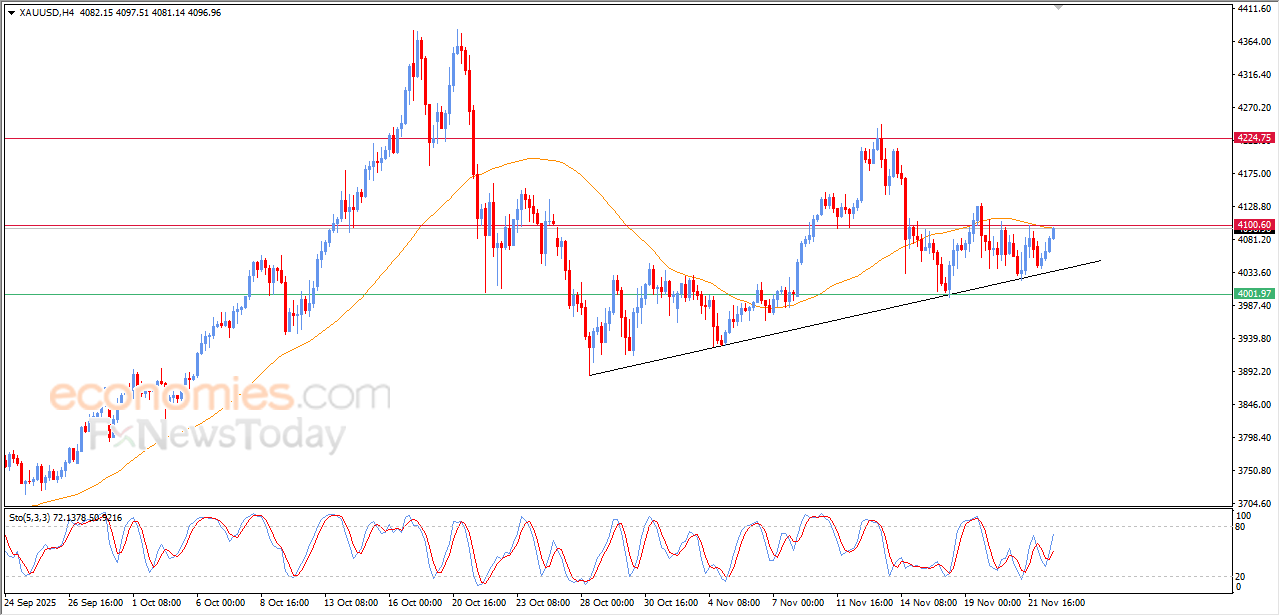

Evening update for Gold -24-11-2025

(Gold) extended its early gains today, taking advantage of its trading alongside minor trend line on the short-term basis, with the emergence of positive signals on the relative strength indicators, reaching the resistance of its EMA50, in attempt to get rid of its negative pressure.

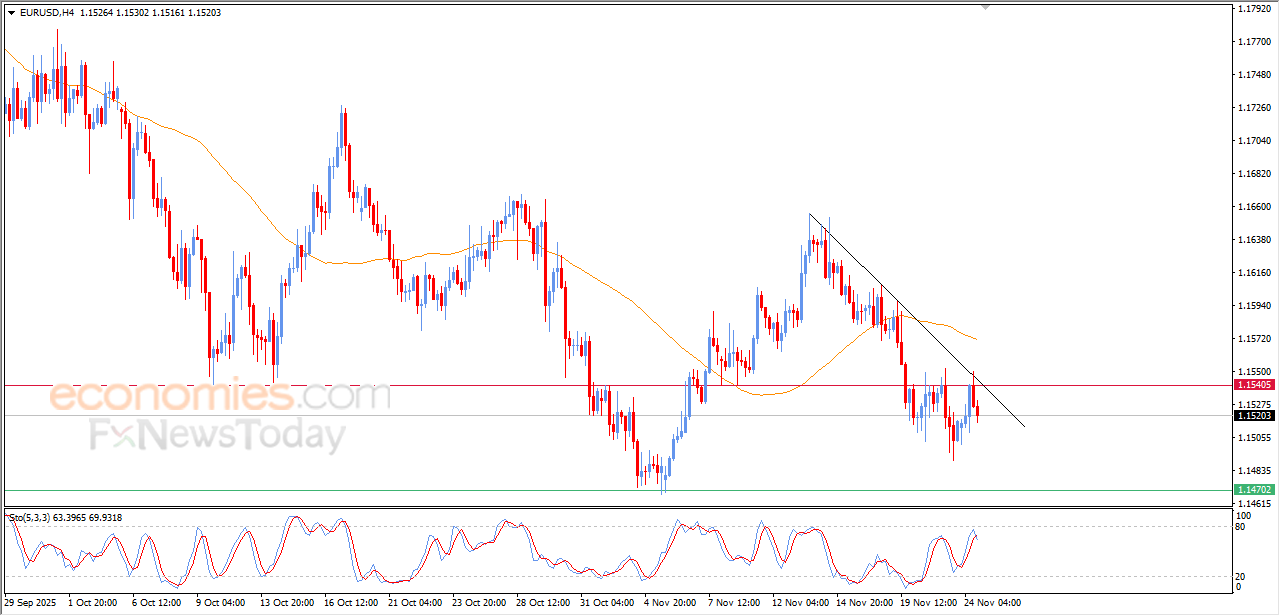

Evening update for EURUSD -24-11-2025

The (EURUSD) declined in its last intraday trading, due to the stability of the resistance at 1.1540, amid the dominance of the main bearish trend and the trading alongside minor trend line on the short-term basis, with the emergence of negative overlapping signals on the relative strength indicators, after reaching overbought levels, exaggeratedly compared to the price move.

Solana price surrounded with negative pressures - Analysis - 24-11-2025

Solana (SOLUSD) declined in its latest intraday trading after the price encountered resistance from the 50-period simple moving average earlier today, forcing it to reverse lower. This drop coincided with the price testing a major short-term descending trendline, which intensified the negative pressure. At the same time, the Relative Strength Indicators show renewed bearish signals after reaching extremely overbought levels.

Therefore, we expect the cryptocurrency to decline in the upcoming intraday sessions, as long as it remains below 134.00, targeting the key support level at 121.25.

Expected direction for the upcoming sessions: Bearish

Stellar price declines alongside downward secondary trend line - Analysis - 24-11-2025

Stellar (XLMUSD) stabilized lower in its latest intraday trading, as the main downtrend continues to dominate its movement while trading along a short-term descending trendline supporting this bearish structure. The price has settled once again below the 50-period simple moving average, exposing it to further negative pressure in the coming period, especially with negative signals appearing on the Relative Strength Indicators after reaching extremely overbought levels. This reduces the chances of any meaningful recovery.

Therefore, we expect the cryptocurrency to decline in the upcoming intraday sessions, as long as it remains below the resistance level of 0.2525, targeting the first support level at 0.2325.

Expected direction for the upcoming sessions: Bearish