End of day gold price forecast update - 15-05-2024

Gold price continues to rise to surpass 2380.00$ and approach the first waited positive target at 2400.00$, to support the expectations of continuing the bullish trend on the intraday and short-term basis, noting that surpassing the mentioned target will push the price towards 2431.44$ as a next positive station.

End of day EURUSD price forecast update - 15-05-2024

The EURUSD price managed to achieve our first waited target at 1.0875$ and attempts to breach it, to support the continuation of the expected bullish trend on the intraday and short-term basis, which its next target reaches 1.0975$, noting that failing to consolidate above 1.0875$ might push the price to rebound bearishly and test 1.0795$ areas before any new attempt to rise.

Dow Jones Approaches the 40,000 Barrier for the First Time in History. Predictions, Analysis, and How to Trade It

Technical Forecast for Dow Jones Index Price

By studying the weekly chart of the Dow Jones Industrial Average, we find that the index started building a long-term upward wave at the end of the first quarter of 2020, starting from the bottom areas recorded at 18208.30 and reaching the historical peak it recently recorded at 40055.35, moving within an ascending channel that carries the index towards more expected rises in the medium and long term, with targets exceeding the 40,000-point barrier to reach areas of 45000.00 and then 46000.00.

- In the same timeframe, we find that the Stochastic indicator provides positive signals that encourage the industrial index to offer more expected positive trades, along with the positive support provided by the 50-day moving average continuously.

- The challenge now is to break the peak recently recorded at 40055.35 to ensure that a negative technical pattern is not formed, causing a significant shift in the trend towards a decline and facilitating the index's mission to push for more gains.

Best 2 Dow Jones Index Trading Brokers

Positive Technical Pattern Supporting Uptrend

On the other hand, on the daily timeframe, we find that the Dow Jones index has completed forming a cup and handle pattern after breaking the 35700.00 barrier. The targets for this pattern start at 41500.00 and extend to 42840.00 as a full target for this positive pattern.

The following chart illustrates the technical idea and the completion of the mentioned pattern and the upward push journey towards the positive targets:

