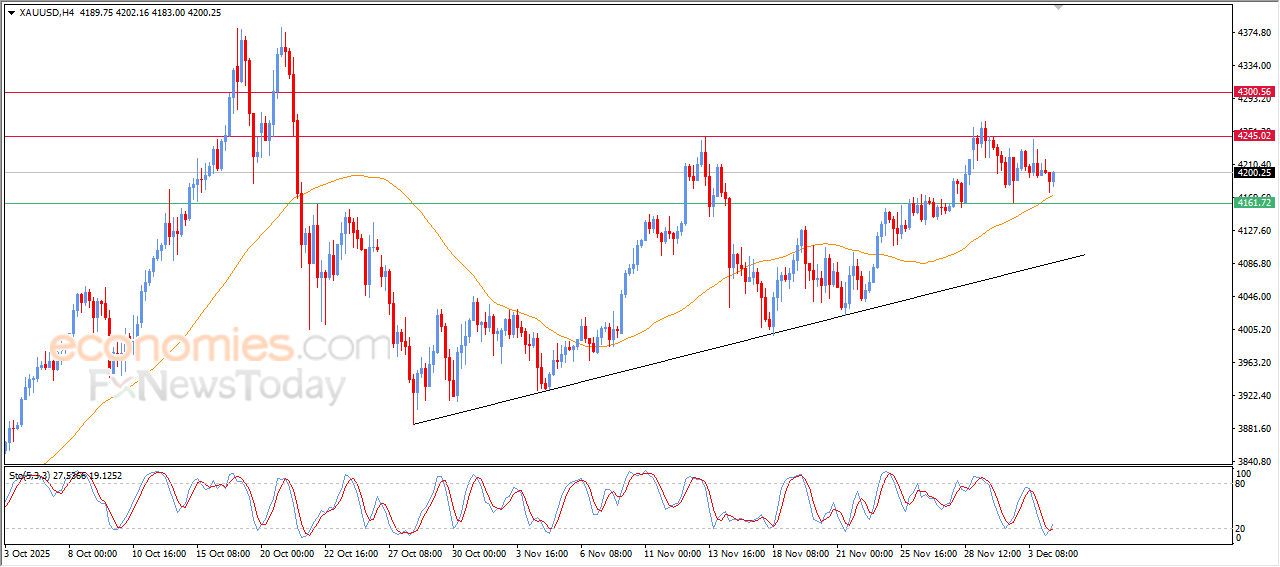

Forecast update for Gold -04-12-2025.

The price of (Gold) rose in its last intraday trading, as it leans on the EMA50’s support, gaining bullish momentum that helped it to stop its early losses, especially with the beginning of forming positive divergence on the relative strength indicators, after reaching oversold levels, exaggeratedly compared to the price move, with the emergence of the positive signals from there, under the dominance of the bullish trend on the short-term basis and its trading alongside trend line.

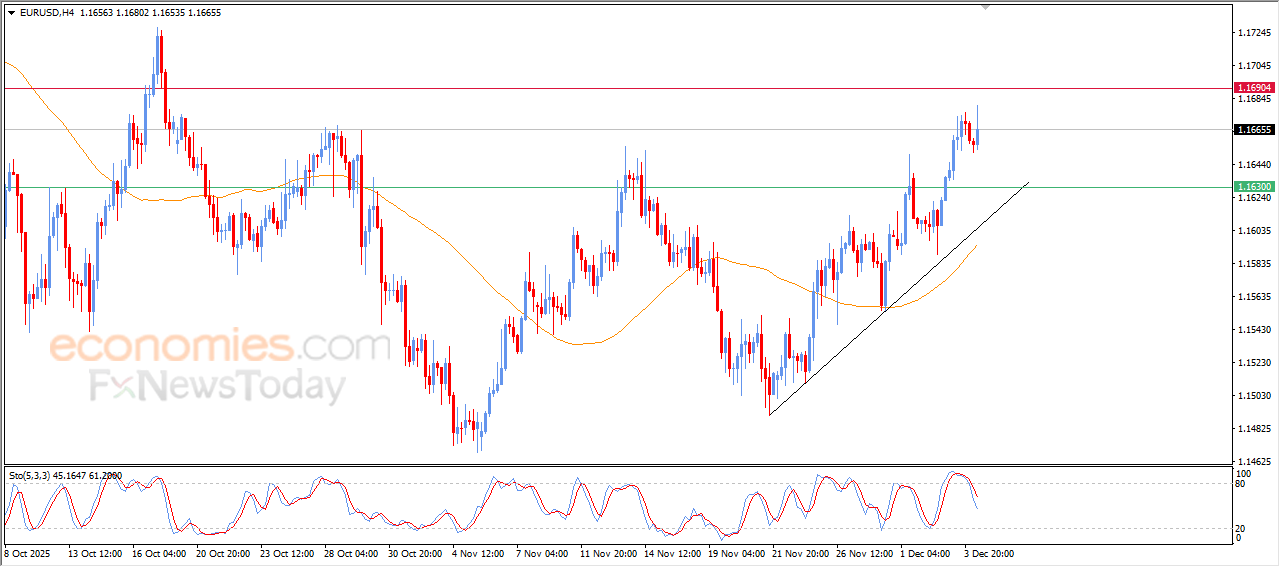

Forecast update for EURUSD -04-12-2025.

