Forecast update for Gold -21-08-2025

AI Summary

- Gold price declined in last intraday trading due to dynamic resistance and negative signals on RSI

- BestTradingSignal.com offers professional trading signals for US stocks, crypto, forex, and VIP signals for Gold, Oil, Forex, Bitcoin, Ethereum, and Indices

- Tailored packages available for subscription via Telegram with high accuracy signals from an expert team

The price of (Gold) declined in its last intraday trading, suffering with the dynamic resistance that is represented by its trading below EMA5O, amid the dominance of minor bearish wave on the short-term basis and its moves alongside a supportive bias line for the trend, besides the emergence of the negative signals on the (RSI), after reaching overbought levels, forming negative divergence that intensifies the negative pressure.

VIP Trading Signals Performance by BestTradingSignal.com (August 11–15, 2025)

BestTradingSignal.com – Professional Trading Signals with high accuracy. Subscribe now to tailored packages for the world’s leading markets and receive signals instantly via Telegram from an expert team:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramCheck full VIP signals performance report for the week of August 11–15, 2025: Full Report

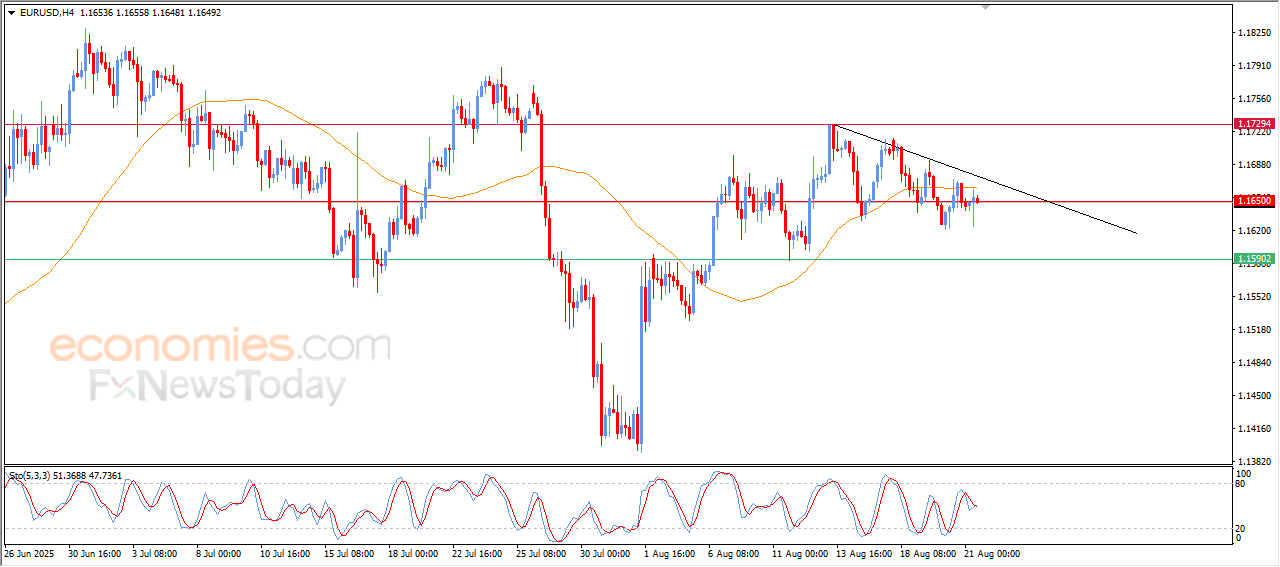

Forecast update for EURUSD -21-08-2025

The price of (EURUSD) witnessed fluctuated trading in its last intraday levels, amid its trading with a minor bearish bias line on a short-term basis, with the continuation of the negative pressure that comes from its trading below EMA50, which prevented its recovery in the last period, besides the emergence of the negative signals on the (RSI).

VIP Trading Signals Performance by BestTradingSignal.com (August 11–15, 2025)

BestTradingSignal.com – Professional Trading Signals with high accuracy. Subscribe now to tailored packages for the world’s leading markets and receive signals instantly via Telegram from an expert team:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramCheck full VIP signals performance report for the week of August 11–15, 2025: Full Report

The CADCHF renews the pressure on the support– Forecast today – 21-8-2025

The CADCHF ended the bullish correctional rebound by providing negative close below 0.6020 barrier, activating the negative attempts by reaching the support at 0.5785.

Note that the stability of the price within the bearish channel’s levels and providing negative momentum by the main indicators will increase the chances for breaking the current support, which allows it to resume the negative attack by reaching 0.5735 reaching the next main target at 0.5655.

The expected trading range for today is between 0.5735 and 0.5830

Trend forecast: Bearish

The EURJPY eases the way for correctional decline– Forecast today – 21-8-2025

The EURJPY pair reached 171.10 level, then formed some mixed trading, to keep its negative stability below 172.00 level, forming extra barrier against the bearish correctional attempts.

The continuation of providing negative momentum by stochastic confirms the price readiness to form more of the bearish correctional trading, to keep waiting for attacking 170.40 level, then attempts to break the barrier at 169.80 to resume the attempts of gathering the gains in the near and medium period.

The expected trading range for today is between 170.45 and 172.10

Trend forecast: Bearish