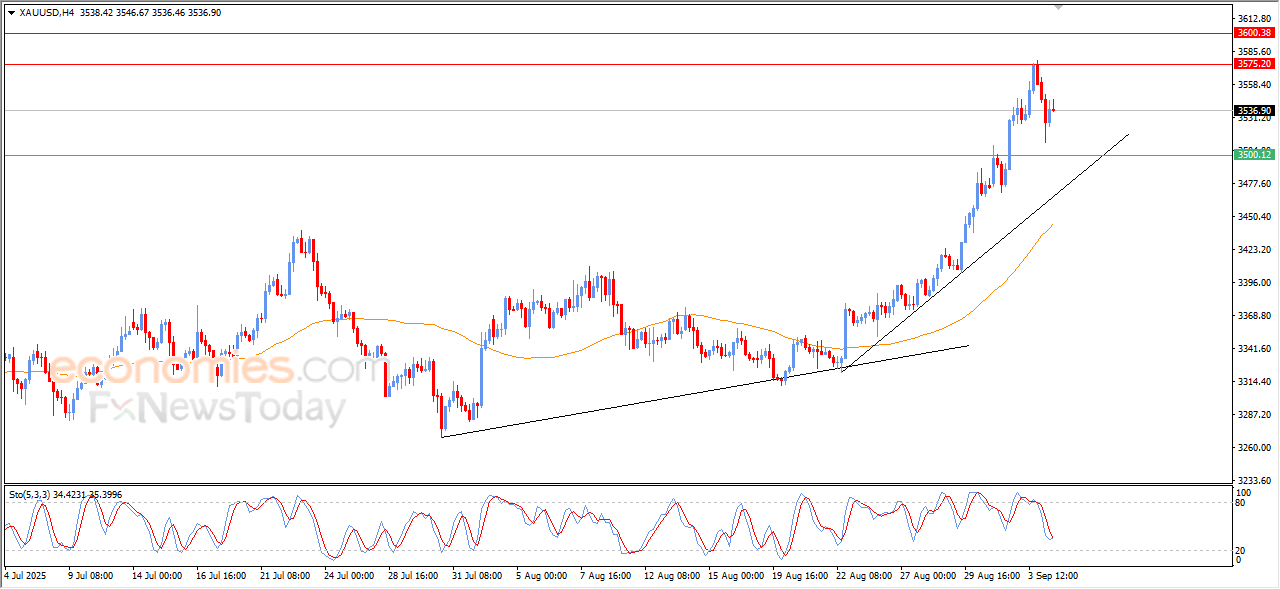

Forecast update for Gold -04-09-2025

AI Summary

- Gold price settled high in last trading, showing positive momentum and strength in near-term basis

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for Gold, Oil, Forex, Bitcoin, Ethereum, and Indices

- Subscription packages available starting from €44/month for US Stock Signals, with full performance report available for August 25-29, 2025.

The price of (Gold) settled high in its last intraday trading, after offloading its clear overbought condition on the (RSI), noticing the emergence of positive overlapping signals, increasing the positive momentum, especially with the dominance of the main bullish trend and its trading alongside a supportive minor bias line for the track, indicating its strength and dominance on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

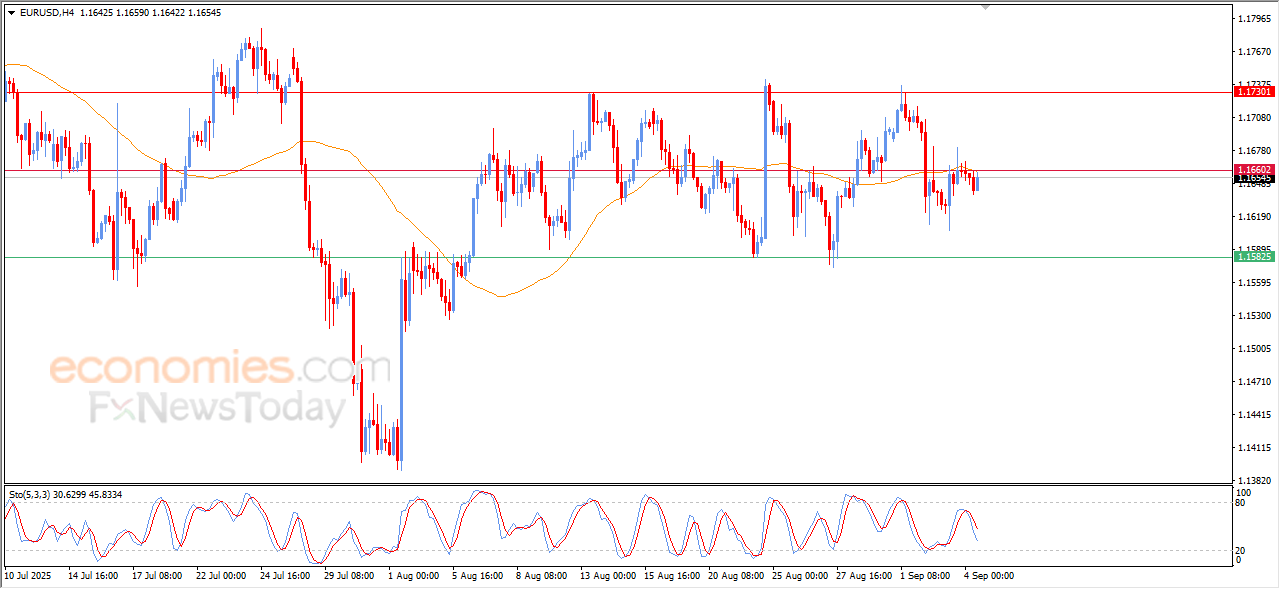

Forecast update for EURUSD -04-09-2025.

The price of (EURUSD) rose cautiously in its last intraday trading, amid the continuation of the negative that comes from its trading below EAM50, holding below the resistance of 1.1660, besides the emergence of the negative signals on the (RSI), after reaching exaggerated overbought levels that intensifies the negative pressure.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

The GBPCAD keeps the positivity– Forecast today – 4-9-2025

The GBPCAD kept its stability within the stability of the bullish channel’s levels, forming strong support by161.8%Fibonacci extension level at 1.8410, while allowing it to form bullish waves and its stability near 1.8565.

Note that the stability of moving the average 55 near the current support, and by stochastic attempt to provide positive momentum, these factors will increase the chances for forming new bullish rally, to attempt to step above the obstacle at 1.8650, then attempt to achieve extra gains by reaching 1.8730 and 1.8800.

The expected trading range for today is between 1.8510 and 1.8650

Trend forecast: Bullish

Natural gas price approaches from the resistance– Forecast today – 4-9-2025

Natural gas prices activated with stochastic positivity by forming new bullish wave, to approach from the main resistance at $3.190.

The upcoming scenario depends on the strength of the current resistance, its stability makes us expect forming sharp decline, to target $2.950 and $2.810 level, while breaching the resistance and holding above it will provide a chance for regaining the bullish bias, to begin recording several gains that might begin at $3.310.

The expected trading range for today is between $2.810 and $3.180

Trend forecast: Bearish