The price of (EURUSD) returned to rise in its last intraday trading, after witnessing natural profit-taking phase during its early trading for today, offloading its overbought conditions on the relative strength indicators, gaining more positive momentum, amid the dominance of bullish corrective wave on the short-term basis, with its trading alongside supportive trend line for the stability of this track.

The CADJPY keeps the bullish attempts– Forecast today – 4-12-2025

The CADJPY keeps the bullish scenario by its stability above the extra support at 109.30, attempting to form the flag pattern, which supports the chances for resuming the main bullish scenario.

Gathering bullish momentum is important for surpassing the barrier at 111.65 level, to expect forming a strong bullish rally to target 112.25 level initially, reaching the next main target at 112.90.

The expected trading range for today is between 110.90 and 112.20

Trend forecast: Bullish

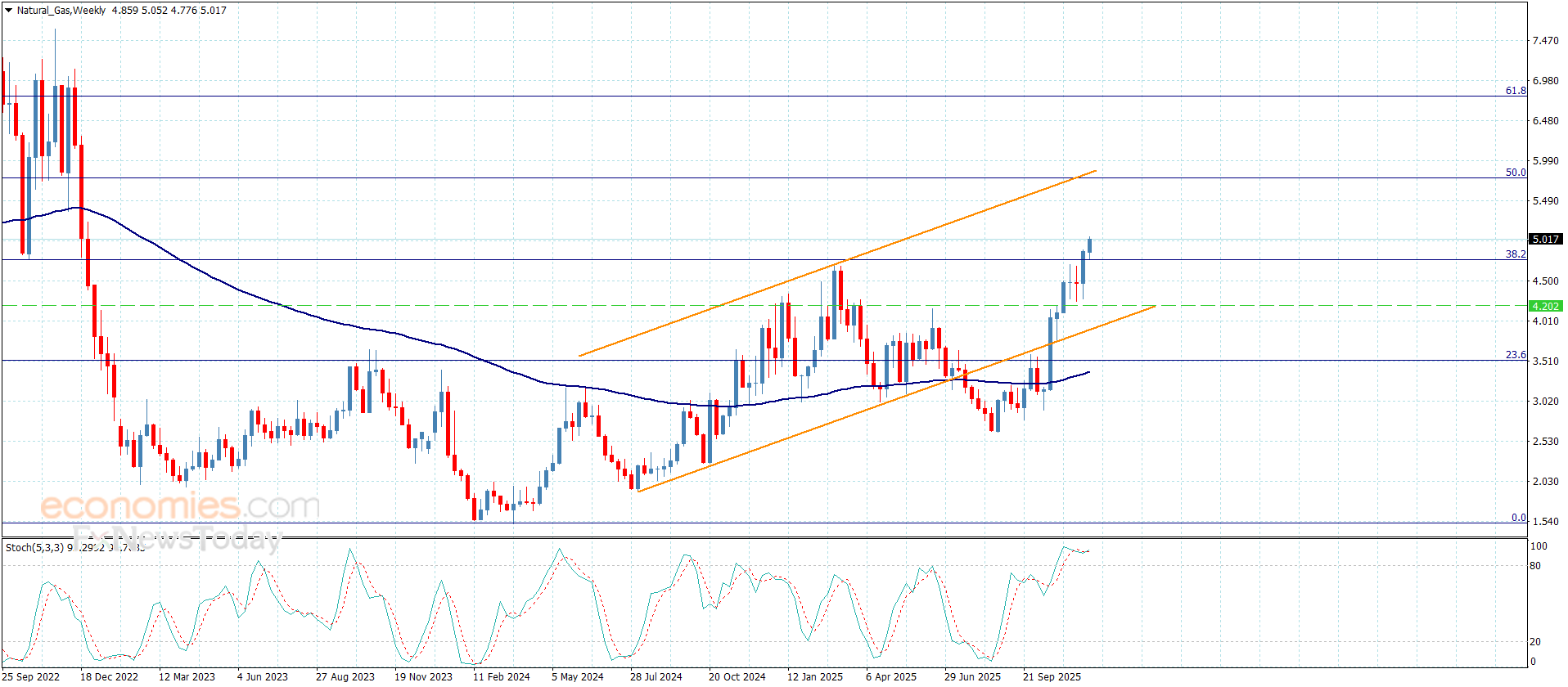

Natural gas price approaches the target– Forecast today – 4-12-2025

Natural gas price continued forming bullish waves, taking advantage of its stability within the bullish channel’s levels, to form a solid support by %38.2 Fibonacci correction level at $4.500, to approach from the initial main target by reaching $5.052 level.

Stochastic stability within the overbought level will increase the efficiency of the bullish track, to pave the way for surpassing $5.180 level, to open the way for recording extra gains that might extend towards $5.250 and $5.710.

The expected trading range for today is between $4.950 and $5.450

Trend forecast: Bullish