Intraday Timeframes

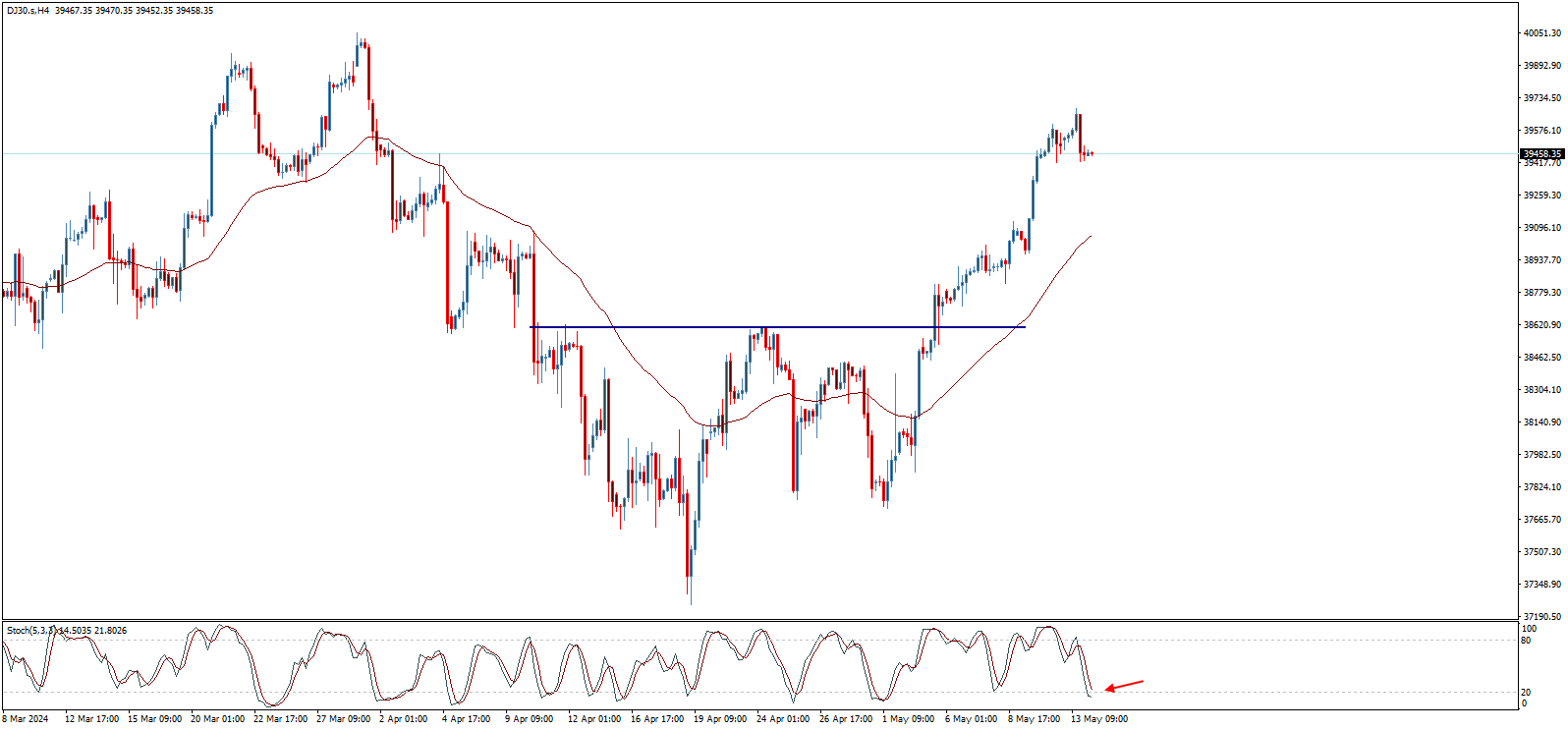

Recently, on the intraday timeframes, we notice that the price received a positive boost after completing a double bottom pattern shown in the following image. This pattern is considered a stimulus to push the industrial index to break the peak recently recorded around 40055.35 and then move towards achieving more long-term gains, noting that technical indicators provide positive signals that add more confirmation and encouragement for the continuation of the upward wave.

Downside Risk Opportunities

- Despite all the positive technical factors mentioned above, there is a possibility of a short-term and medium-term trend shift to a decline. This possibility is confirmed if the index fails to break the 40055.35 areas and drops to break the 37250.00 level, which will lead to the completion of a double top pattern that has the ability to push the index down and target the support of the long-term ascending channel and visit the 35000.00 areas before any new attempt to rise.

The opposite scenario is illustrated in the following chart:

Fundamental Analysis of Dow Jones in 2024

The Dow Jones Industrial Average achieved last week "ended Friday, May 10" the largest weekly gain in 2024, approaching strongly from reaching its highest levels ever recorded in March, before entering a wide short-term correction cycle.

Those gains were achieved thanks to the disclosure of major companies in the United States of better-than-expected business results during the first quarter of this year, in addition to renewed hopes for more interest rate cuts by the Federal Reserve.

It is likely that the strong performance of the Dow Jones Industrial Average will continue this week, which will make it approach significantly from trading above the important psychological barrier at 40,000 points for the first time in history.

Overall, analysts in major economic institutions and global banks expect the Dow Jones Index to perform positively in 2024, with expectations of an increase ranging between 8.5% and 20%.

The year 2024 is full of challenges and opportunities for the Dow Jones Industrial Average, as a combination of economic and geopolitical factors interacts to determine its trends.

Despite the challenges, there are optimistic expectations that innovation and investment in infrastructure can support the index, making it accurately reflect the state of the American economy and future expectations.

Key Predictions for the Dow Jones Industrial Average

- Dow Jones Predictions This Week: After recording the highest level in six weeks above the 39,000-point level, some analysts expect the index to continue rising to the record level at approximately 39,900 points.

- Dow Jones Predictions in May: The Dow Jones Index is likely to continue rising throughout the sessions of this month, with a strong possibility of recording new historical levels above 40,000 points.

- Dow Jones Predictions in 2024: Most analysts on Wall Street expect the Dow Jones Industrial Average to rise by an average of 10% this year, of which only 5% has been achieved so far, meaning easily surpassing the psychological barrier at 40,000 points before the end of this year.

- Dow Jones Predictions in 2025: With the Federal Reserve implementing an easing cycle, more liquidity is expected to enter Wall Street markets, which means the Dow Jones Index will continue towards the 45,000-point level in 2025.

About the Dow Jones Industrial Average

The Dow Jones is a major stock market index on the New York Stock Exchange, tracking the performance of 30 of the largest industrial companies listed on Wall Street. It is one of the oldest and most famous market indices in the United States and globally.

- History of the Dow Jones Index: Founded in 1896 by journalists "Charles Dow" and "Edward Jones", it initially included 12 industrial companies and was then expanded over time to include 30 industrial companies.

- How the Dow Jones Index is Calculated: The value of the Dow Jones Index is calculated by summing the stock prices of its component companies and dividing by a divisor, which is periodically adjusted to keep the index value tradable.

How important is the Dow Jones Index?

- Main Index: The Dow Jones Index is one of the most important indices in the world, used by investors to track the performance of the US market on Wall Street.

- Measuring the US Economy: The Dow Jones Index is often used as a general gauge of the health of the US economy, the largest economy in the world.

- Benchmark Index: The Dow Jones Index is used as a benchmark for many investment funds, stock options, and other financial derivatives.

