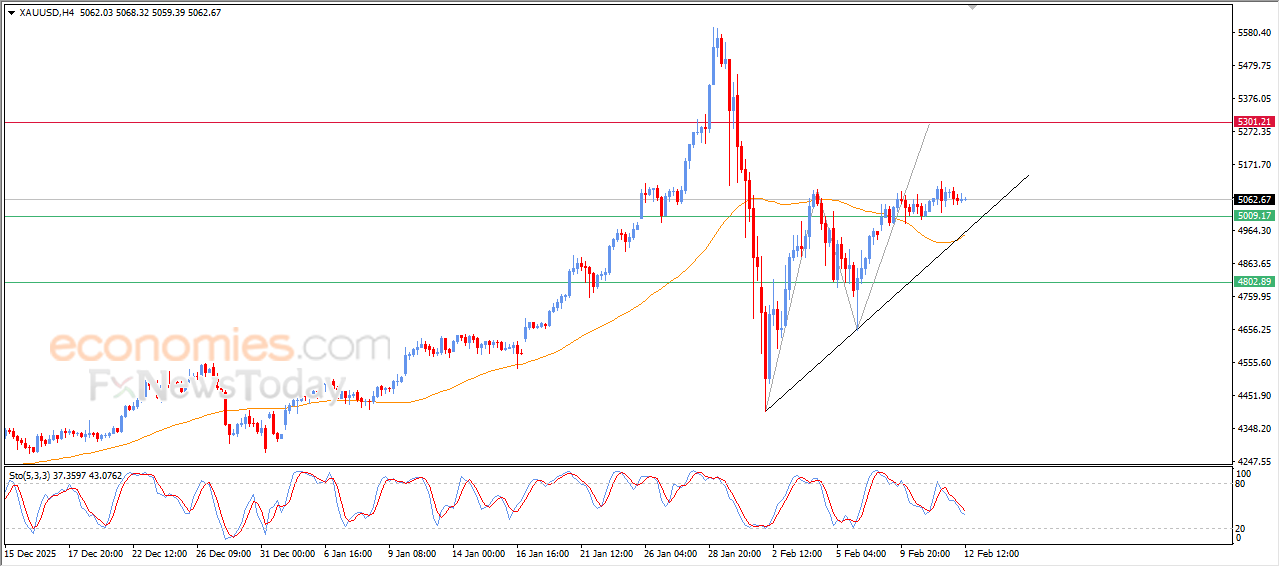

Forecast update for gold -12-02-2026.

The price of gold witnessed fluctuating trading on its last intraday levels, attempting to gain bullish momentum that might help it to recover and rise again, amid its trading alongside minor bullish trend line on short-term basis, and there is dynamic pressure due to its trading above EMA50, on the other hand, we notice the emergence of relative strength indicators, which obstructed the rise in the previous period.

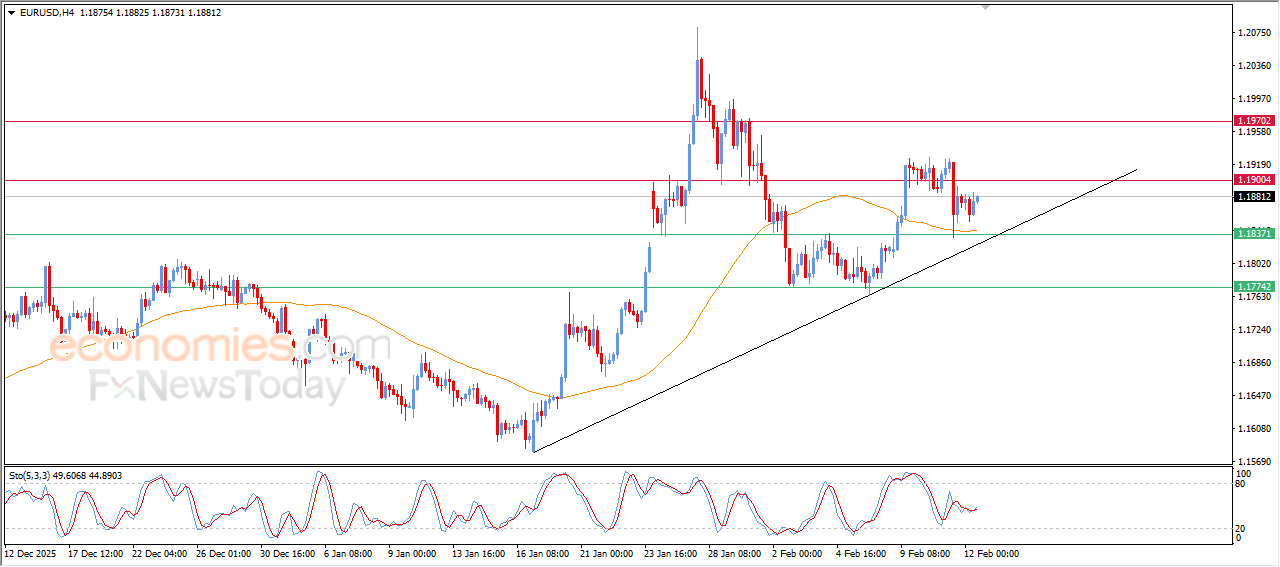

Forecast update for EURUSD -12-02-2026.

