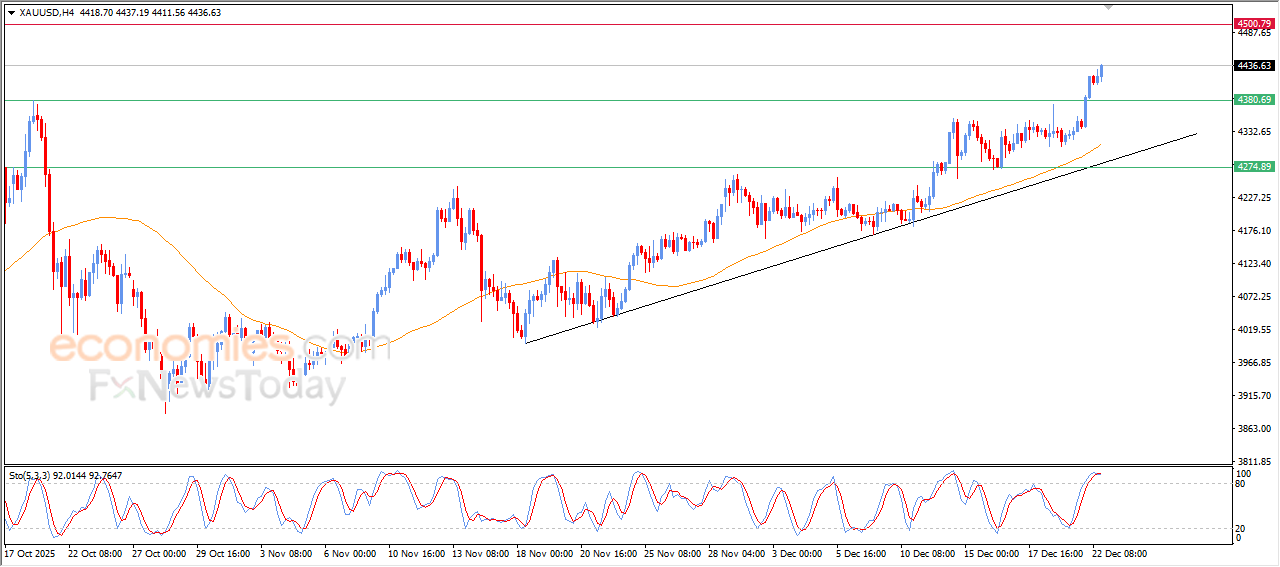

Evening update for Gold -22-12-2025

(Gold) kept rising in its last intraday trading, taking advantage of breaching $4,380, amid the continuation of the dynamic pressure that is represented by its trading above EMA50,reinforcing the strength and dominance of the main bullish trend on the short-term basis, on the other hand, we notice the emergence of negative overlapping signals on the relative strength indicators, after reaching overbought levels, which might reduce the gains in the upcoming gains.

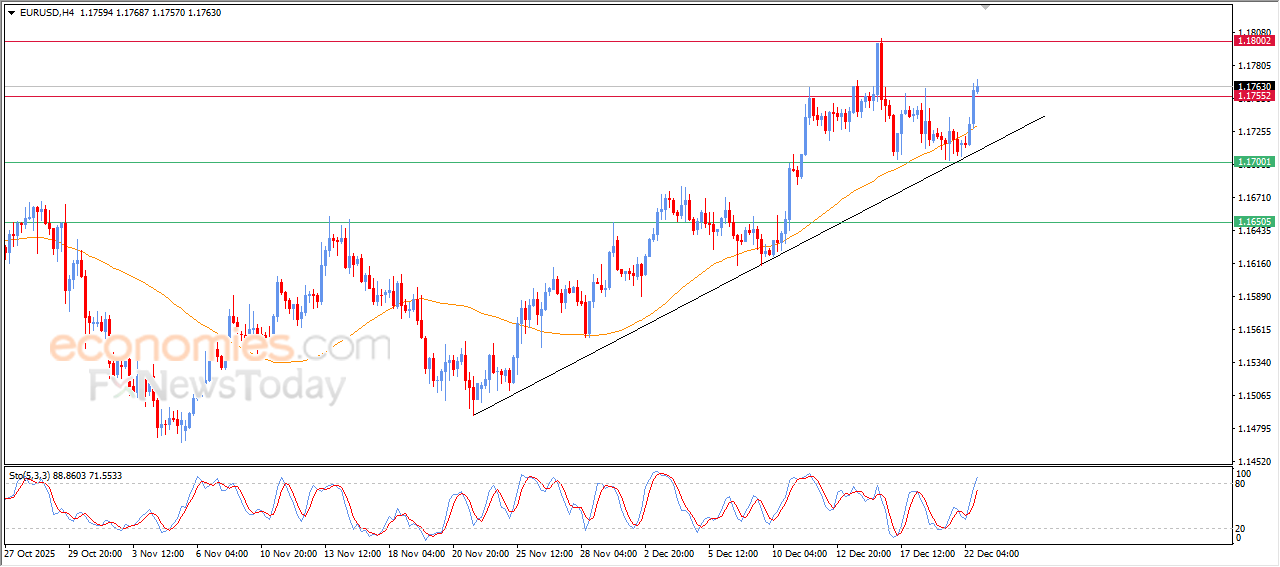

Evening update for EURUSD -22-12-2025

The (EURUSD) extended its gains on its last intraday trading, breaching 1.1755 resistance. This resistance represents expected target in our previous analysis, supported by the emergence of the positive signals on the relative strength indicators, supported by its continuous trading above EMA50, under the dominance of the main bullish trend alongside trendline.

Cardano price climbs amid negative pressures - Analysis - 22-12-2025

Cardano (ADAUSD) advanced in its latest intraday trading, supported by positive signals from the RSI indicators after they had previously reached extremely oversold levels. However, this move comes under the dominance of the main short-term descending trend, with continued negative pressure from trading below the 50-day SMA, which limits the price’s chances of a sustained recovery in the near term.

Therefore we expect the cryptocurrency to decline in its upcoming intraday trading, as long as it remains below the resistance level at 0.3700, targeting the support level at 0.3370.

Expected trend for the upcoming trading: Bearish

Dash price tries to vent off oversold saturation - Analysis - 22-12-2025

Dash (DASHUSD) has been moving sideways within a narrow trading range, as the price attempts to relieve its clear oversold condition on the RSI indicators, especially with the emergence of positive signals. This comes amid the dominance of the main short-term descending trend, with price action remaining below the 50-day SMA, which has kept pressure on the price and forced it to remain in a consolidation phase.

Therefore we expect the cryptocurrency to decline in its upcoming intraday trading, as long as the resistance level at $43.30 remains intact, targeting the support level at $34.90.

Expected trend for the upcoming trading: Bearish