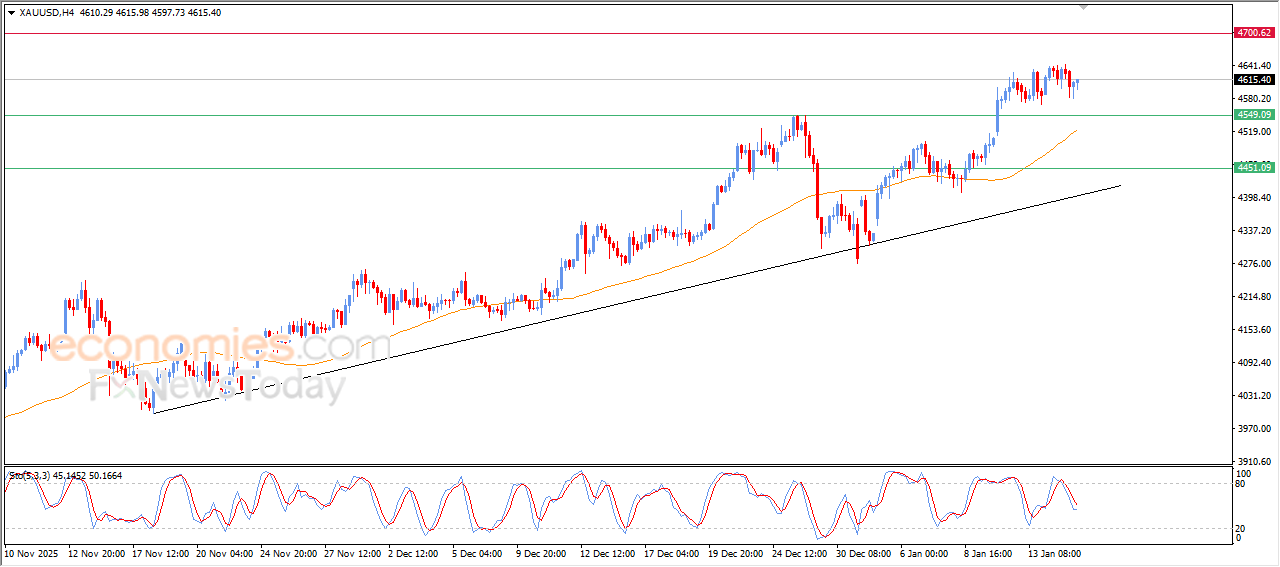

Forecast update for gold -15-01-2026.

The price of gold rose in its last intraday trading, after offloading its overbought conditions on the relative strength indicators, amid the continuation of the dynamic support that is represented by its trading above EMA50 and under the dominance of the main bullish trend on a short-term basis, with its trading alongside supportive trend line for this trend.

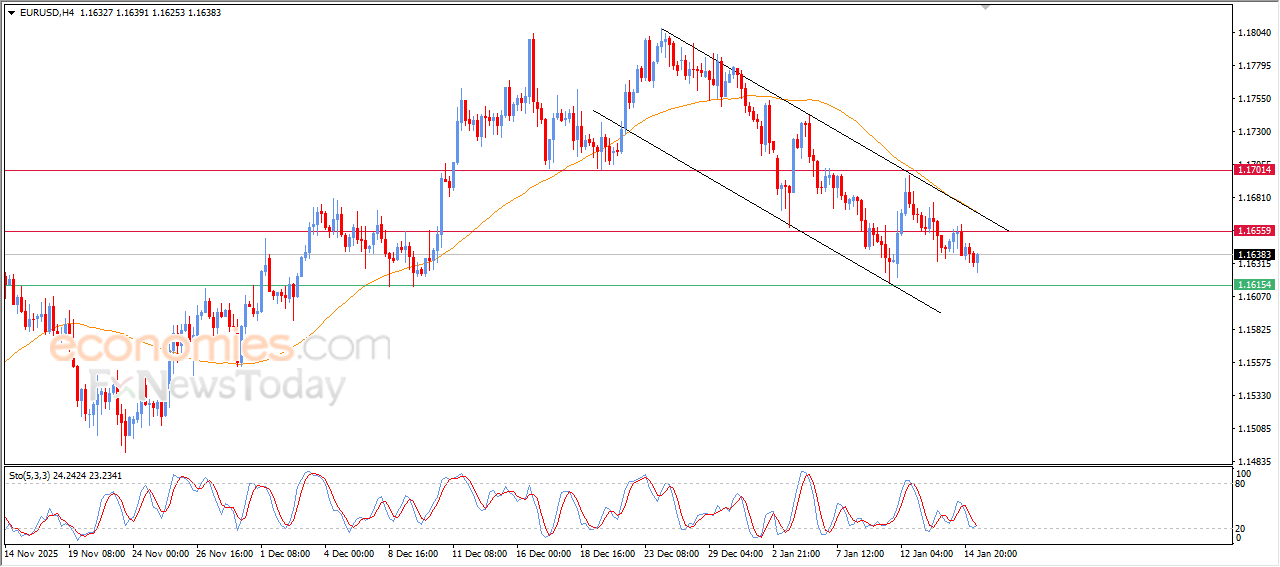

Forecast update for EURUSD -15-01-2026.

