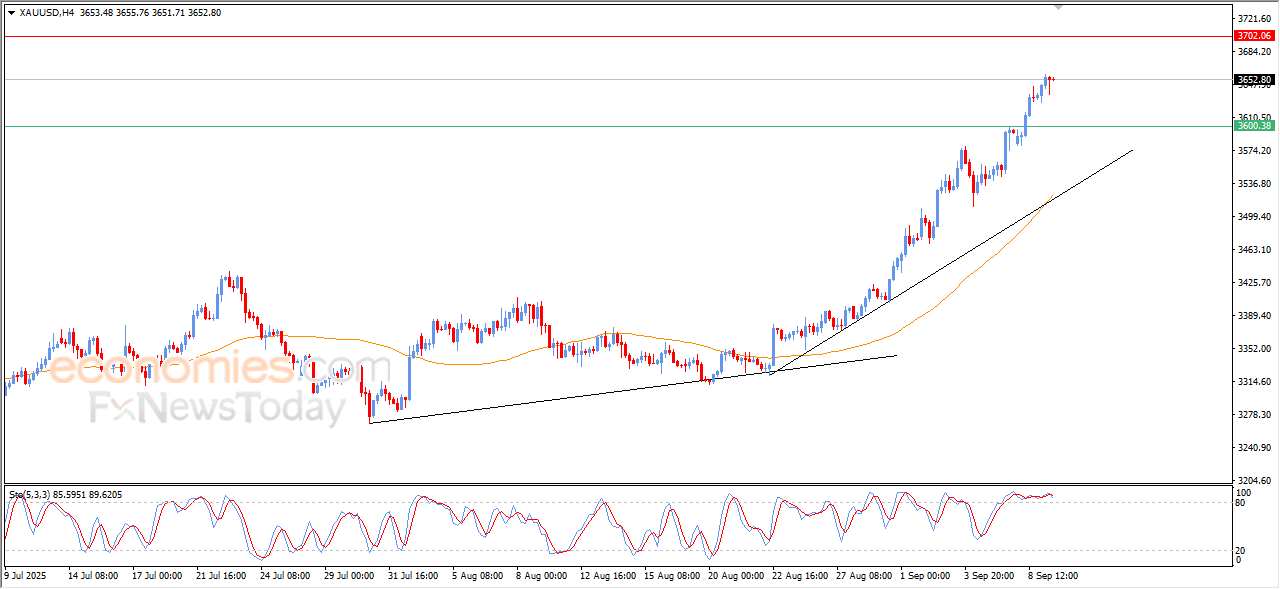

Forecast update for Gold -09-09-2025

AI Summary

- Gold price settled with limited rise, facing negative pressure due to overbought condition and may see correctional rebounds in the near-term

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for Gold, Oil, Forex, Bitcoin, Ethereum, and Indices

- Subscription packages range from €44/month for US Stock Signals to €179/month for VIP Signals, with performance reports available for September 1-5, 2025.

The price of (Gold) settled with limited rise on its last intraday trading, with the emergence of negative overlapping signals on the (RSI), putting negative pressure on the price due to its neediness to offload some of this overbought condition, gathering the gains of its previous rises, which might push it for some of the correctional rebounds on the near-term basis, amid the dominance of the main bullish trend and its trading alongside a bias line.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025:

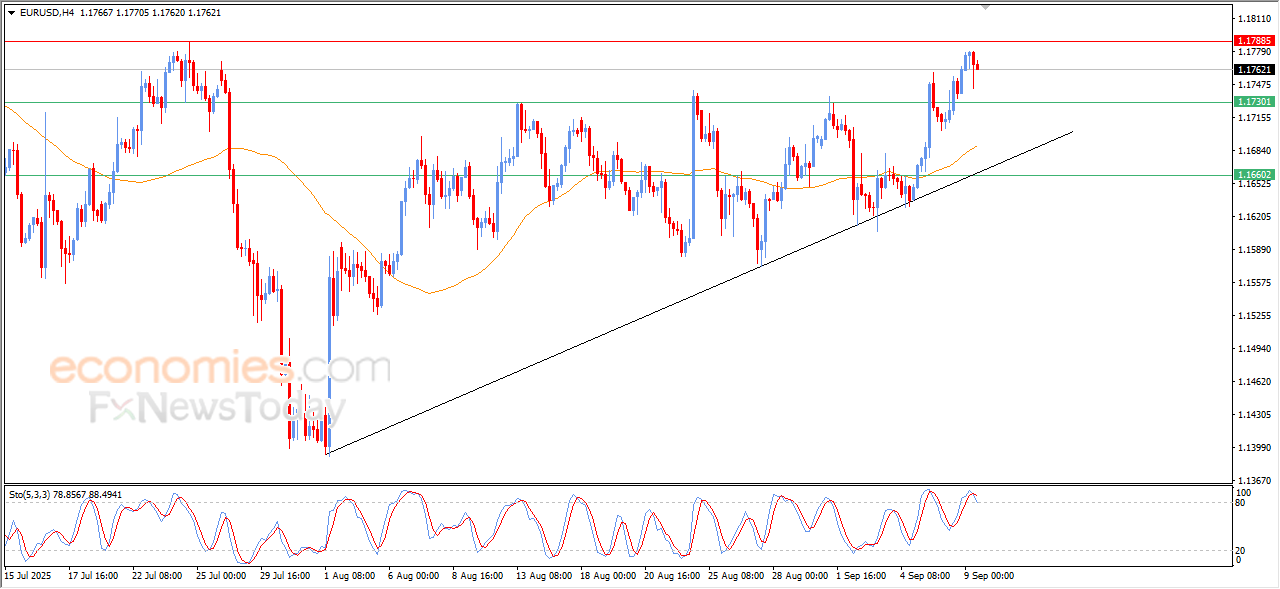

Forecast update for EURUSD -09-09-2025.

The price of (EURUSD) declined in its last intraday trading, gathering the gains of its previous rises, attempting to gain bullish momentum that might assist it to attack the critical resistance ay 1.1785, besides the price attempt to offload its clear overbought conditions on the (RSI), especially with the emergence of the negative signals, with the dominance of the bullish trend on the short-term basis and its trading alongside a supportive line for this trend.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025:

The coffee price repeats the positive closes – Forecast today – 9-9-2025

The coffee price confirmed the stability of the bullish track by providing several positive closes above the extra support at 370.20, activating the positivity of the main indicators by its rally to 384.65, confirming its readiness to resume the bullish attack.

We expect to attack 393.00 level, surpassing it is important to increase the chances for reaching extra stations that might extend to 424.10 reaching the achieved top at 440.00 level.

The expected trading range for today is between 375.00 and 424.10

Trend forecast: Bullish

Natural gas price tests the resistance– Forecast today – 9-9-2025

Natural gas price ended the bullish correctional rally by testing the resistance at $3.210, then begin forming bearish waves, affected by the negativity of the indicators and providing negative momentum, to notice its stability near $3.100.

The continuation of facing negative pressures will confirm its surrender to the previously suggested scenario, to keep waiting for targeting $2.810 level, and breaking this barrier will extend the losses directly towards $2.620 reaching the next main target at $2.390.

The expected trading range for today is between $2.820 and $3.150

Trend forecast: Bearish