What are the Components of the Dow Jones Index?

• Composition: The companies listed in the Dow Jones Index consist of a diverse group of sectors, including technology, healthcare, finance, and industry.

• Selecting Companies: Companies listed in the index are selected based on their size, liquidity, and importance in the US economy.

• Periodic Review: The list of companies making up the index is reviewed periodically.

List of Companies Currently Listed on the Dow Jones Index

- Apple (AAPL)

- Microsoft (MSFT)

- Johnson & Johnson (JNJ)

- ExxonMobil (XOM)

- Boeing (BA)

- Nike (NKE)

- JPMorgan Chase (JPM)

- Caterpillar (CAT)

- Home Depot (HD)

- UnitedHealth Group (UNH)

- Coca-Cola (KO)

- Intel (INTC)

- Procter & Gamble (PG)

- Verizon Communications (VZ)

- Walmart (WMT)

- Bank of America (BAC)

- Pfizer (PFE)

- IBM (IBM)

- Abbott Laboratories (ABT)

- Cisco Systems (CSCO)

- Merck & Co. (MRK)

- Dow Chemical (DOW)

- Walt Disney (DIS)

- Travelers Companies (TRV)

- McDonald's (MCD)

- 3M (MMM)

- Wells Fargo (WFC)

- Coca-Cola (KO)

- Intel (INTC)

- Procter & Gamble (PG)

Factors Affecting the Dow Jones Industrial Average

The Dow Jones Industrial Average is an important indicator of the health of the US economy and is affected by several factors, including:

- Economic Growth: Strong economic growth in the United States boosts the performance of companies listed in the Dow Jones Index, pushing the index upwards.

- Inflation: High inflation can erode company profits, leading to lower stock prices and a lower index value.

- Interest Rates: Interest rates affect the cost of borrowing for companies and individuals. When interest rates rise, companies become less profitable and consumer spending may decrease, leading to lower stock prices and a lower index value.

- Geopolitical Factors: Geopolitical events such as wars, tensions, conflicts, and political unrest can affect investor confidence and lead to sharp market fluctuations, which may affect the value of the Dow Jones Index.

- Performance of Listed Companies: The performance of companies making up the Dow Jones Index is one of the most important factors affecting its value. When these companies achieve strong profits, their stock prices tend to rise, leading to an increase in the index value.

- Investor Sentiment: Investor sentiment plays a significant role in market movements on Wall Street. When investors are optimistic, they are more likely to buy stocks, which can lead to higher stock prices and an increase in the index value.

- Technical Factors: Technical analysis and algorithms affect the movements and directions of the Dow Jones Index.

Key Price Points for the Dow Jones Industrial Average

- August 1896: The Dow Jones Index recorded its lowest level ever at 28.66 points.

- March 2024: The Dow Jones Index recorded its highest level ever at 39,889 points.

- August 1896: The Dow Jones Index recorded its lowest closing level ever at 31.97 points.

- March 2024: The Dow Jones Index recorded its highest closing level ever at 39,807 points.

Best Performance of the Dow Jones Industrial Average in History

• Year 1915: Best annual performance of the Dow Jones Industrial Average ever, with an increase of 82%.

• First Quarter 1933: Best quarterly performance of the Dow Jones Industrial Average ever, with an increase of 77%.

• August 1932: Best monthly performance of the Dow Jones Industrial Average ever, with an increase of 36%.

Key Forecasts for the Dow Jones in 2024

- Goldman Sachs: Expects the Dow Jones Index to reach 40,000 points by the end of 2024. The bank predicts that technology and healthcare sectors may perform well despite geopolitical tensions.

- Bank of America: Expects the Dow Jones Index to continue rising this year, targeting a range between 40,000 and 41,000 points, thanks to companies adapting to high interest rates and the possibility of starting a monetary easing cycle by the Federal Reserve.

- Morgan Stanley: Expects the Dow Jones Index to reach 42,000 points before the end of the year, if the US economy continues to show a steady growth trend, along with technological development and innovation.

- Deutsche Bank: Germany's largest bank expects the Dow Jones Index to rise to 40,000 points before the end of this year, as the US economy approaches a soft landing with declining inflation and strong GDP growth, which is an excellent scenario for the stock market.

- Citigroup: Expects the Dow Jones Index to end 2024 at 38,000 points, due to persistent inflation in the United States and reduced likelihood of interest rate cuts by the Federal Reserve.

Factors Affecting the Dow Jones Industrial Average Forecasts

There are many factors that can affect the Dow Jones forecasts. Here is an overview of the most important ones:

1. Macroeconomic Factors:

- Economic Growth: Strong growth in the US economy enhances the performance of companies listed in the Dow Jones Index, pushing the index upwards.

- Labor Market: Low unemployment rates and increased job opportunities can contribute to increased consumption and economic growth, which enhances the performance of companies listed in the Dow Jones Index.

