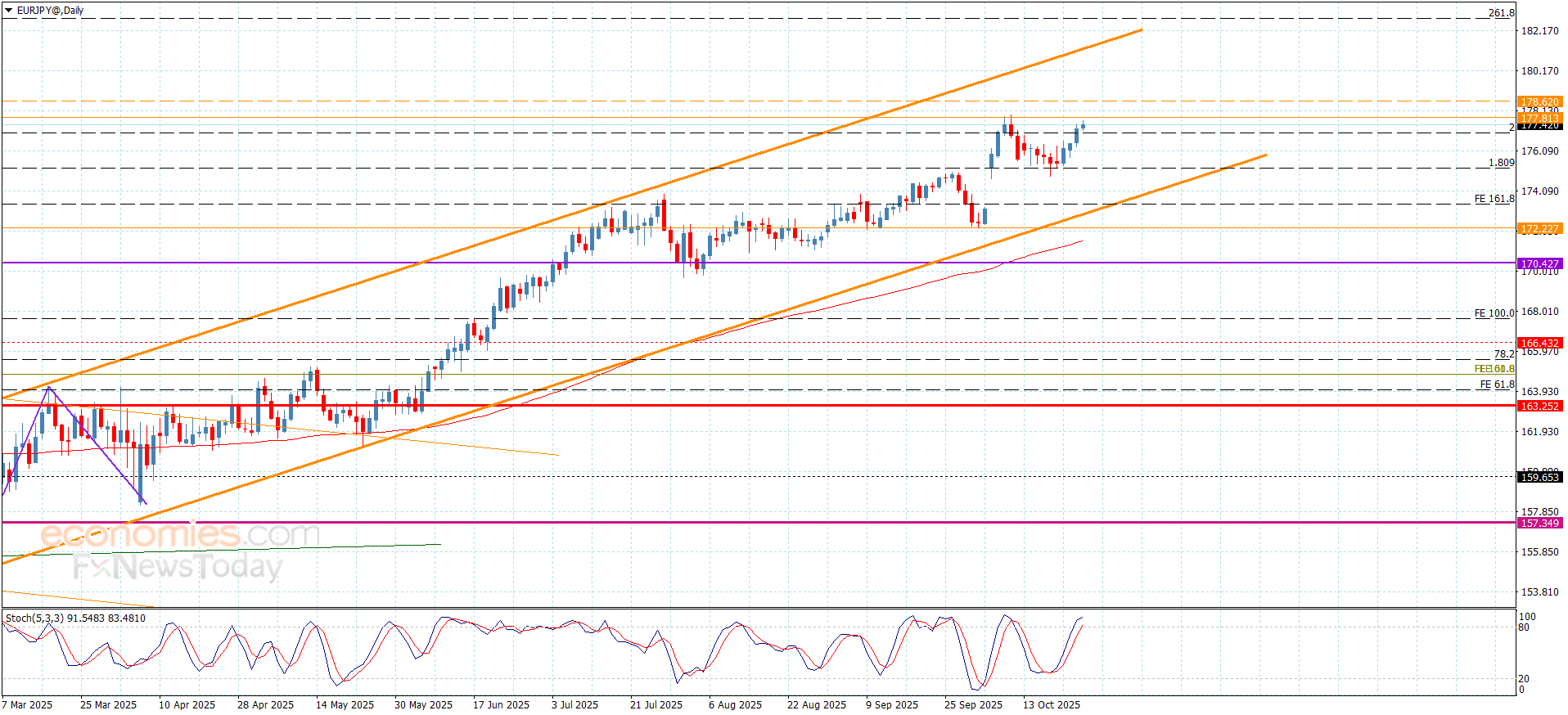

The EURJPY keeps rising– Forecast today – 24-10-2025

The EURJPY pair took advantage of the main indicators of unionism and provided positive momentum, surpassing 177.05 level to confirm its readiness to resume the bullish attack, by hitting 177.65 level.

In general, the stability within the bullish channel’s levels and the stability of the initial main support at 175.25 confirms the continuation of the bullish trading, to keep our bullish suggestion, which might target 178.60 level that forms the next main target for the current trading.

The expected trading range for today is between 176.90 and 178.60

Trend forecast: Bullish