The price of EURUSD rose in its last intraday trading, amid the continuation of the dynamic support that is represented by its trading above EMA50, under the dominance of the main bullish trend on short-term basis, as it moves alongside supportive trend line for this path, accompanied by the emergence of positive signals from relative strength indicators, to indicate extending its gains in the upcoming period.

The CADCHF is moving away from the support– Forecast today – 12-2-2026

The CADCHF confirmed the continuation of the bullish corrective scenario by providing new bullish closes above $0.5595 support, to begin recording some gains by hitting 0.5635 level.

Forming extra support at 0.5650 level and beginning of providing bullish momentum by stochastic will increase the chances of recording extra gains, to reach 0.5720 and 0.5750.

The expected trading range for today is between 0.5650 and 0.5750

Trend forecast: Bullish

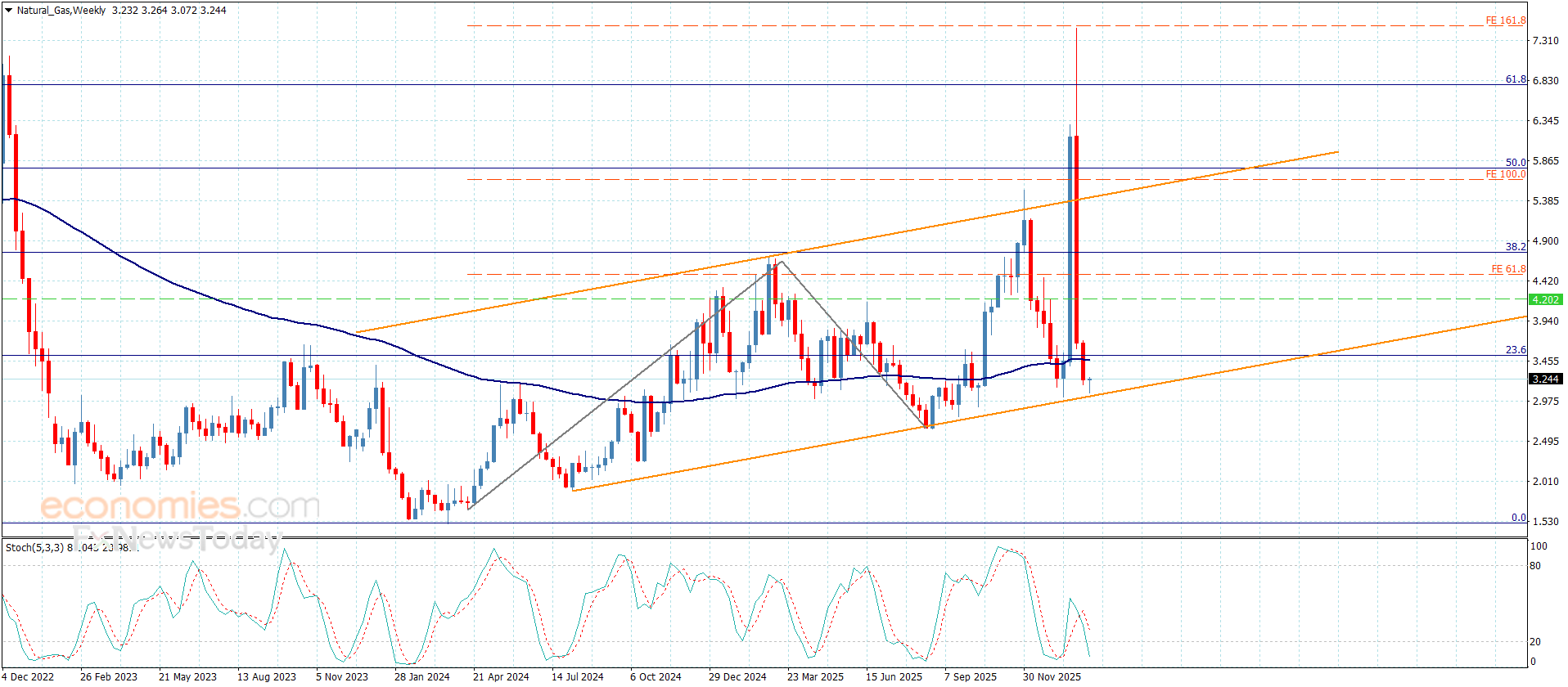

Natural gas price settles above the support level– Forecast today – 12-2-2026

Natural gas price continued resisting stochastic negativity, to settle above $3.050 support and its rally towards $3.250 level, to confirm the previously suggested bullish scenario.

Gathering bullish momentum in the current period trading is important to surpass the barrier at $3.520, to begin recording several gains by its rally towards $3.910 initially, while breaking the current support and holding below it will confirm its move to a new bearish phase, which forces it to suffer more losses by reaching $2.850 and $2.660.

The expected trading range for today is between $3.000 and $3.450

Trend forecast: Bullish