The price of EURUSD rose in its last intraday trading, with the emergence of positive overlapping signals on the relative strength indicators, after reaching oversold levels, to attempt to recover some of its previous losses, and attempts to offload this oversold conditions, amid the continuation of the negative pressure due to its trading below EMA50, intensifying the dominance of the bearish corrective trend on the short-term basis, especially with its trading within channel’s range.

The GBPCHF presses on the barrier– Forecast today – 15-1-2026

GBPCHF succeeded in resuming the bullish attack in its last trading, depending on forming a solid base at 1.8400 level, surpassing the moving average 55 and targeting the barrier at 1.8680.

Stochastic decline towards 50 level make us expect an unstable situation, waiting for gathering bullish momentum to ease the mission of breaching the current barrier, to open the way for recording new gains by its rally towards 1.8790 and 1.8840.

The expected trading range for today is between 1.8600 and 1.8790

Trend forecast: Bullish

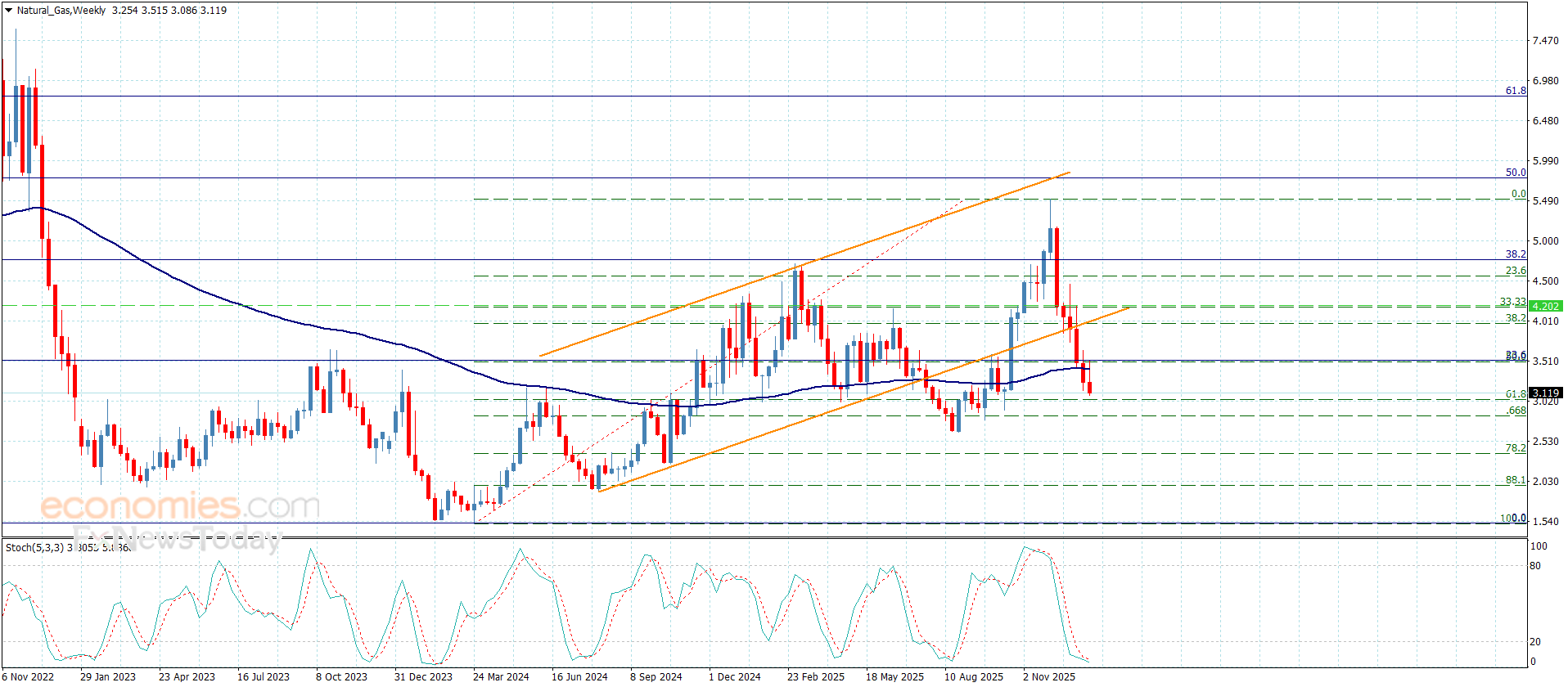

Natural gas price approaches the initial target– Forecast today – 15-1-2026

Natural gas price kept its negative stability below $3.550 level, activating with the main indicators negativity by reaching $3.080, to approach the initial target.

Stochastic stability within the oversold level might force the price to form more negative trading, to target %66.8 Fibonacci correction level at $2.850, then monitor its behavior due to the importance of these levels to detect the expected trend in the near and medium period trading.

The expected trading range for today is between $2.850 and $2.850

Trend forecast: Bearish