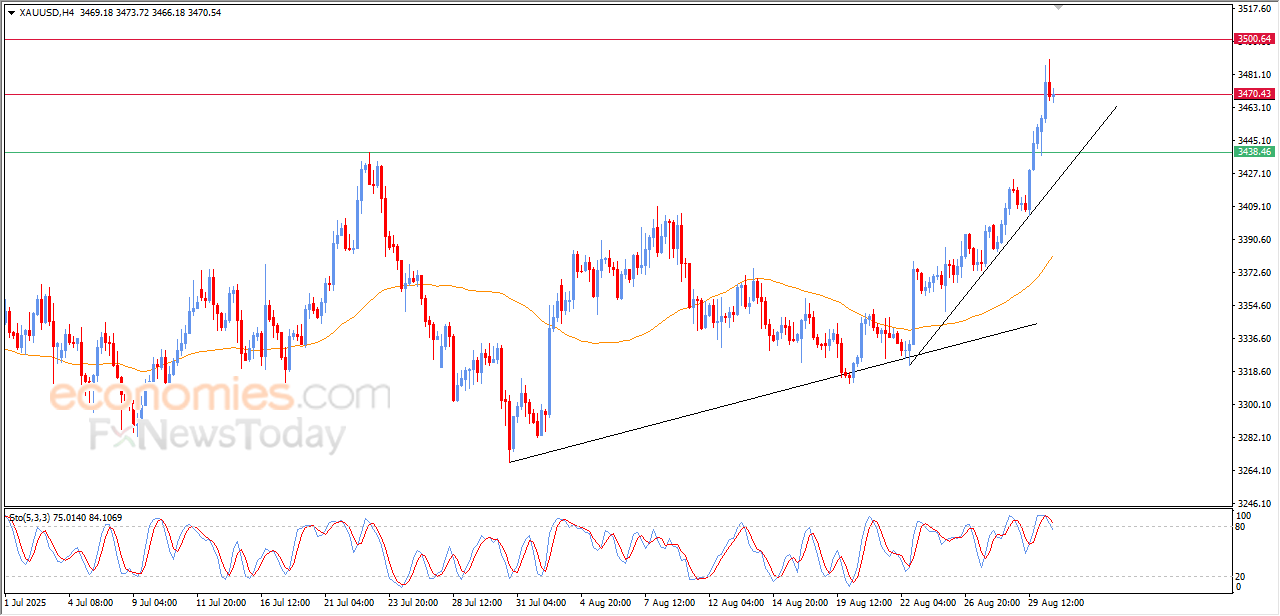

Forecast update for Gold -01-09-2025

AI Summary

- Gold price declined in last trading session, correcting from overbought levels with negative signals, but still expected to resume its rise in short-term bullish trend

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for Gold, Oil, Forex, Bitcoin, Ethereum, and Indices

- Subscription packages available starting from €44/month for US Stock Signals, with full performance report for August 25-29, 2025 available to view

The price of (Gold) declined in its last intraday trading, gather the gains of its previous rises, and attempts to offload some of its clear overbought level on the (RSI), especially with the emergence of the negative signals, in a natural technical correctional move to gather the required positive momentum to recover and resume its rise again, amid the dominance of the main bullish trend on the short-term basis and its trading alongside minor and main bias lines that support this track.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

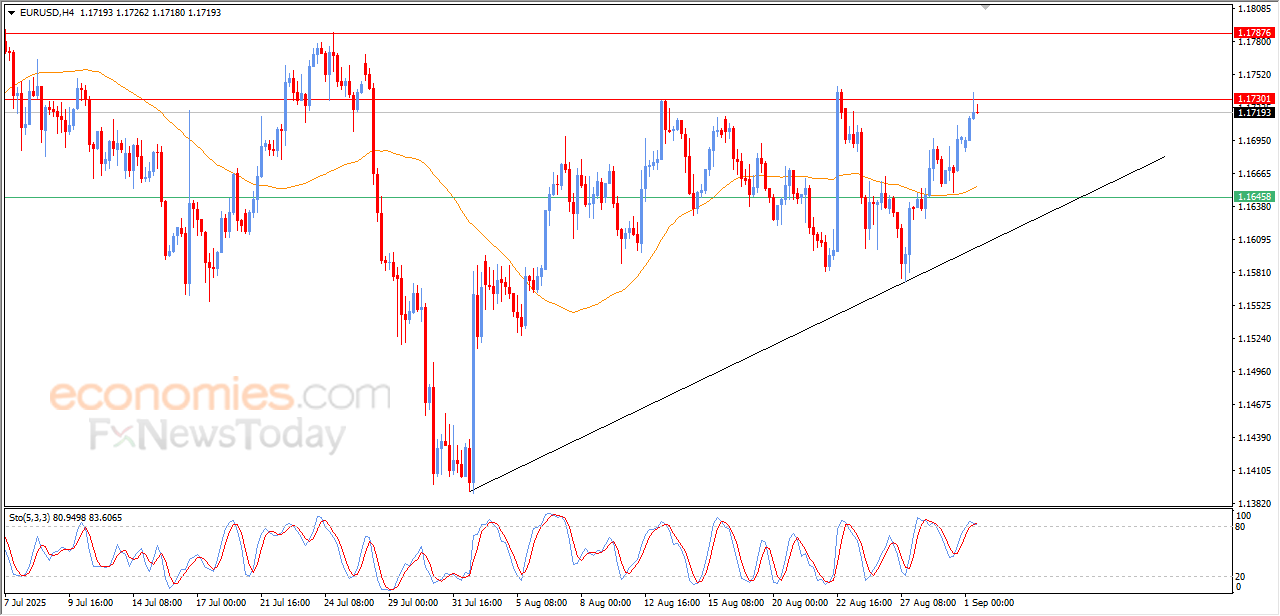

Forecast update for EURUSD -01-09-2025.

The price of (EURUSD) extended its rise in its last intraday trading, reaching our morning target at the key resistance of 1.1730, taking advantage of the dynamic support that is represented by its trading above EMA50, with its trading alongside a bullish correctional trend line on the short-term basis, on the other hand, we notice the emergence of negative overlapping signals on the (RSI), after reaching overbought levels, forming an obstacle against the continuation of the rise on the intraday basis, pushing for some correctional rebounds, to target offloading these overbought conditions.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

The GBPAUD is forced to decline– Forecast today – 1-9-2025

The GBPAUD failed to breach 2.1020 barrier, forcing it to form new bearish correctional waves, to settle near the moving average 55 at 2.0620.

Despite the stability of the price within the bullish channel levels, the attempt of forming extra barrier at 2.0745 level by the continuation of providing negative momentum, these factors confirm the dominance of the bearish correctional bias, targeting 2.0560 level reaching extra support near 2.0483.

The expected trading range for today is between 2.0710 and 2.0560

Trend forecast: Bearish

Natural gas price settles below the resistance– Forecast today – 1-9-2025

Natural gas price continued forming bullish correctional trading, to test the neckline of the head and shoulders pattern by reaching $3.050, but it will not affect the main bearish track, depending on the resistance at $3.170.

Stochastic reach to the overbought level confirms surpassing the positive pressure, increasing the chances for gaining the required negative momentum, to activate the negative attempts to reach $2.850, to repeat the pressure on $2.650 barrier.

The expected trading range for today is between $2.850 and $3.100

Trend forecast: Bearish