- Inflation: Moderate inflation can be positive as it reflects economic growth, while high inflation can lead to higher interest rates, increasing borrowing costs and putting pressure on company profits.

2. Federal Reserve Monetary Policy:

- Interest Rates: Higher interest rates increase borrowing costs for companies and individuals, which can lead to slower economic growth and pressure on company profits. Conversely, lower rates boost spending and investment.

- Quantitative Easing Programs: Quantitative easing measures involving the purchase of financial assets by the Federal Reserve can increase market liquidity and boost stock prices.

3. Government Fiscal Policy:

- Government Spending: Increased government spending on infrastructure and services ("expansionary policy") can boost the economy and lead to a rise in the Dow Jones Index.

- Tax Policies: Lower corporate taxes boost profits and attract investments, while higher taxes can have the opposite effect on the performance of companies listed in the Dow Jones Index.

4. Geopolitical Situations:

- International Tensions: Trade disputes, such as those between the US and China, can lead to significant market fluctuations. Economic sanctions and geopolitical crises can also affect investor confidence.

- Political Stability: Political stability and clear expectations of government policies enhance investor confidence and support the market.

5. Performance of Major Companies:

- Earnings and Financial Reports: The performance of companies listed in the Dow Jones Index directly affects the index. Strong earnings reports and revenue growth boost stock values and thus the index value.

- Future Outlook: Positive expectations for future company performance enhance investor confidence.

6. Market and Investor Trends:

- Psychological Factors: Investor confidence and expectations play a significant role in market movements. Good and bad news can lead to significant fluctuations.

- Technical Trading: Technical analysis and market trends, such as support and resistance levels, can influence daily trading decisions.

7. Innovation and Technology:

- Technological Innovation: Leading technology sectors, such as major tech companies listed in the Dow Jones, can push the index higher thanks to innovations and rapid growth.

- Investments in Research and Development: Increased investments in research and development enhance the growth of technology companies listed in the Dow Jones.

8. Unexpected Events:

- Natural Disasters and Pandemics: Unexpected events such as natural disasters or pandemics can lead to significant market fluctuations, especially in US financial markets, being the largest in the world.

- Global Economic Events: Economic crises in other parts of the world can affect US markets on Wall Street due to global economic interconnectedness.

Frequently Asked Questions about the Dow Jones

Is the Current Dow Jones Level Suitable for Investment?

The Dow Jones Index is trading near its highest levels ever at 39,900 points, approaching the target of 40,000 points for most banks and institutions. We believe that investing in the Dow Jones at these levels involves high risk.

This risk is mitigated if the Federal Reserve shows determination to make multiple interest rate cuts this year while controlling inflation and high prices.

How to Invest in the Dow Jones?

There are several ways to invest in the Dow Jones:

- Investing through Exchange-Traded Funds (ETFs): ETFs are financial instruments that track the performance of a specific index, in this case, the Dow Jones Index. One of the most famous ETFs tracking the Dow Jones Index is the SPDR Dow Jones Industrial Average (trading symbol: DIA).

- Investing in Individual Stocks of Companies Listed in the Dow Jones: Instead of investing in a fund that tracks the entire index, you can buy individual stocks of the companies that make up the Dow Jones Index.

- Investing in Mutual Funds: Some mutual funds, managed by financial professionals, primarily invest in stocks that make up the Dow Jones Index.

- Futures and Options: For more experienced investors, futures and options can be used to invest in the Dow Jones Index.

Will the Dow Jones Index Reach 40,000 Points?

In light of recent economic developments in the United States, it is not entirely unlikely that the Dow Jones Index will continue to 40,000 points this year, and exceed this level strongly in the coming years.

Is it Expected that the Dow Jones Index will Rise in 2024?

Yes, the Dow Jones Industrial Average is expected to continue rising this year. Most predictions from institutions, major banks, and experts are stable around a bull market for the index as it approaches the 40,000-point barrier.

Will the Dow Jones Index Collapse in 2024?

It is unlikely and improbable that the Dow Jones Industrial Average will collapse this year, especially since it includes only high-quality stocks strongly related to the performance of the US economy. In the event of poor performance by these companies, they are immediately excluded from the index and replaced with other strong ones.

Pfizer price gathers momentum - Forecast today - 15-05-2024

Pfizer’s stock price (PFE) fell in the intraday levels, after the pivotal resistance of $28.40 held on, while gathering momentum to pierce that resistance, as it also vented off overbought saturation in the RSI, with negative signals coming out of them, as the stock is also buoyed by piercing the downward short-term trend line previously, and by trading above the 50-day SMA.

Therefore we expect the stock to rise and target the resistance of $31.80, provided the resistance of $28.40 holds on.

Trend forecast: Likely Bullish