Forecast update for Gold -11-09-2025

AI Summary

- Gold price declined in last trading session, looking for a rising low to gain positive momentum

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for Gold, oil, forex, Bitcoin, Ethereum, and indices

- VIP signals performance report for September 1-5, 2025 available for viewing on the website

The price of (Gold) declined in its last trading on the intraday levels, amid its attempts to look for a rising low to take it as a base that might help it to gain the required positive momentum to recover, amid the dominance of the main bullish trend on the short-term basis, and its trading alongside a bias line, with the emergence of positive overlapping signals on the (RSI), after reaching oversold levels, indicating the end of the negative momentum and the beginning of reversing the trend on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025:

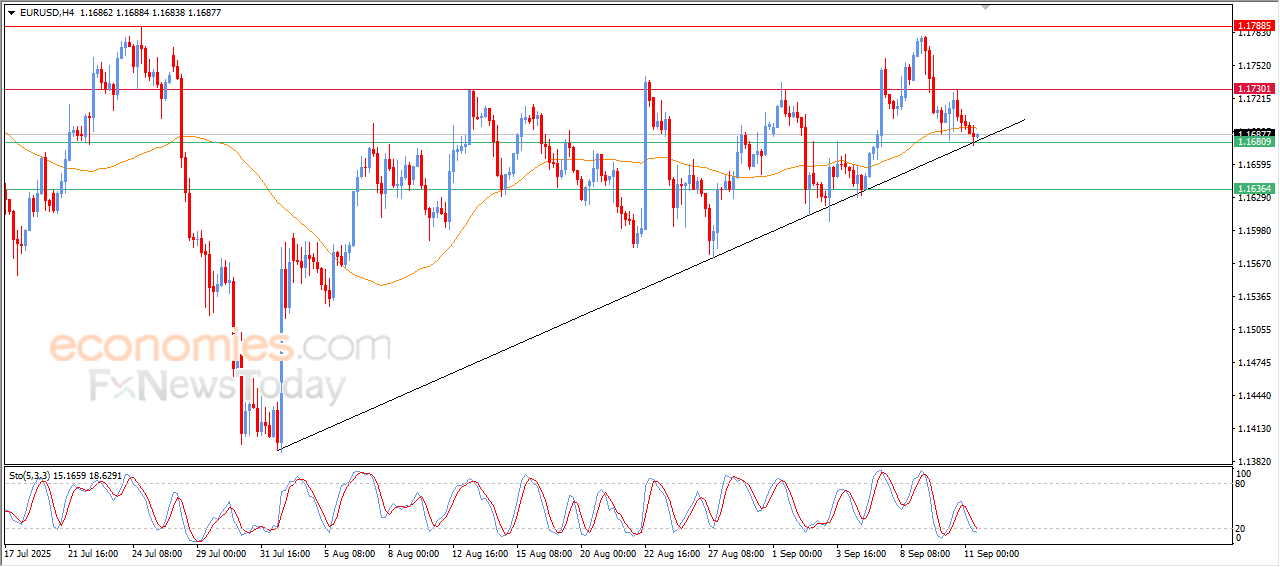

Forecast update for EURUSD -11-09-2025.

The price of (EURUSD) kept declining in its last intraday trading, amid the emergence of the negative signals on the (RSI), despite reaching oversold levels, surpassing the support of its EMA50, exhausting its positive chances that might supports its recovery to lean on the support of the bullish trend line on the short-term basis as a last attempt for gaining the required positive momentum to recover.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025:

The EURNZD is forced to decline – Forecast today – 11-9-2025

The EURNZD suffered strong negative pressures in its last trading, which forces it to break the extra support at 1.9775, suffering extra losses by its approach from the bullish channel’s support at 1.9645.

The current scenario depends on the strength of the bullish channel’s support, to expect forming bullish waves to breach 1.9775 level, then achieving extra gains by its rally to 1.9850, while breaking the main support will confirm moving to the negative track, which forces it to suffer big losses by reaching 1.9585 and 1.9525.

The expected trading range for today is between 1.9650 and 1.9800

Trend forecast: Bullish

Natural gas price activates with stochastic negativity– Forecast today – 11-9-2025

Natural gas price confirmed the dominance of the bearish bias by its move from the critical resistance at $3.210, taking advantage of stochastic negativity to fluctuate near $3.030.

The continuation of providing negative momentum by the main indicators will increase the efficiency of the bearish track that might target $3.810 level, to attempt to renew the pressure on $2.620 barrier to find an exit to target new negative stations in the upcoming period.

The expected trading range for today is between $2.820 and $3.150

Trend forecast: Bearish